Meta Platforms (META) shares soared roughly 10% this morning after the Facebook parent posted a market-beating Q4 and issued upbeat guidance for the current quarter. On the earnings call, Susan Li — the company’s chief of finance — said capital expenditures could more than double on a year-over-year basis to about $135 billion in 2026.

The post-release surge pushed META stock’s standard relative strength index (14-day) up to 73, indicating overbought conditions. But none of it is cause for concern, according to Jefferies’ senior analyst.

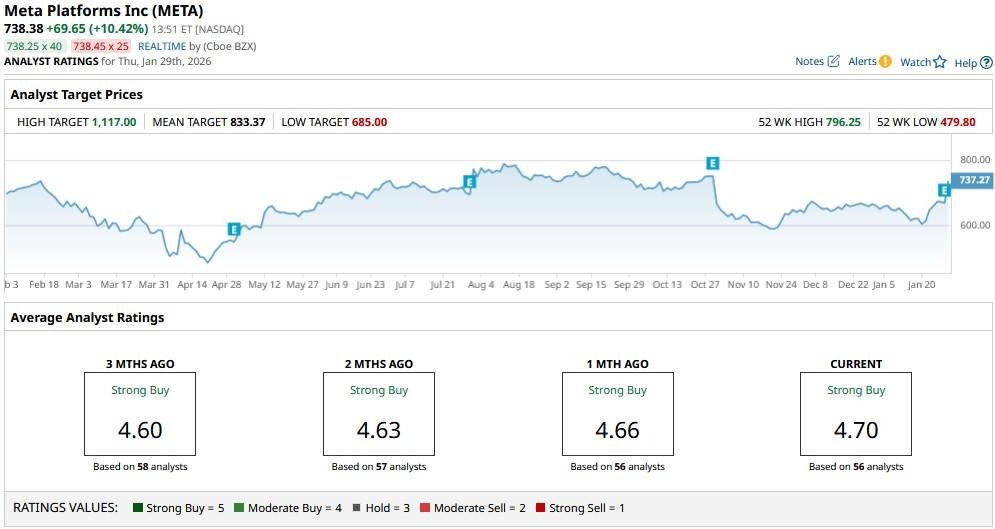

Despite recent rally, Meta Platforms remains down 7% versus its 52-week high.

Why RSI Shouldn’t Deter Investors From Buying Meta Stock

According to industry estimates, META’s operating margin could compress by nearly 5% this year as it makes good on its capex guidance for 2026.

However, peak pressure is already baked in at current levels, argued Jefferies’ top analyst Brent Thill in his latest research note.

He feels comfortable with Meta Platforms’ aggressive spending on artificial intelligence (AI), since its investments have already started paying off.

Artificial intelligence is helping the Nasdaq-listed firm optimize ads and boost engagement across its family of apps, which helped its sales come in more than a billion dollars above expectations in Q4.

Thill has a $910 price target on Meta shares, indicating potential upside of about 23% from here.

What Could Drive META Shares Higher in 2026

Meta’s Llama 4 failed to take on rivals like GPT-5 or Gemini 3, but its upcoming text and image models scheduled for launch within the next few months will alter the narrative, Thill told clients.

The Jefferies analyst also dubbed WhatsApp an underappreciated opportunity. Why? Because it has the highest number of daily active users (DAUs) among Meta's apps, yet it’s the most under-monetized of them all.

According to Thill, the messaging platform’s revenue run rate sits at $9 billion currently, but it may quadruple from here within the next four years.

All in all, META stock is worth buying as it's strongly positioned to offset operating expenses with top-line strength and efficiency gains, Thill concluded.

Meta Platforms Remains a ‘Buy’ Rated Stock

Other Wall Street firms also agree with Jefferies’ constructive view on Meta Platforms Inc.

The consensus rating on Meta shares sits at a “Strong Buy,” with the mean target of $833 indicating upside potential of roughly 14% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart