Pittsburgh, Pennsylvania-based The Kraft Heinz Company (KHC) manufactures and markets food and beverage products. Valued at a market cap of $27.5 billion, the company’s products include condiments and sauces, cheese and dairy products, refreshment beverages, and other grocery products.

This packaged food company has considerably lagged behind the broader market over the past 52 weeks. Shares of KHC have declined 21% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15%. Moreover, on a YTD basis, the stock is down 3.3%, compared to SPX’s 1.9% return.

Narrowing the focus, KHC has also underperformed the First Trust Nasdaq Food & Beverage ETF (FTXG), which decreased 1.7% over the past 52 weeks and gained 5.2% on a YTD basis.

Last week, reports indicated that Berkshire Hathaway Inc.’s (BRK-B) newly appointed CEO, Greg Abel, has begun steps to divest the firm’s roughly 28% stake, about 325 million shares in Kraft Heinz. The potential sale led to a weak start to the year for KHC, with the stock down over 4% on a YTD basis.

For the current fiscal year, ending in December, analysts expect KHC’s EPS to decline 17.3% year over year to $2.53. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

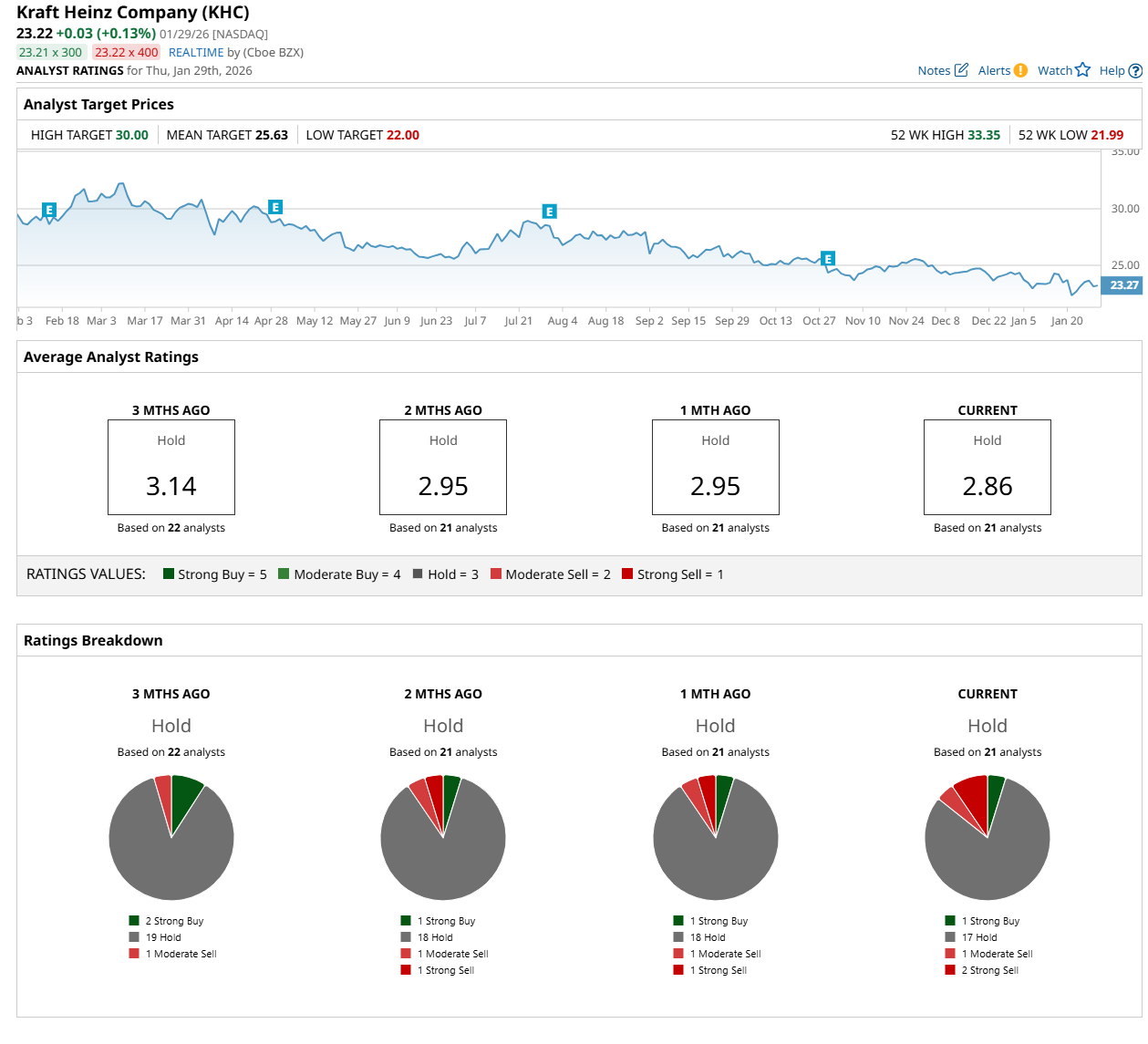

Among the 21 analysts covering the stock, the consensus rating is a "Hold,” which is based on one “Strong Buy,” 17 “Hold,” one "Moderate Sell,” and two "Strong Sell” ratings.

The configuration is more bearish than a month ago, with one analyst suggesting a “Strong Sell” rating.

On Jan. 21, Matthew Smith, CFA from Stifel Financial Corp. (SF), maintained a "Hold" rating on KHC, with a price target of $26, indicating a 12% potential upside from the current levels.

The mean price target of $25.63 represents a 10.4% premium from KHC’s current price levels, while the Street-high price target of $30 suggests a 29.2% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Energy Stock Is Up 700%, But I Wouldn’t Touch It with a 10-Foot Pole

- PayPal Reports Q4 Earnings on Feb. 3. Why You Should Press Pause on PYPL Stock For Now.

- Analysts Love These 2 Picks-and-Shovels Gold Stocks. Should You Buy Them as Gold Prices Hit New Record Highs?

- Here’s a Critical Pick-and-Shovel Trade to Invest in the NIMBY Backlash Against AI Data Centers