Huntington Bancshares Incorporated (HBAN) is an Ohio-based regional bank holding company that operates primarily through its principal subsidiary, The Huntington National Bank. It provides a wide range of financial services like consumer, commercial, and mortgage banking; deposits and loans; payments; wealth management; and insurance, to individuals, small businesses, and corporate clients across more than 1,000 branches in multiple states. The company’s market cap currently stands around $27.4 billion.

Shares of the regional bank have been underperforming the broader market. Over the past 52 weeks, HBAN stock has declined marginally, while the broader S&P 500 Index ($SPX) has rallied 15%. Moreover, shares of Huntington Bancshares are up 2.5% over the past six months, compared to SPX’s 9.2% returns.

In addition, HBAN stock has lagged behind the Financial Select Sector SPDR Fund’s (XLF) 3.3% return over the past 52 weeks but has surpassed the ETF’s marginal fall over the past six months.

On Jan. 22, shares of Huntington Bancshares slid nearly 6% after the bank released its Q4 FY2025 earnings, as investors weighed solid operating performance against near-term concerns. The company posted adjusted EPS of $0.37, slightly lower than the previous quarter but higher than a year earlier, signaling improving underlying profitability. Net interest income jumped by $197 million, or 14% year over year, reflecting strong balance-sheet growth, while noninterest income rose 4% annually to $582 million despite sequential softness.

Lending activity remained robust, with average loans and leases climbing 14% to $146.6 billion, highlighting sustained demand across key segments. The quarter also marked the successful completion of the Veritex integration, and management reaffirmed its expansion strategy through the pending Cadence Bank partnership, positioning Huntington for accelerated growth despite short-term market volatility.

For the current fiscal year, ending in December 2026, analysts expect HBAN’s EPS to grow 11.4% year-over-year to $1.66. The company’s earnings surprise history is promising. It beat or matched the bottom-line estimates in three of the past four quarters, while missing on the previous quarter.

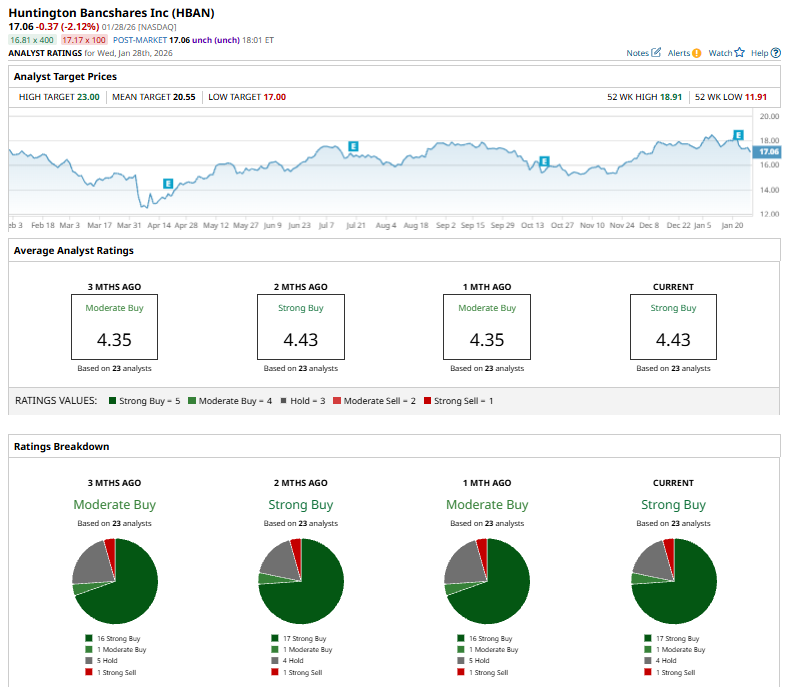

Among the 23 analysts covering the stock, the consensus rating is a “Strong Buy.” That's an upgrade from the “Moderate Buy” rating one month ago. The current rating is based on 17 “Strong Buy” ratings, one “Moderate Buy,” four “Holds,” and one “Strong Sell.”

This configuration is bullish than it was one month ago, when 16 analysts had a “Strong Buy” rating.

On Jan. 26, optimism around Huntington Bancshares received a boost after Truist Securities analyst Brian Foran reaffirmed his “Buy” rating on the stock and raised his price target to $21, a 5% increase from his previous forecast. The upgrade reflected growing confidence in Huntington’s earnings trajectory, balance-sheet strength, and execution of its expansion strategy.

HBAN is trading 20.5% below the mean price target of $20.55. The Street-high price target of $23 implies a potential upside of 34.8% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.