Intel’s (INTC) latest earnings report disappointed investors, but the market’s reaction could be creating an unexpected opportunity elsewhere in the semiconductor space. Intel shares sold off last Friday after Chief Executive Officer Lip-Bu Tan gave a weak forecast and warned that the chipmaker continues to face manufacturing challenges. Buried within the company’s newly filed 10-K, however, was a data point that may prove far more important for Intel’s biggest rival than for Intel itself.

Specifically, Intel’s disclosure of external foundry revenue offered a clearer picture of how demand for server processors is evolving—and where supply may be falling short. For a market already grappling with unprecedented demand driven by AI infrastructure buildouts, any sign that Intel is struggling to fully meet customer needs has meaningful implications. When capacity constraints collide with surging demand, market share doesn’t disappear—it shifts. That dynamic is where Advanced Micro Devices (AMD) enters the picture.

In this article, we will break down why Intel’s struggles could directly benefit AMD and how the recent post-earnings selloff may have created a buying opportunity in AMD stock.

About Advanced Micro Devices Stock

Advanced Micro Devices is a globally recognized semiconductor firm specializing in the development and distribution of high-performance computing products. AMD offers a broad range of products, including AI accelerators, x86 microprocessors, and graphics processing units (GPUs), available both as standalone components and integrated within other systems. The company’s product lineup includes well-known brands like AMD Ryzen processors and AMD Radeon graphics. AMD’s market cap currently stands at $410.3 billion.

Shares of the chipmaker have kicked off the new year on an upbeat note, climbing 16% on a year-to-date (YTD) basis as investor optimism around its business outlook grows.

Intel’s Supply Challenges Signal Potential Upside for AMD

Intel’s recent 10-K filing suggests a potential upside for Advanced Micro Devices due to Intel’s server CPU market performance, specifically because Intel’s estimated server CPU shipment growth is lagging the overall market growth, indicating an opportunity for AMD to capture a larger share.

Wells Fargo noted that Intel’s full-year 2025 external foundry revenue was $307 million. That figure includes $222 million in the fourth quarter, a sharp increase from $159 million in 2024, analyst Aaron Rakers wrote in a note. However, Rakers noted that the deconsolidation of Altera, which Intel partially sold to Silver Lake in September 2025, contributed to Q4 external revenue.

Moreover, Rakers said that the company’s 10-K showed server CPU volume rose 9% year-over-year (YoY) in 2025. At the same time, the average selling price declined 4%, partly reflecting pricing actions taken in the first half of the year and a higher mix of “lower core count products,” Rakers added. As a result, the analyst estimated Intel’s server CPU shipments grew 8% YoY in Q4, which is below the broader market growth estimates of around 15-17% YoY. Notably, Intel is facing significant internal supply constraints, particularly with its Intel 7 technology used in server CPUs, limiting its ability to meet the high demand in the booming AI-driven server market. Last week, Intel CEO Lip-Bu Tan said the company is making progress in improving chip-manufacturing yields but has not yet reached industry-leading levels. At the same time, Intel management said the AI infrastructure buildout is fueling “unprecedented demand” for semiconductors. And all of this is excellent news for AMD.

It’s worth noting that both Intel and AMD use the x86 chip architecture to make the CPU processors that serve as the primary computing engines for PCs and servers. With that, if Intel is seeing strong processor demand but lacks the manufacturing capacity to meet it, AMD stands to benefit, as it captures the remaining share of the CPU market. Moreover, the decline in Intel’s average selling price for server CPUs also signals weaker pricing power, which could further strengthen AMD’s competitive position. “Our estimate of Intel’s Xeon CPU ship at +8% y/y would leave us incrementally positive on AMD’s server ship results for 4Q25,” Rakers said.

Meanwhile, several other Wall Street analysts echoed Rakers’ view. Over the weekend, Piper Sandler analyst Harsh Kumar raised his price target on AMD stock to $300 from $280 and reiterated his “Overweight” rating. “We remain very enthusiastic about AMD’s prospects going into 2026 and into the March quarter guidance,” Kumar wrote. He also expects AMD to continue gaining market share in the server CPU market. Separately, UBS analysts said in a note that Intel’s difficulty keeping up with demand “reads very positively for AMD,” adding that “AMD must be gaining share by leaps and bounds” in the server CPU market.

All Eyes on AMD’s Q4 Results

AMD is set to report its fourth-quarter results next Tuesday after the market closes. Analysts expect quarterly revenue of $9.67 billion, up 26.25% YoY. The company’s earnings per share (EPS) are projected to grow 20.97% YoY to $1.32 in Q4. Key focus areas include MI300/MI350 GPU demand, margin trends, and competition with Nvidia.

AMD’s Data Center segment is expected to be a major growth driver, supported by continued strong demand for Instinct accelerators and EPYC CPUs. The company is expanding production of its latest chips and scaling manufacturing to full AI systems, following competitors like Nvidia to meet robust demand. Last year, AMD completed its acquisition of ZT Systems, adding capabilities to design rack-scale AI servers that integrate chips, networking, and software. Investors will be watching closely to see how much ground AMD gains in the AI chip market, particularly relative to Nvidia’s dominant position.

The Client (PC) segment is expected to show significant YoY growth as well, bolstered by strong demand for AI-enabled Ryzen processors. Investors will also scrutinize the company’s adjusted gross margin. This metric is critical to assessing the company’s profitability and competitive positioning.

In addition, market participants will closely monitor the chipmaker’s guidance for Q1 2026.

What Do Analysts Expect for AMD Stock?

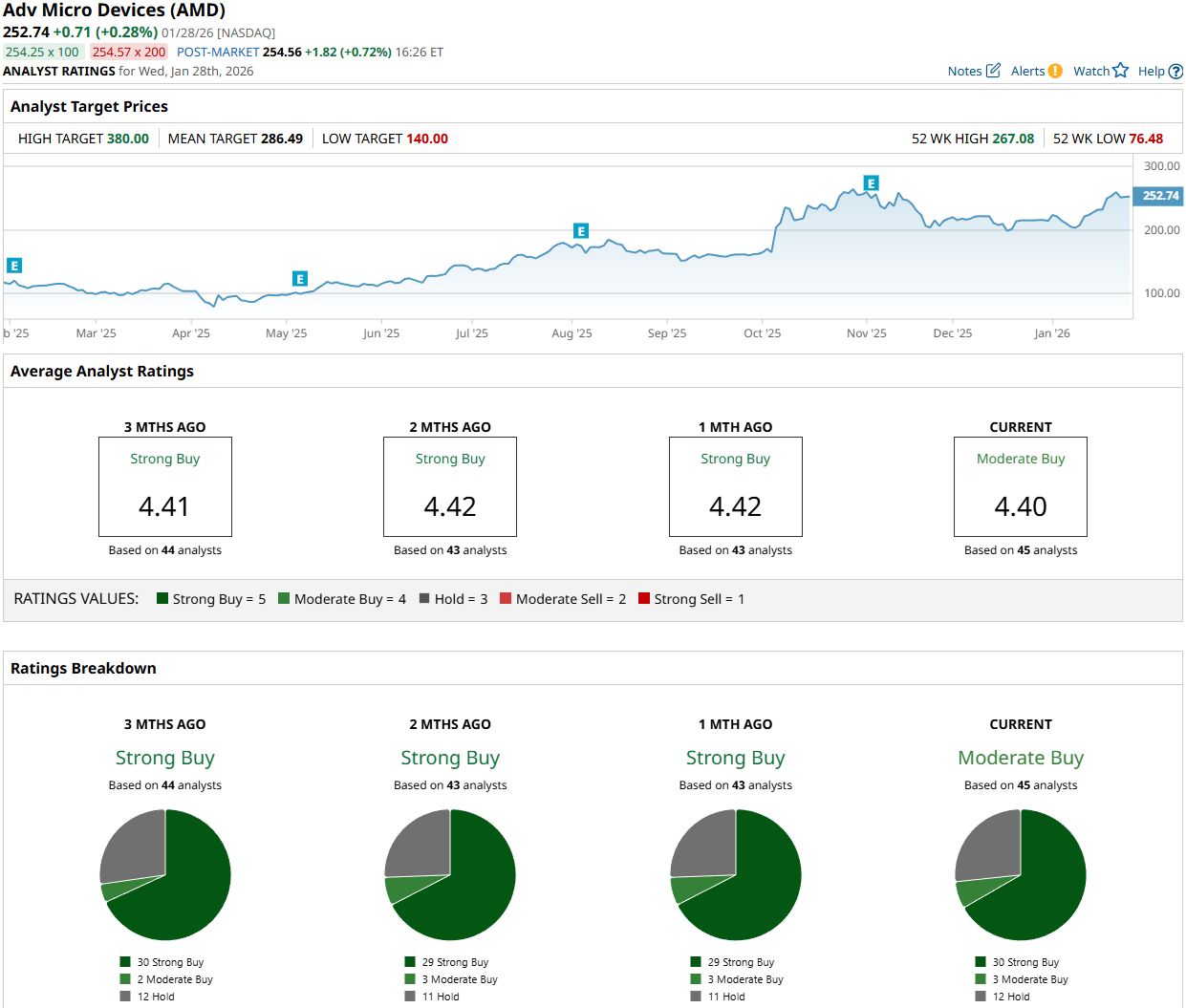

Most Wall Street analysts remain optimistic on AMD, as reflected in the stock’s consensus “Moderate Buy” rating. Of the 45 analysts covering the stock, 30 recommend a “Strong Buy,” three suggest a “Moderate Buy,” and 12 advise holding. The mean price target for AMD stock stands at $286.49, implying a 13.4% upside potential from current levels.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Intel Has a Problem Investors Might Actually Love: Is INTC a Buy Now?

- The S&P 500 Is Near Record Highs, But Volatility Is Rearing Its Ugly Head. The Best Way to Play It Now.

- This Old-School Company Is Up 100% on AI Demand. Should You Buy Shares Now?

- Should You Buy the Post-Earnings Selloff in Tesla Stock?