Shares of Advanced Micro Devices (AMD) have rallied significantly, surging 111% over the past year. That momentum has carried into 2026 as well, with the stock already up more than 16% year-to-date. The strength in AMD stock reflects its growing share in the fast-growing data center market, a strong artificial intelligence (AI) product roadmap, and key partnerships with major industry leaders. Collaborations with companies such as OpenAI and Oracle (ORCL) have strengthened AMD’s position, helping boost confidence in its long-term growth potential.

The market sentiment received another lift during AMD’s recent Financial Analyst Day, where management outlined strong growth expectations for the next three to five years.

Now, attention is shifting to AMD’s upcoming fourth-quarter earnings report, scheduled for Tuesday, Feb. 3. Given the company’s solid business momentum, expectations remain elevated that AMD can sustain its growth trajectory.

Still, investors should be mindful of the stock’s recent earnings track record. Despite the company’s solid execution, AMD shares have declined following earnings releases in each of the past four consecutive years.

With that backdrop, let’s take a closer look at what Wall Street is expecting from AMD’s Q4 report.

AMD to Deliver Strong Growth in Q4

AMD is likely to deliver another strong quarter, supported by solid momentum across its data center AI, server, and PC businesses. The demand trends remain favorable, with the company benefiting from accelerating adoption of its latest products and continued market share gains in rapidly growing data end markets.

AMD’s data center segment could continue to contribute meaningfully to its growth. Revenue in this segment is expected to sustain double-digit growth, driven by the ramp of its Instinct MI350 series GPUs and ongoing gains in the server CPU market.

AMD’s server business reached an all-time high in Q3, reflecting the rapid uptake of its fifth-generation EPYC processors. At the same time, prior-generation EPYC processors also delivered robust sales, highlighting AMD’s competitive positioning across a wide range of workloads.

Cloud demand remains a tailwind. AMD posted record sales as hyperscale customers expanded EPYC deployments to power both internal services and public cloud offerings.

On the AI side, AMD’s Instinct accelerator business continues to gain traction. Revenue increased, driven by the sharp ramp of MI350 series sales and broader deployments of the MI300 series.

Looking ahead, AMD expects Q4 2025 revenue of approximately $9.6 billion, representing around 25% year-over-year (YoY) growth. Management forecasts strong double-digit gains in the data center segment, while the embedded segment is expected to return to growth. Sequentially, revenue is projected to rise about 4%, supported by continued double-digit growth in data center sales, strong server demand, and the ongoing ramp of the MI350 GPU.

Higher sales volumes will likely translate into improved profitability. AMD expects an adjusted gross margin of roughly 54.5% in Q4, reflecting a YoY improvement of about 50 basis points. Earnings growth is also expected to remain solid, with analysts projecting Q4 earnings of $1.12 per share, up 27.3% YoY.

Overall, AMD’s expanding footprint in AI accelerators, continued server share gains, and improving margins position the company for strong revenue and earnings performance in Q4 and beyond.

Will AMD Stock Surge Higher?

AMD’s diversified product portfolio and growing demand across key markets position it well to deliver strong growth. The company’s EPYC processors are gaining traction in data centers, while its Instinct GPUs are benefiting from the accelerating AI-driven demand. Further, management’s medium-term growth outlook remains strong, supporting the upside in AMD stock.

Even after a strong run-up in share price, AMD’s valuation still appears reasonable. AMD trades at a forward price-to-earnings multiple of 45.5, which is justified given analysts' expectations of earnings growth of more than 76% in 2026.

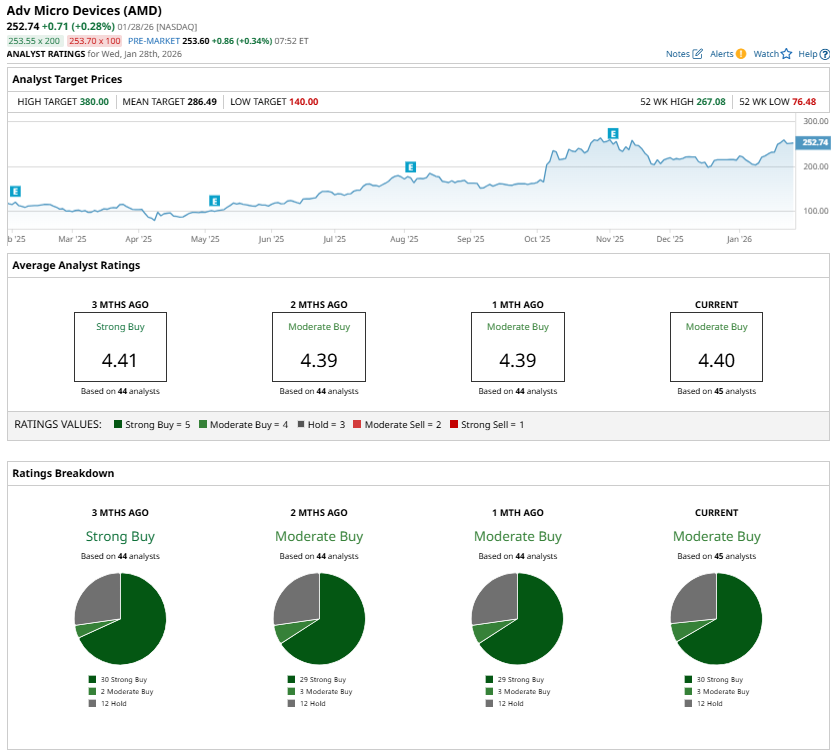

Although AMD shares have shown a pattern of pulling back after earnings reports over the past year, the AI-driven tailwinds provide additional upside for the stock in the months and years ahead. Analysts currently maintain a “Moderate Buy” consensus rating on AMD stock.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Dividend King to Buy and Hold Through Any Market

- Intel Has a Problem Investors Might Actually Love: Is INTC a Buy Now?

- The S&P 500 Is Near Record Highs, But Volatility Is Rearing Its Ugly Head. The Best Way to Play It Now.

- This Old-School Company Is Up 100% on AI Demand. Should You Buy Shares Now?