International Flavors & Fragrances Inc. (IFF) is a leading specialty ingredients company that develops, manufactures, and supplies flavors, fragrances, and related products for the food and beverage, personal care, home care, and health & biosciences markets worldwide. Headquartered in New York, the company’s diverse portfolio spans natural and synthetic flavor compounds, fragrance ingredients, cosmetic actives, enzymes, and other value-added solutions that help consumer brands innovate and differentiate their products. IFF’s market cap is around $18.2 billion.

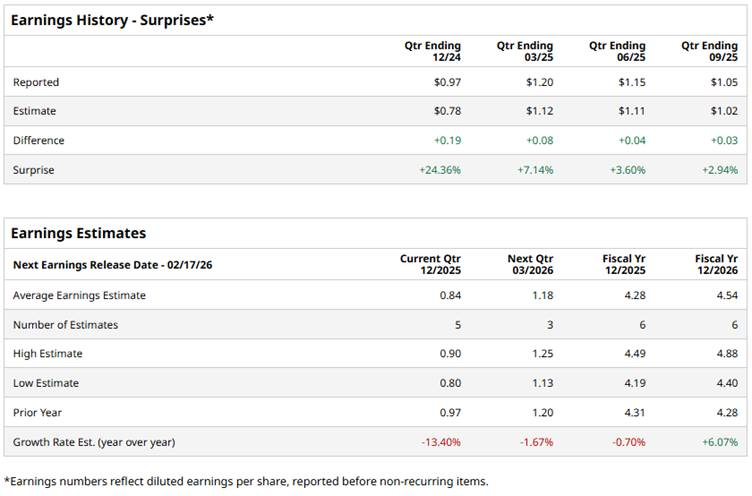

The company is slated to announce its fiscal Q4 2025 earnings results soon. Ahead of this event, analysts expect IFF to report an EPS of $0.84, a 13.4% decline from $0.97 in the year-ago quarter. However, it has exceeded Wall Street’s earnings expectations in each of the past four quarters.

For fiscal 2025, analysts forecast IFF to report an EPS of $4.28, marking a marginal decrease from $4.31 in fiscal 2024. However, its EPS is anticipated to grow 6.1% year-over-year to $4.54 in fiscal 2026.

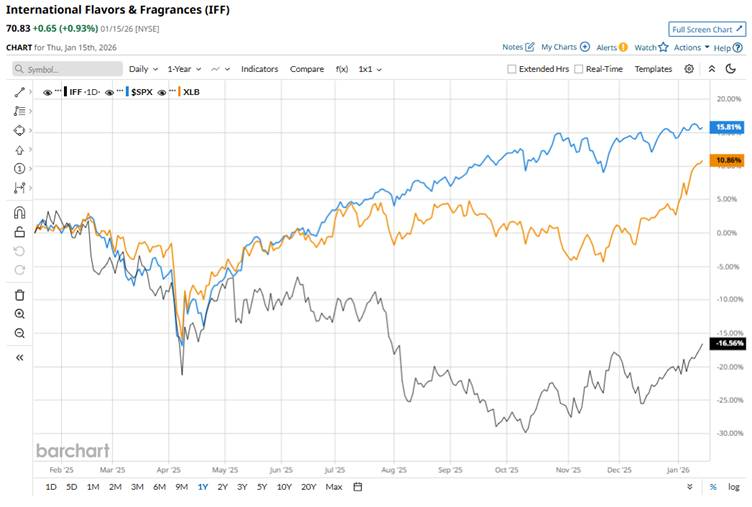

Over the past 52 weeks, shares have dropped 15.9%, underperforming the broader S&P 500 Index’s ($SPX) 16.7% returns and the State Street Materials Select Sector SPDR ETF’s (XLB) 12.5% gains over the same time frame.

International Flavors & Fragrances’ stock declined primarily due to persistent concerns over its slow turnaround progress. Also, the company faced several operational challenges, including lower demand and volume softness and continued high raw material and manufacturing costs, which pressured margins.

Despite beating earnings estimates, revenue declines and a cautious market sentiment regarding IFF’s ability to execute a full recovery contributed to investor apprehension, leading to the stock’s decline. In Q3 2025, IFF reported revenue of about $2.7 billion, an 8% decrease from the prior-year quarter.

Analysts’ consensus view on IFF is cautiously optimistic, with a “Moderate Buy” rating overall. Among 20 analysts covering the stock, 12 suggest a “Strong Buy,” two give a “Moderate Buy,” and six recommend a “Hold.” The average analyst price target of $81.02 suggests an upside potential of 14.4%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nasdaq Futures Climb on AI Optimism

- As Citigroup Slashes Jobs, Should You Buy, Sell, or Hold the Dividend Stock Yielding 2%?

- Intel Is Back From the Brink, But It Only Gets Tougher From Here. How Should You Play INTC in 2026?

- Cathie Wood Is Trimming Her Palantir Stake Again. How Should You Play PLTR in January 2026?