Saint Louis, Missouri-based Centene Corporation (CNC) operates as a healthcare enterprise, providing programs and services to under-insured and uninsured families, commercial organizations, and military families. With a market cap of $17.4 billion, Centene operates through Medicaid, Medicare, Commercial, and Other segments.

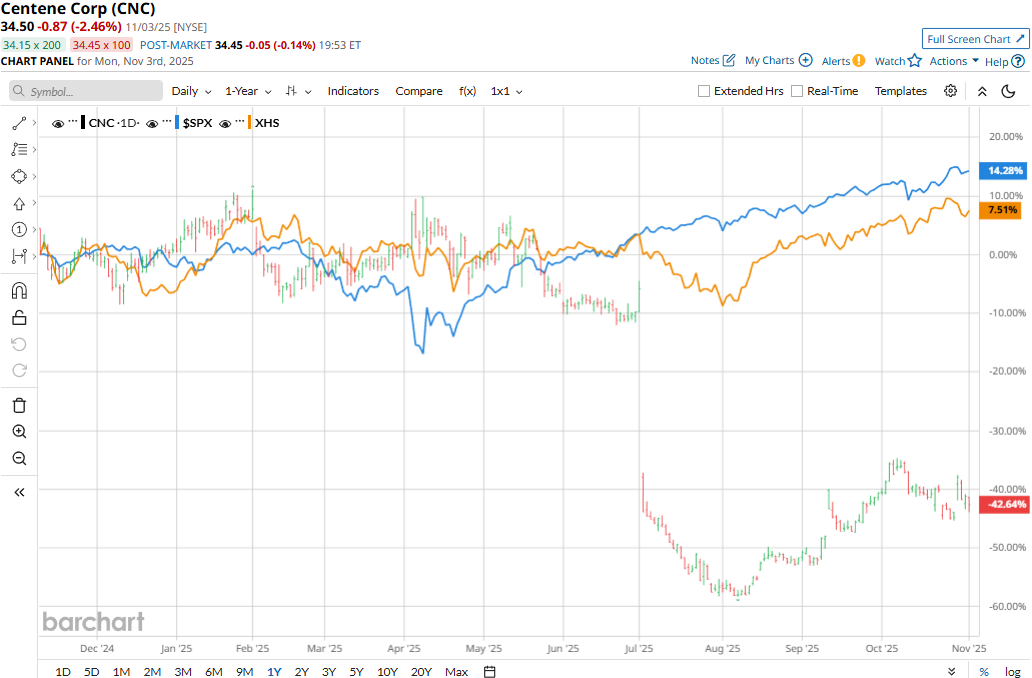

Centene has substantially underperformed the broader market over the past year. CNC stock has plummeted 43.1% on a YTD basis and 45.7% over the past 52-week period, lagging behind the S&P 500 Index’s ($SPX) surge of 16.5% on a YTD basis and 19.6% over the past year.

Zooming in further, CNC has also lagged behind the SPDR S&P Health Care Services ETF’s (XHS) 15% gains on a YTD basis and 10.3% returns over the past year.

Centene’s stock surged 12.5% in the trading session following the release of its better-than-expected Q3 results on Oct. 29. The company made significant progress against the near-term milestones it laid out for investors in July. Driven by solid premium collection, the company’s topline for the quarter surged 18.2% year-over-year to $49.7 billion, beating the Street’s expectations by 4.4%. Meanwhile, its adjusted EPS dropped from $1.62 in the year-ago quarter to $0.50 but surpassed the consensus estimates by a staggering 338.1%. Further, the company remains focused on driving margin improvement and shareholder value creation.

For the full fiscal 2025, ending in December, analysts expect CNC to deliver an adjusted EPS of $2.01, down 72% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates once over the past four quarters, it surpassed the projections on three other occasions.

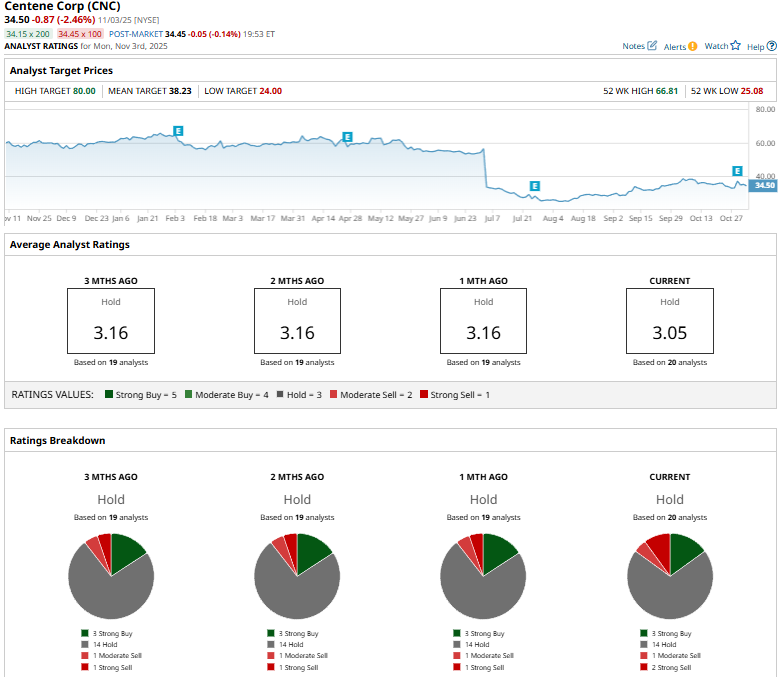

Among the 20 analysts covering the CNC stock, the consensus rating is a “Hold.” That’s based on three “Strong Buys,” 14 “Holds,” one “Moderate Sell,” and two “Strong Sells.”

This configuration is slightly less optimistic than a month ago, when only one analyst gave a “Strong Sell” recommendation.

On Oct. 31, TD Cowen analyst Ryan Langston maintained a “Hold” rating on CNC and raised the price target from $30 to $34.

CNC’s mean price target of $38.23 represents a premium of 10.8% from current price levels. Meanwhile, the street-high target of $80 suggests a massive potential upside of 131.9%.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart