Indianapolis, Indiana-based Eli Lilly and Company (LLY) discovers and develops various drugs and medicines. It operates as one of the largest pharmaceutical companies in the world and boasts a diverse portfolio of numerous successful drugs, including Mounjaro, Trulicity, Verzenio, and more. With a market cap of $816.7 billion, its operations span various countries in the Americas, EMEA, and the Indo-Pacific.

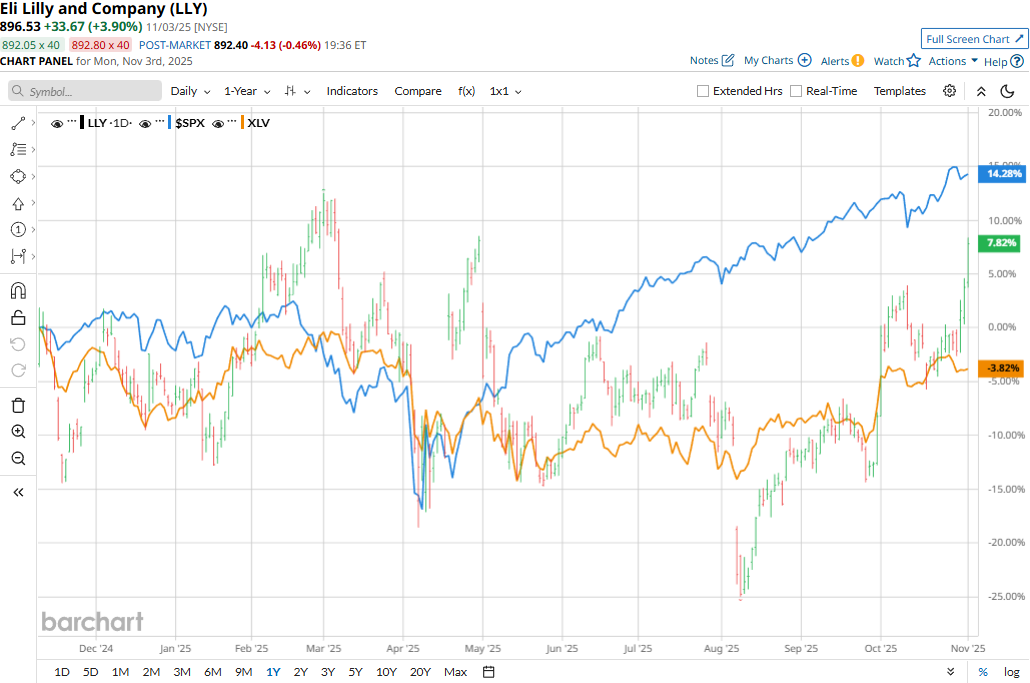

Despite its notable strengths, the pharma giant has lagged behind the broader market over the past year. LLY stock prices have gained 16.1% on a YTD basis and 9.5% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.5% gains in 2025 and 19.6% returns over the past year.

Narrowing the focus, LLY outperformed the Health Care Select Sector SPDR Fund’s (XLV) 5% uptick in 2025 and 2.2% decline over the past year.

Eli Lilly’s stock prices gained 3.8% in the trading session following the release of its impressive Q3 results on Oct. 30. Driven by the solid volume growth in Mounjaro and Zepbound sales, the company’s topline for the quarter skyrocketed 53.9% year-over-year to $17.6 billion, beating the Street’s expectations by a massive 9.9%. Meanwhile, its adjusted EPS surged by a humongous 494.9% year-over-year to $7.02, surpassing the consensus estimates by 16.6%. Further, observing the trend, Eli Lilly raised its full-year revenues and EPS guidance, boosting investor confidence.

For the full fiscal 2025, ending in December, analysts expect LLY to deliver an adjusted EPS of $24.04, up 85.1% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates once over the past four quarters, it surpassed the projections on three other occasions.

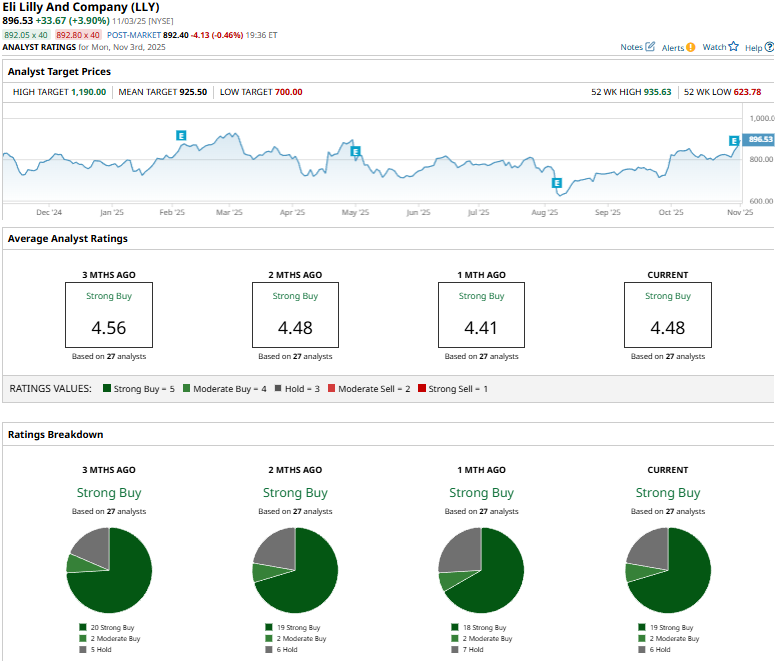

Among the 27 analysts covering the LLY stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buys,” two “Moderate Buys,” and six “Holds.”

This configuration is slightly less optimistic than three months ago, when 20 analysts gave “Strong Buy” recommendations.

On Oct. 31, Cantor Fitzgerald analyst Carter Gould maintained an “Overweight” rating on LLY and raised the price target from $925 to $985.

LLY’s mean price target of $925.50 represents a modest premium of 3.2% from current price levels. Meanwhile, the street-high target of $1,190 suggests a notable potential upside of 32.7%.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart