Palo Alto, California-based HP Inc. (HPQ) is a global technology company. Valued at $25.9 billion by market cap, HP focuses on consumer and commercial PCs, printing hardware, and imaging solutions, including 3D and industrial printing.

HP stock has plunged 15.2% on a YTD basis and 24.3% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 16.3% gains in 2025 and 17.7% returns over the past year.

On a closer look, HP has also lagged behind the Technology Select Sector SPDR Fund’s (XLK) 29.3% gains in 2025 and a 31% surge over the past 52 weeks.

On Oct. 13, HP shares climbed 5.9% after the company announced the launch of a new manufacturing facility and AI R&D center in Saudi Arabia. The Riyadh site, which began producing the HP EliteDesk AI PC, aims to expand production while strengthening regional supply chains and improving delivery times.

For fiscal 2025 ending in October, analysts anticipate non-GAAP EPS of $3.11, reflecting an 8% decline from the prior year. HP’s recent earnings performance has been uneven, missing Wall Street's profit expectations in three of the last four quarters and merely meeting estimates in the most recent one.

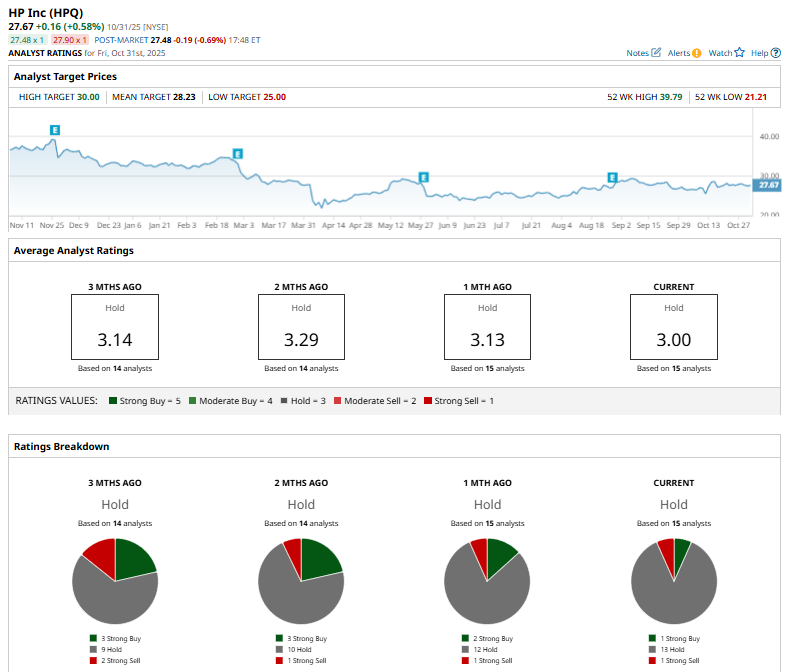

The stock maintains a consensus “Hold” rating overall. Of the 15 analysts covering the stock, opinions include one “Strong Buy,” 13 “Holds,” and one “Strong Sell.”

This configuration is slightly more bearish than one month ago, when two analysts gave a “Moderate Buy” recommendation.

On Oct. 14, HSBC upgraded the stock to “Buy” and increased its price target to $30, which is also the Street-high target, from $28.10, citing improving demand prospects for PCs and printers. The firm expects a boost from the end of Windows 10 support, projecting 5.1% PC shipment growth in fiscal 2025, along with stronger printer sales and reduced tariff risk due to HP’s lower exposure to China imports.

HP’s mean price target of $28.23 suggests a 2% upside from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart