TORONTO, ON / ACCESSWIRE / November 10, 2022 / Vox Royalty Corp. (TSXV:VOX)(NASDAQ: VOXR) ("Vox" or the "Company"), a returns-focused mining royalty company, is pleased to announce that it has executed a binding royalty sale and purchase agreement dated November 9, 2022 with First Quantum Minerals Ltd. (TSX:FM) ("FQM"), to acquire rights to a portfolio of up to four Canadian royalties, for total consideration of up to C$650,000.

Pursuant to the terms of the purchase and sale agreement, on closing, Vox will issue C$525,000 of Vox common shares, being 164,319 common shares at an issue price of C$3.1950 per common share for the Estrades and Opawica royalties further described below (the "Transaction"). Closing of the Transaction remains conditional upon final acceptance by the TSX Venture Exchange.

Additional closings and cash payments of C$100,000 (Winston Lake) and C$25,000 (Norbec & Millenbach) will be due and payable following (i) the exercise of separate third-party option agreements, (ii) the issuance of the Winston Lake and Norbec & Millenbach royalties to FQM, and (iii) the assignment of the Winston Lake and Norbec & Millenbach royalties to Vox.

Royalty Portfolio

Asset |

Operator |

Location |

Stage |

Royalty |

| Estrades | Galway Metals Inc. | Québec, Canada | Engineering Studies | 2.0% NSR(a) |

| Opawica | Imperial Mining Group Ltd | Québec, Canada | Exploration | 0.49% NSR |

| Winston Lake | Metallum Resources Inc. | Ontario, Canada | Exploration |

2% NSR (1% buyback for C$3.0M)(b) |

| Norbec & Millenbach | Falco Resources Ltd | Québec, Canada | Exploration | 2% NSR(c) |

(a) Vox notes that the Estrades royalty covers only a portion of the Estrades Project.

(b) Vox holds the right to acquire the royalty issued to FQM upon Metallum exercising its option to acquire the property from FQM.

(c) Vox holds the right to acquire the royalty issued to FQM upon Falco exercising its option to acquire the property from FQM.

Spencer Cole, Chief Investment Officer - stated: "We are very excited to be expanding our Canadian royalty portfolio with the addition of up to four royalties in Québec and Ontario. The Estrades royalty adds fantastic longer-term potential to Vox shareholders as there are very few zinc-gold deposits globally which also contain gold grades in excess of 3 g/t. We look forward to seeing how the Estrades restart studies progress as well as seeing whether the Winston Lake deposit is incorporated into Metallum's future Superior Project mine plan."

Transaction Highlights(1)(2)(3)(4)(5)

- Provides exposure to the high-grade advanced stage Estrades, Gold Polymetallic Project, with substantial exploration upside at depth below the existing resource, along strike and via further exploration targets on the extensive land package;

- With a substantial ~27,000m drilling programme carried out at Estrades in 2021, a further ~15,000m drilling earmarked for 2022, historical underground mine infrastructure still in place and ongoing environmental and engineering studies, Vox believes that Estrades is progressing well towards a future development scenario;

- Vox believes that the feasibility study completed in October 2021 at Metallum Resources Inc's Superior Zinc Copper Project indicates strong economics, and provides a potential pathway for the future inclusion of ore from the royalty-linked Winston Lake deposit (located ~750m from the main Pick Lake deposit) into the mine plan;

- Potential longer-term optionality from the Norbec & Millenbach royalty rights, which provide future upside to regional exploration and development activities in proximity to the Horne 5 Gold Project; and

- Exploration at the greenfield Opawica Gold Project has identified a 350m gold-bearing zone which has never been tested below the 150m level or along the additional 1.5km strike extent of the geological structure to the west.

Asset Overview - Estrades(1)(2)(3)

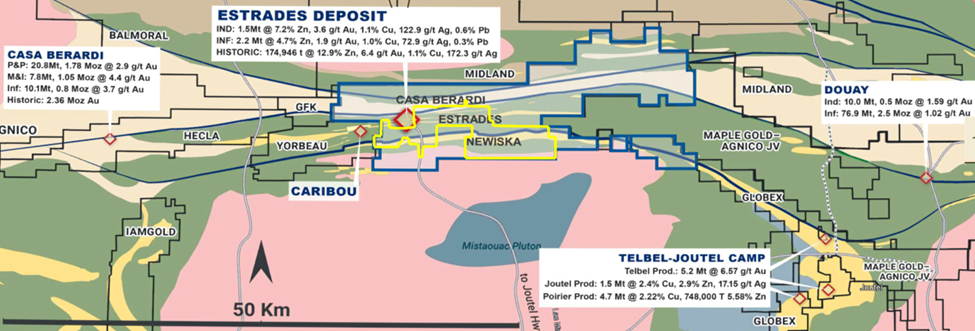

The 20,000-hectare Estrades zinc-gold property is located in the Abitibi region of western Québec and centered around the historical Estrades Mine, which was developed by Breakwater Resources Ltd. ("Breakwater") via a 200m deep by 150m along strike decline in the early 1990's, and which produced a total of 175,000t at a grade of 13% Zn, 6.35g/t Au, 1.1% Cu and 172g/t Ag. Vox previously conducted due diligence on the Estrades Project prior to completing a royalty transaction with Breakwater and its parent entities Nyrstar NV and Trafigura Beheer B.V. in January 2021.

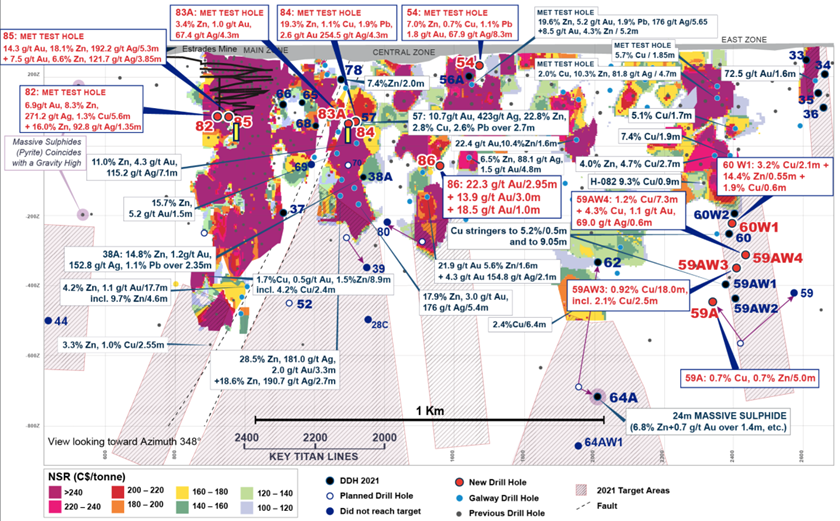

The Estrades property hosts three primary mineralized horizons - the former producing, high grade Estrades volcanogenic massive sulphide ("VMS") mine where all the current resources are located, the Newiska VMS horizon to the south, and the Casa Berardi horizon (gold target) to the north. The Estrades Deposit contains an indicated resource of 1.5Mt @ 7.2% Zn, 3.6 g/t Au, 1.1% Cu, 122.9 g/t Ag and 0.6% Pb as well as an inferred resource of 2.2Mt @ 4.7% Zn, 1.9 g/t Au, 1.0% Cu, 72.9 g/t Ag and 0.3% Pb.

Galway Metals Inc ("Galway") carried out a total of 26,937m of drilling across the three mineralized horizons in 2021 and ~15,000m is planned for 2022, with key targets including drilling the deep IP/MT TITAN targets on the east and west sides below the resource in search of source vents and targets along the Newiska horizon looking for new deposit discoveries. Galway in addition plans to continue the environmental and engineering studies, including metallurgical and ore sorting tests. This work includes evaluating alternative variations of long hole mining methods that could be applied to potentially reduce development and operating costs, materially improving project economics.

Figure 1: Estrades Project Location with the royalty area outlined in yellow

(Source: https://galwaymetalsinc.com/wp-content/uploads/2021/06/GWM-PPT-FINAL-1.pdf)

Figure 2: Estrades Project, Resource Section

(Source: https://galwaymetalsinc.com/wp-content/uploads/2021/06/GWM-PPT-FINAL-1.pdf)

The Estrades royalty was created pursuant to a royalty agreement dated August 17, 2016, covers 86 claims, and entitles Vox to a 2.0% Net Smelter Returns ("NSR") royalty on any ore mined. The royalty area is located to the south and east of the historical mine area and excludes the area covered by the original mining lease. The royalty covers a large proportion of the East Zone resource and Vox management estimates that the royalty claims cover approximately 25% of the total Estrades resource as outlined in Figure 2 and Table 1. In addition the royalty covers the Newiska VMS exploration target, but excludes the Casa Berardi gold exploration target.

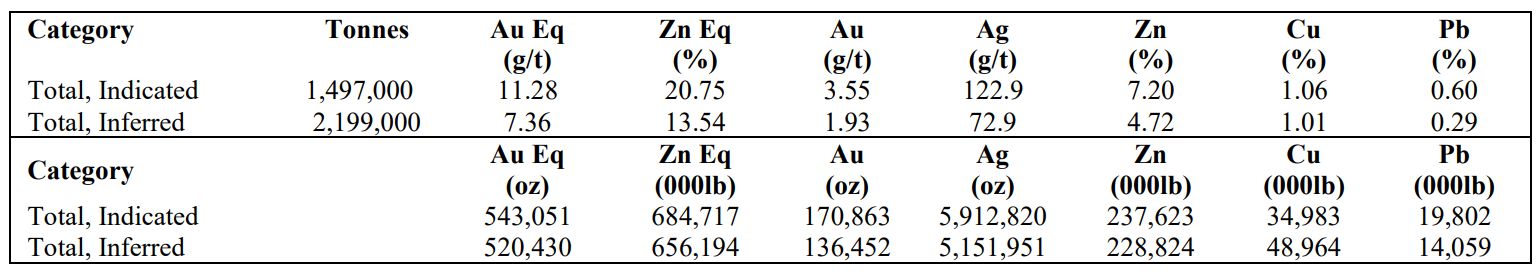

Estrades Resource Estimate as at 10 September 2018(1)

Table 1: Estrades Resource Estimate as at 10 September 2018

(Source - https://galwaymetalsinc.com/wp-content/uploads/2022/08/GWM-MDA-Q2-2022-FINAL.pdf

For more information on the Estrades Project, please visit the Galway website at https://galwaymetalsinc.com/.

Asset Overview - Winston Lake(5)(6)(7)

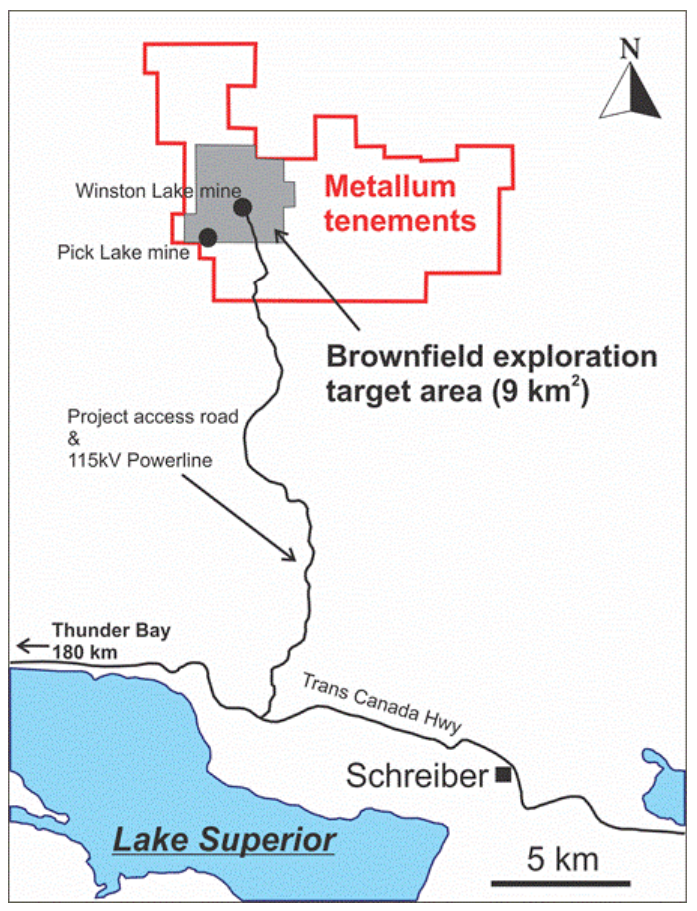

Winston Lake forms part of Metallum Resources Inc's ("Metallum") Superior Zinc and Copper Polymetallic Project located near the town of Schreiber, east of Thunder Bay, Ontario, as outlined in Figure 5. Inmet Mining, subsequently acquired by FQM, commenced development of Winston Lake in 1986 with production continuing for 11 years, with additional ore added from the Pick Lake deposit from 1995 until operations were suspended in 1998. A total of 3.4Mt @ 1.0% Cu and 16% Zn was mined and processed with a current Indicated Mineral Resource at Winston Lake of 290,000t @ 10.4% Zn, 0.7% Cu, 0.9 g/t Au and 18 g/t Ag.

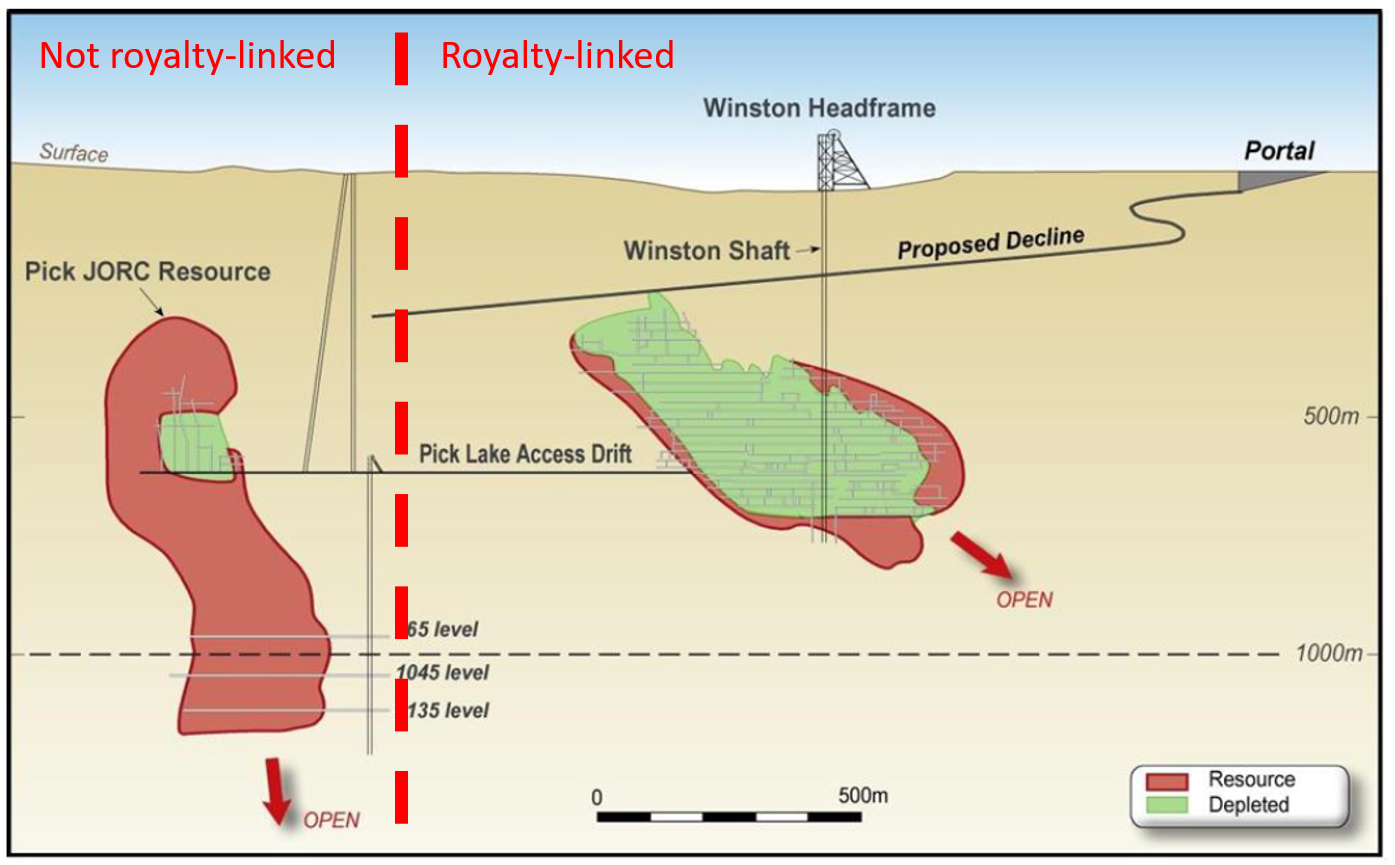

Metallum completed a feasibility study over the Superior Project in October 2021, which contemplates accessing the Pick Lake deposit (not royalty-linked) via a decline from existing infrastructure at the royalty-linked Winston Lake deposit (as outlined in Figure 6). The feasibility study outlines an expected average production rate of 69.8 ktpa of zinc concentrate and 5.3 ktpa of copper concentrate, with a mine life of 8.5 years. Whilst the feasibility was focused on the Pick Lake deposit, Vox management believes that there is potential for the remaining Winston Lake resource to be incorporated into a future mine plan. Metallum has initiated discussions with multiple global metal traders regarding future offtake agreements linked to additional funding solutions.

Figure 5: Superior Project Area and surrounding infrastructure

(Source: https://www.metallumzinc.com/wp-content/uploads/2022/05/metallum-resources-feasibility-study.pdf

Figure 6: Superior Project - Pick Lake and Winston Lake Orebodies with the approximate royalty boundary indicated

(Source: https://www.metallumzinc.com/wp-content/uploads/2022/05/metallum-resources-feasibility-study.pdf

The Winston Lake property is held by FQM and is subject to an option agreement dated February 9, 2018, whereby Metallum may elect to acquire the property in exchange for the grant of a 2% NSR to FQM and the assumption of liabilities related to the property. Upon exercise of the option and grant of the royalty to FQM, FQM has agreed that the royalty will be assigned to Vox and Metallum will retain a right to buy back 50% of the royalty for a payment of C$3,000,000. Vox management expects the option to be exercised in early 2023, subject to the discretion of Metallum's management team. The royalty covers the full extent of the Winston Lake resource and excludes the Pick Lake resource.

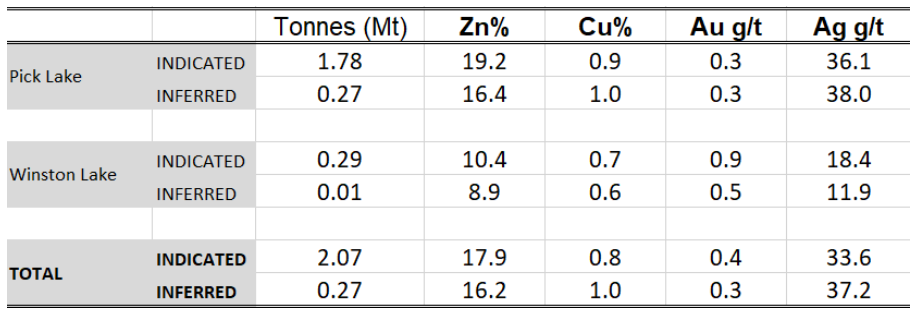

Superior Project - Resource Estimate as at 15 October 2020(6)

The drillholes database that was utilised for the for the Superior Lake Project (Pick Lake and Winston Lake) contains 1,812 drill holes with an effective date of October 15, 2020. Based on internal analysis, Vox management anticipates that 100% of the Winston Lake mineral resource is royalty-linked and none of the Pick Lake mineral resource is royalty-linked.

Table 2: Superior Project Resource Estimate as at 15 October 2020

(Source: https://galwaymetalsinc.com/wp-content/uploads/2022/08/GWM-MDA-Q2-2022-FINAL.pdf)

For more information on the Superior Project, please visit the Metallum website at https://www.metallumzinc.com/

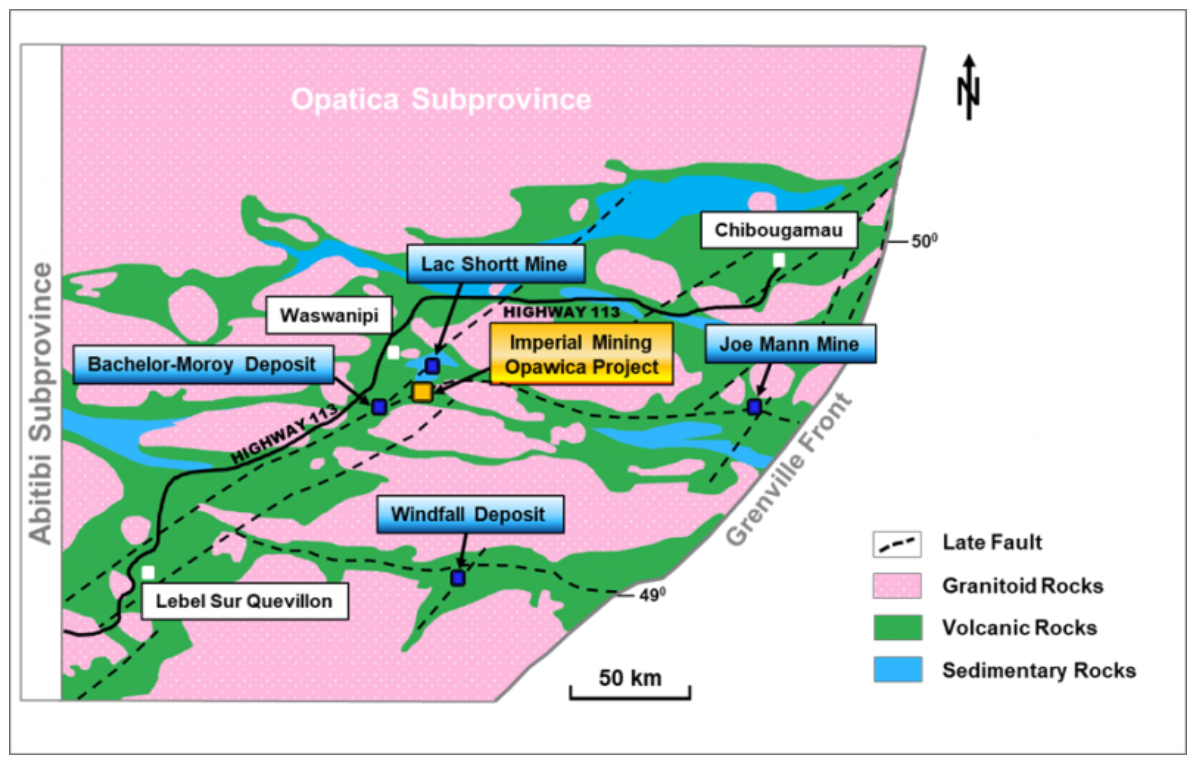

Asset Overview - Opawica(4)

The Opawica Project is located 20km east of Desmaraisville, Québec, and consists of 42 contiguous claims covering 23km2. The Operator, Imperial Mining Group Ltd ("Imperial"), is targeting gold deposits on the major regional NE-SW and E-W deformation corridors which hosts several past producers such as Lac Shortt (2.7Mt @ 4.6 g/t Au) and Joe Mann (4.8Mt @ 7.56 g/t Au) as well as existing measured and indicated resources at Windfall (6.02Mt @ 9.6 g/t Au) and at Bachelor-Moroy (893,000t @ 5.58 g/t Au).

Historical exploration defined a 350m long gold-bearing zone on the eastern part of the property which has never been tested below the 150m level. In addition to the potential at depth, no work has historically been carried out on the 1.5km portion of the structure to the west of the gold-bearing zone. Since 2018, Imperial has carried out a 3D-IP survey, geological mapping, and a ground magnetic survey, which formed the basis for a new 3D geological model over the Central Gold Zone. A 2020 drilling programme was successful in intersecting gold mineralisation (3.11 g/t Au over 1.1m and 2.41 g/t Au over 2.8m) within a feldspar porphyry dyke within this Central Gold Zone. These results and findings will be used to guide future exploration.

Figure 4: Opawica Project Area and surrounding deposits

(Source: https://imperialmgp.com/projects/opawica/)

The Opawica royalty was created pursuant to a property acquisition agreement dated May 14, 2009 and entitles Vox to an effective 0.49% NSR royalty (being a 49% interest in a 1% NSR royalty). Kinross Gold Corporation (TSX: K) (NYSE: KGC), with a current market capitalisation of C$7B, holds the remaining 51% interest.

For more information on the Opawica Project, please visit the Imperial website at https://imperialmgp.com/

Asset Overview - Norbec & Millenbach(8)

On June 30, 2021, Falco Resources Ltd ("Falco") and FQM entered into an option agreement pursuant to which FQM granted Falco the sole and exclusive right to acquire the historical Norbec and Millenbach mining site (Mining Concessions 177 and 517) which is located approximately 11km to the northwest of Falco's Horne 5 Gold-Silver-Copper-Zinc Project in Québec. Falco plans to use these two royalty-linked mining concessions as a surface tailings storage site for the Horne 5 Project.

Subject to Falco's decision to exercise the option, FQM will transfer the concessions to Falco and retain a 2% NSR, following which FQM has agreed to assign the royalty interest to Vox. Whilst the site is initially earmarked for tailings, Vox retains exposure to future exploration and development activities on these central mining concessions.

For more information on the Horne 5 Project and associated Norbec & Millenbach site, please visit the Falco website at https://www.falcores.com/en/.

Transaction Closing

The Transaction is subject to the final acceptance of the TSX Venture Exchange, which the Company expects will be delivered during Q4 2022.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns-focused mining royalty company with a portfolio of over 50 royalties and streams spanning eight jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically-focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 20 separate transactions to acquire over 50 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Spencer Cole |

Kyle Floyd Chief Executive Officer info@voxroyalty.com +1-345-815-3939 |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Vox Royalty Corp. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, statements regarding the royalties and projects related thereto (including expectations for construction decisions, resource estimates or production from the underlying projects and estimates of project success), and the ability of the Company to acquire effective ownership of all three royalties. Such statements and information reflect the current view of Vox. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Vox's actual results, performance or achievements or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of a property.

Technical References & Notes

-

Estrades Resource Estimate released September 20, 2018 and dated November 5, 2018 (And amended in March 2019) - https://galwaymetalsinc.com/2018/09/galway-metals-reports-resource-increases-at-its-estrades-polymetallic-vms-project-in-quebec/.

- Mr. Reno Pressacco, P. Geo. (Principal Geologist at Roscoe Postle Associates), is the Qualified Person responsible for preparation and disclosure of the Estrades Mineral Resource estimate and is independent of Galway.

- CIM Definition Standards were followed for Mineral Resources.

- No Mineral Reserves are present.

- All metal prices, the US$/C$ exchange rate and cut-off grade were provided by RPA Inc.

- Mineral Resources are estimated at long-term metal prices (USD) as follows: Au $1,450/oz, Ag $21.00/oz, Zn $1.15/lb, Cu $3.50/lb and Pb $1.00/lb.

- Mineral Resources are estimated using an average long-term foreign exchange rate of US$0.80 per C$1.00.

- Mineral Resources are estimated at a cut-off grade of C$140/tonne NSR, which included provisions for metallurgical recoveries, freight, mining, milling, refining and G&A costs, smelter payables for each metal and applicable royalty payments.

- Metallurgical recoveries for resource estimation are: Zn 92%, Cu 90%, Pb 85%, Au 80% and Ag 70%.

- A minimum mining width of approximately 1.5 m was used.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Au Eq (g/t) and Zn Eq (%) represent the in-situ metal content expressed as Au and Zn equivalents and do not provide for metal recoveries or other economic considerations.

- Preliminary analysis indicates that no metal is dominant; however, Au and Zn are the largest contributors.

- Numbers may not add due to rounding.

- For information on the Estrades Project, please refer to the Technical Report On The Mineral Resource Estimate For The Estrades Project, Northwestern Québec, Canada, prepared in accordance with NI 43-101, and dated November 5, 2018 with an effective date of September 10, 2018 (the "Estrades Technical Report"), led by independent consultants Roscoe Postle Associates. The Estrades Technical Report is available at https://galwaymetalsinc.com/wp-content/uploads/2021/02/RPA-43-101-Ammended-March-2019.pdf.

- Galway Metals News Release dated September 9, 2022 titled "Galway Metals: Extensive 2022 Programs Being Undertaken at the Former Producing High-Grade Estrades Project in the Abitibi of Western Quebec" - https://galwaymetalsinc.com/2022/02/galway-metals-extensive-2022-programs-being-undertaken-at-the-former-producing-high-grade-estrades-project-in-the-abitibi-of-western-quebec/.

- Galway Metals News Release dated August 29, 2022 titled "Galway Metals Inc.: Management's Discussion And Analysis For The Three And Six Months Ended June 30, 2022" - https://galwaymetalsinc.com/wp-content/uploads/2022/08/GWM-MDA-Q2-2022-FINAL.pdf.

- Source: https://imperialmgp.com/projects/opawica/

- Source: "Metallum Resources Inc - Superior Zinc and Copper Project NI 43-101 Technical Report - Feasibility Study" dated October 13, 2021 with an Effective Date of September 15, 2021. https://www.metallumzinc.com/wp-content/uploads/2022/05/metallum-resources-feasibility-study.pdf .

-

Winston Lake Resource Estimate released October 15, 2020 (Amended January 18, 2021) and effective October 15, 2020 - https://www.sedar.com/DisplayProfile.do?lang=EN&issuerType=03&issuerNo=00008433

- Dr. Marat Abzalov (a Consultant / Director) of independent consultants MASSA Geoservices, is the Qualified Person responsible for preparation and disclosure of the Pick Lake and Winston Lake Mineral Resource estimate.

- Estimation of the mineralisation grade was made using Ordinary Kriging (OK) technique that was applied to Zn, Cu, Au and Ag

- For the Winston Lake deposit second pass estimation was made using Simple Kriging with a local mean. Local mean grades were estimated by averaging all samples located with the 80x80x10m panels.

- After completion of the estimation the block model was transferred back to Micromine and estimated block grades copied to corresponding sub-cells.

- The model was visually inspected and compared with the drillholes data. Review of the model by cross-sections indicates that the model accurately reproduces layering and zoning of the VMS seam.

- Mineral Resources of the project estimated and reported using 3% Zn as a lower cut-off.

- Metallum News Release dated May 31, 2022 titled "Discussions commenced with metal traders and smelters regarding offtake for Superior Lake Zinc Project" - https://www.metallumzinc.com/2022/05/31/discussions-commenced-with-metal-traders-and-smelters-regarding-offtake-for-superior-lake-zinc-project/.

- Falco Management Discussion and Analyses dated March 31, 2022 titled "Management Discussion and Analyses For The Three-Month and Nine-Month Periods Ended March 31, 2022" - https://www.falcores.com/wp-content/uploads/2022/06/Investors_MDA_2022_Q3.pdf.

SOURCE: Vox Royalty Corp

View source version on accesswire.com:

https://www.accesswire.com/724955/Vox-To-Acquire-Canadian-Royalty-Portfolio-From-First-Quantum-Minerals