HEICO has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 17.7% to $315.39 per share while the index has gained 15.6%.

Is HEI a buy right now? Find out in our full research report, it’s free.

Why Are We Positive On HEICO?

Founded in 1957, HEICO (NYSE: HEI) manufactures and services aerospace and electronic components for commercial aviation, defense, space, and other industries.

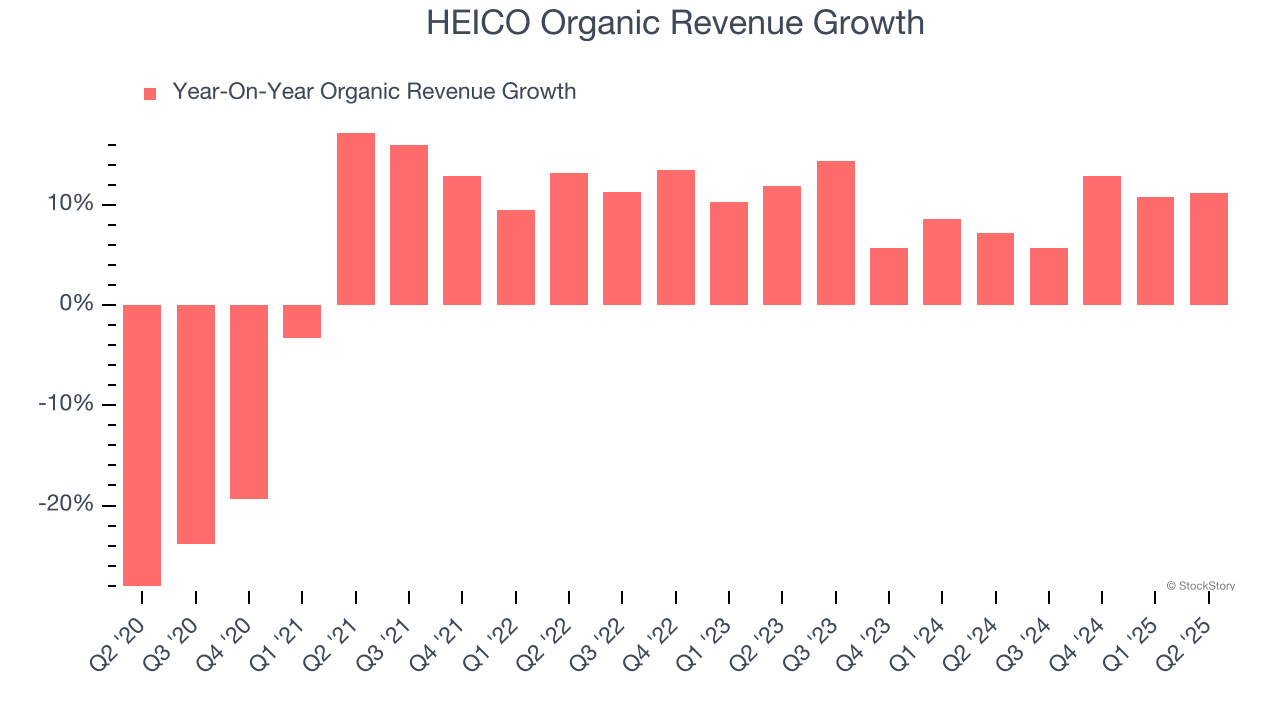

1. Organic Growth Indicates Solid Core Business

Investors interested in Aerospace companies should track organic revenue in addition to reported revenue. This metric gives visibility into HEICO’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, HEICO’s organic revenue averaged 9.6% year-on-year growth. This performance was solid and shows it can expand steadily without relying on expensive (and risky) acquisitions.

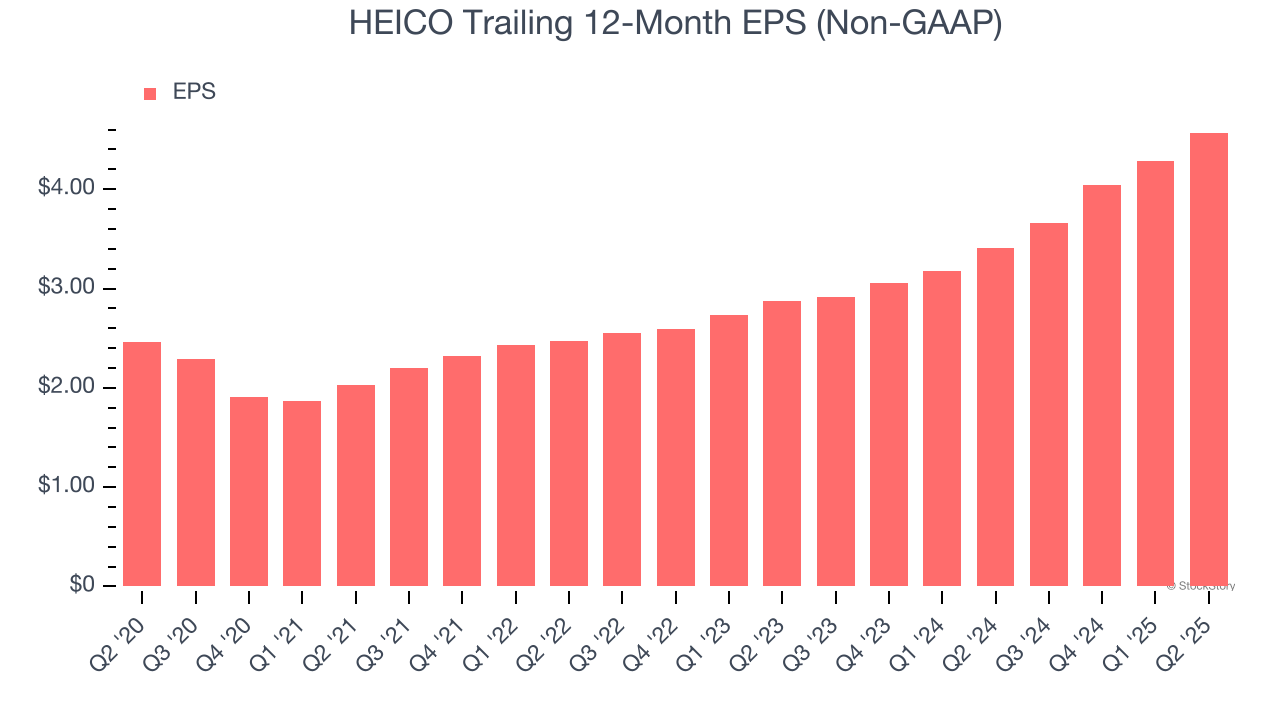

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

HEICO’s EPS grew at a remarkable 13.2% compounded annual growth rate over the last five years. This performance was better than most industrials businesses.

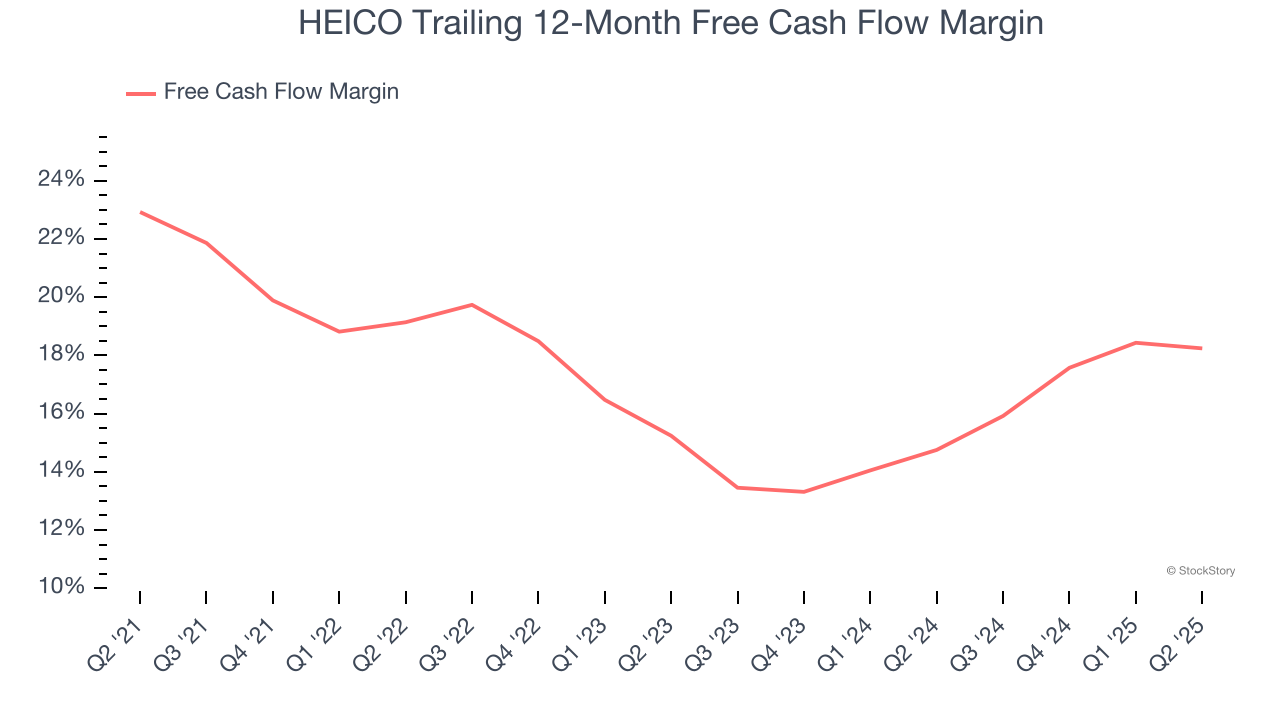

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

HEICO has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 17.5% over the last five years.

Final Judgment

These are just a few reasons HEICO is a high-quality business worth owning, but at $315.39 per share (or 62.3× forward P/E), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than HEICO

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.