United Parks & Resorts has been treading water for the past six months, holding steady at $51.21. The stock also fell short of the S&P 500’s 15.6% gain during that period.

Is now the time to buy PRKS? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Does United Parks & Resorts Spark Debate?

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE: PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

Two Things to Like:

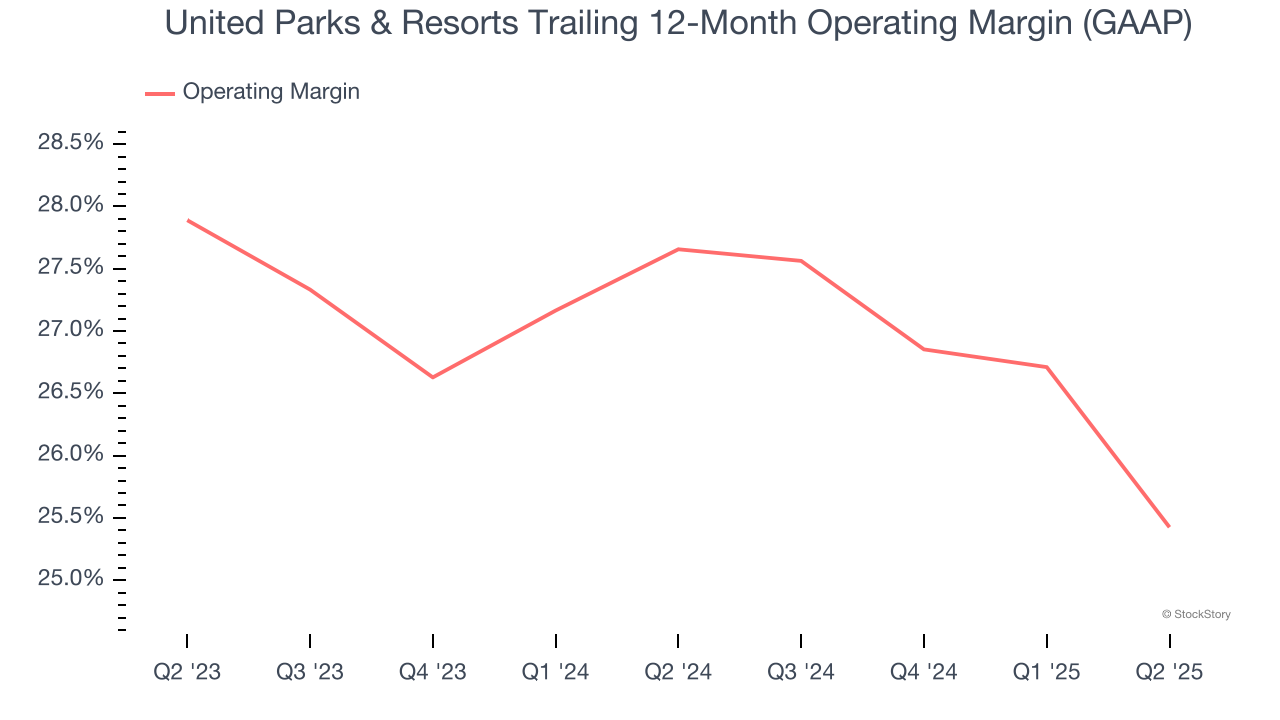

1. Operating Margin Reveals a Well-Run Organization

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

United Parks & Resorts’s operating margin has been trending down over the last 12 months, but it still averaged 26.5% over the last two years, elite for a consumer discretionary business. This shows it’s an well-run company with an efficient cost structure, and we wouldn’t weigh the short-term trend too heavily.

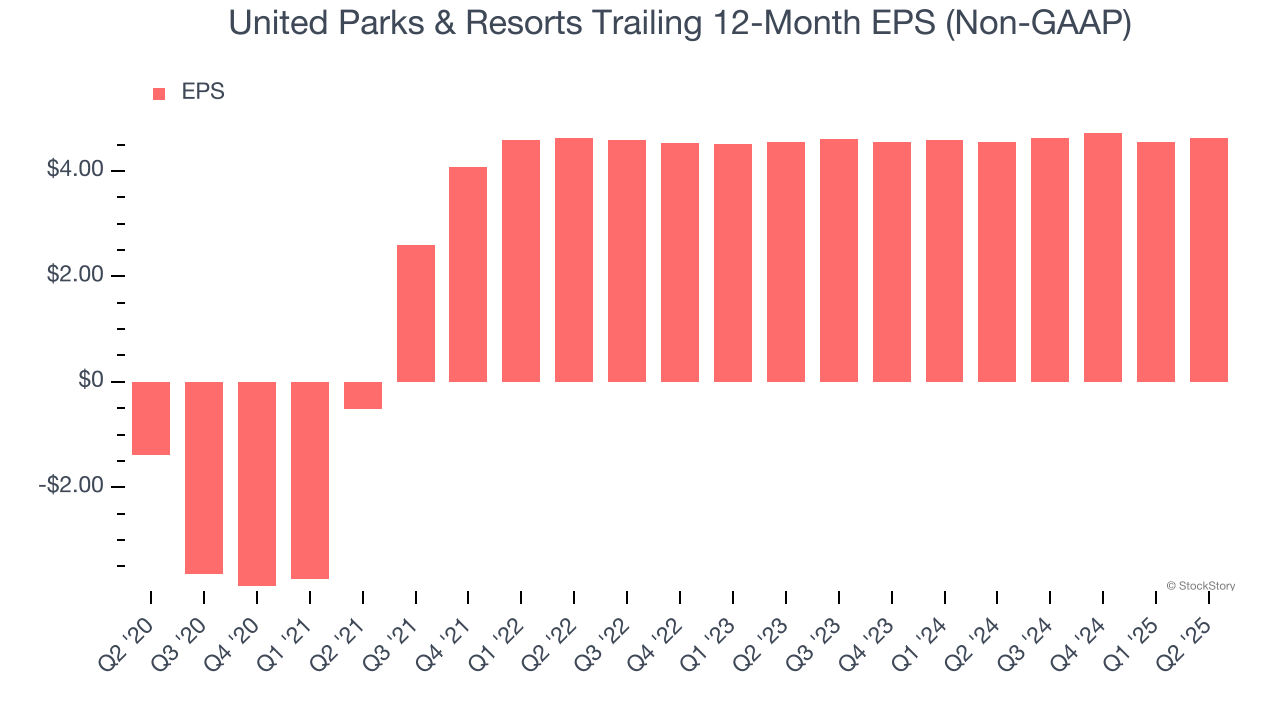

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

United Parks & Resorts’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

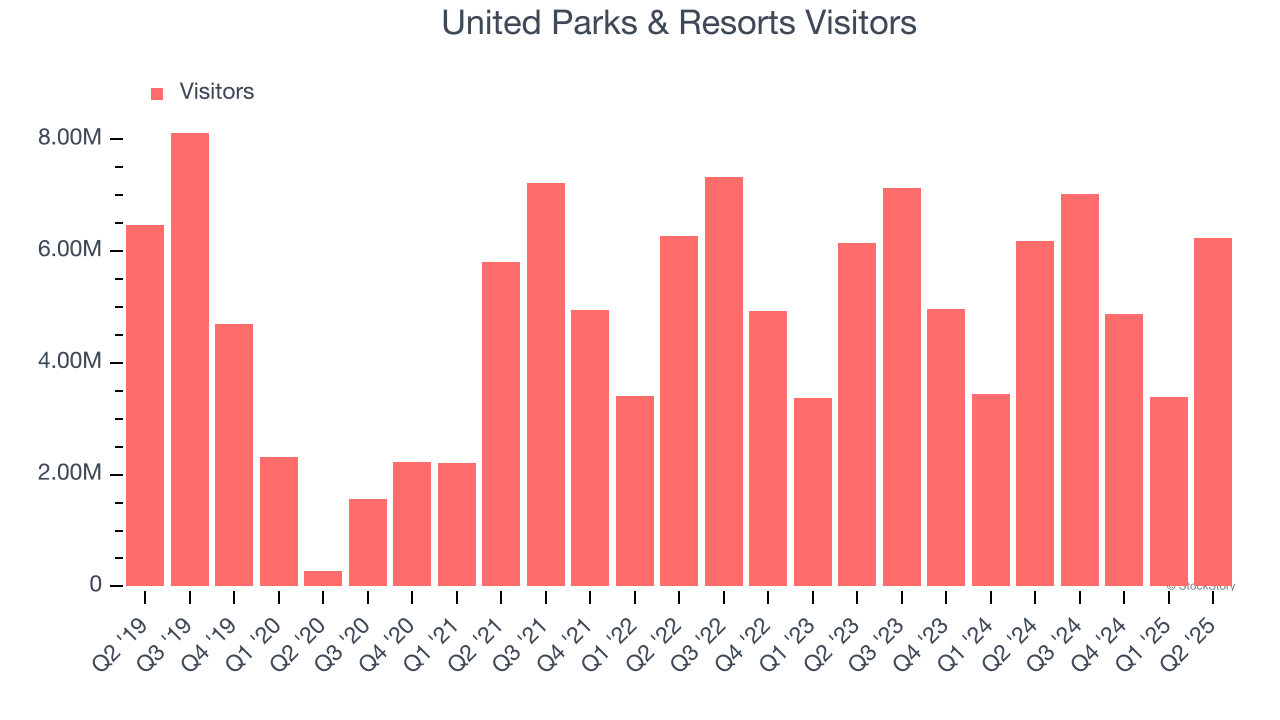

Inability to Grow Visitors Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like United Parks & Resorts, our preferred volume metric is visitors). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Over the last two years, United Parks & Resorts failed to grow its visitors, which came in at 6.23 million in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests United Parks & Resorts might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

United Parks & Resorts has huge potential even though it has some open questions. With its shares lagging the market recently, the stock trades at 10.5× forward P/E (or $51.21 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.