Outdoor lifestyle products brand (NYSE: YETI) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 3.8% year on year to $445.9 million. Its non-GAAP profit of $0.66 per share was 20.4% above analysts’ consensus estimates.

Is now the time to buy YETI? Find out by accessing our full research report, it’s free.

YETI (YETI) Q2 CY2025 Highlights:

- Revenue: $445.9 million vs analyst estimates of $462.8 million (3.8% year-on-year decline, 3.7% miss)

- Adjusted EPS: $0.66 vs analyst estimates of $0.55 (20.4% beat)

- Adjusted EBITDA: $64 million vs analyst estimates of $73.59 million (14.4% margin, 13% miss)

- Management raised its full-year Adjusted EPS guidance to $2.41 at the midpoint, a 21.1% increase

- Operating Margin: 13.9%, in line with the same quarter last year

- Free Cash Flow Margin: 11.2%, up from 9.7% in the same quarter last year

- Market Capitalization: $3.02 billion

Matt Reintjes, President and Chief Executive Officer, commented, “We are making excellent progress on our long-term strategic priorities—accelerating innovation, expanding our global brand, and diversifying our supply chain. We are seeing these strategies play out in the market with momentum in product innovation and diversification across our portfolio with notable strength in bags, our global expansion with exceptional performance in the UK and Europe and strong end user demand in Canada and Australia, and the transformational shift in our supply chain. Our brand continues to expand, connecting both domestically and, importantly, globally. Amidst a disruptive macroeconomic environment, we are positioning YETI to deliver long-term, sustainable top and bottom-line growth supported by a strong financial foundation. Our strong balance sheet and robust free cash flow generation are enabling investment in growth initiatives while also advancing our capital allocation priorities, including share repurchases. We exited the second quarter with encouraging momentum across our key growth drivers, and we are seeing signs of continued improvement in the third quarter, reinforcing our confidence in the trajectory ahead.”

Company Overview

Founded by two brothers from Texas, YETI (NYSE: YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

Revenue Growth

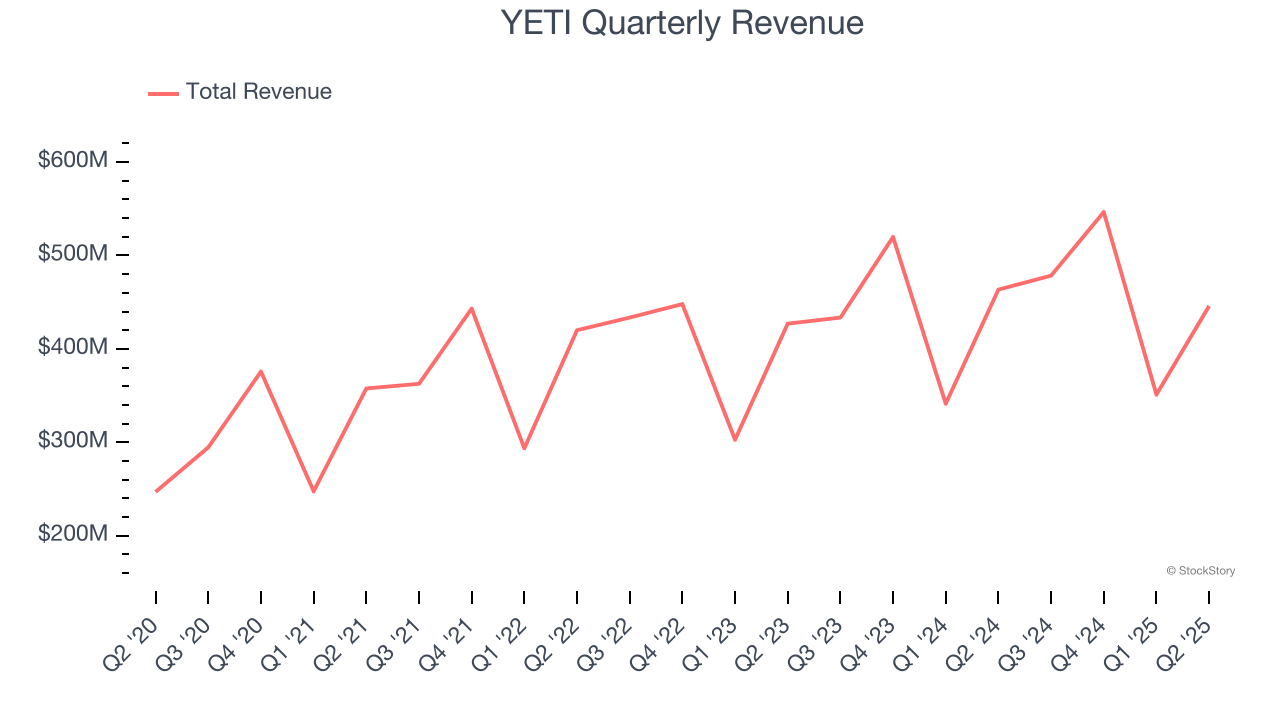

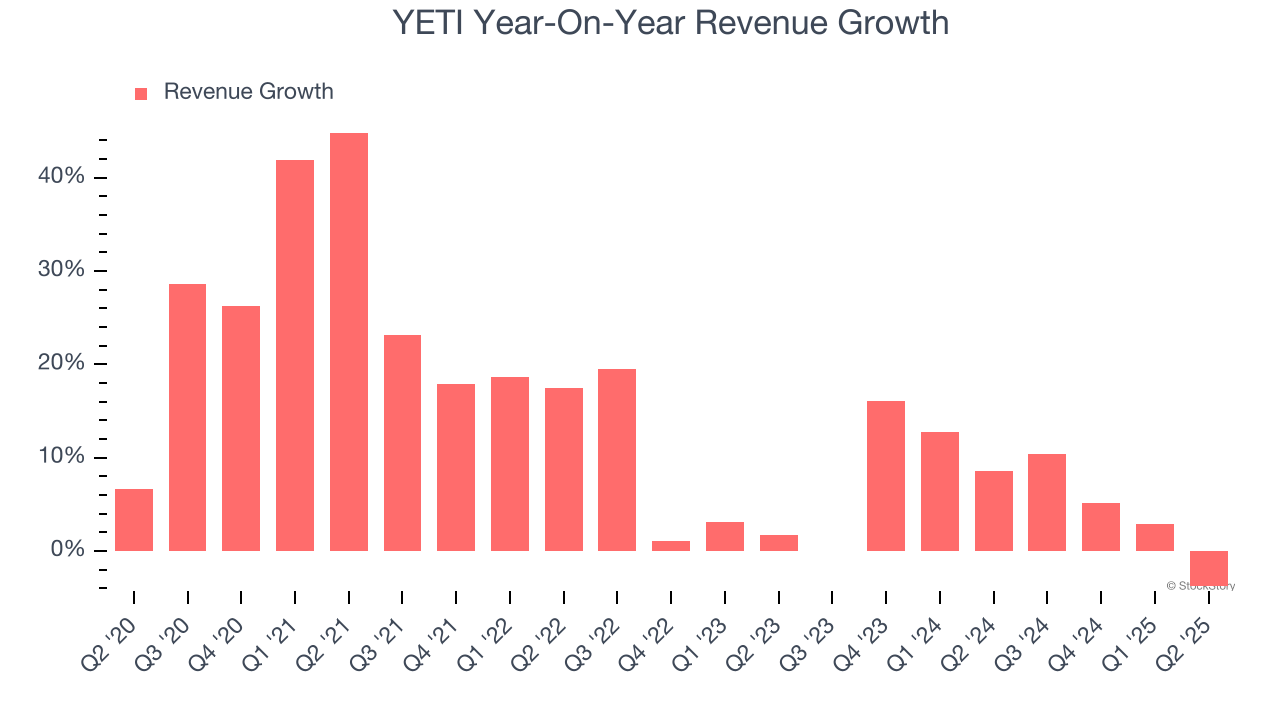

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, YETI grew its sales at a 14% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. YETI’s recent performance shows its demand has slowed as its annualized revenue growth of 6.3% over the last two years was below its five-year trend.

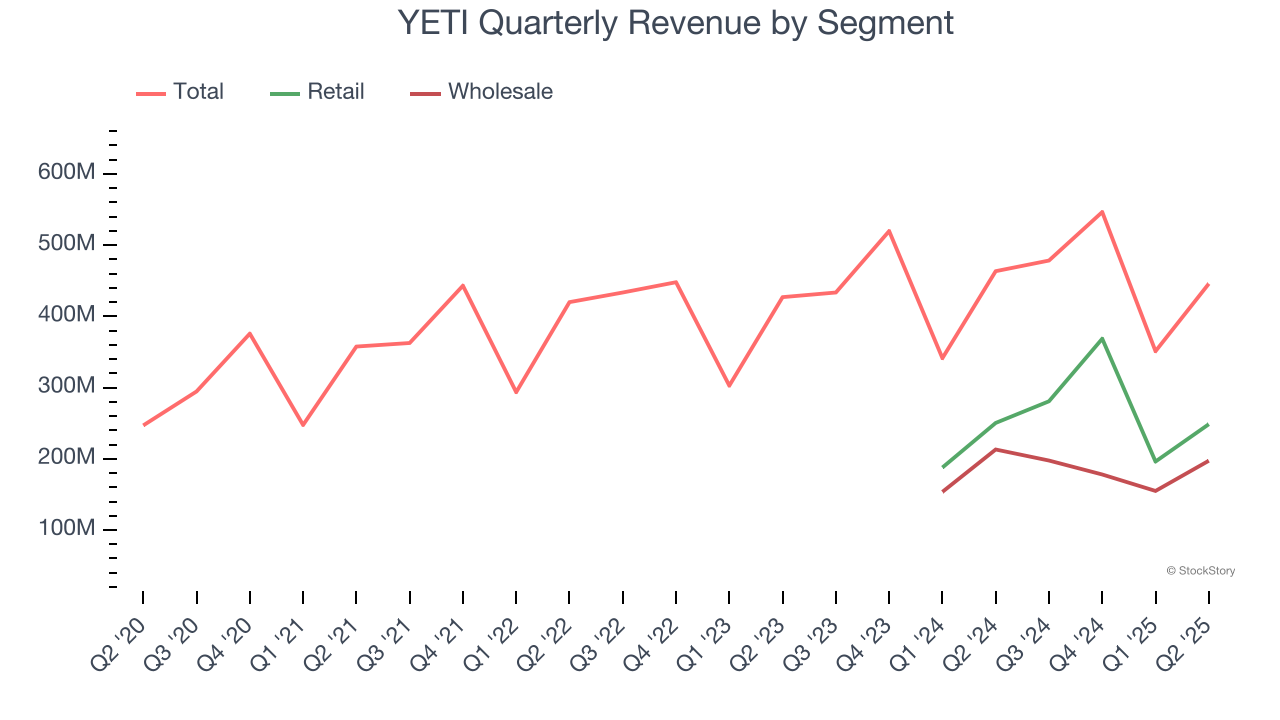

We can better understand the company’s revenue dynamics by analyzing its most important segments, Retail and Wholesale, which are 55.8% and 44.2% of revenue. Over the last two years, YETI’s Retail revenue (direct sales to customers) averaged 1.9% year-on-year growth. On the other hand, its Wholesale revenue (sales to retailers) averaged 3.3% declines.

This quarter, YETI missed Wall Street’s estimates and reported a rather uninspiring 3.8% year-on-year revenue decline, generating $445.9 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

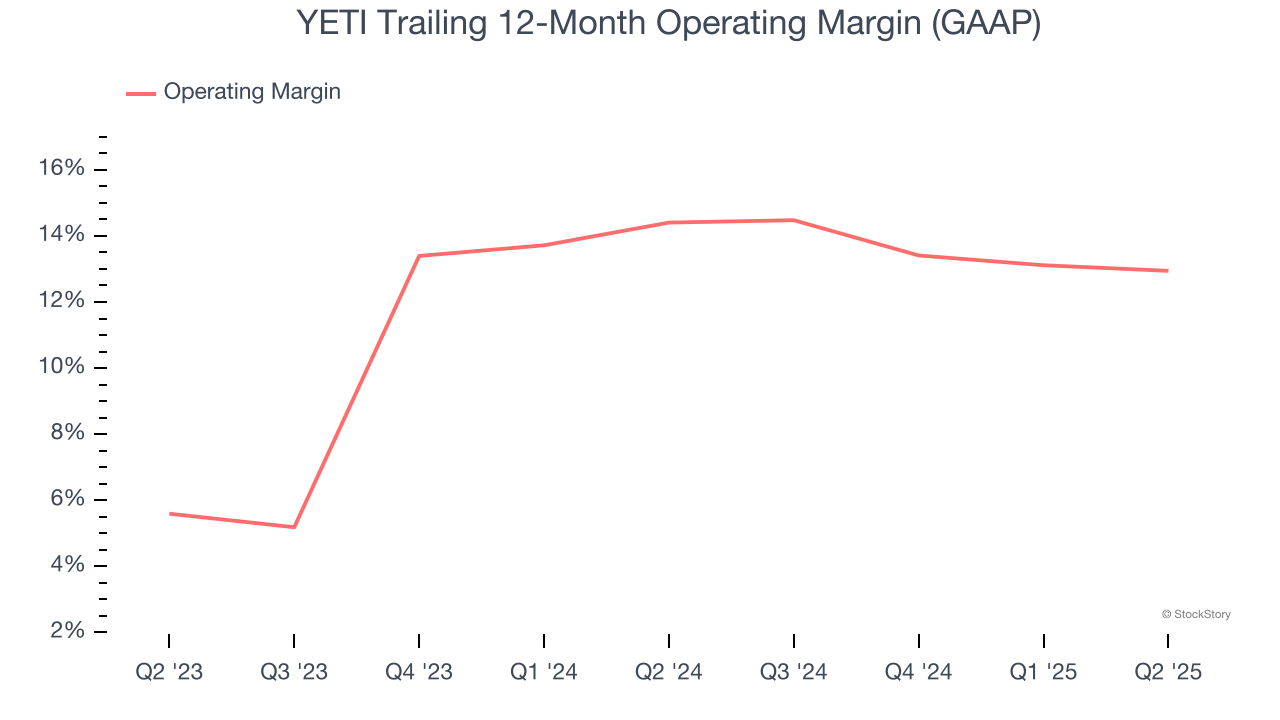

YETI’s operating margin has shrunk over the last 12 months, but it still averaged 13.7% over the last two years, solid for a consumer discretionary business. This shows it generally manages its expenses well.

In Q2, YETI generated an operating margin profit margin of 13.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

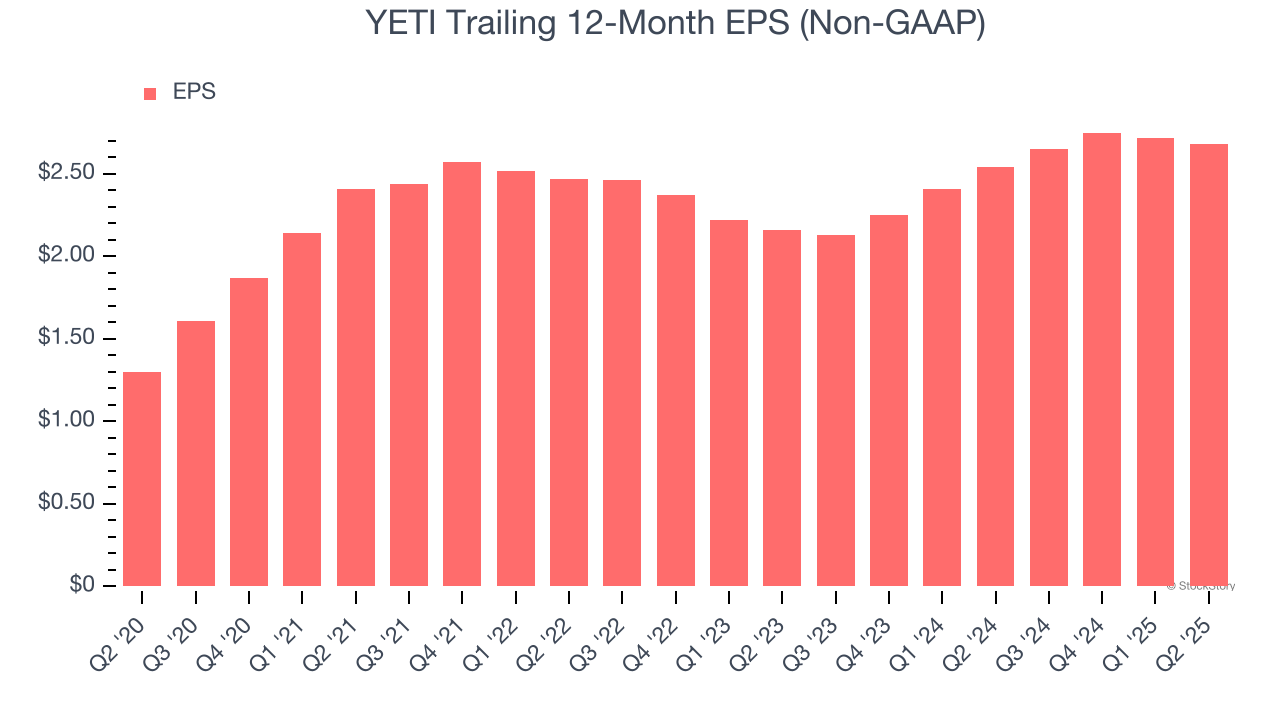

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

YETI’s solid 15.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q2, YETI reported adjusted EPS at $0.66, down from $0.70 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects YETI’s full-year EPS of $2.68 to shrink by 19.3%.

Key Takeaways from YETI’s Q2 Results

We were impressed by YETI’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its adjusted operating income outperformed Wall Street’s estimates. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The market seemed to be hoping for more, and the stock traded down 13.7% to $31.45 immediately after reporting.

So should you invest in YETI right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.