Dental products company Dentsply Sirona (NASDAQ: XRAY) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 4.9% year on year to $936 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $3.65 billion at the midpoint. Its non-GAAP profit of $0.52 per share was 3.2% above analysts’ consensus estimates.

Is now the time to buy Dentsply Sirona? Find out by accessing our full research report, it’s free.

Dentsply Sirona (XRAY) Q2 CY2025 Highlights:

- Revenue: $936 million vs analyst estimates of $932.9 million (4.9% year-on-year decline, in line)

- Adjusted EPS: $0.52 vs analyst estimates of $0.50 (3.2% beat)

- Adjusted EBITDA: $197 million vs analyst estimates of $180.6 million (21% margin, 9.1% beat)

- The company reconfirmed its revenue guidance for the full year of $3.65 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $1.90 at the midpoint

- Operating Margin: -13.7%, down from 5.1% in the same quarter last year

- Free Cash Flow Margin: 1.7%, down from 15.9% in the same quarter last year

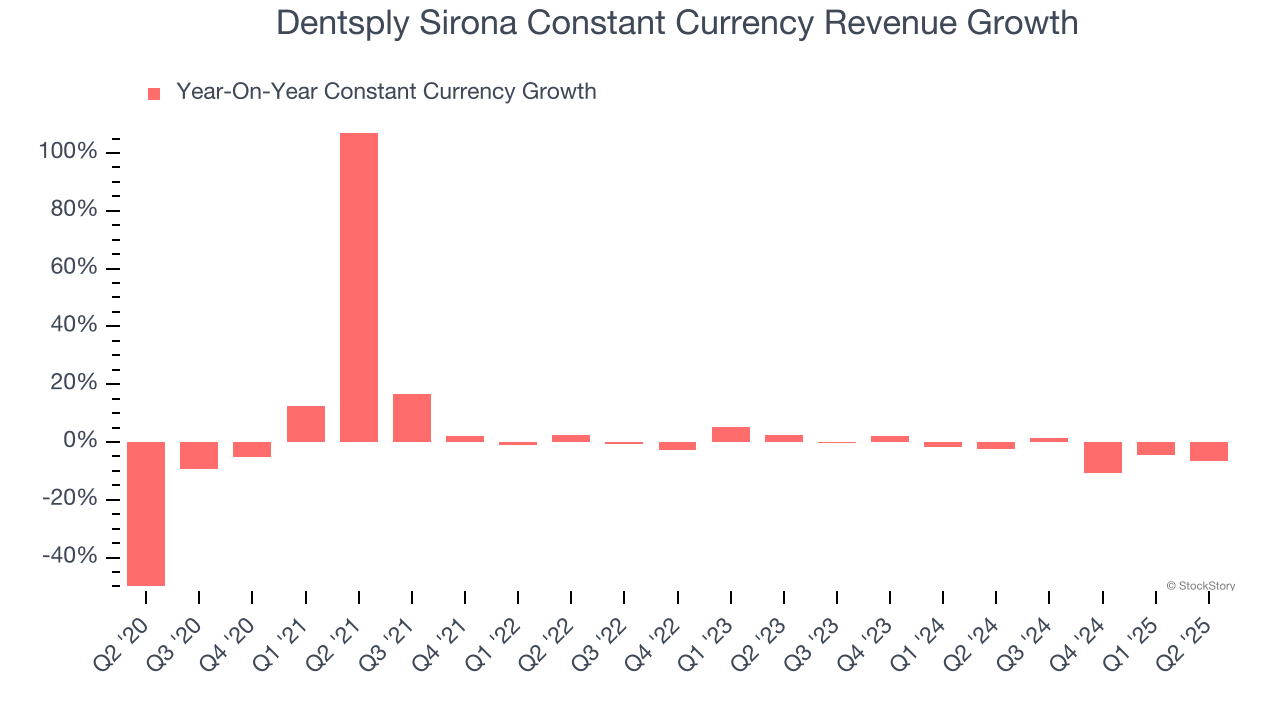

- Constant Currency Revenue fell 6.7% year on year (-2.4% in the same quarter last year)

- Market Capitalization: $2.73 billion

"I see tremendous opportunity at Dentsply Sirona and I am looking forward to digging in with the team to increase our customer-centric focus and to direct investments in areas that will generate sustainable growth," said Dan Scavilla, Chief Executive Officer.

Company Overview

With roots dating back to 1877 when it introduced the first dental electric drill, Dentsply Sirona (NASDAQ: XRAY) manufactures and sells professional dental equipment, technologies, and consumable products used by dentists and specialists worldwide.

Revenue Growth

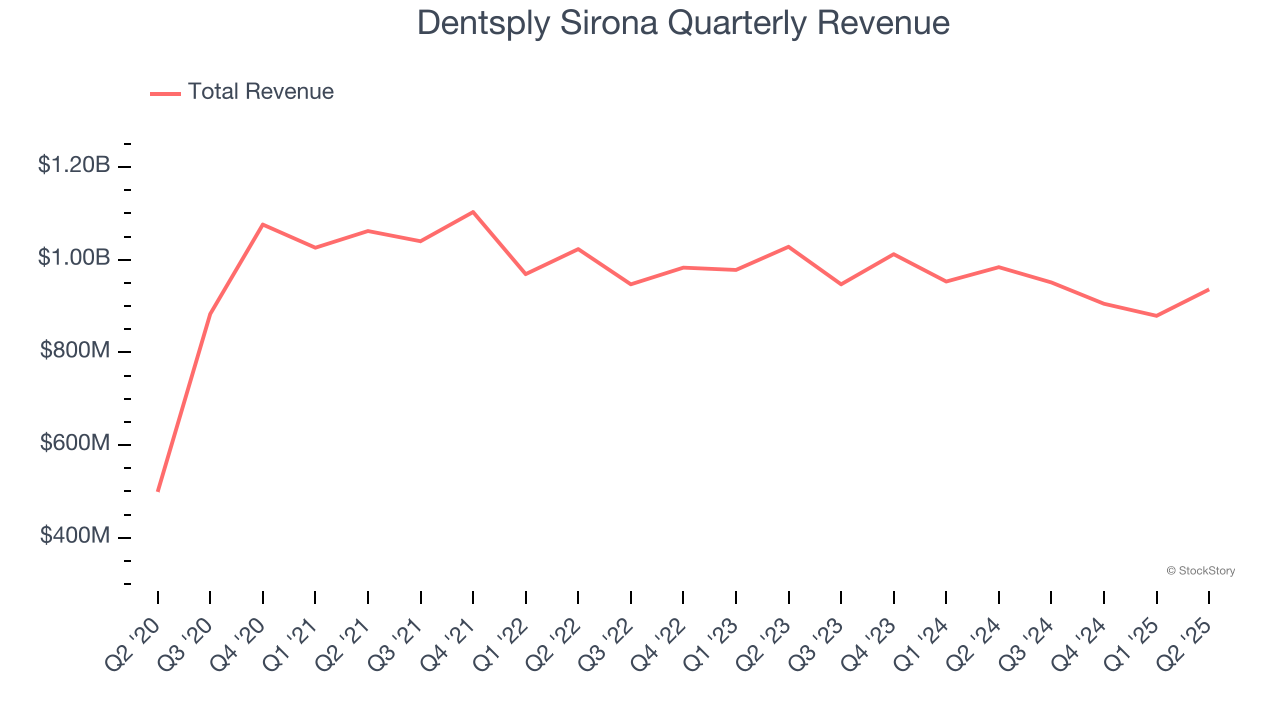

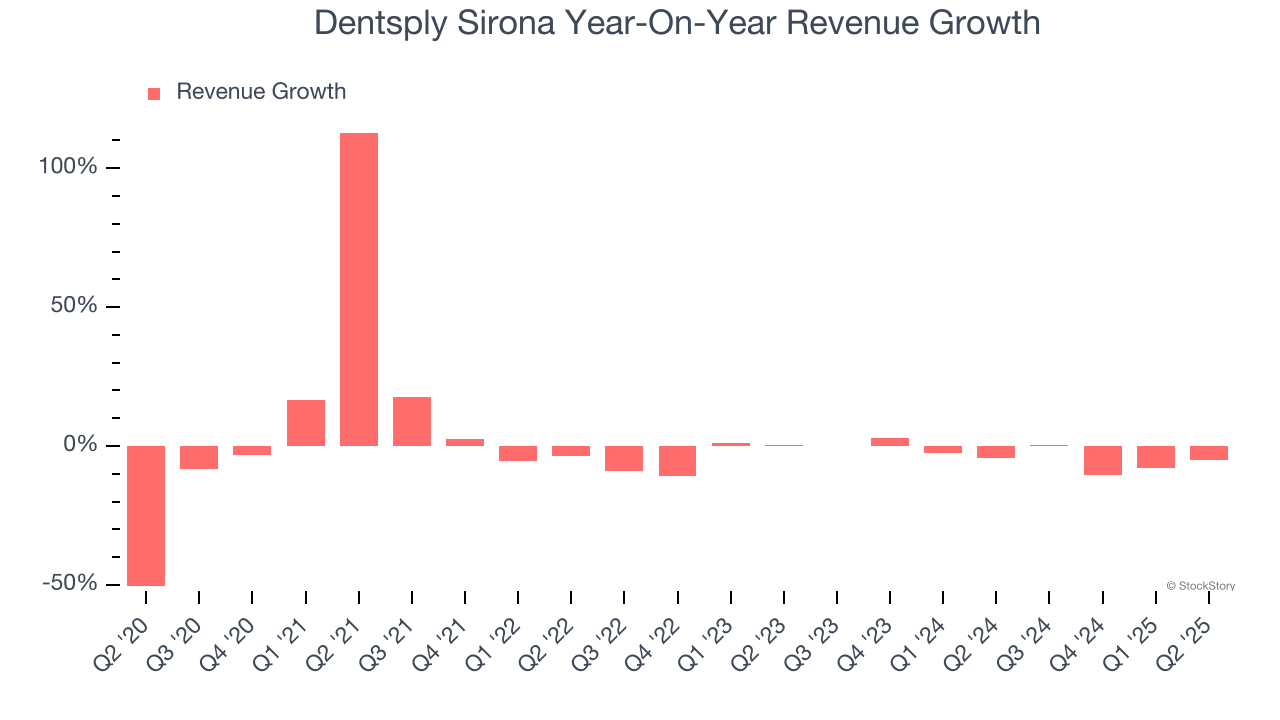

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Dentsply Sirona grew its sales at a tepid 1.2% compounded annual growth rate. This fell short of our benchmarks and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Dentsply Sirona’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.4% annually.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 2.9% year-on-year declines. Because this number aligns with its normal revenue growth, we can see that Dentsply Sirona has properly hedged its foreign currency exposure.

This quarter, Dentsply Sirona reported a rather uninspiring 4.9% year-on-year revenue decline to $936 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

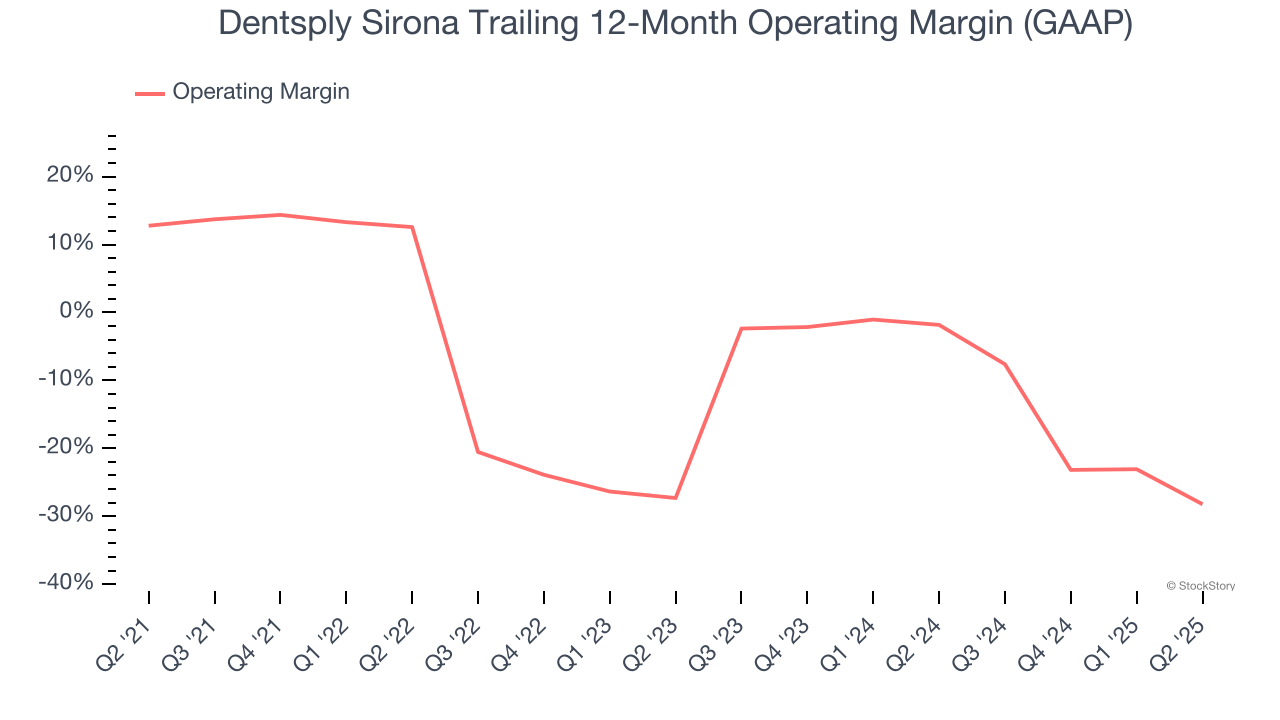

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Dentsply Sirona’s high expenses have contributed to an average operating margin of negative 5.8% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Dentsply Sirona’s operating margin decreased by 41 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Dentsply Sirona’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q2, Dentsply Sirona generated a negative 13.7% operating margin. The company's consistent lack of profits raise a flag.

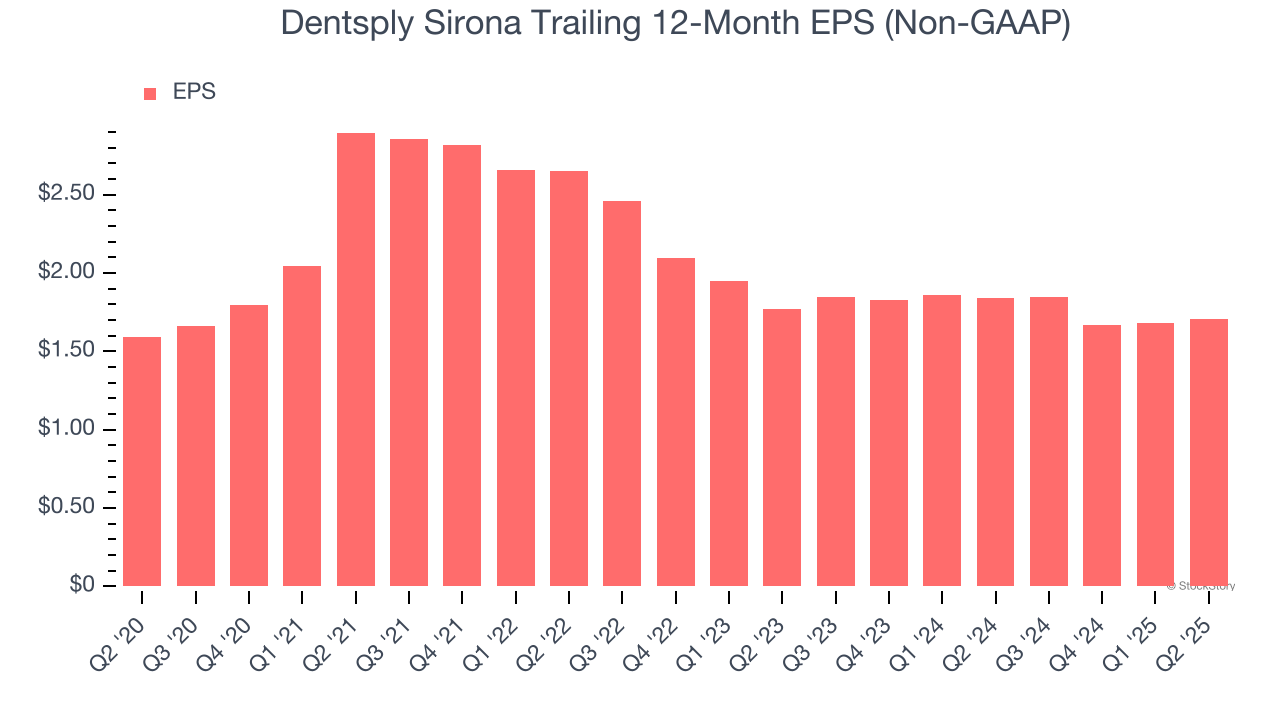

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Dentsply Sirona’s unimpressive 1.4% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

In Q2, Dentsply Sirona reported adjusted EPS at $0.52, up from $0.49 in the same quarter last year. This print beat analysts’ estimates by 3.2%. Over the next 12 months, Wall Street expects Dentsply Sirona’s full-year EPS of $1.71 to grow 13.6%.

Key Takeaways from Dentsply Sirona’s Q2 Results

It was good to see Dentsply Sirona narrowly top analysts’ full-year EPS guidance expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its constant currency revenue missed. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 4.5% to $13.05 immediately following the results.

So do we think Dentsply Sirona is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.