Gaming products and services provider Light & Wonder (NASDAQ: LNW) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 1.1% year on year to $809 million. Its non-GAAP profit of $1.58 per share was 12.7% above analysts’ consensus estimates.

Is now the time to buy Light & Wonder? Find out by accessing our full research report, it’s free.

Light & Wonder (LNW) Q2 CY2025 Highlights:

- Revenue: $809 million vs analyst estimates of $846.2 million (1.1% year-on-year decline, 4.4% miss)

- Adjusted EPS: $1.58 vs analyst estimates of $1.40 (12.7% beat)

- Adjusted EBITDA: $352 million vs analyst estimates of $351.8 million (43.5% margin, in line)

- Operating Margin: 25%, up from 21.4% in the same quarter last year

- Free Cash Flow Margin: 3.6%, down from 6.7% in the same quarter last year

- Market Capitalization: $7.42 billion

Company Overview

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ: LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

Revenue Growth

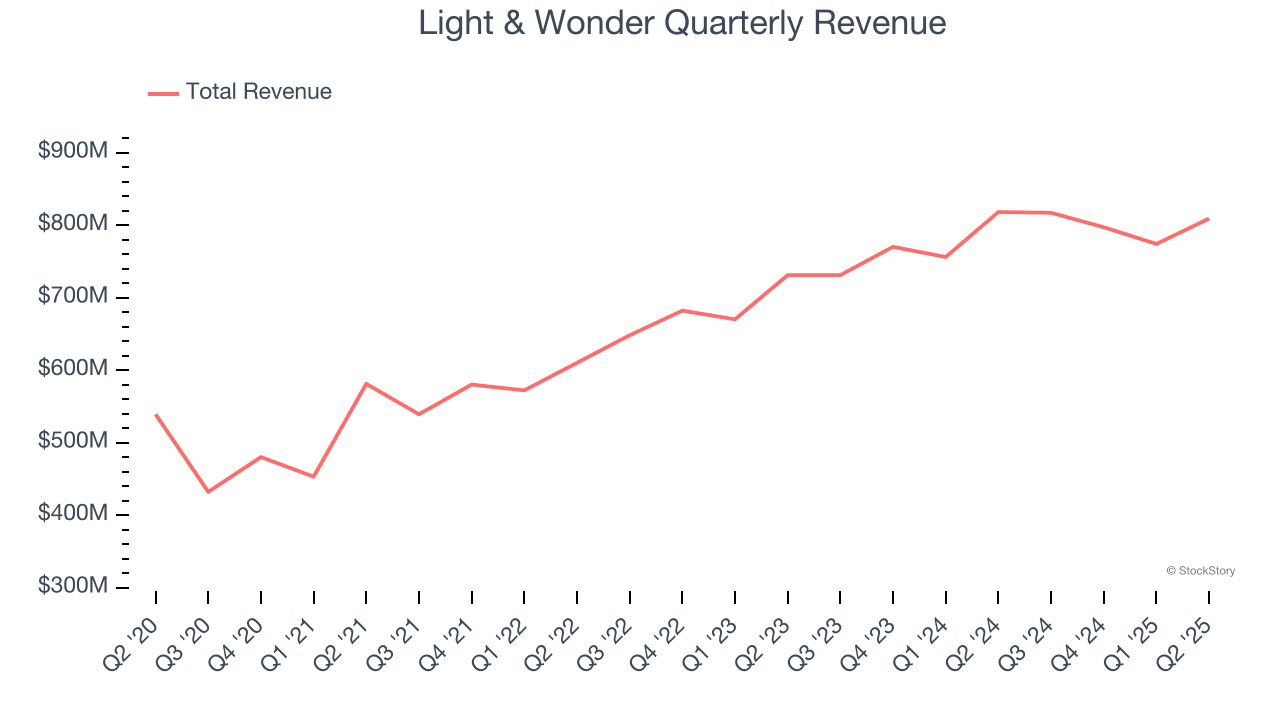

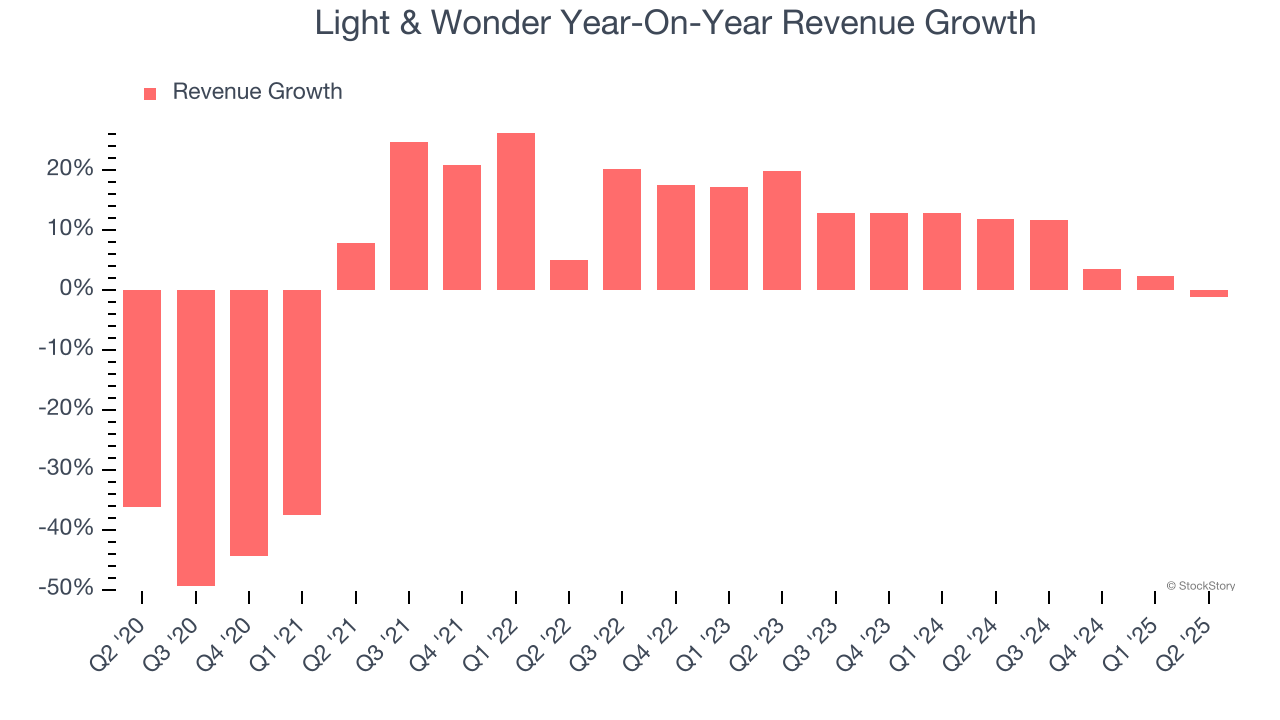

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Light & Wonder’s 1.4% annualized revenue growth over the last five years was weak. This wasn’t a great result, but there are still things to like about Light & Wonder.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Light & Wonder’s annualized revenue growth of 8.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

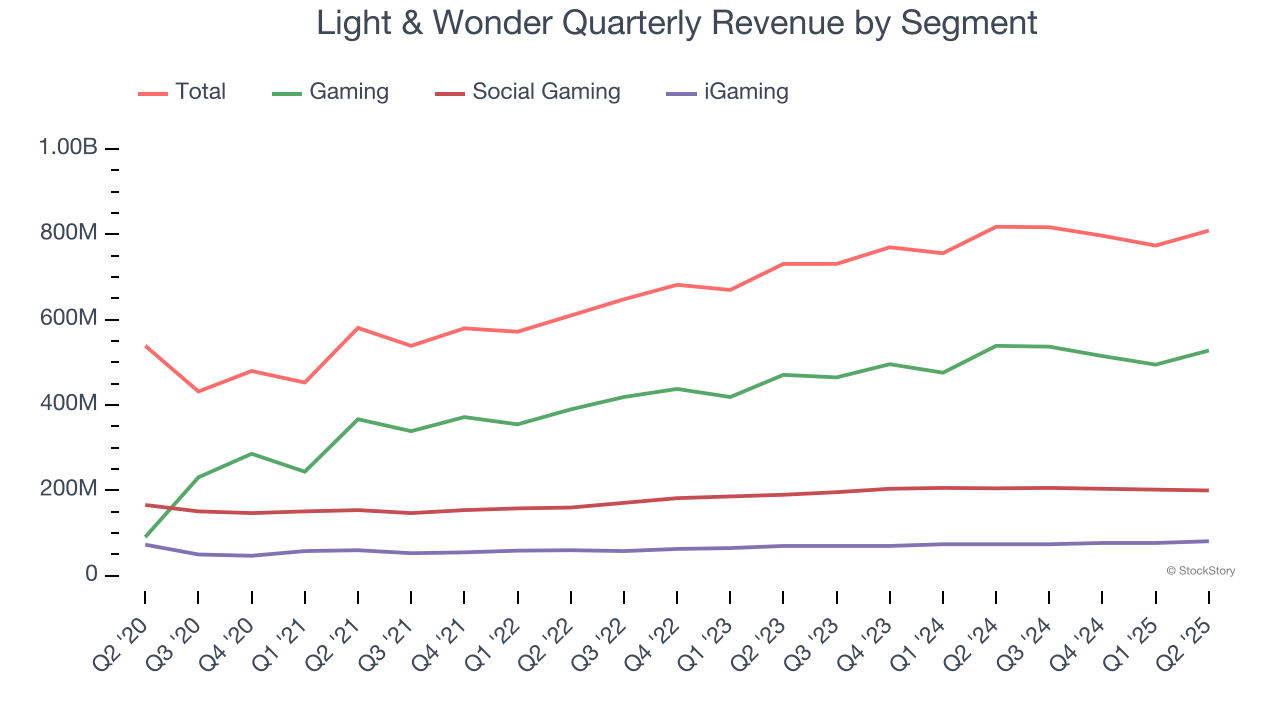

Light & Wonder also breaks out the revenue for its three most important segments: Gaming, Social Gaming, and iGaming, which are 65.3%, 24.7%, and 10% of revenue. Over the last two years, Light & Wonder’s revenues in all three segments increased. Its Gaming revenue (slot machines, casino games) averaged year-on-year growth of 9.2% while its Social Gaming (free-to-play games) and iGaming (digital games) revenues averaged 5.8% and 10.1%.

This quarter, Light & Wonder missed Wall Street’s estimates and reported a rather uninspiring 1.1% year-on-year revenue decline, generating $809 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

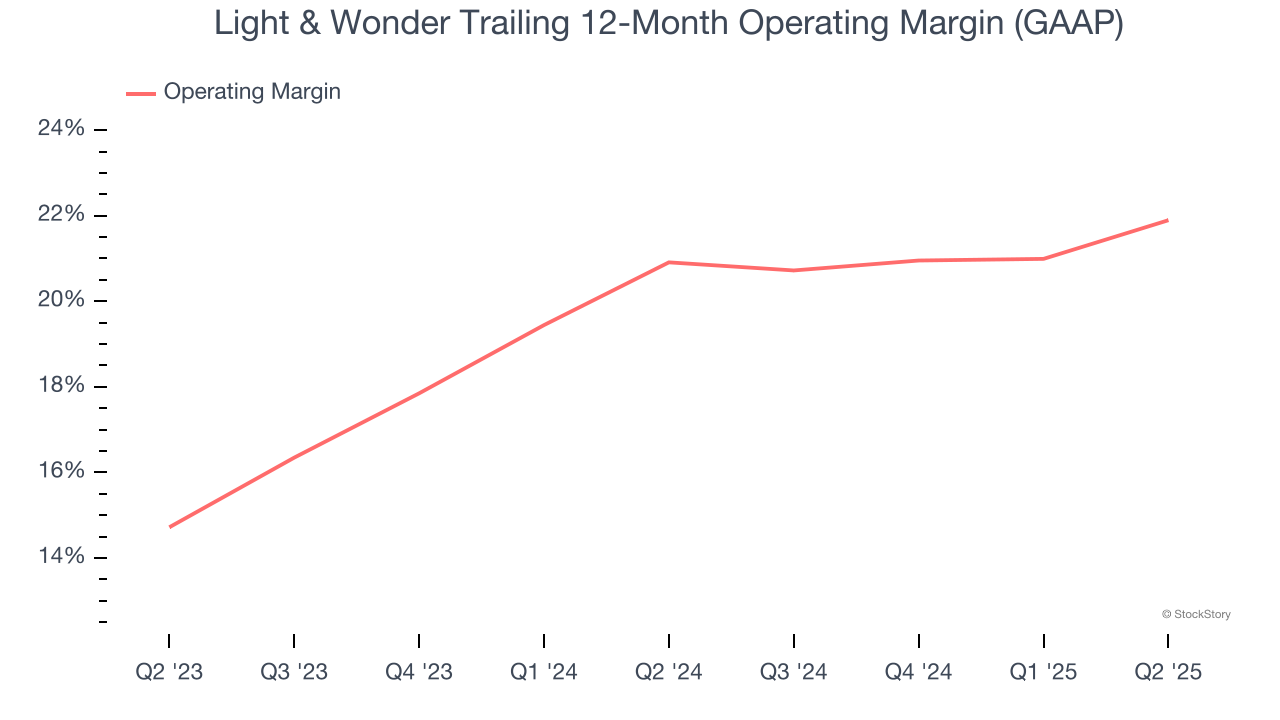

Light & Wonder’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 21.4% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

In Q2, Light & Wonder generated an operating margin profit margin of 25%, up 3.6 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

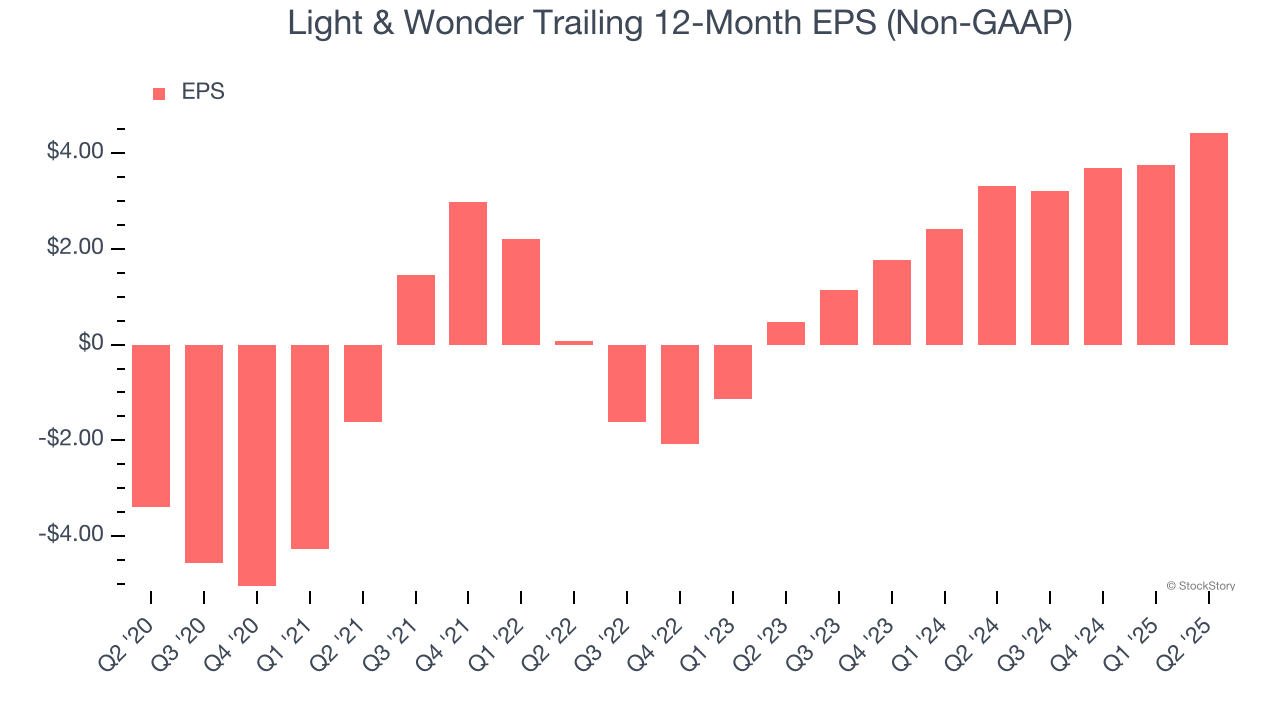

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Light & Wonder’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q2, Light & Wonder reported adjusted EPS at $1.58, up from $0.90 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Light & Wonder’s full-year EPS of $4.43 to grow 51.4%.

Key Takeaways from Light & Wonder’s Q2 Results

It was encouraging to see Light & Wonder beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its iGaming revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.7% to $88.50 immediately following the results.

Light & Wonder’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.