Casual restaurant chain Dine Brands (NYSE: DIN) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 11.9% year on year to $230.8 million. Its non-GAAP profit of $1.17 per share was 19.4% below analysts’ consensus estimates.

Is now the time to buy Dine Brands? Find out by accessing our full research report, it’s free.

Dine Brands (DIN) Q2 CY2025 Highlights:

- Revenue: $230.8 million vs analyst estimates of $223.5 million (11.9% year-on-year growth, 3.3% beat)

- Adjusted EPS: $1.17 vs analyst expectations of $1.45 (19.4% miss)

- Adjusted EBITDA: $56.19 million vs analyst estimates of $62.63 million (24.3% margin, 10.3% miss)

- EBITDA guidance for the full year is $225 million at the midpoint, below analyst estimates of $233.6 million

- Operating Margin: 18%, down from 25.4% in the same quarter last year

- Free Cash Flow Margin: 13.4%, up from 8.8% in the same quarter last year

- Locations: 3,387 at quarter end, down from 3,436 in the same quarter last year

- Market Capitalization: $340.8 million

“In the second quarter, we continued to build positive momentum across both Applebee’s and IHOP, with notable improvements in sales and traffic. Applebee’s benefited from strong consumer response to our value-driven promotions and continued innovation in menu and marketing, while IHOP saw growth fueled by its refreshed brand positioning and value strategy. At the same time, our Dual Brands initiative is building traction with our franchisees as our second domestic unit also opened with strong economics. We remain confident that our ongoing investments will generate sustainable value for our shareholders and franchisees based on these results,” said John Peyton, Chief Executive Officer of Dine Brands.

Company Overview

Operating a franchise model, Dine Brands (NYSE: DIN) is a casual restaurant chain that owns the Applebee’s and IHOP banners.

Revenue Growth

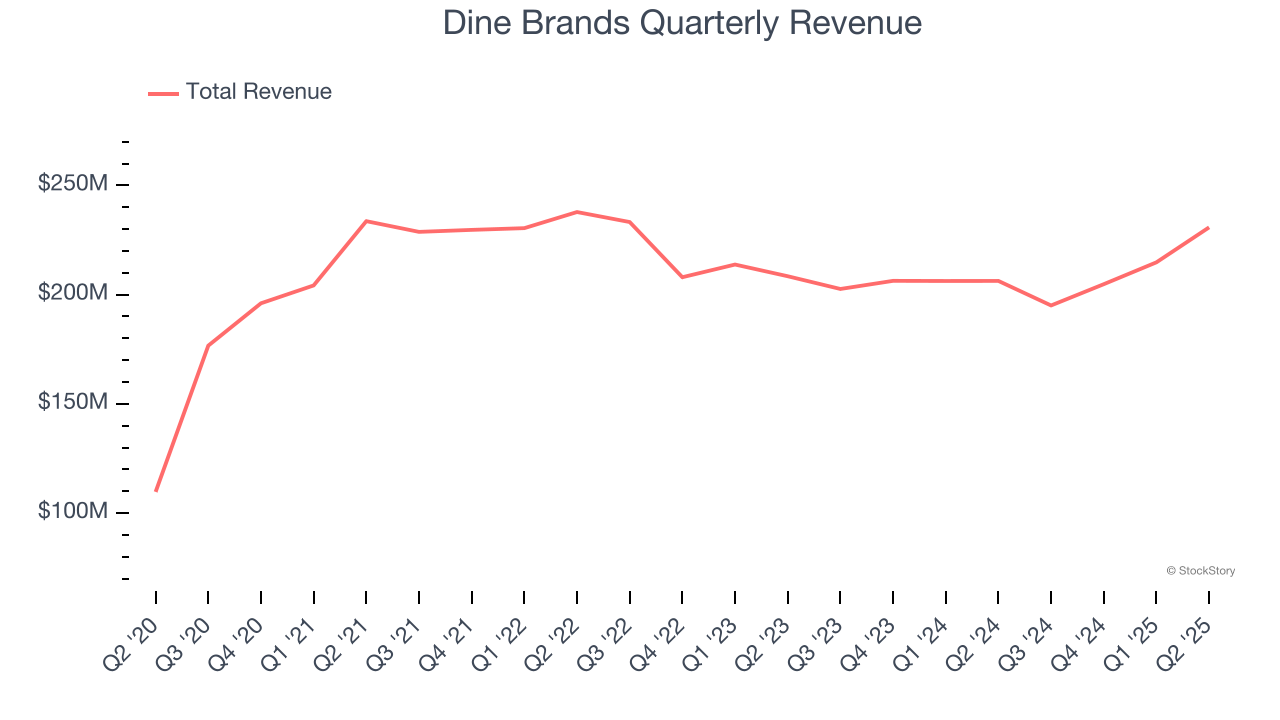

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $845.4 million in revenue over the past 12 months, Dine Brands is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Dine Brands struggled to increase demand as its $845.4 million of sales for the trailing 12 months was close to its revenue six years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it didn’t open many new restaurants and observed lower sales at existing, established dining locations.

This quarter, Dine Brands reported year-on-year revenue growth of 11.9%, and its $230.8 million of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months. While this projection implies its newer menu offerings will fuel better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

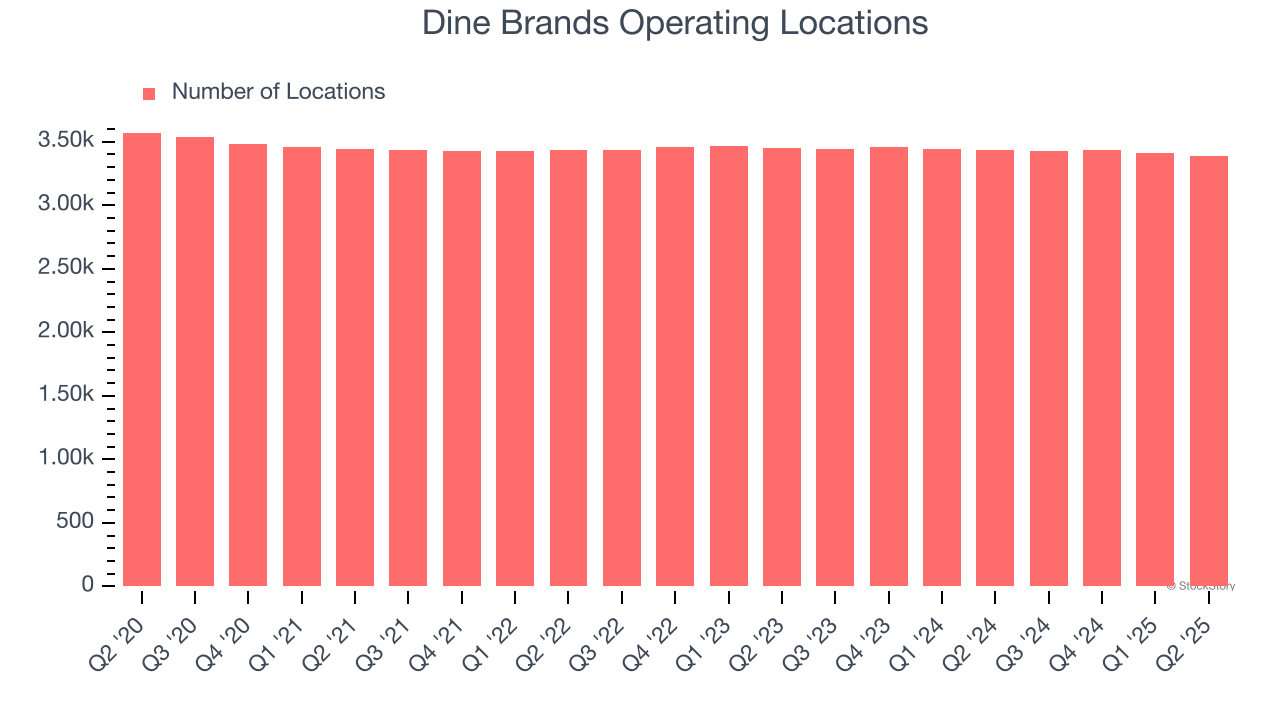

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Dine Brands operated 3,387 locations in the latest quarter, and over the last two years, has kept its restaurant count flat while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

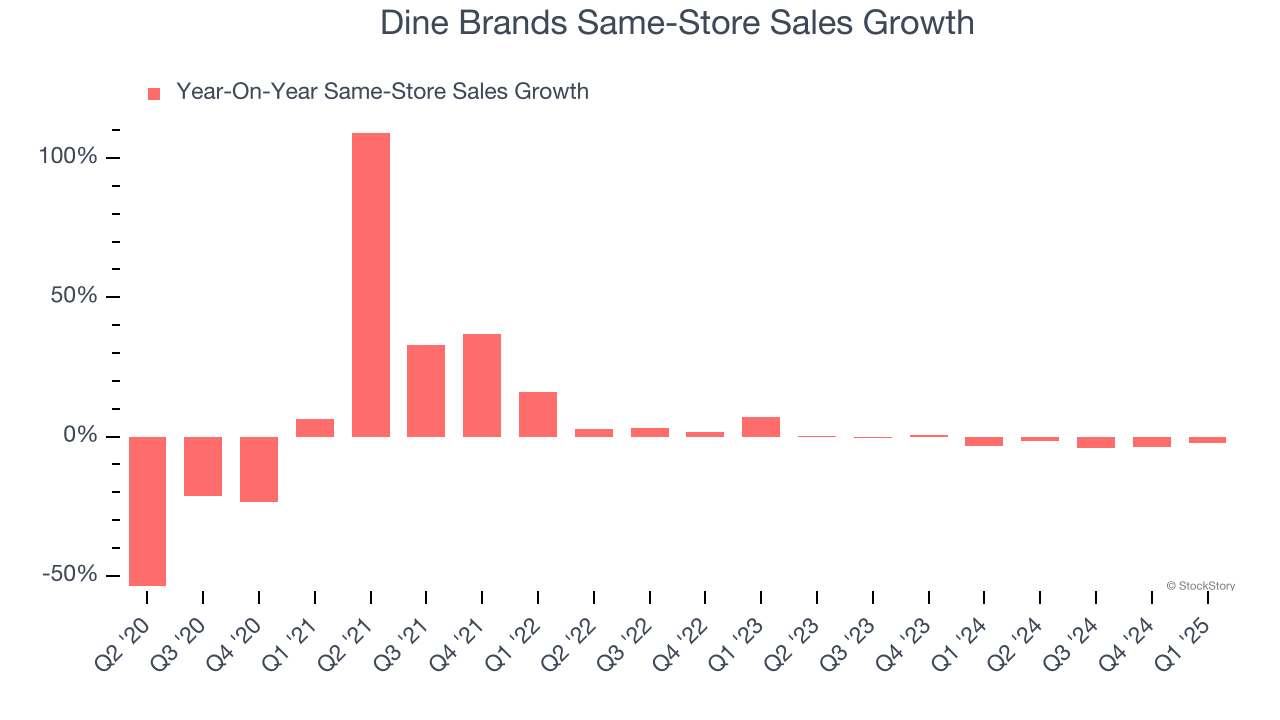

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Dine Brands’s demand has been shrinking over the last two years as its same-store sales have averaged 2.2% annual declines. This performance isn’t ideal, and we’d be concerned if Dine Brands starts opening new restaurants to artificially boost revenue growth.

Note that Dine Brands reports its same-store sales intermittently, so some data points are missing in the chart below.

Key Takeaways from Dine Brands’s Q2 Results

We were impressed by how significantly Dine Brands blew past analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 3.9% to $20.95 immediately after reporting.

Dine Brands’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.