Digital media measurement and analytics provider DoubleVerify (NYSE: DV) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 21.3% year on year to $189 million. Guidance for next quarter’s revenue was better than expected at $190 million at the midpoint, 1.9% above analysts’ estimates. Its GAAP profit of $0.05 per share was in line with analysts’ consensus estimates.

Is now the time to buy DoubleVerify? Find out by accessing our full research report, it’s free.

DoubleVerify (DV) Q2 CY2025 Highlights:

- Revenue: $189 million vs analyst estimates of $180.9 million (21.3% year-on-year growth, 4.5% beat)

- EPS (GAAP): $0.05 vs analyst estimates of $0.06 (in line)

- Adjusted EBITDA: $57.27 million vs analyst estimates of $53.81 million (30.3% margin, 6.4% beat)

- Revenue Guidance for Q3 CY2025 is $190 million at the midpoint, above analyst estimates of $186.4 million

- EBITDA guidance for Q3 CY2025 is $62 million at the midpoint, above analyst estimates of $61.14 million

- Operating Margin: 7.2%, in line with the same quarter last year

- Free Cash Flow Margin: 21.2%, up from 19% in the previous quarter

- Market Capitalization: $2.51 billion

“We drove 21% year-over-year growth in Q2, significantly outperforming the revenue expectations we raised at Innovation Day and building momentum across all key areas of the business,” said Mark Zagorski, CEO of DoubleVerify.

Company Overview

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

Revenue Growth

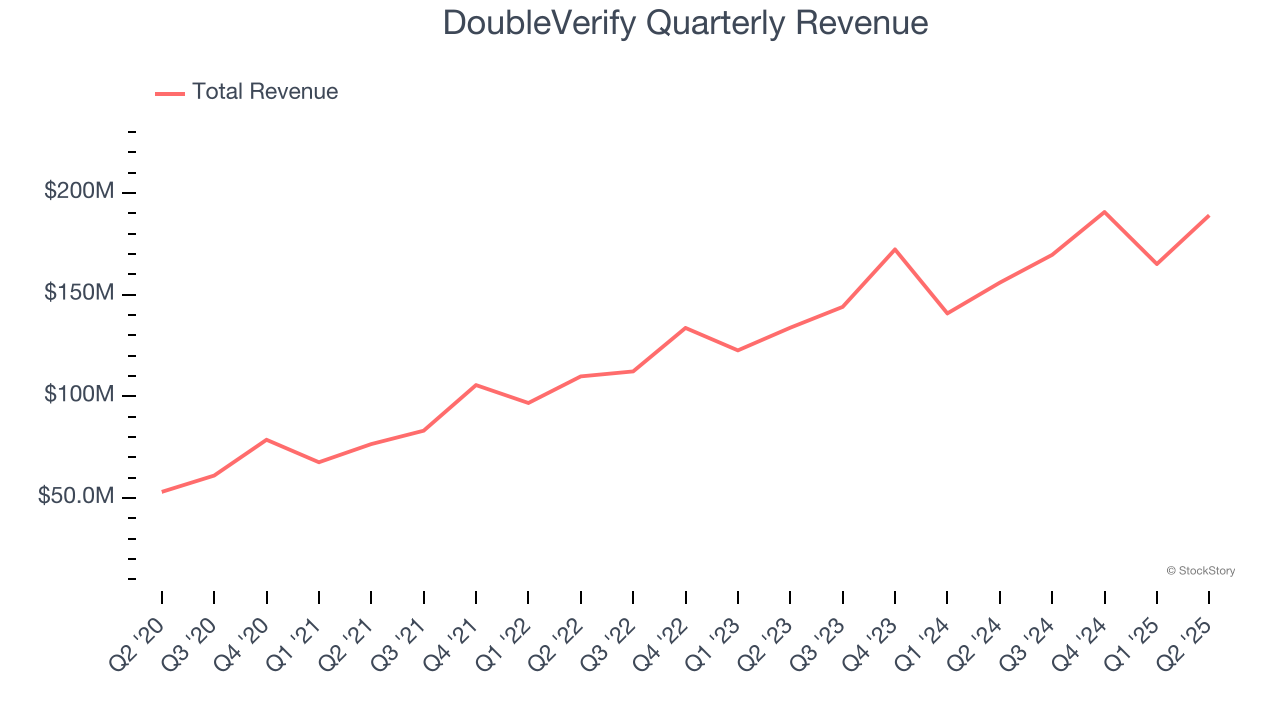

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, DoubleVerify grew its sales at a decent 21.8% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, DoubleVerify reported robust year-on-year revenue growth of 21.3%, and its $189 million of revenue topped Wall Street estimates by 4.5%. Company management is currently guiding for a 12.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.4% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

DoubleVerify is extremely efficient at acquiring new customers, and its CAC payback period checked in at 4.8 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give DoubleVerify more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from DoubleVerify’s Q2 Results

We enjoyed seeing DoubleVerify beat analysts’ revenue and EBITDA expectations this quarter. We also liked that guidance was largely ahead of Wall Street's estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $15.60 immediately after reporting.

DoubleVerify had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.