Looking back on semiconductor manufacturing stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Kulicke and Soffa (NASDAQ: KLIC) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was 2.9% below.

Luckily, semiconductor manufacturing stocks have performed well with share prices up 24.9% on average since the latest earnings results.

Kulicke and Soffa (NASDAQ: KLIC)

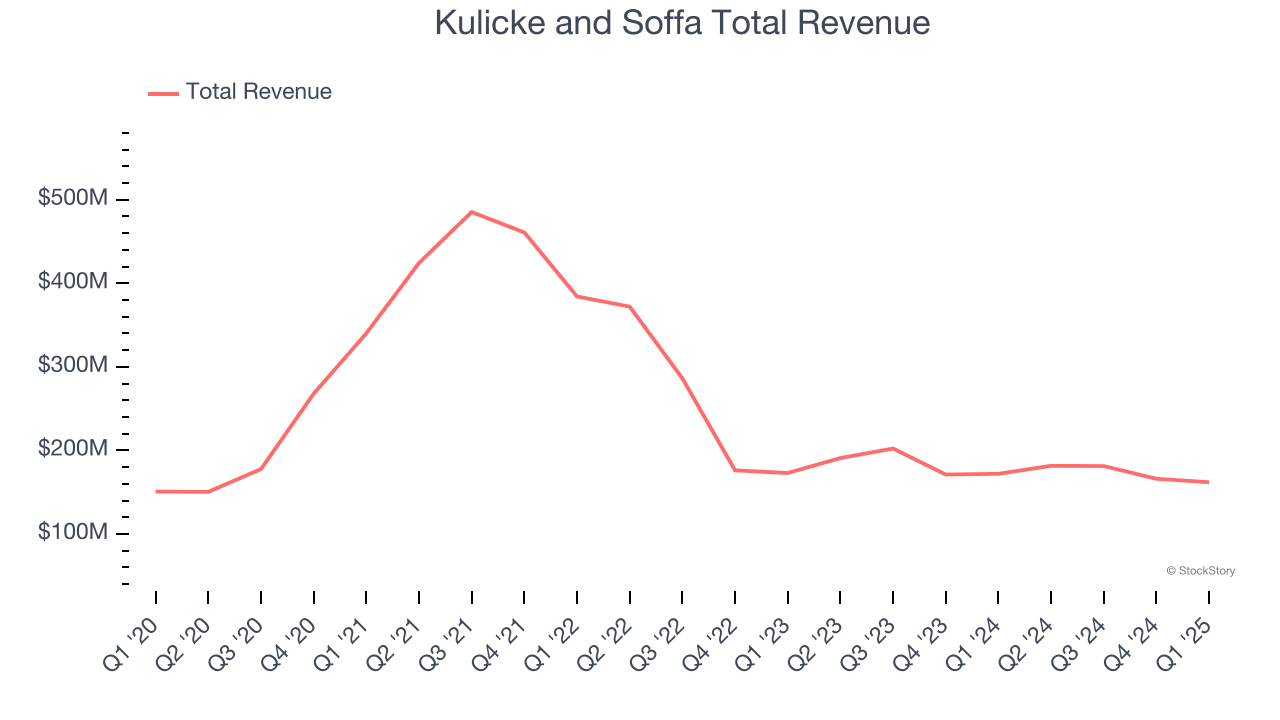

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $162 million, down 5.9% year on year. This print fell short of analysts’ expectations by 1.9%. Overall, it was a softer quarter for the company with a significant miss of analysts’ adjusted operating income and EPS estimates.

Fusen Chen, Kulicke & Soffa's President and Chief Executive Officer, stated, "We recently experienced more cautious order activity unique to certain Southeast Asia markets. Despite this near-term regional dynamic, we continue to support our global customer base, see positive core-market utilization data and remain well prepared to accelerate growth through Vertical Wire, Power-Semiconductor, Advanced Dispense and Thermo-Compression technology transitions."

Interestingly, the stock is up 16.4% since reporting and currently trades at $36.95.

Read our full report on Kulicke and Soffa here, it’s free.

Best Q1: FormFactor (NASDAQ: FORM)

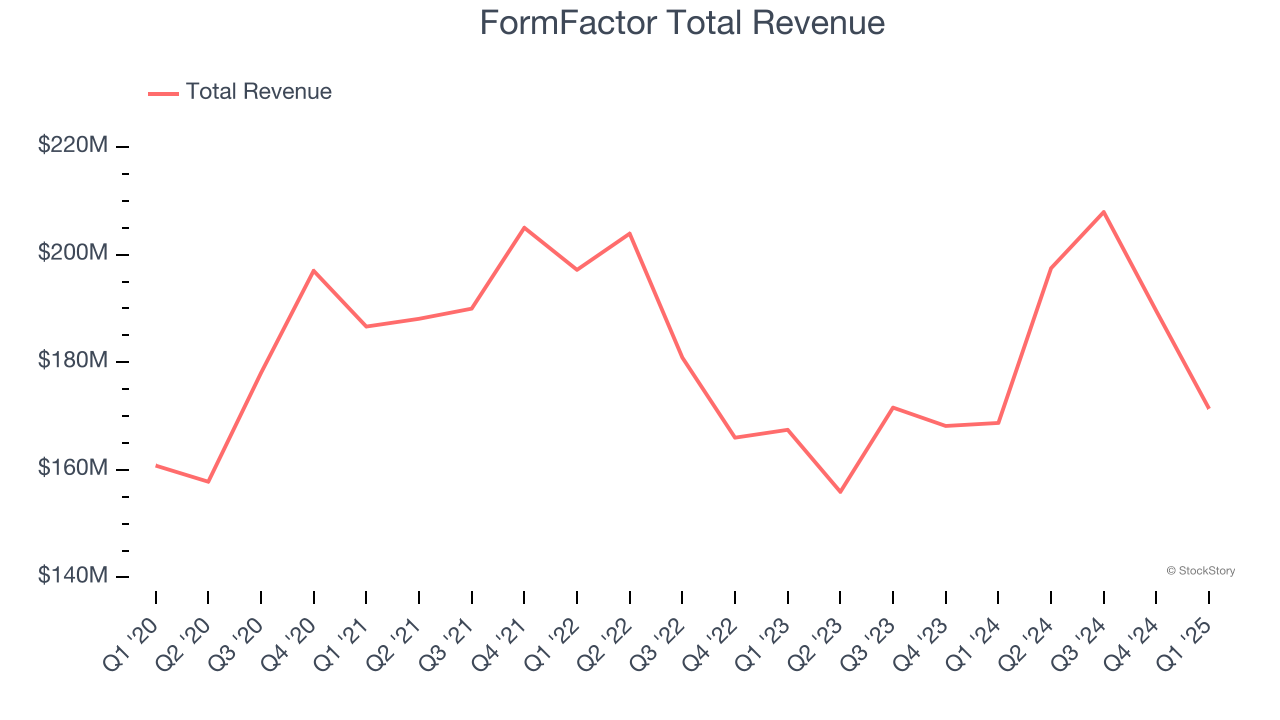

With customers across the foundry and fabless markets, FormFactor (NASDAQ: FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $171.4 million, up 1.6% year on year, outperforming analysts’ expectations by 0.9%. The business had a strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 29.3% since reporting. It currently trades at $36.30.

Is now the time to buy FormFactor? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Photronics (NASDAQ: PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ: PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $211 million, down 2.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

The stock is flat since the results and currently trades at $19.88.

Read our full analysis of Photronics’s results here.

Applied Materials (NASDAQ: AMAT)

Founded in 1967 as the first company to develop tools for other businesses in the semiconductor industry, Applied Materials (NASDAQ: AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Applied Materials reported revenues of $7.1 billion, up 6.8% year on year. This number met analysts’ expectations. More broadly, it was a mixed quarter as it also recorded a solid beat of analysts’ EPS estimates but an increase in its inventory levels.

The stock is up 13.4% since reporting and currently trades at $198.01.

Read our full, actionable report on Applied Materials here, it’s free.

Amkor (NASDAQ: AMKR)

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ: AMKR) provides outsourced packaging and testing for semiconductors.

Amkor reported revenues of $1.32 billion, down 3.2% year on year. This print topped analysts’ expectations by 3%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EPS estimates.

Amkor pulled off the biggest analyst estimates beat among its peers. The stock is up 25.9% since reporting and currently trades at $22.

Read our full, actionable report on Amkor here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.