Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Regeneron (NASDAQ: REGN) and its peers.

Over the next few years, immuno-oncology companies, which harness the immune system to fight illnesses such as cancer, faces strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 4 immuno-oncology stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3.9%.

In light of this news, share prices of the companies have held steady as they are up 4.1% on average since the latest earnings results.

Weakest Q1: Regeneron (NASDAQ: REGN)

Founded by scientists who wanted to build a company where science could thrive, Regeneron Pharmaceuticals (NASDAQ: REGN) develops and commercializes medicines for serious diseases, with key products treating eye conditions, allergic diseases, cancer, and other disorders.

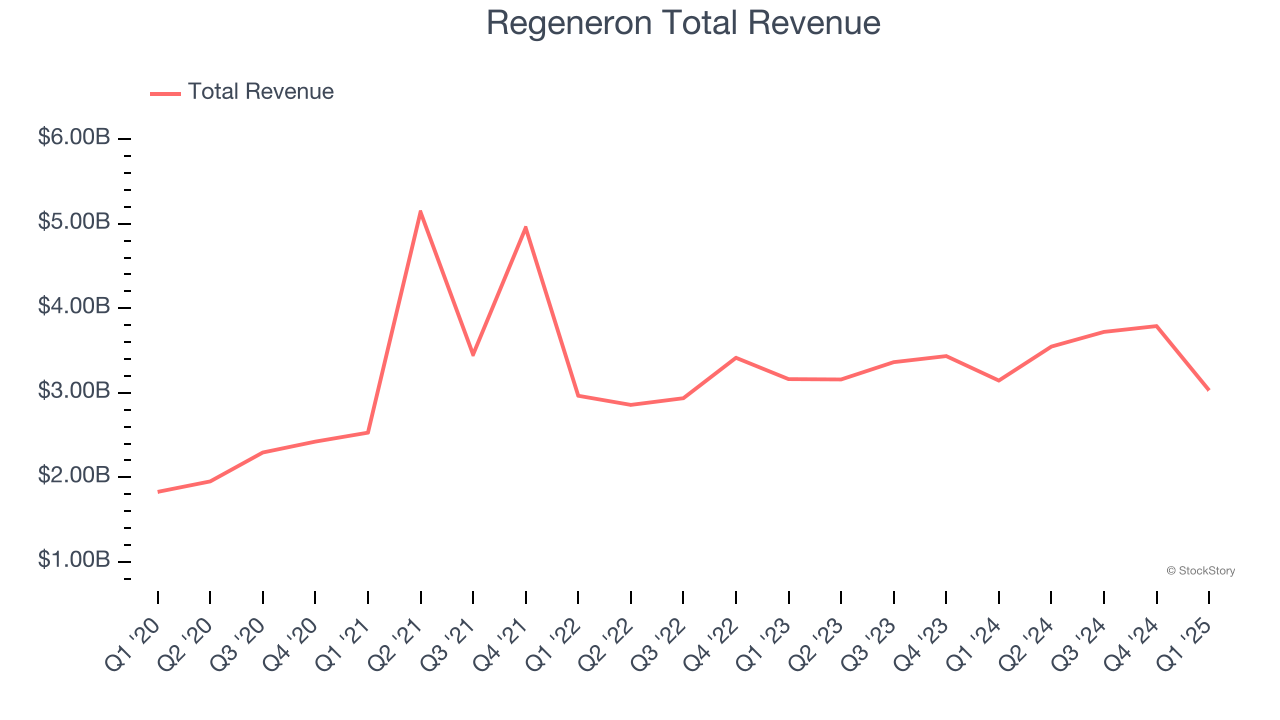

Regeneron reported revenues of $3.03 billion, down 3.7% year on year. This print fell short of analysts’ expectations by 6.1%. Overall, it was a disappointing quarter for the company with a miss of analysts’ EPS estimates.

"Regeneron has one of the most exciting pipelines in the industry, with unmatched diversity, scientific distinction, and potential to help millions of patients," said Leonard S. Schleifer, M.D., Ph.D., Board co-Chair, President and Chief Executive Officer of Regeneron.

Regeneron delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is down 16.2% since reporting and currently trades at $511.25.

Read our full report on Regeneron here, it’s free.

Best Q1: Natera (NASDAQ: NTRA)

Founded in 2003 as Gene Security Network before rebranding in 2012, Natera (NASDAQ: NTRA) develops and commercializes genetic tests for prenatal screening, cancer detection, and organ transplant monitoring using its proprietary cell-free DNA technology.

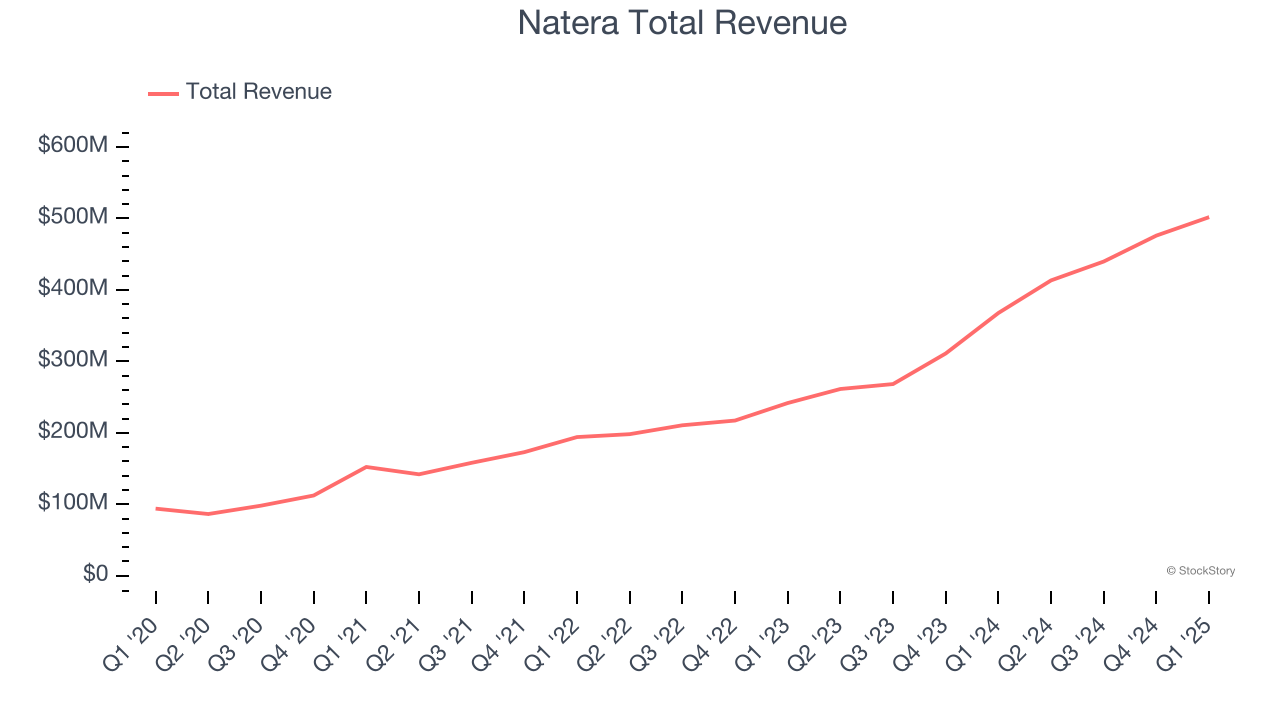

Natera reported revenues of $501.8 million, up 36.5% year on year, outperforming analysts’ expectations by 12.5%. The business had an exceptional quarter with full-year revenue guidance exceeding analysts’ expectations and a solid beat of analysts’ EPS estimates.

Natera achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 5.2% since reporting. It currently trades at $171.32.

Is now the time to buy Natera? Access our full analysis of the earnings results here, it’s free.

Exact Sciences (NASDAQ: EXAS)

With a mission to detect cancer earlier when it's more treatable, Exact Sciences (NASDAQ: EXAS) develops and markets cancer screening and diagnostic tests, including its flagship Cologuard stool-based colorectal cancer screening test.

Exact Sciences reported revenues of $706.8 million, up 10.9% year on year, exceeding analysts’ expectations by 2.7%. It was a satisfactory quarter as it also posted full-year revenue guidance slightly topping analysts’ expectations but a significant miss of analysts’ EPS estimates.

Exact Sciences delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 12.4% since the results and currently trades at $53.02.

Read our full analysis of Exact Sciences’s results here.

Incyte (NASDAQ: INCY)

Founded in 1991 and evolving from a genomics research firm to a commercial-stage drug developer, Incyte (NASDAQ: INCY) is a biopharmaceutical company that discovers, develops, and commercializes proprietary therapeutics for cancer and inflammatory diseases.

Incyte reported revenues of $1.05 billion, up 19.5% year on year. This number topped analysts’ expectations by 6.4%. Overall, it was an exceptional quarter as it also recorded an impressive beat of analysts’ EPS estimates.

The stock is up 15.1% since reporting and currently trades at $68.45.

Read our full, actionable report on Incyte here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.