Over the past six months, Warby Parker’s stock price fell to $21.36. Shareholders have lost 12% of their capital, which is disappointing considering the S&P 500 has climbed by 1.9%. This may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy WRBY? Find out in our full research report, it’s free.

Why Does WRBY Stock Spark Debate?

Founded in 2010, Warby Parker (NYSE: WRBY) designs, manufactures, and sells eyewear, including prescription glasses, sunglasses, and contact lenses, through its e-commerce platform and physical retail locations.

Two Positive Attributes:

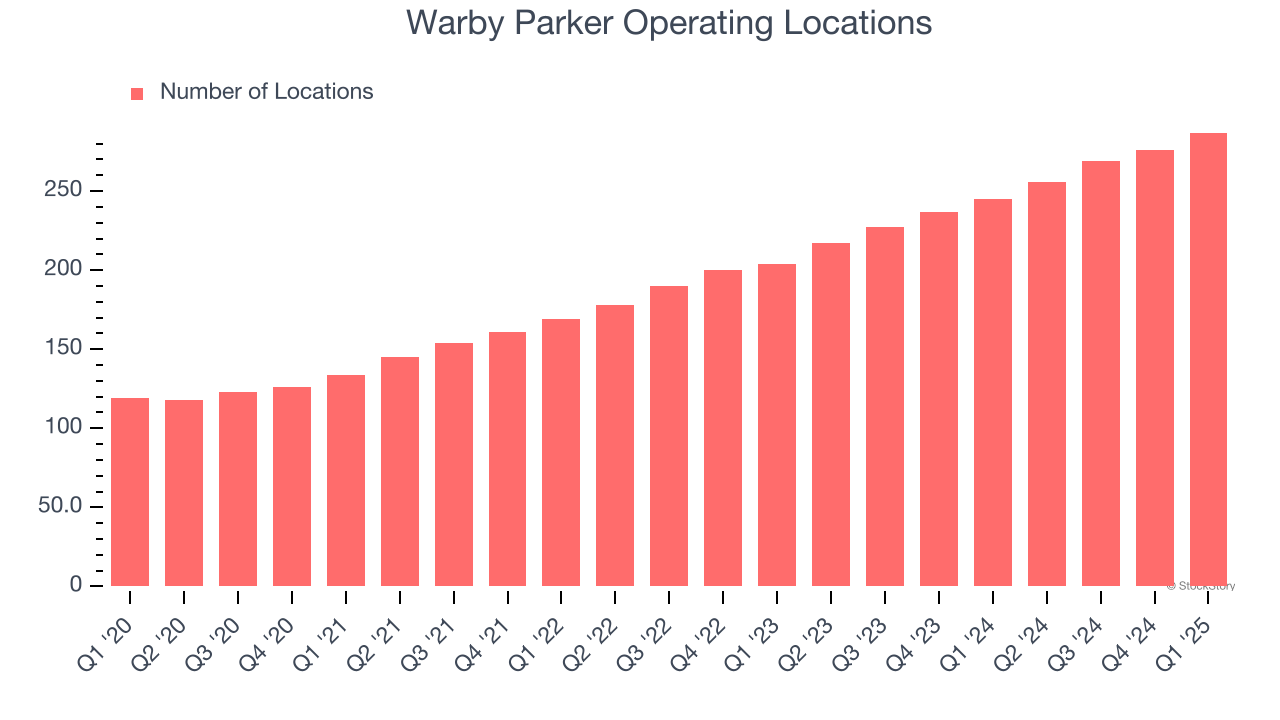

1. New Stores Opening at Breakneck Speed

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Warby Parker sported 287 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 18.8% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

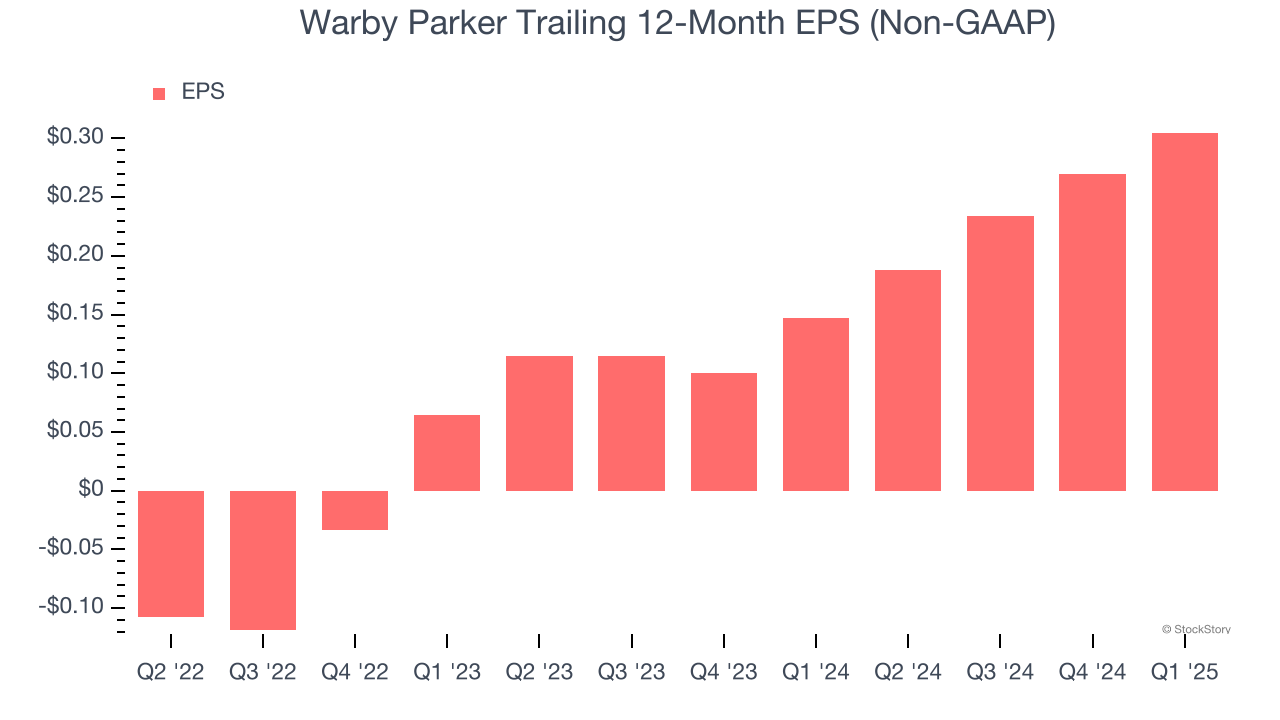

2. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Warby Parker’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

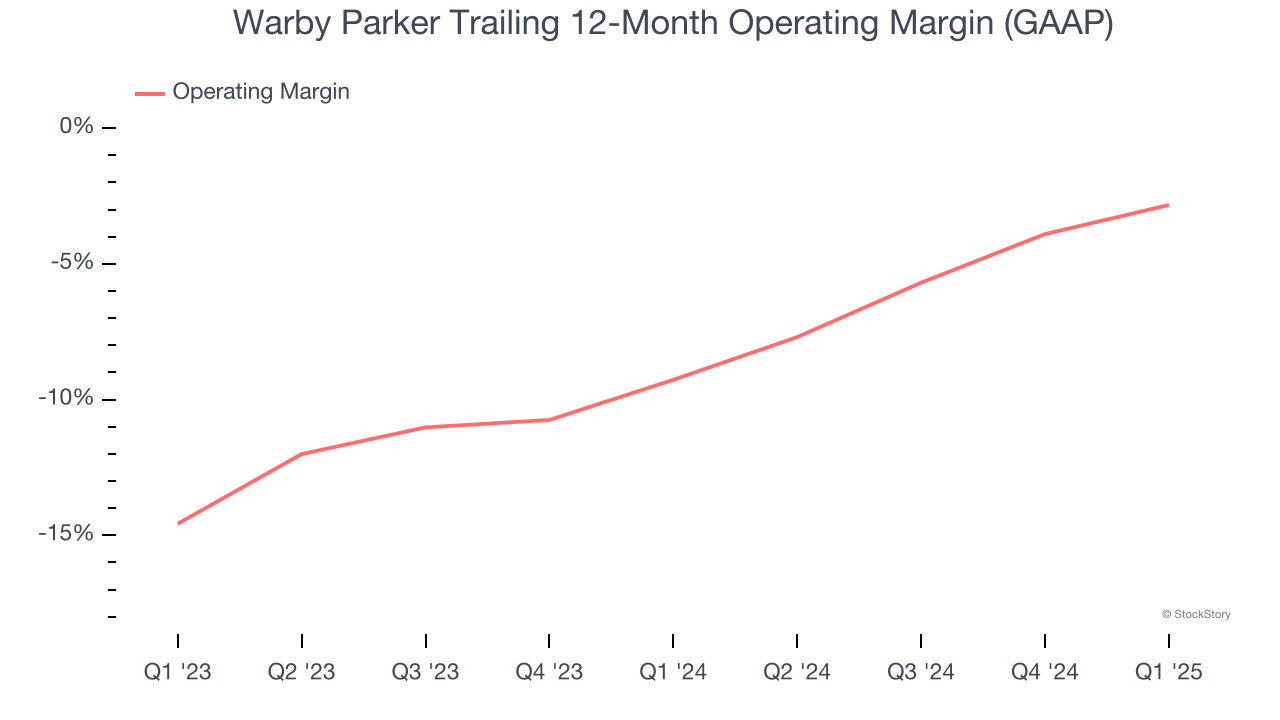

Operating Losses Sound the Alarms

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although Warby Parker was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 5.8% over the last two years. Despite the consumer retail industry’s secular decline, unprofitable public companies are few and far between. It’s unfortunate that Warby Parker was one of them.

Final Judgment

Warby Parker’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 57× forward P/E (or $21.36 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.