Over the last six months, USANA’s shares have sunk to $30.44, producing a disappointing 12.3% loss - a stark contrast to the S&P 500’s 1.9% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in USANA, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is USANA Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than USNA and a stock we'd rather own.

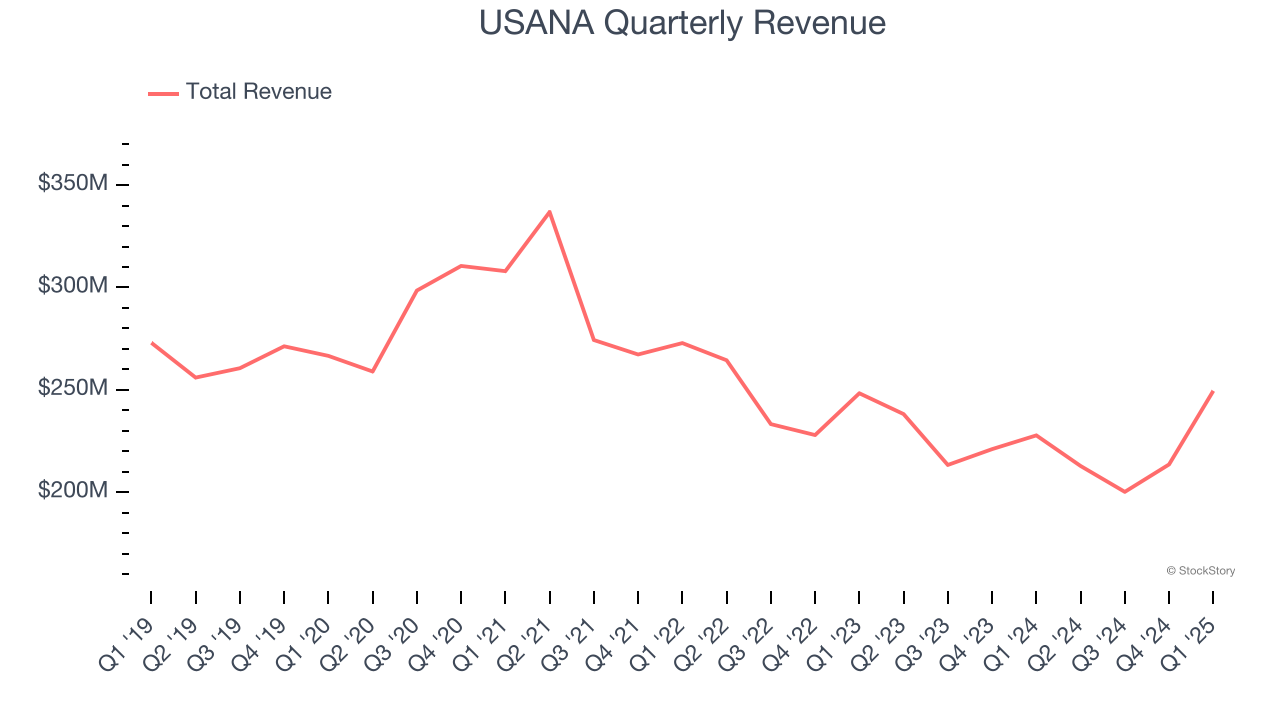

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. USANA struggled to consistently generate demand over the last three years as its sales dropped at a 8.7% annual rate. This was below our standards and is a sign of lacking business quality.

2. Fewer Distribution Channels Limit its Ceiling

With $876.2 million in revenue over the past 12 months, USANA is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

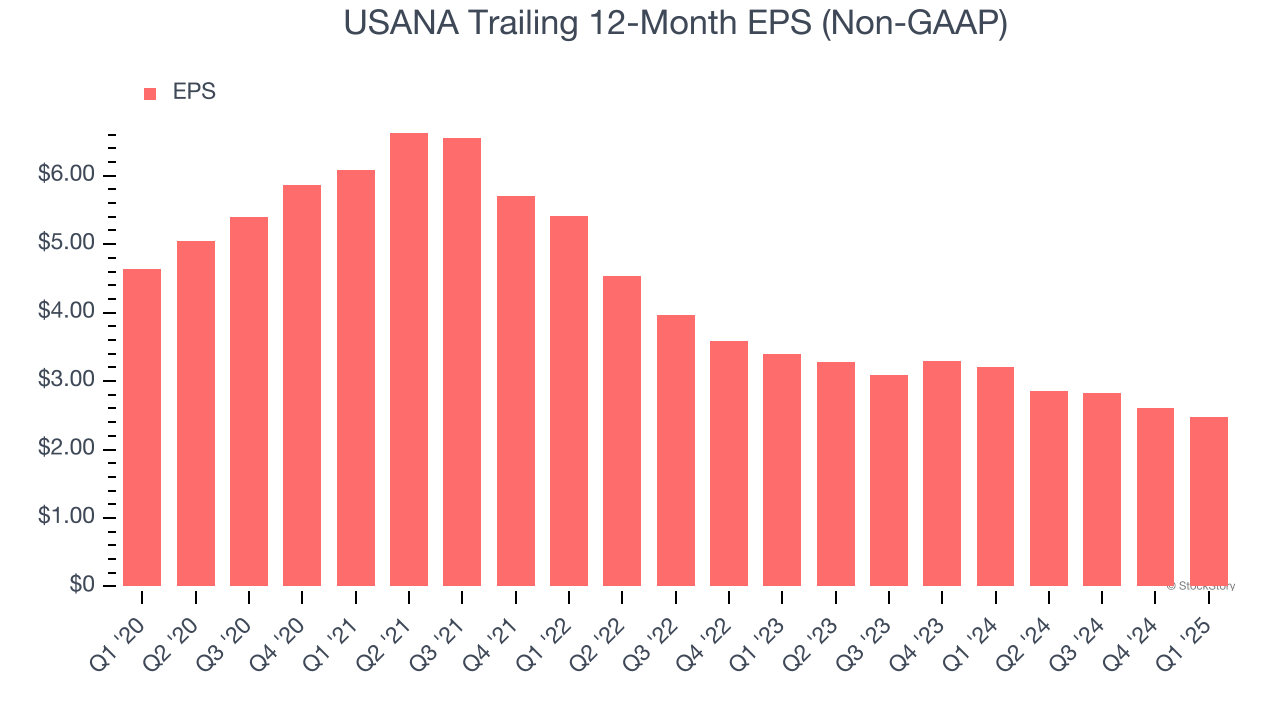

3. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for USANA, its EPS declined by 23% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

USANA’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 11.3× forward P/E (or $30.44 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Like More Than USANA

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.