Wrapping up Q1 earnings, we look at the numbers and key takeaways for the aerospace stocks, including AerSale (NASDAQ: ASLE) and its peers.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 15 aerospace stocks we track reported a strong Q1. As a group, revenues missed analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 0.7% below.

Luckily, aerospace stocks have performed well with share prices up 18.9% on average since the latest earnings results.

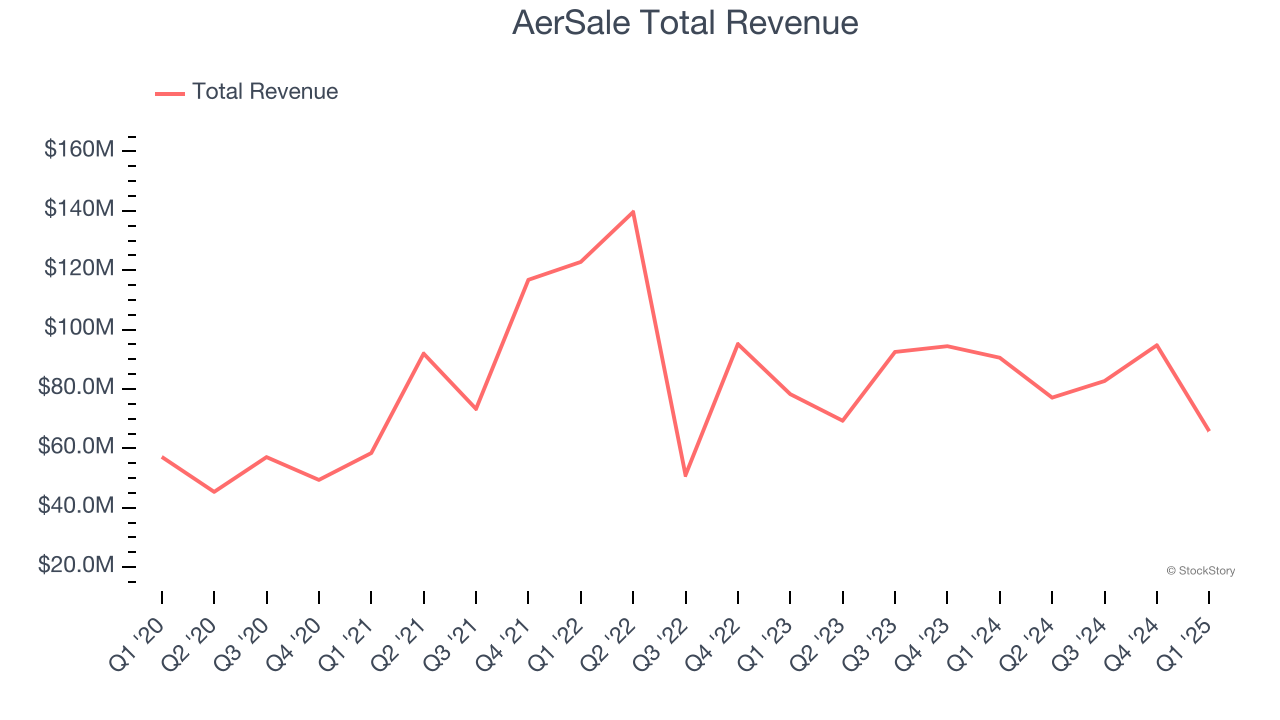

AerSale (NASDAQ: ASLE)

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ: ASLE) delivers full-service support to mid-life commercial aircraft.

AerSale reported revenues of $65.78 million, down 27.4% year on year. This print fell short of analysts’ expectations by 26.3%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

AerSale delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 16.5% since reporting and currently trades at $5.87.

Read our full report on AerSale here, it’s free.

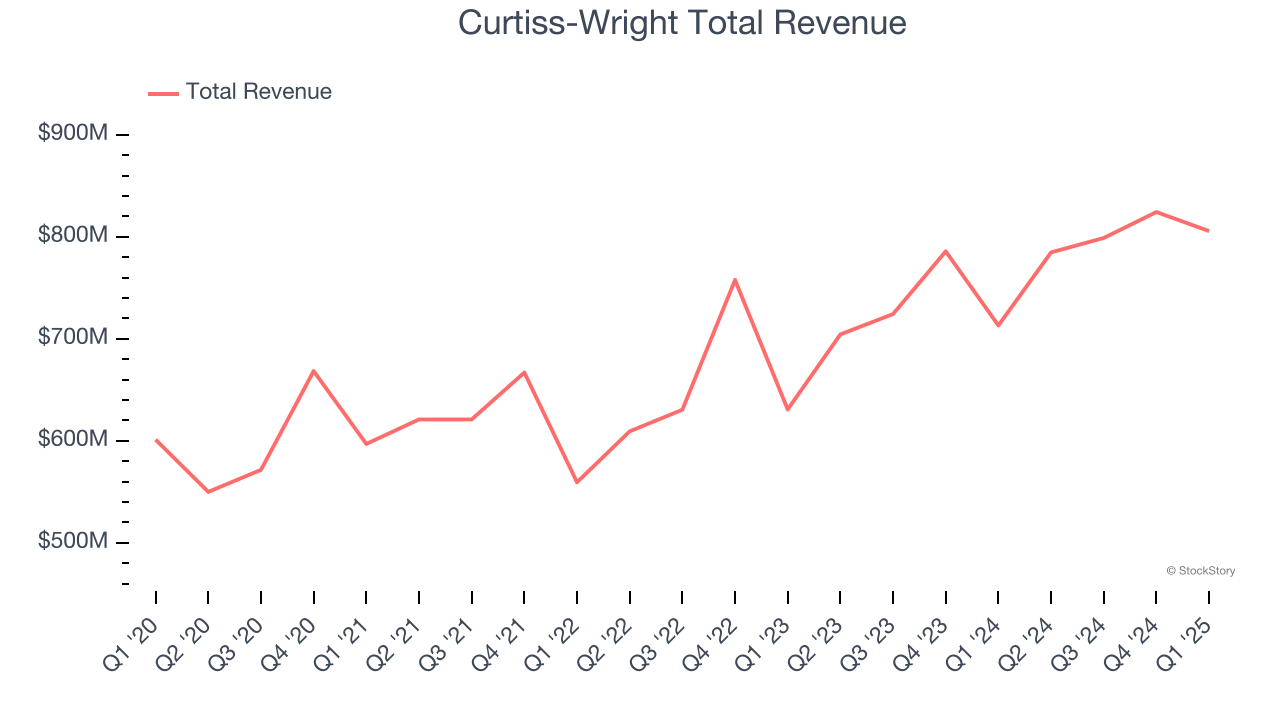

Best Q1: Curtiss-Wright (NYSE: CW)

Formed from a merger of 12 companies, Curtiss-Wright (NYSE: CW) provides a range of products and services to the aerospace, industrial, electronic, and maritime industries.

Curtiss-Wright reported revenues of $805.6 million, up 13% year on year, outperforming analysts’ expectations by 5%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 27% since reporting. It currently trades at $460.52.

Is now the time to buy Curtiss-Wright? Access our full analysis of the earnings results here, it’s free.

Hexcel (NYSE: HXL)

Founded shortly after World War II by a group of engineers from UC Berkley, Hexcel (NYSE: HXL) manufactures lightweight composite materials primarily for the aerospace and defense sectors.

Hexcel reported revenues of $456.5 million, down 3.3% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Hexcel delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 8.4% since the results and currently trades at $54.75.

Read our full analysis of Hexcel’s results here.

HEICO (NYSE: HEI)

Founded in 1957, HEICO (NYSE: HEI) manufactures and services aerospace and electronic components for commercial aviation, defense, space, and other industries.

HEICO reported revenues of $1.10 billion, up 14.9% year on year. This number topped analysts’ expectations by 3.5%. It was an exceptional quarter as it also put up an impressive beat of analysts’ EBITDA estimates.

The stock is up 13.7% since reporting and currently trades at $312.

Read our full, actionable report on HEICO here, it’s free.

Howmet (NYSE: HWM)

Inventing the first forged aluminum truck wheel, Howmet (NYSE: HWM) specializes in lightweight metals engineering and manufacturing multi-material components used in vehicles.

Howmet reported revenues of $1.94 billion, up 6.5% year on year. This result was in line with analysts’ expectations. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ adjusted operating income estimate.

The stock is up 23% since reporting and currently trades at $170.25.

Read our full, actionable report on Howmet here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.