Marvell Technology has gotten torched over the last six months - since December 2024, its stock price has dropped 30.9% to $75.35 per share. This may have investors wondering how to approach the situation.

Following the pullback, is this a buying opportunity for MRVL? Find out in our full research report, it’s free.

Why Does Marvell Technology Spark Debate?

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

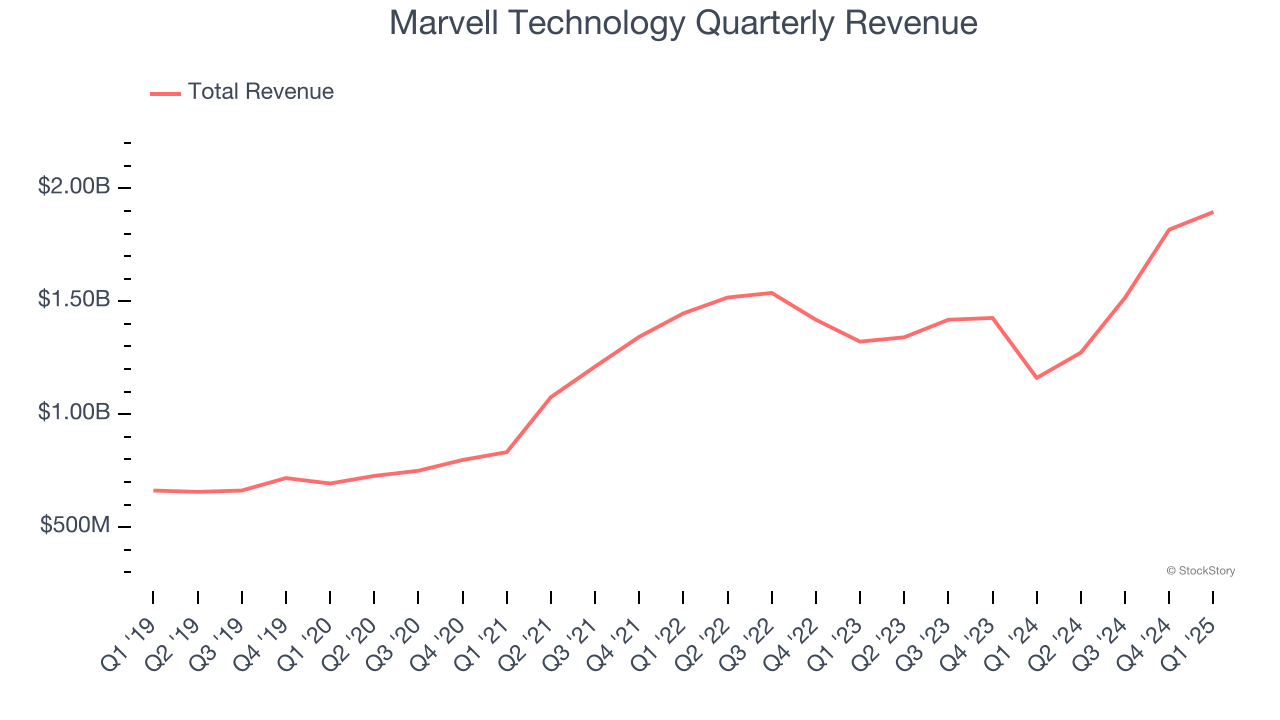

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Marvell Technology grew its sales at an exceptional 18.9% compounded annual growth rate. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Marvell Technology’s revenue to rise by 31.8%, an improvement versus its 18.9% annualized growth for the past five years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

One Reason to be Careful:

Operating Losses Sound the Alarms

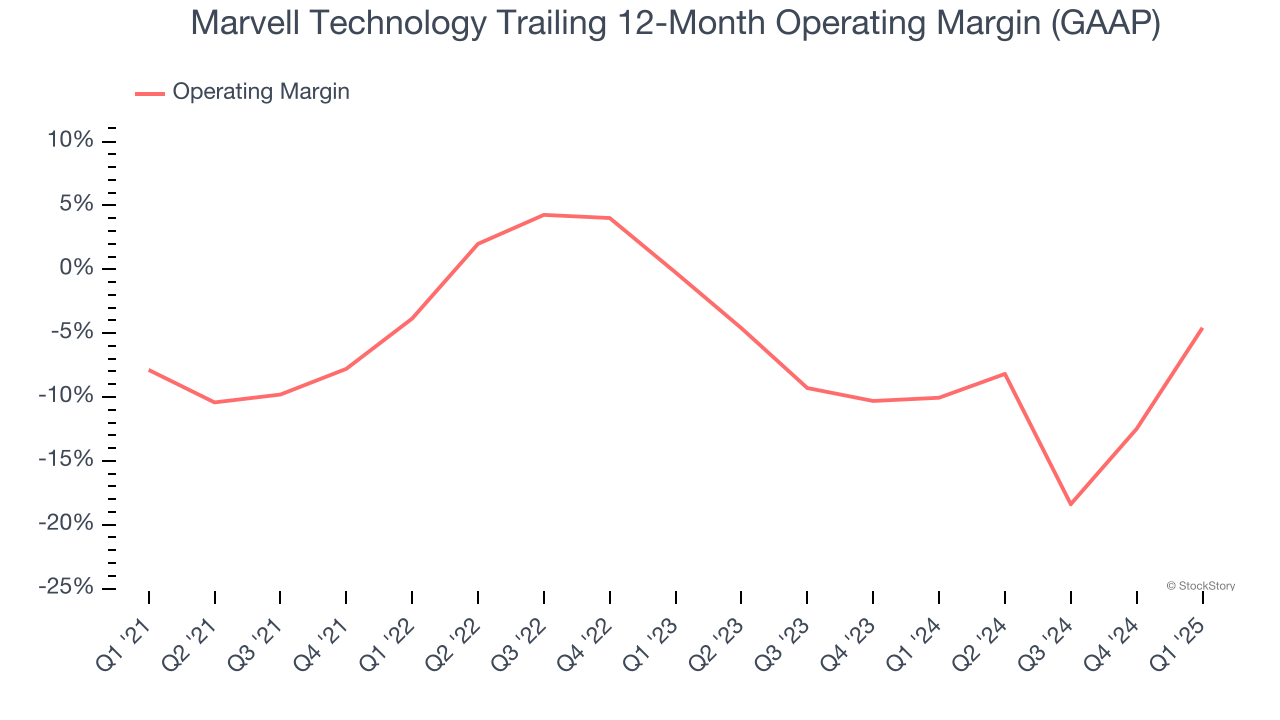

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although Marvell Technology was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 7% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out.

Final Judgment

Marvell Technology’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 25.2× forward P/E (or $75.35 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Marvell Technology

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.