Personal care company The Honest Company (NASDAQ: HNST) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 12.8% year on year to $97.25 million. Its GAAP profit of $0.03 per share was $0.03 above analysts’ consensus estimates.

Is now the time to buy The Honest Company? Find out by accessing our full research report, it’s free.

The Honest Company (HNST) Q1 CY2025 Highlights:

- Revenue: $97.25 million vs analyst estimates of $91.97 million (12.8% year-on-year growth, 5.7% beat)

- EPS (GAAP): $0.03 vs analyst estimates of $0 ($0.03 beat)

- Adjusted EBITDA: $6.93 million vs analyst estimates of $4.94 million (7.1% margin, 40.2% beat)

- EBITDA guidance for the full year is $28.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 2.6%, up from -1.5% in the same quarter last year

- Free Cash Flow was -$3 million, down from $260,000 in the same quarter last year

- Market Capitalization: $546.7 million

“Our first quarter results demonstrate our solid start to 2025, with double-digit revenue growth, gross margin expansion, and positive net income in the period reflecting the continued strength of our strategy and disciplined execution of our team,” said Chief Executive Officer, Carla Vernón.

Company Overview

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ: HNST) sells diapers and wipes, skin care products, and household cleaning products.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $389.4 million in revenue over the past 12 months, The Honest Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

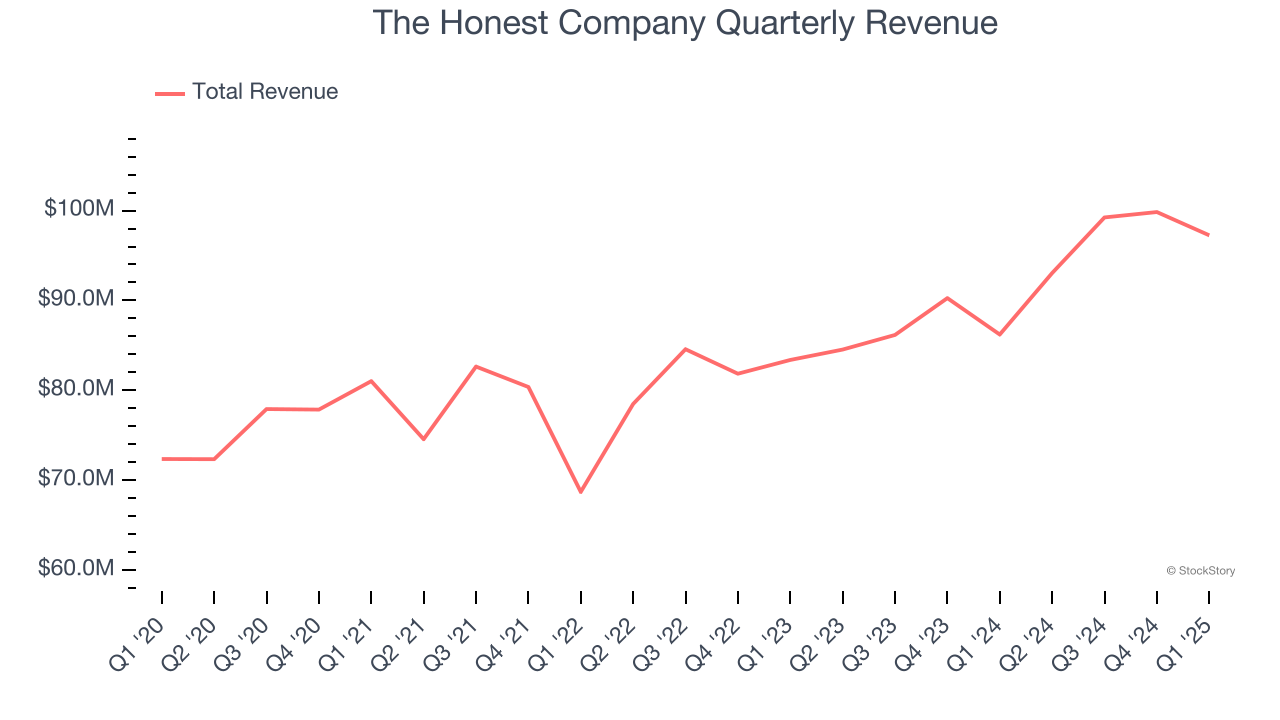

As you can see below, The Honest Company grew its sales at a decent 8.3% compounded annual growth rate over the last three years. This shows its offerings generated slightly more demand than the average consumer staples company, a useful starting point for our analysis.

This quarter, The Honest Company reported year-on-year revenue growth of 12.8%, and its $97.25 million of revenue exceeded Wall Street’s estimates by 5.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

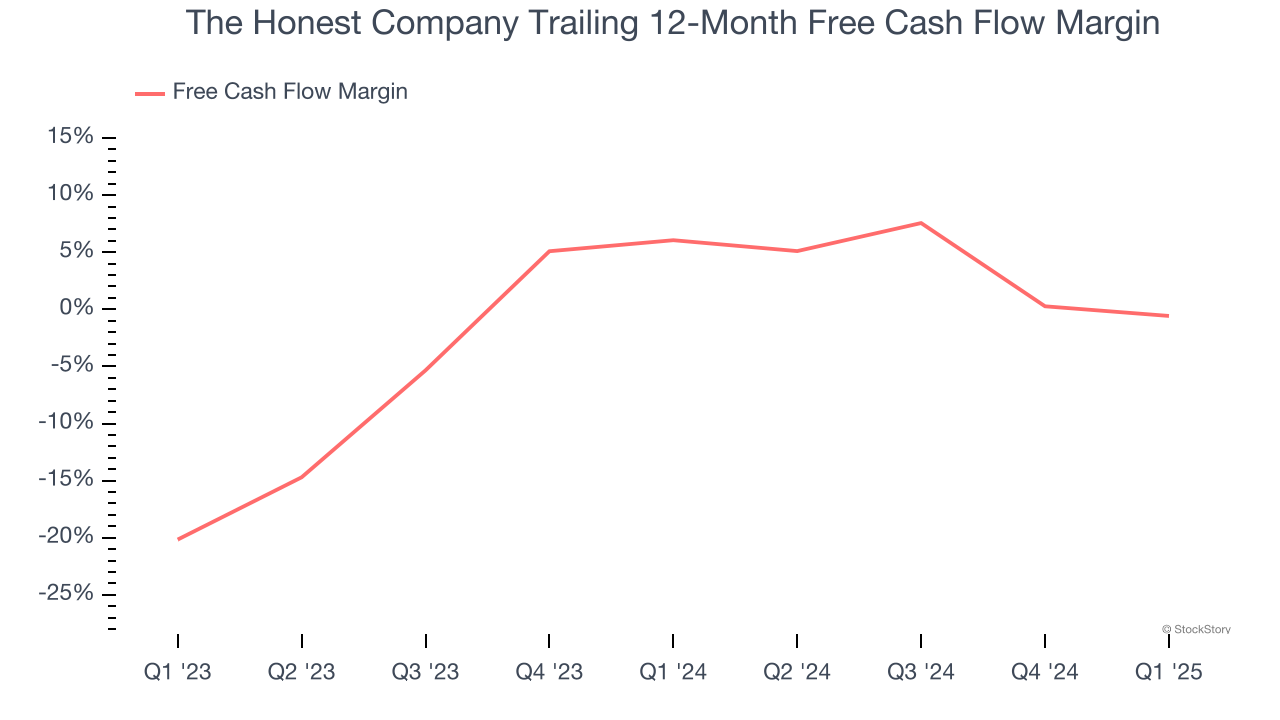

The Honest Company has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.5%, subpar for a consumer staples business.

Taking a step back, we can see that The Honest Company’s margin dropped by 6.6 percentage points over the last year. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

The Honest Company burned through $3 million of cash in Q1, equivalent to a negative 3.1% margin. The company’s cash burn increased meaningfully year on year and is a deviation from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from The Honest Company’s Q1 Results

We were impressed by how significantly The Honest Company blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 7.3% to $5.14 immediately after reporting.

Indeed, The Honest Company had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.