Environmental engineering firm Tetra Tech (NASDAQ: TTEK) announced better-than-expected revenue in Q1 CY2025, with sales up 4.9% year on year to $1.10 billion. On top of that, next quarter’s revenue guidance ($1.15 billion at the midpoint) was surprisingly good and 4.2% above what analysts were expecting. Its GAAP profit of $0.02 per share was 93.4% below analysts’ consensus estimates.

Is now the time to buy Tetra Tech? Find out by accessing our full research report, it’s free.

Tetra Tech (TTEK) Q1 CY2025 Highlights:

- Revenue: $1.10 billion vs analyst estimates of $1.04 billion (4.9% year-on-year growth, 6.6% beat)

- EPS (GAAP): $0.02 vs analyst expectations of $0.30 (93.4% miss)

- Adjusted Operating Income: $130.1 million vs analyst estimates of $123.2 million (11.8% margin, 5.6% beat)

- The company lifted its revenue guidance for the full year to $4.77 billion at the midpoint from $4.57 billion, a 4.4% increase

- EPS (GAAP) guidance for Q2 CY2025 is $0.38 at the midpoint, beating analyst estimates by 11.1%

- Operating Margin: 3.6%, down from 11.2% in the same quarter last year

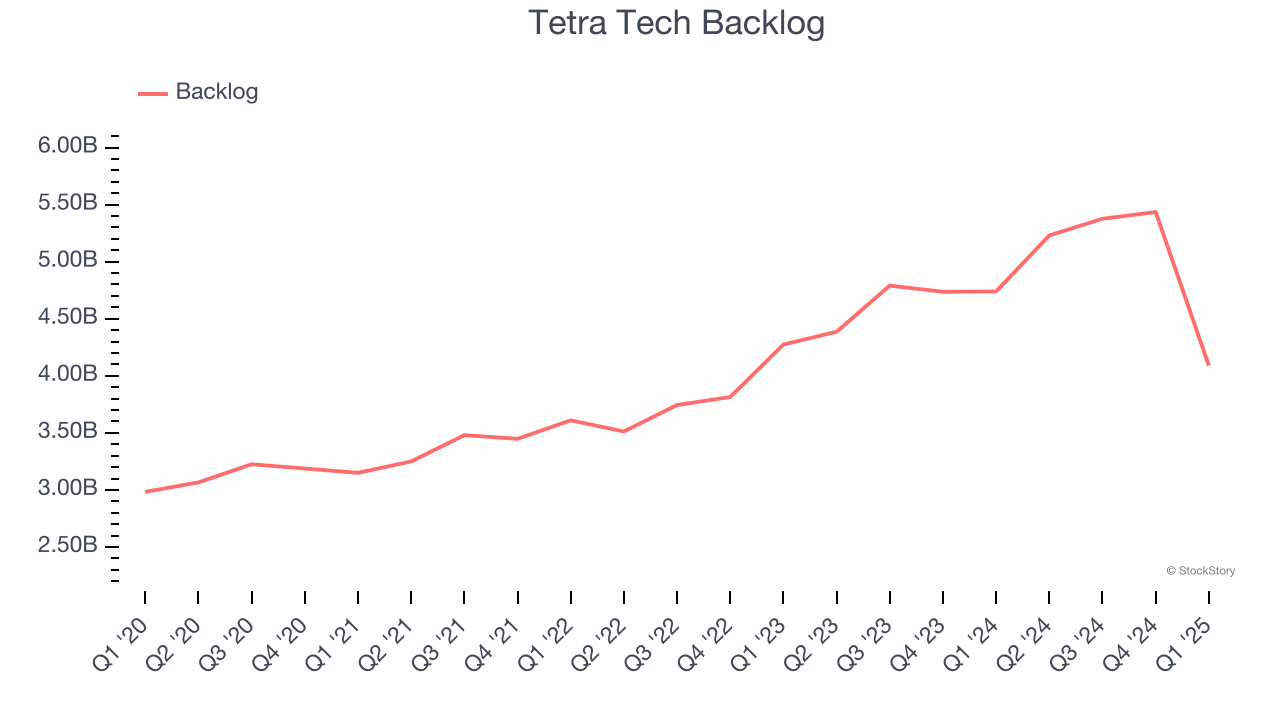

- Backlog: $4.09 billion at quarter end, down 13.7% year on year

- Market Capitalization: $8.19 billion

Company Overview

With a 50-year legacy of "Leading with Science" and operations on all seven continents, Tetra Tech (NASDAQ: TTEK) provides high-end consulting and engineering services focused on water management, environmental solutions, and sustainable infrastructure for government and commercial clients worldwide.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

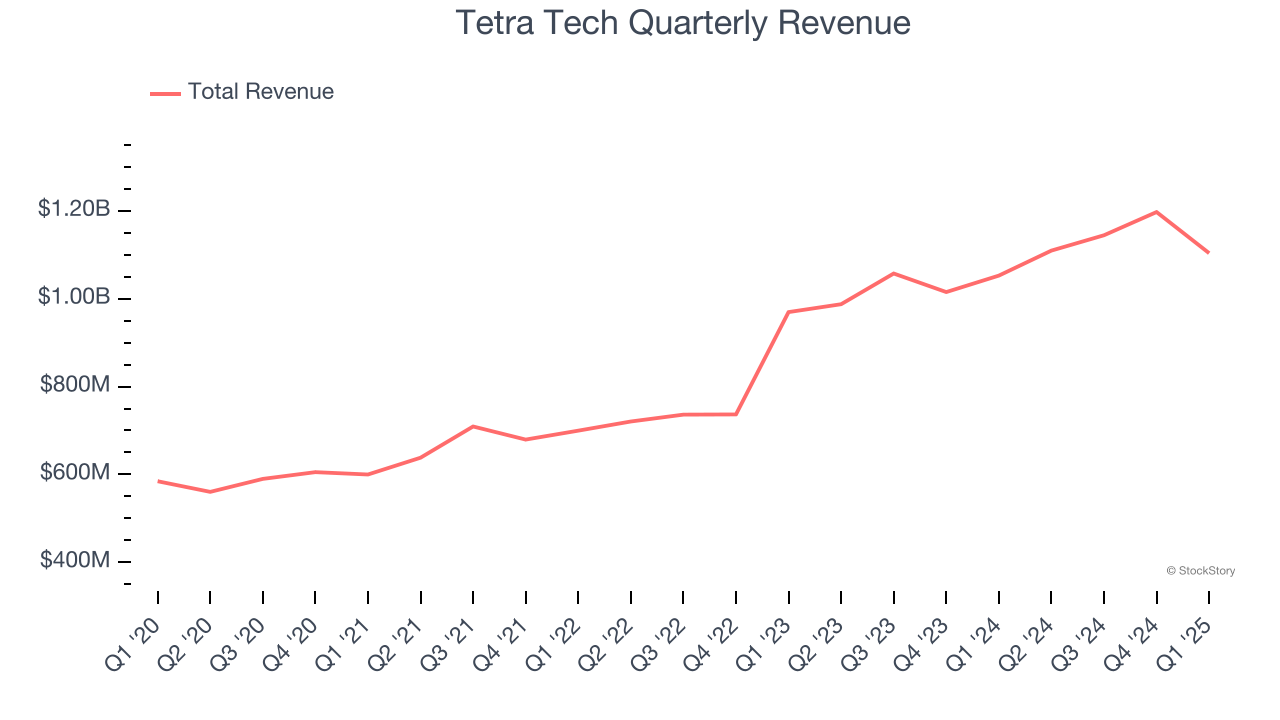

With $4.56 billion in revenue over the past 12 months, Tetra Tech is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

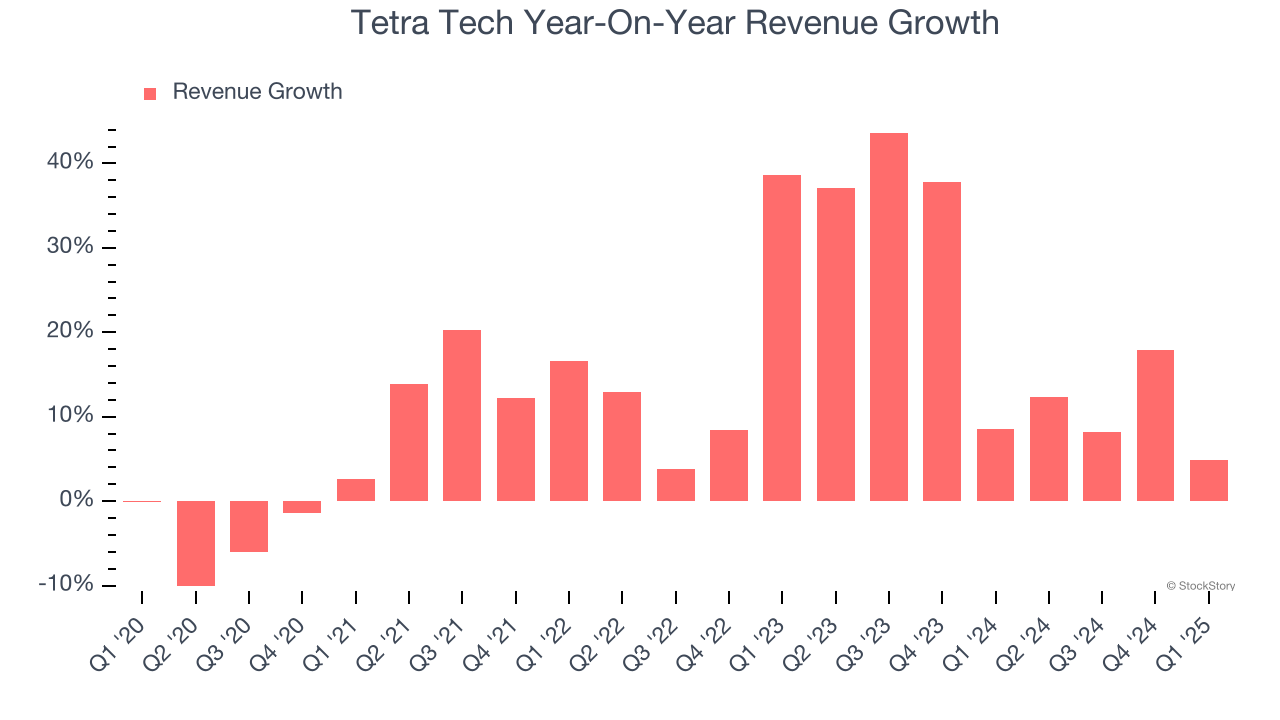

As you can see below, Tetra Tech’s sales grew at an exceptional 13.2% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Tetra Tech’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Tetra Tech’s annualized revenue growth of 20% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Tetra Tech’s backlog reached $4.09 billion in the latest quarter and averaged 15% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Tetra Tech was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Tetra Tech reported modest year-on-year revenue growth of 4.9% but beat Wall Street’s estimates by 6.6%. Company management is currently guiding for a 3.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Adjusted Operating Margin

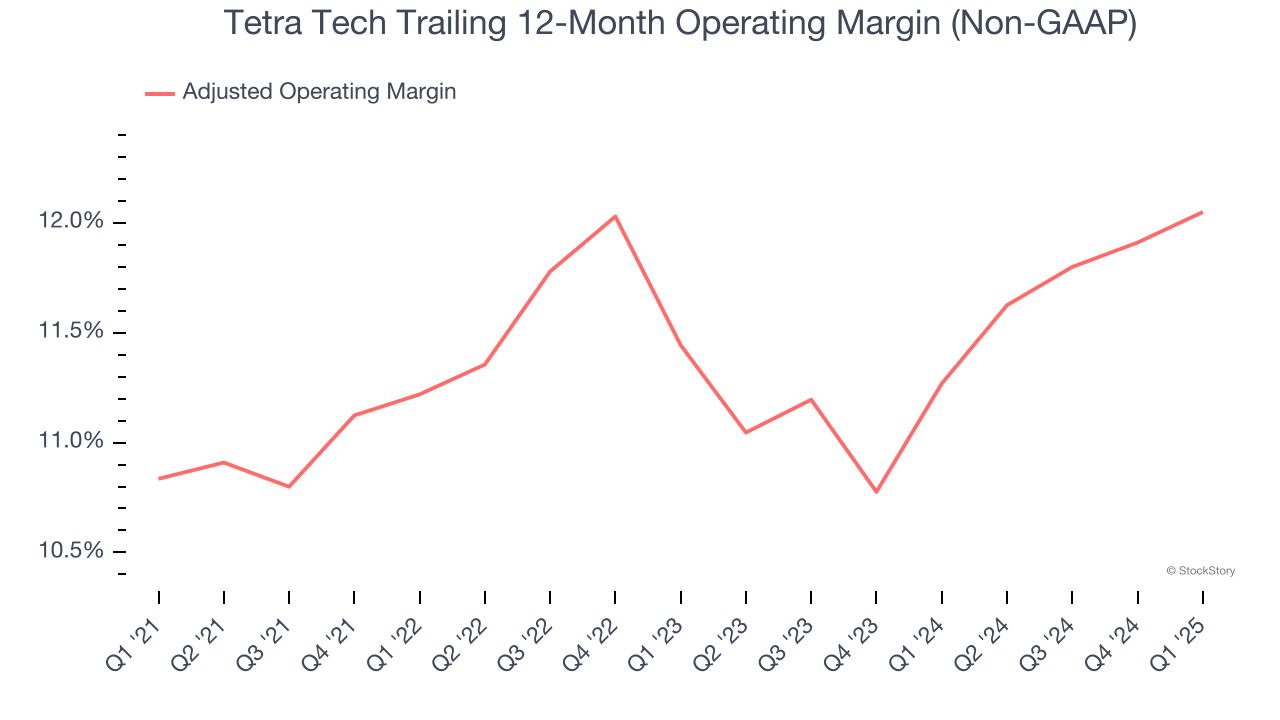

Tetra Tech has done a decent job managing its cost base over the last five years. The company has produced an average adjusted operating margin of 11.4%, higher than the broader business services sector.

Analyzing the trend in its profitability, Tetra Tech’s adjusted operating margin rose by 1.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Tetra Tech generated an adjusted operating profit margin of 11.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

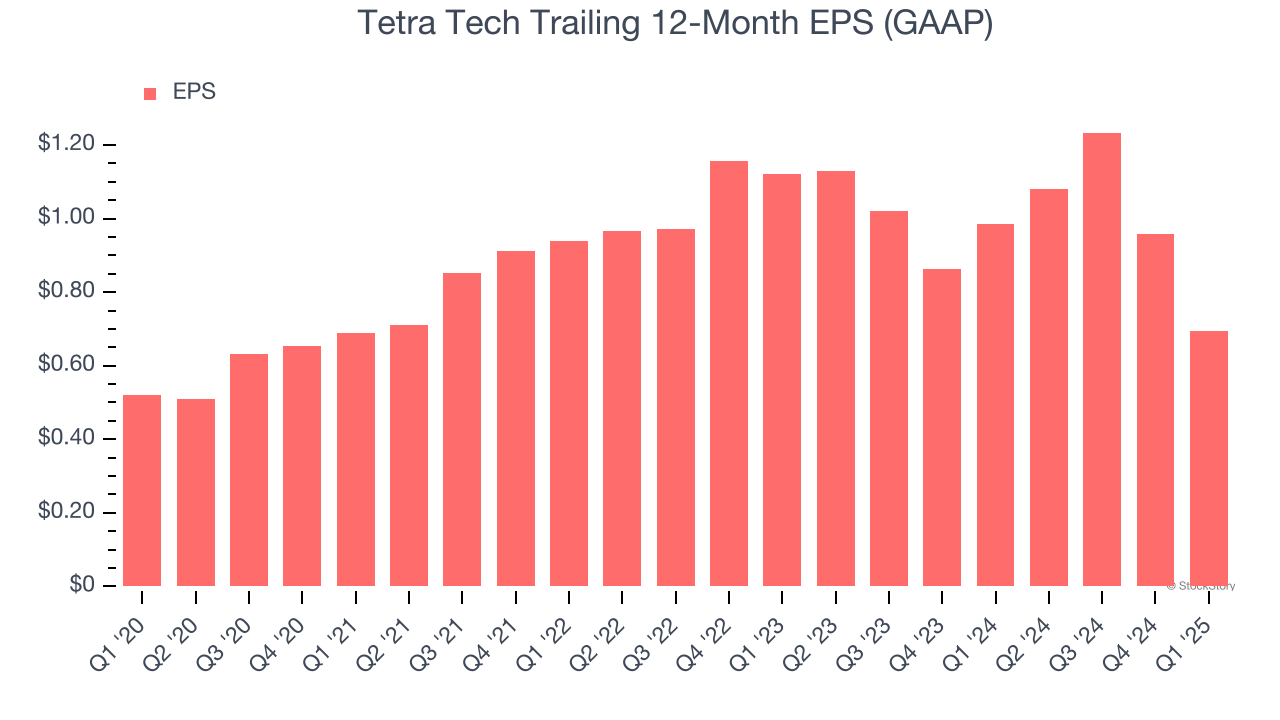

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Tetra Tech’s EPS grew at an unimpressive 6% compounded annual growth rate over the last five years, lower than its 13.2% annualized revenue growth. However, its adjusted operating margin actually expanded during this time, telling us that non-fundamental factors such as taxes affected its ultimate earnings.

In Q1, Tetra Tech reported EPS at $0.02, down from $0.28 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Tetra Tech’s full-year EPS of $0.69 to grow 98.2%.

Key Takeaways from Tetra Tech’s Q1 Results

We were impressed by how significantly Tetra Tech blew past analysts’ revenue and EBITDA expectations this quarter. We were also excited it raised its full-year revenue and EPS guidance. On the other hand, its backlog declined and fell short of Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock traded up 6.7% to $32.95 immediately following the results.

Tetra Tech had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.