Shipping and mailing solutions provider Pitney Bowes (NYSE: PBI) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 40.6% year on year to $493.4 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $1.98 billion at the midpoint. Its non-GAAP profit of $0.33 per share was 22.2% above analysts’ consensus estimates.

Is now the time to buy Pitney Bowes? Find out by accessing our full research report, it’s free.

Pitney Bowes (PBI) Q1 CY2025 Highlights:

- Revenue: $493.4 million vs analyst estimates of $497.9 million (40.6% year-on-year decline, 0.9% miss)

- Adjusted EPS: $0.33 vs analyst estimates of $0.27 (22.2% beat)

- Adjusted EPS guidance for the full year is $1.20 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 20.9%, up from 5% in the same quarter last year

- Free Cash Flow was -$20.46 million compared to -$32.48 million in the same quarter last year

- Market Capitalization: $1.64 billion

Company Overview

With a century-long history dating back to 1920 and processing over 15 billion pieces of mail annually, Pitney Bowes (NYSE: PBI) provides shipping, mailing technology, logistics, and financial services to businesses of all sizes.

Sales Growth

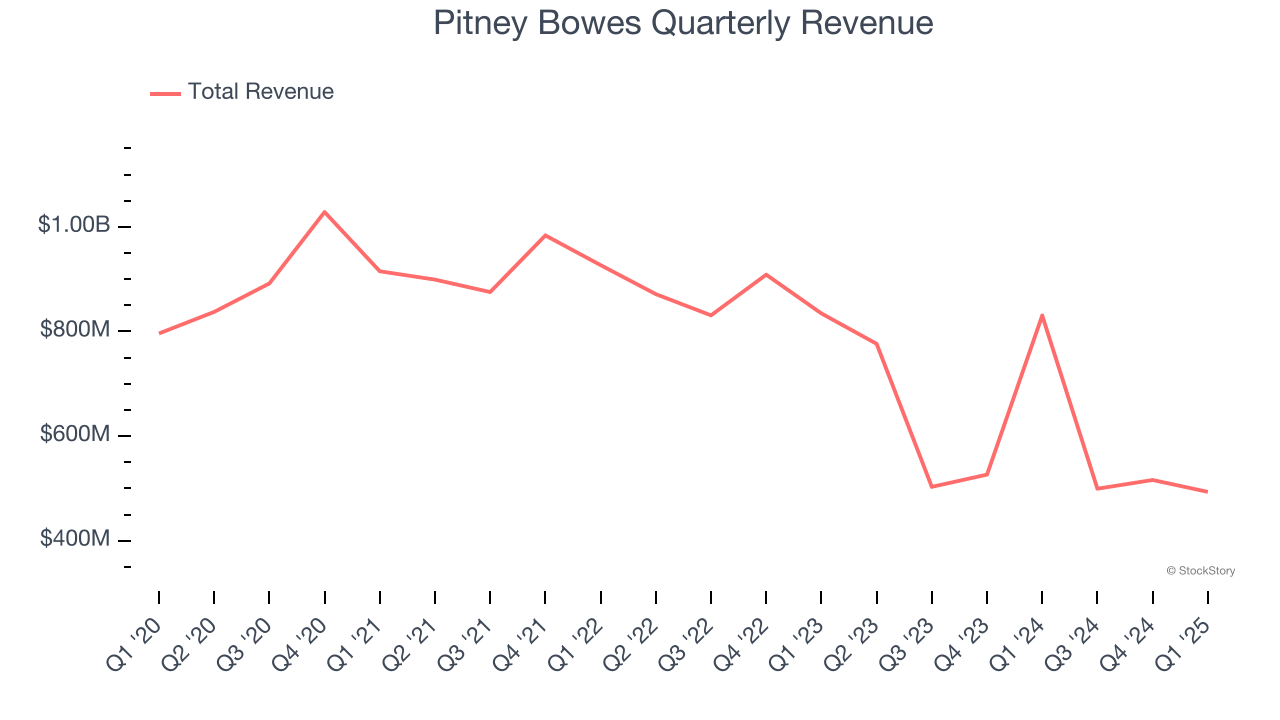

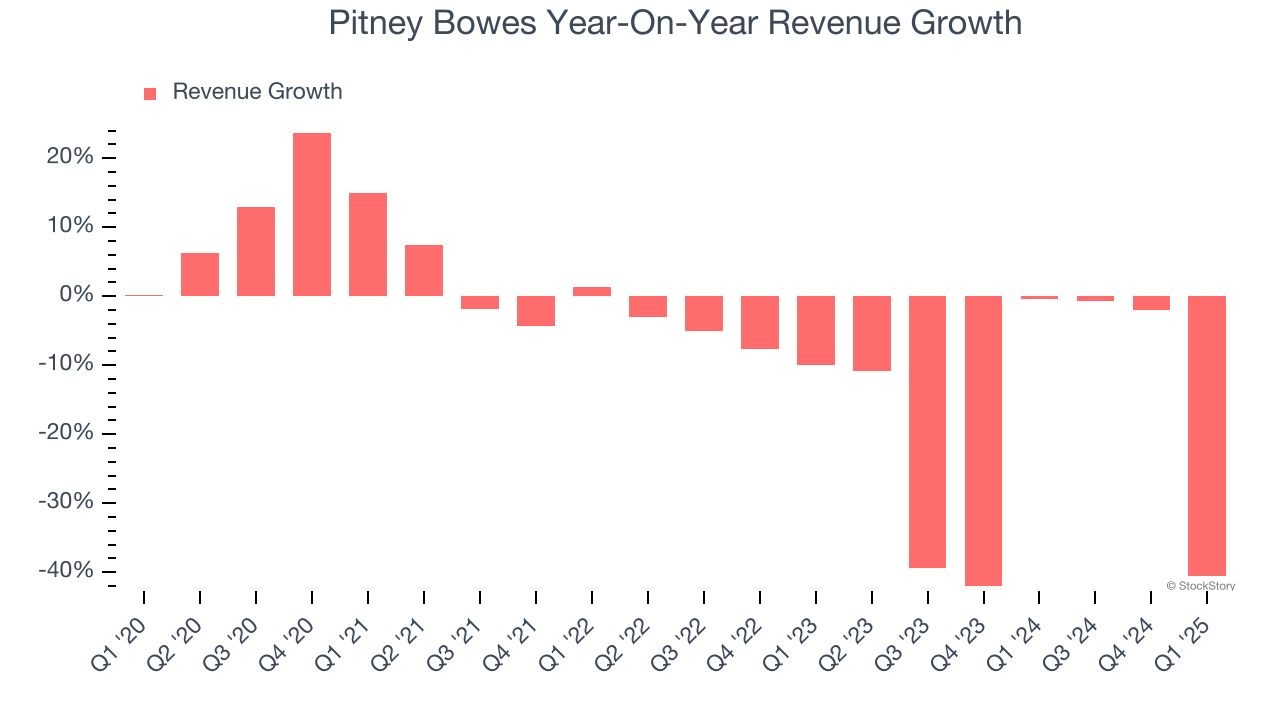

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Pitney Bowes struggled to consistently generate demand over the last five years as its sales dropped at a 9% annual rate. This was below our standards and is a sign of lacking business quality.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Pitney Bowes’s recent performance shows its demand remained suppressed as its revenue has declined by 23.4% annually over the last two years.

This quarter, Pitney Bowes missed Wall Street’s estimates and reported a rather uninspiring 40.6% year-on-year revenue decline, generating $493.4 million of revenue.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

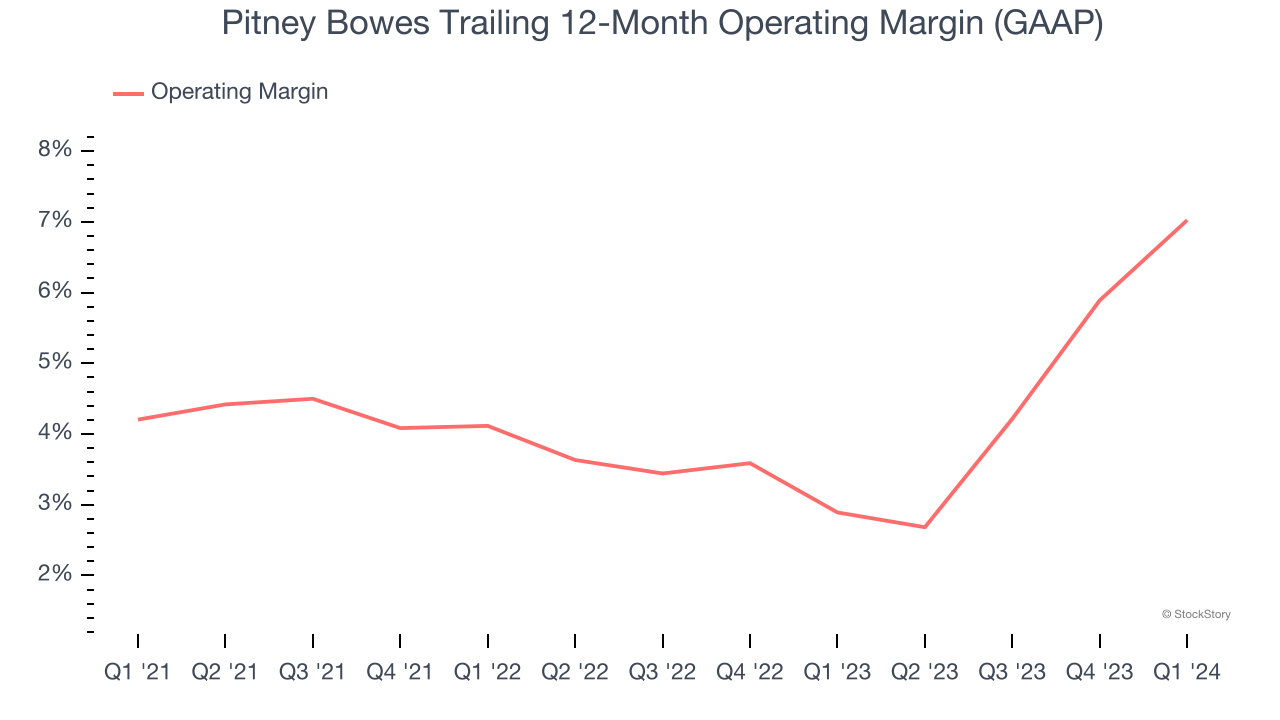

Pitney Bowes was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.3% was weak for a business services business.

On the plus side, Pitney Bowes’s operating margin rose by 8.7 percentage points over the last five years.

This quarter, Pitney Bowes generated an operating profit margin of 20.9%, up 15.9 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

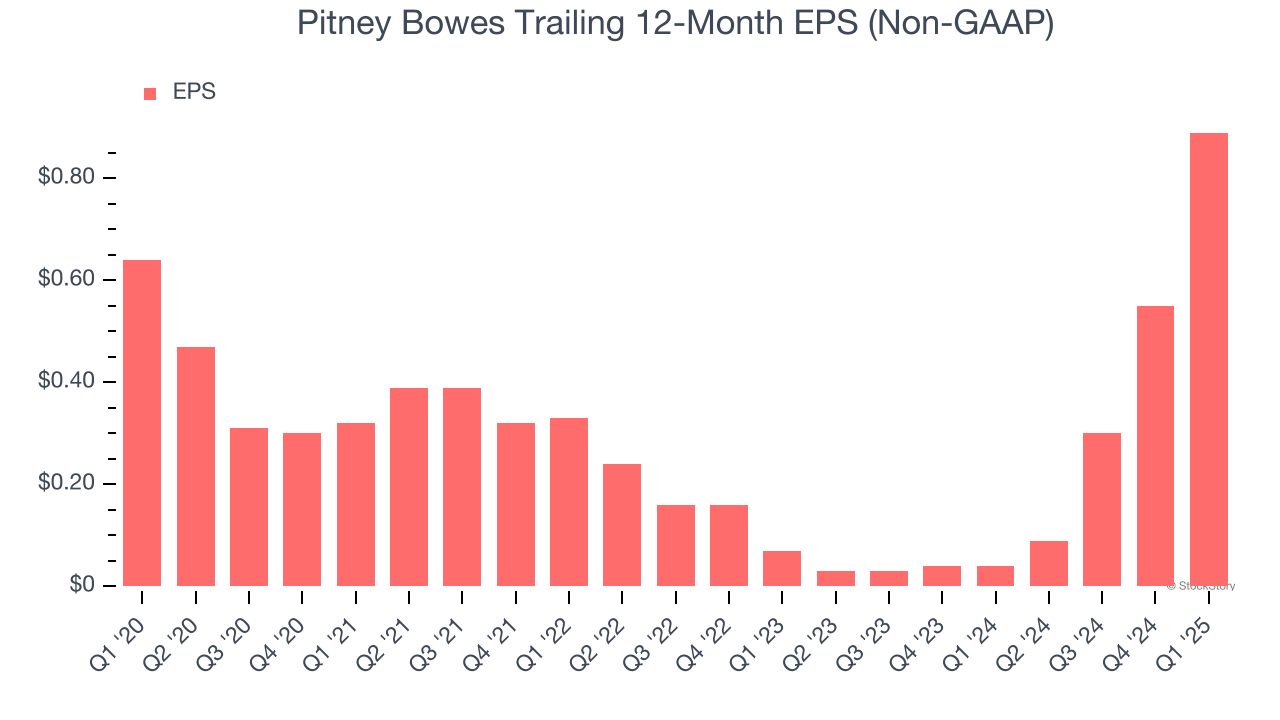

Pitney Bowes’s EPS grew at an unimpressive 6.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 9% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

We can take a deeper look into Pitney Bowes’s earnings to better understand the drivers of its performance. As we mentioned earlier, Pitney Bowes’s operating margin expanded by 8.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Pitney Bowes reported EPS at $0.33, up from negative $0.01 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Pitney Bowes’s full-year EPS of $0.89 to grow 36%.

Key Takeaways from Pitney Bowes’s Q1 Results

We were impressed by how significantly Pitney Bowes blew past analysts’ EPS expectations this quarter. Full-year revenue and EPS guidance was roughly in line. On the other hand, its revenue slightly missed,. Overall, this print was mixed but still had some key positives. The stock traded up 5.9% to $9.48 immediately after reporting.

So should you invest in Pitney Bowes right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.