Neighborhood social network Nextdoor (NYSE: KIND) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 1.9% year on year to $54.18 million.

Is now the time to buy Nextdoor? Find out by accessing our full research report, it’s free.

Nextdoor (KIND) Q1 CY2025 Highlights:

- Revenue: $54.18 million vs analyst estimates of $53.22 million (1.9% year-on-year growth, 1.8% beat)

- Adjusted EBITDA: -$9.16 million vs analyst estimates of -$12.74 million (-16.9% margin, 28.1% beat)

- Operating Margin: -49.9%, up from -65.4% in the same quarter last year

- Weekly Active Users: 46.1 million, up 2.7 million year on year

- Market Capitalization: $570.9 million

"In Q1 we continued to add new users, improved margins, and generated positive operating cash flow — though our most significant progress during Q1 was product-related," said Nextdoor CEO Nirav Tolia.

Company Overview

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE: KIND) is a social network that connects neighbors with each other and with local businesses.

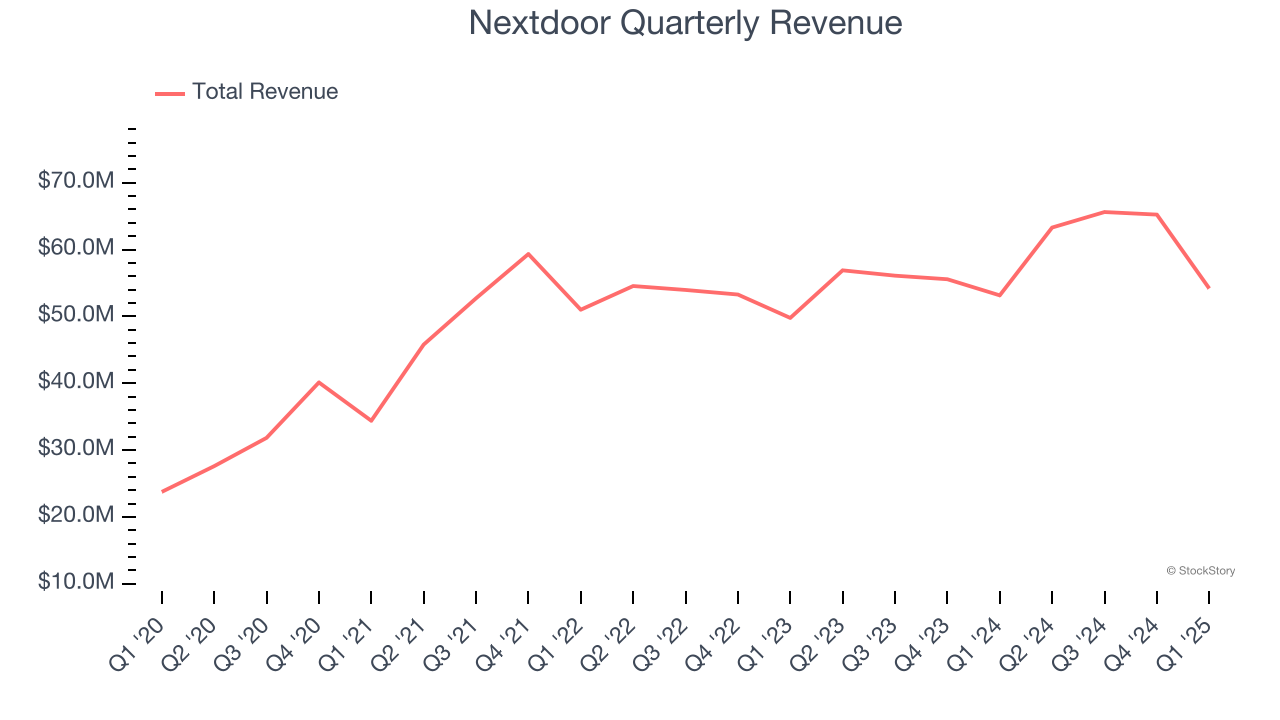

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Nextdoor grew its sales at a sluggish 5.9% compounded annual growth rate. This fell short of our benchmark for the consumer internet sector and is a rough starting point for our analysis.

This quarter, Nextdoor reported modest year-on-year revenue growth of 1.9% but beat Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

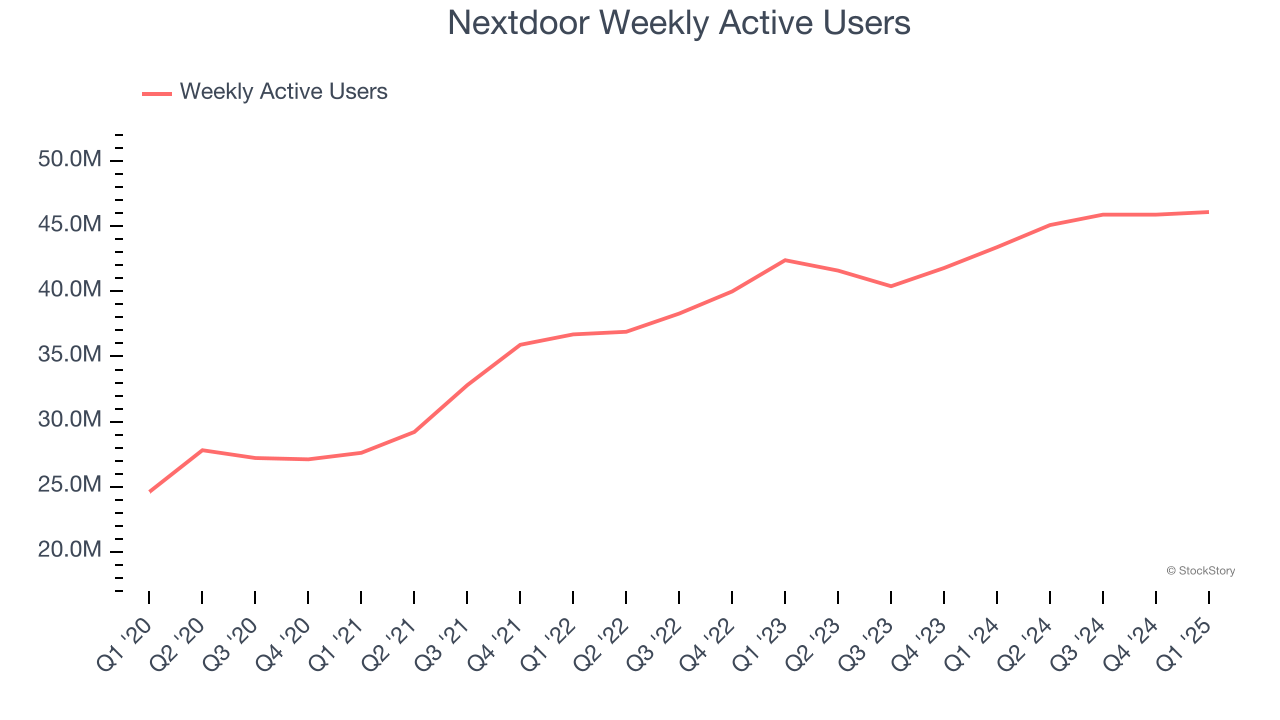

Weekly Active Users

User Growth

As a social network, Nextdoor generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Nextdoor’s weekly active users, a key performance metric for the company, increased by 7.9% annually to 46.1 million in the latest quarter. This growth rate is decent for a consumer internet business and indicates people enjoy using its offerings.

In Q1, Nextdoor added 2.7 million weekly active users, leading to 6.2% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

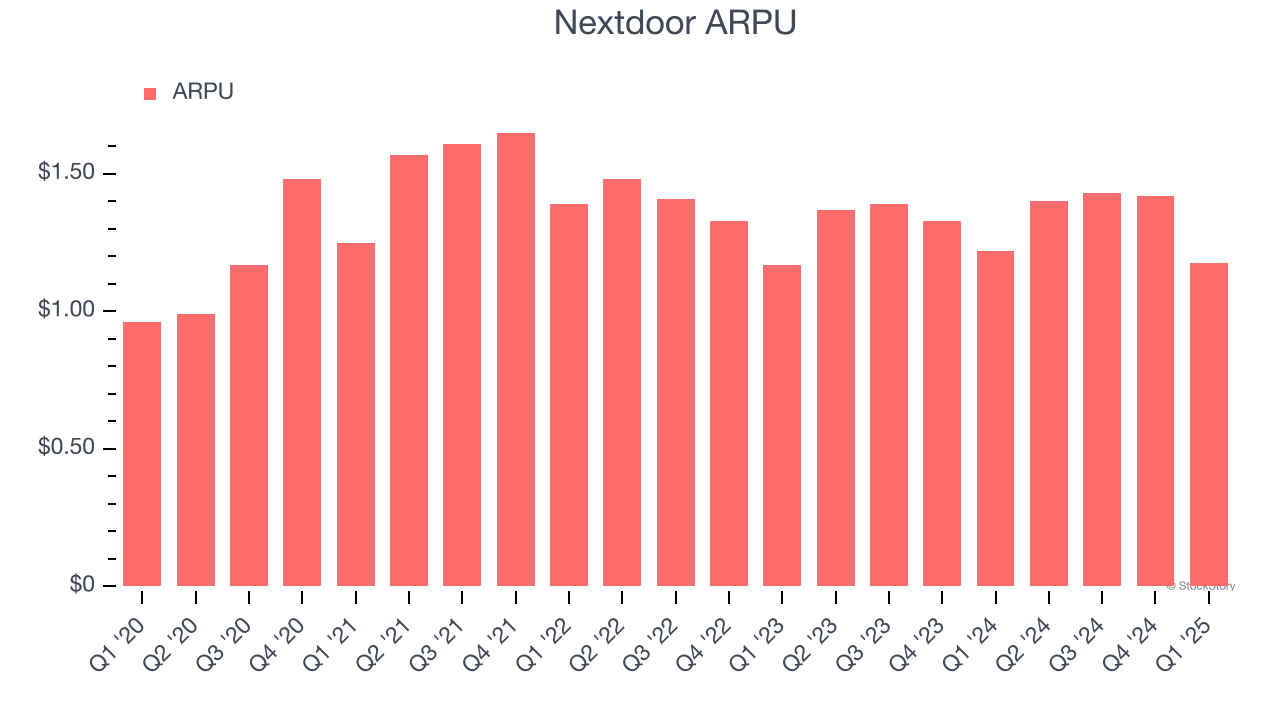

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Nextdoor’s audience and its ad-targeting capabilities.

Nextdoor’s ARPU has been roughly flat over the last two years. This isn’t great, but the increase in weekly active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Nextdoor tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Nextdoor’s ARPU clocked in at $1.18. It declined 3.7% year on year, worse than the change in its weekly active users.

Key Takeaways from Nextdoor’s Q1 Results

We were impressed by how significantly Nextdoor blew past analysts’ EBITDA expectations this quarter. We were also glad its number of weekly active users outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $1.50 immediately following the results.

So should you invest in Nextdoor right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.