Private corrections company GEO Group (NYSE: GEO) missed Wall Street’s revenue expectations in Q1 CY2025, with sales flat year on year at $604.6 million. Next quarter’s revenue guidance of $620 million underwhelmed, coming in 5.2% below analysts’ estimates. Its GAAP profit of $0.14 per share was 19.5% below analysts’ consensus estimates.

Is now the time to buy GEO Group? Find out by accessing our full research report, it’s free.

GEO Group (GEO) Q1 CY2025 Highlights:

- Revenue: $604.6 million vs analyst estimates of $616.8 million (flat year on year, 2% miss)

- EPS (GAAP): $0.14 vs analyst expectations of $0.17 (19.5% miss)

- Adjusted EBITDA: $99.77 million vs analyst estimates of $112.7 million (16.5% margin, 11.5% miss)

- Revenue Guidance for the full year is $2.53 million at the midpoint, below analyst estimates of $2.66 billion

- EPS (GAAP) guidance for the full year is $0.83 at the midpoint, missing analyst estimates by 27.7%

- EBITDA guidance for the full year is $477.5 million at the midpoint, below analyst estimates of $541.9 million

- Operating Margin: 10.1%, down from 13.1% in the same quarter last year

- Market Capitalization: $4.23 billion

George C. Zoley, Executive Chairman of GEO, said, “We are pleased with the progress we have made towards meeting our growth and capital allocation objectives. During the first quarter of 2025, we announced two important contract awards for the reactivation of two company-owned facilities totaling 2,800 beds and representing in excess of $130 million in annualized revenues. We believe we have an unprecedented opportunity to assist the federal government in meeting its expanded immigration enforcement priorities. We have taken several important steps to be prepared to meet that opportunity, including making a significant investment commitment of $70 million to strengthen our capabilities to deliver expanded detention capacity, secure transportation, and electronic monitoring services to ICE and the federal government. We also recently completed a reorganization of our senior management team to oversee the operational execution of this expected future growth activity.”

Company Overview

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE: GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.42 billion in revenue over the past 12 months, GEO Group is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

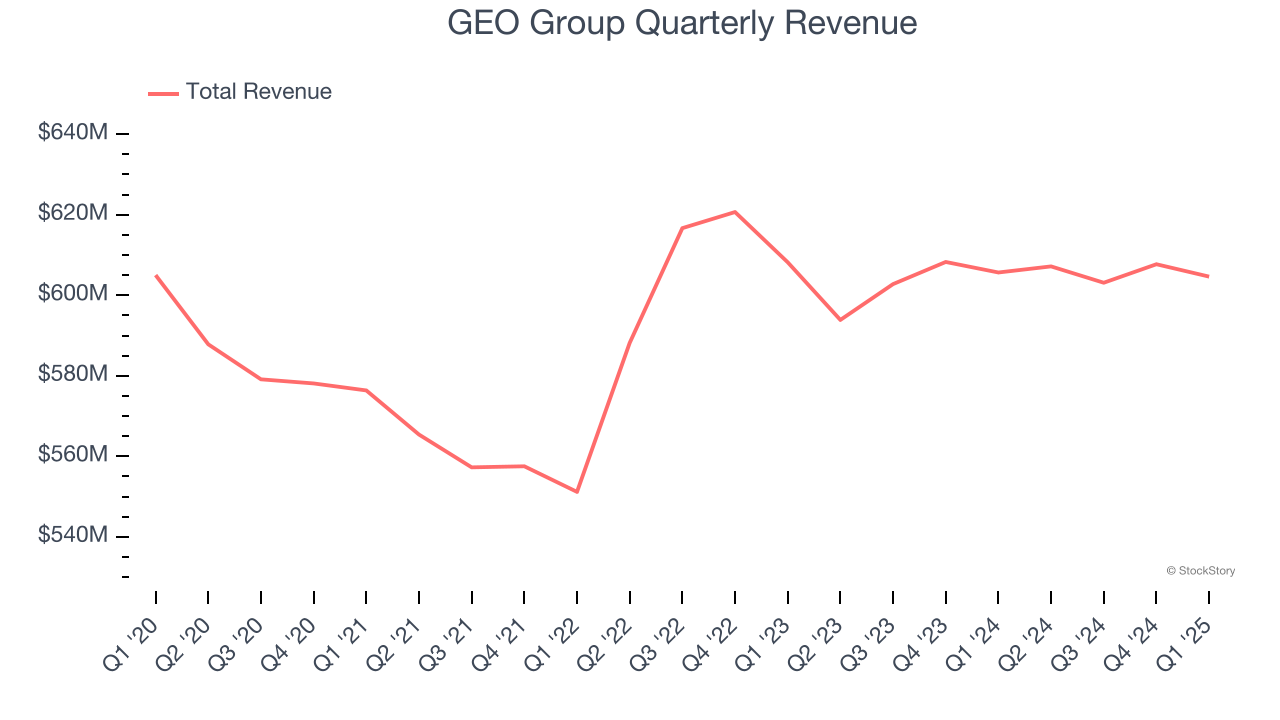

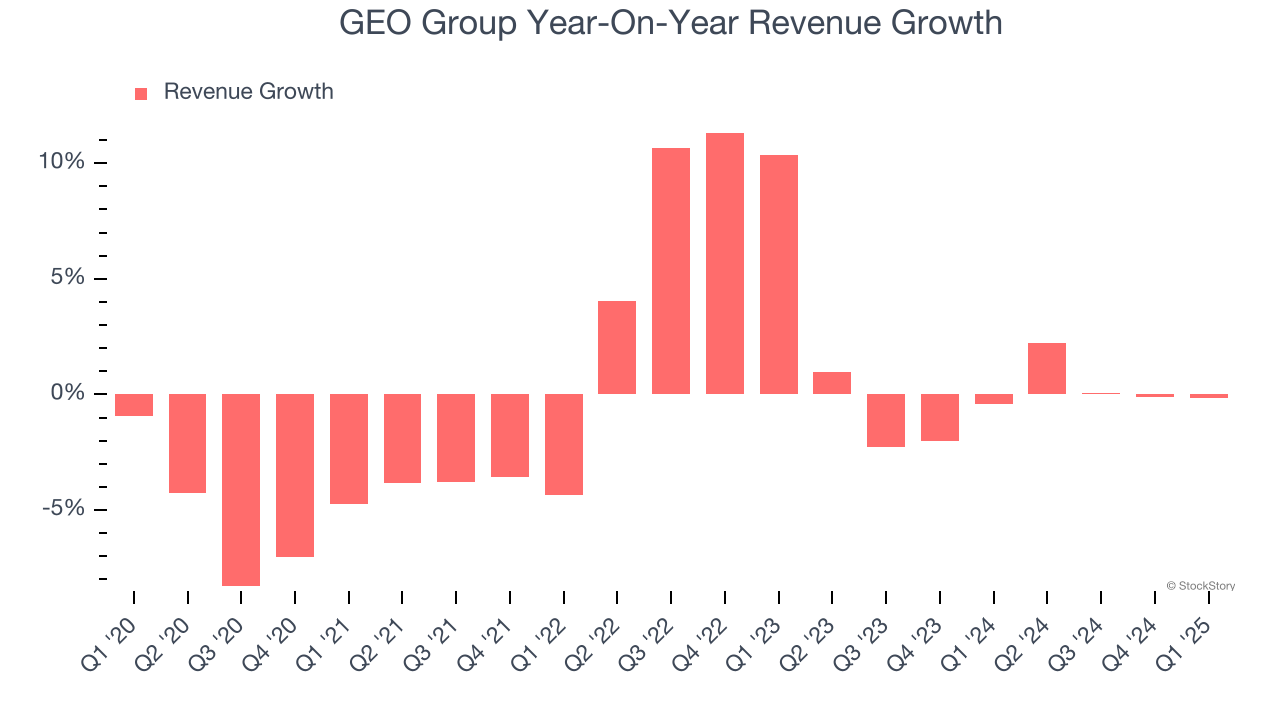

As you can see below, GEO Group struggled to increase demand as its $2.42 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Just like its five-year trend, GEO Group’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, GEO Group missed Wall Street’s estimates and reported a rather uninspiring 0.2% year-on-year revenue decline, generating $604.6 million of revenue. Company management is currently guiding for a 2.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.5% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will spur better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

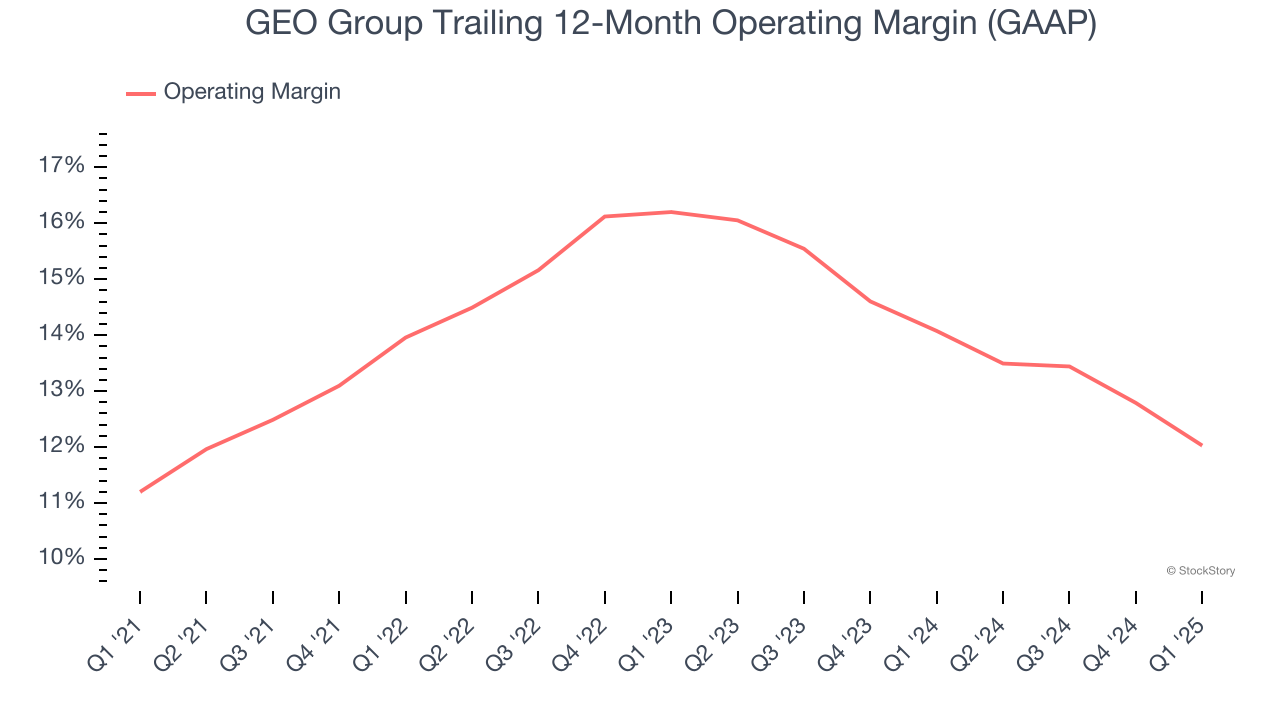

GEO Group has managed its cost base well over the last five years. It demonstrated solid profitability for a business services business, producing an average operating margin of 13.5%.

Analyzing the trend in its profitability, GEO Group’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, highlighting the consistency of its expense base.

In Q1, GEO Group generated an operating profit margin of 10.1%, down 3.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

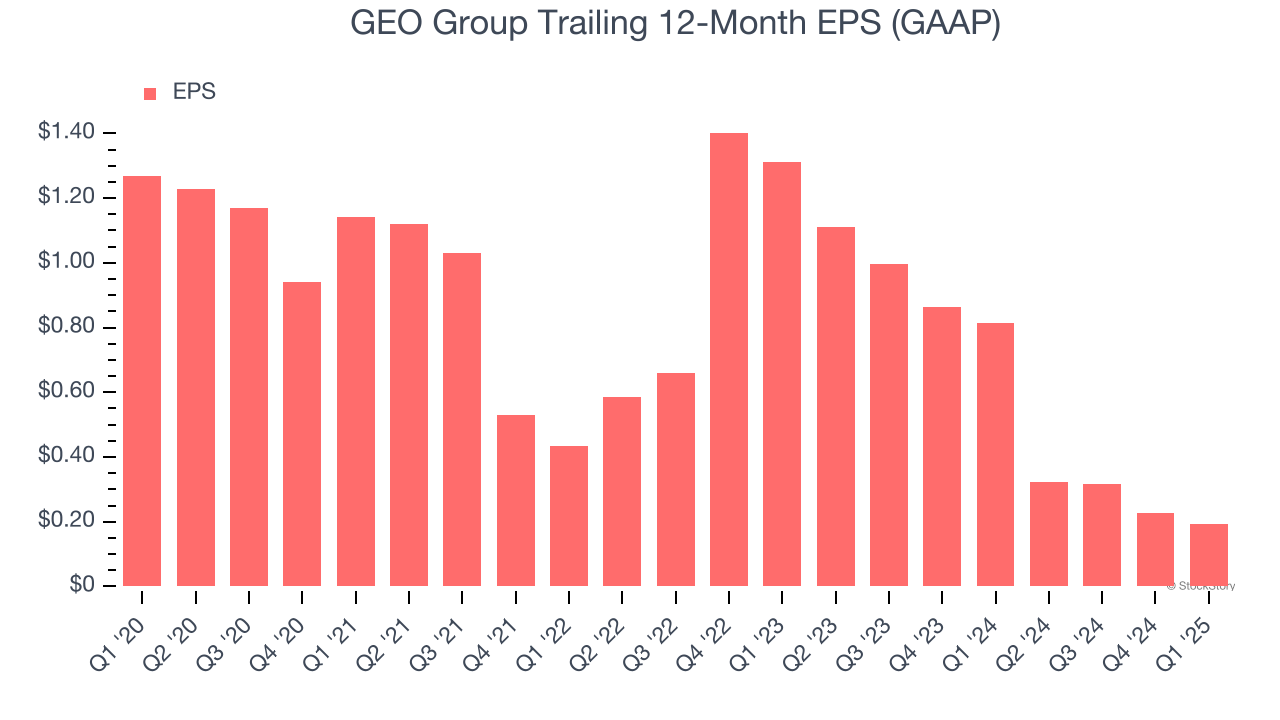

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for GEO Group, its EPS declined by 31.4% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

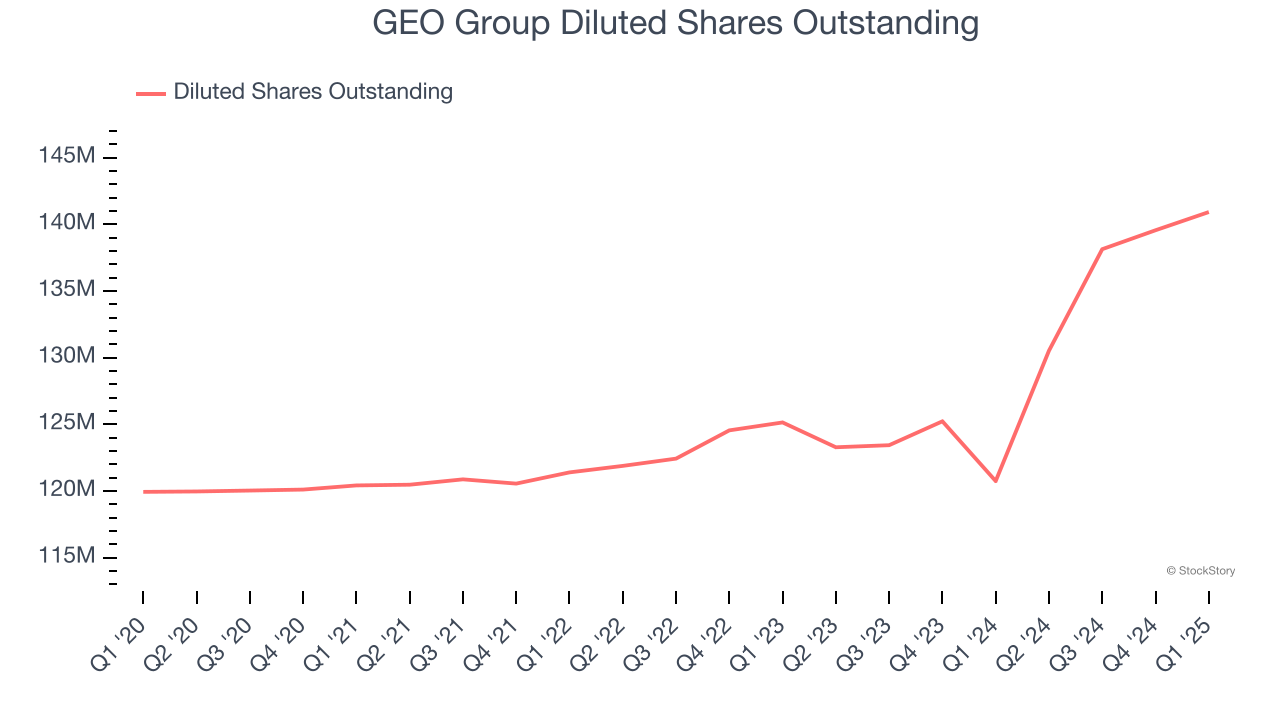

We can take a deeper look into GEO Group’s earnings to better understand the drivers of its performance. A five-year view shows GEO Group has diluted its shareholders, growing its share count by 17.5%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, GEO Group reported EPS at $0.14, down from $0.17 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects GEO Group’s full-year EPS of $0.19 to grow 751%.

Key Takeaways from GEO Group’s Q1 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed significantly and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4.3% to $29 immediately after reporting.

GEO Group’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.