Packaged foods company B&G Foods (NYSE: BGS) will be reporting earnings tomorrow afternoon. Here’s what to expect.

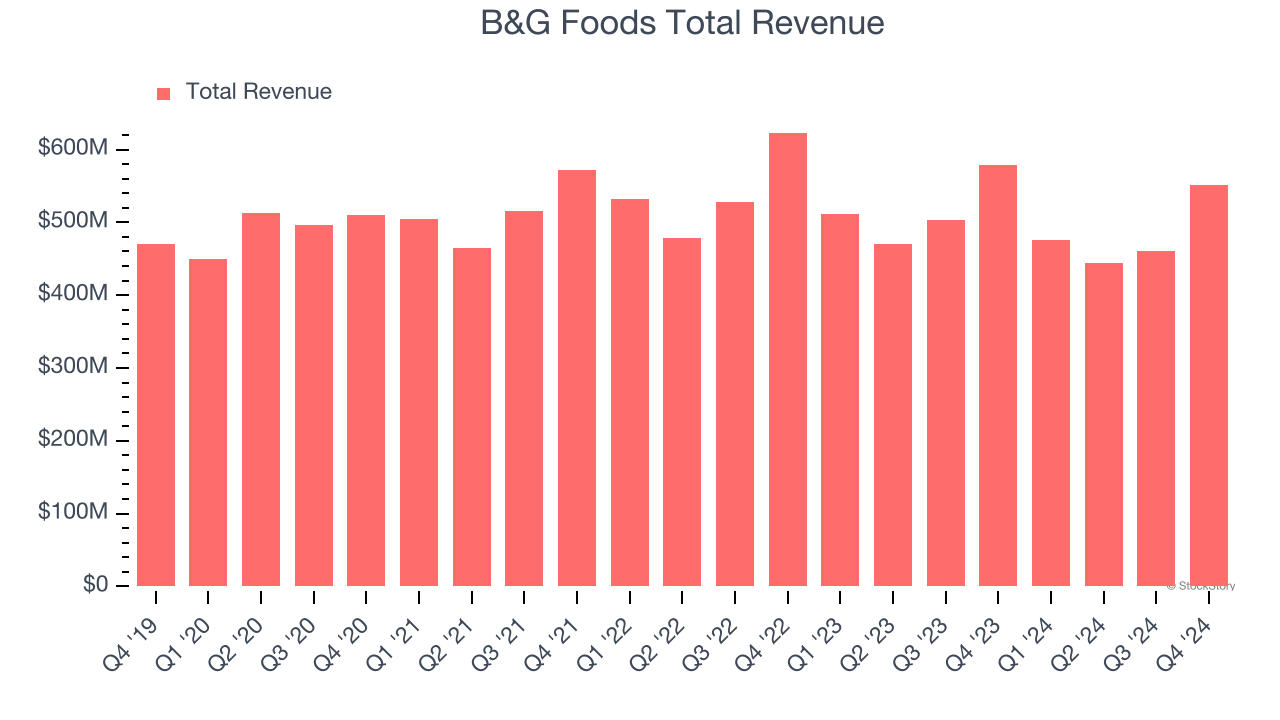

B&G Foods beat analysts’ revenue expectations by 1.2% last quarter, reporting revenues of $551.6 million, down 4.6% year on year. It was a mixed quarter for the company, with a narrow beat of analysts’ EBITDA estimates but full-year revenue guidance meeting analysts’ expectations.

Is B&G Foods a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting B&G Foods’s revenue to decline 3.9% year on year to $456.5 million, improving from the 7.1% decrease it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.16 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. B&G Foods has missed Wall Street’s revenue estimates four times over the last two years.

Looking at B&G Foods’s peers in the shelf-stable food segment, some have already reported their Q1 results, giving us a hint as to what we can expect. Lamb Weston delivered year-on-year revenue growth of 4.3%, beating analysts’ expectations by 2.4%, and Simply Good Foods reported revenues up 15.2%, topping estimates by 1.6%. Lamb Weston traded up 9.1% following the results while Simply Good Foods was also up 9.2%.

Read our full analysis of Lamb Weston’s results here and Simply Good Foods’s results here.

There has been positive sentiment among investors in the shelf-stable food segment, with share prices up 2.1% on average over the last month. B&G Foods’s stock price was unchanged during the same time and is heading into earnings with an average analyst price target of $7.29 (compared to the current share price of $6.42).

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.