As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the ground transportation industry, including Werner (NASDAQ: WERN) and its peers.

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 16 ground transportation stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

Thankfully, share prices of the companies have been resilient as they are up 7.1% on average since the latest earnings results.

Werner (NASDAQ: WERN)

Conducting business in over a 100 countries, Werner (NASDAQ: WERN) offers full-truckload, less-than-truckload, and intermodal delivery services.

Werner reported revenues of $771.5 million, up 3.5% year on year. This print exceeded analysts’ expectations by 1%. Despite the top-line beat, it was still a softer quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 20.3% since reporting and currently trades at $30.54.

Read our full report on Werner here, it’s free for active Edge members.

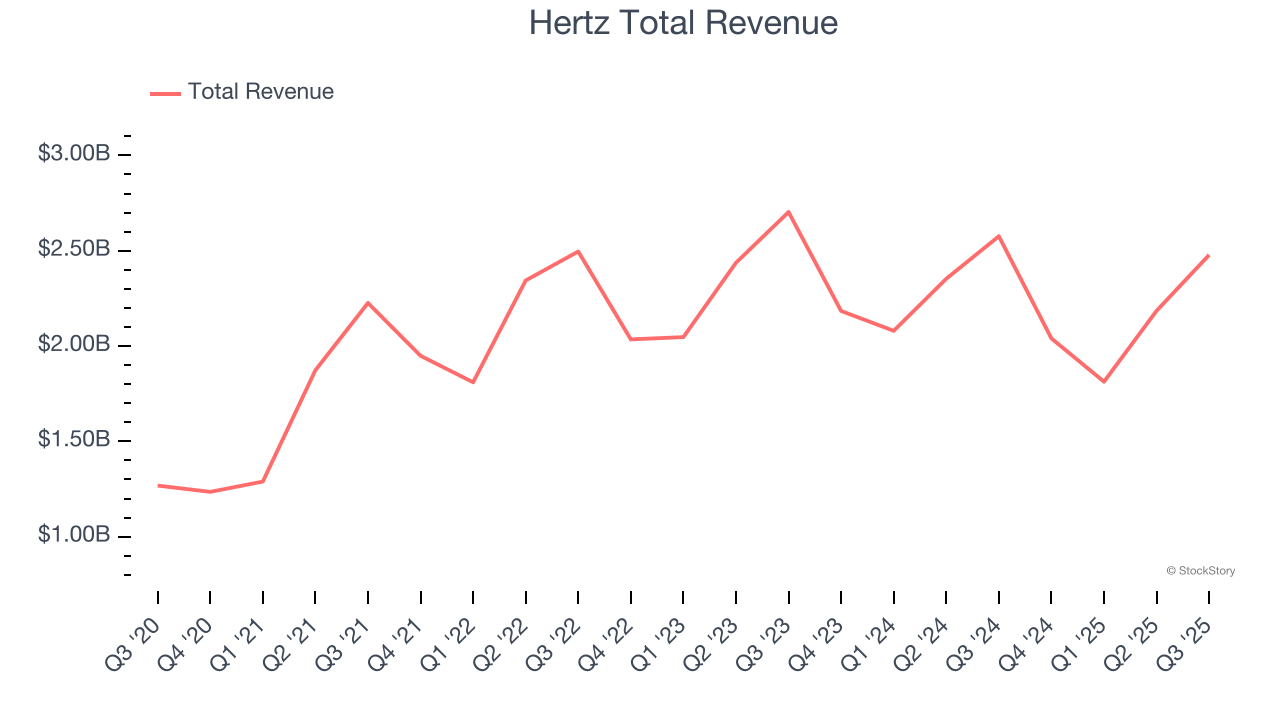

Best Q3: Hertz (NASDAQ: HTZ)

Started with a dozen Model T Fords, Hertz (NASDAQ: HTZ) is a global car rental company providing vehicle rental services to leisure and business travelers.

Hertz reported revenues of $2.48 billion, down 3.8% year on year, outperforming analysts’ expectations by 3.1%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Hertz delivered the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 1.6% since reporting. It currently trades at $5.04.

Is now the time to buy Hertz? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Universal Logistics (NASDAQ: ULH)

Founded in 1932, Universal Logistics (NASDAQ: ULH) is a provider of customized transportation and logistics solutions operating throughout the United States and in Mexico, Canada, and Colombia.

Universal Logistics reported revenues of $396.8 million, down 7% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 6.3% since the results and currently trades at $16.28.

Read our full analysis of Universal Logistics’s results here.

Old Dominion Freight Line (NASDAQ: ODFL)

With its name deriving from the Commonwealth of Virginia’s nickname, Old Dominion (NASDAQ: ODFL) delivers less-than-truckload (LTL) and full-container load freight.

Old Dominion Freight Line reported revenues of $1.41 billion, down 4.3% year on year. This number met analysts’ expectations. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 14.9% since reporting and currently trades at $156.39.

RXO (NYSE: RXO)

With access to millions of trucks, RXO (NYSE: RXO) offers full-truckload, less-than-truckload, and last-mile deliveries.

RXO reported revenues of $1.42 billion, up 36.6% year on year. This print was in line with analysts’ expectations. Taking a step back, it was a softer quarter as it logged a significant miss of analysts’ EBITDA estimates and EPS in line with analysts’ estimates.

RXO delivered the fastest revenue growth among its peers. The stock is down 21.2% since reporting and currently trades at $13.89.

Read our full, actionable report on RXO here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.