Teledyne has been treading water for the past six months, recording a small return of 2.8% while holding steady at $502.68. The stock also fell short of the S&P 500’s 13.6% gain during that period.

Is now the time to buy Teledyne, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Teledyne Not Exciting?

We're swiping left on Teledyne for now. Here are three reasons you should be careful with TDY and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

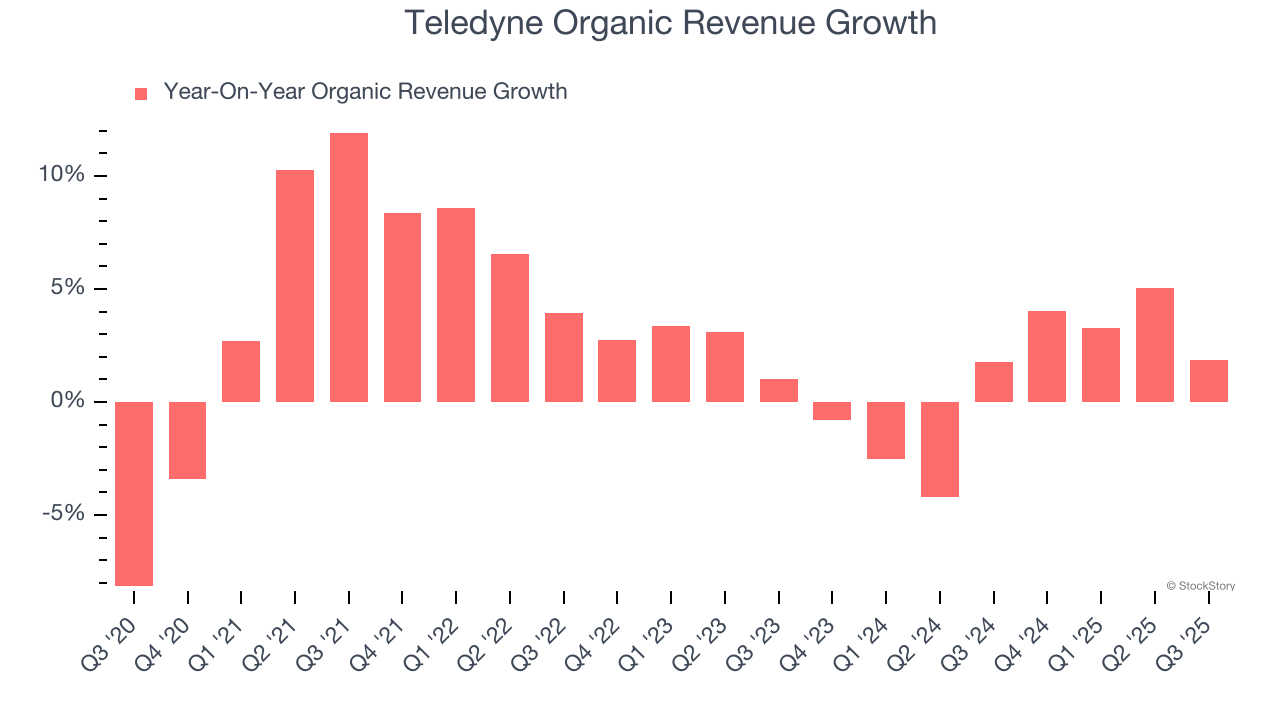

Investors interested in Inspection Instruments companies should track organic revenue in addition to reported revenue. This metric gives visibility into Teledyne’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Teledyne’s organic revenue averaged 1.1% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Teledyne’s revenue to rise by 4.5%, close to its 14.1% annualized growth for the past five years. This projection doesn't excite us and indicates its newer products and services will not accelerate its top-line performance yet.

3. Previous Growth Initiatives Haven’t Impressed

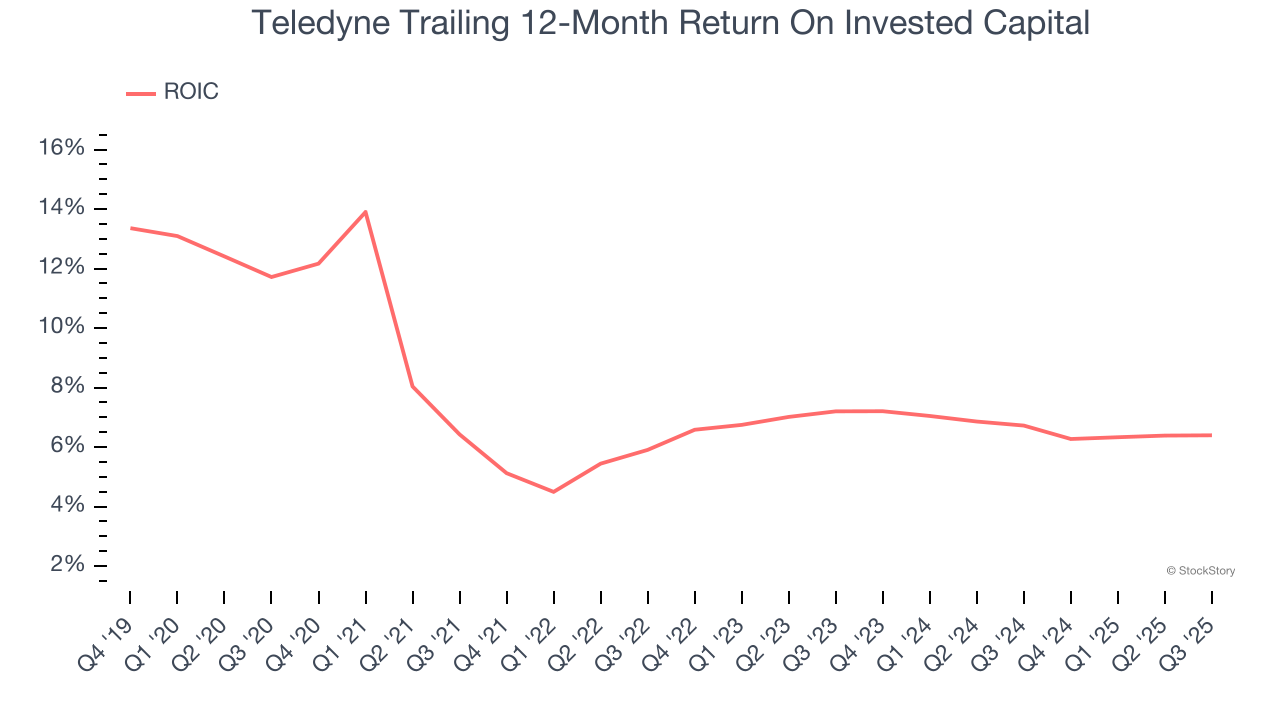

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Teledyne historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.5%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

Teledyne isn’t a terrible business, but it isn’t one of our picks. With its shares lagging the market recently, the stock trades at 22× forward P/E (or $502.68 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of Teledyne

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.