Reinsurance Group of America currently trades at $201.70 per share and has shown little upside over the past six months, posting a middling return of 3.2%. The stock also fell short of the S&P 500’s 13.6% gain during that period.

Is now the time to buy Reinsurance Group of America, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Reinsurance Group of America Not Exciting?

We're cautious about Reinsurance Group of America. Here are three reasons we avoid RGA and a stock we'd rather own.

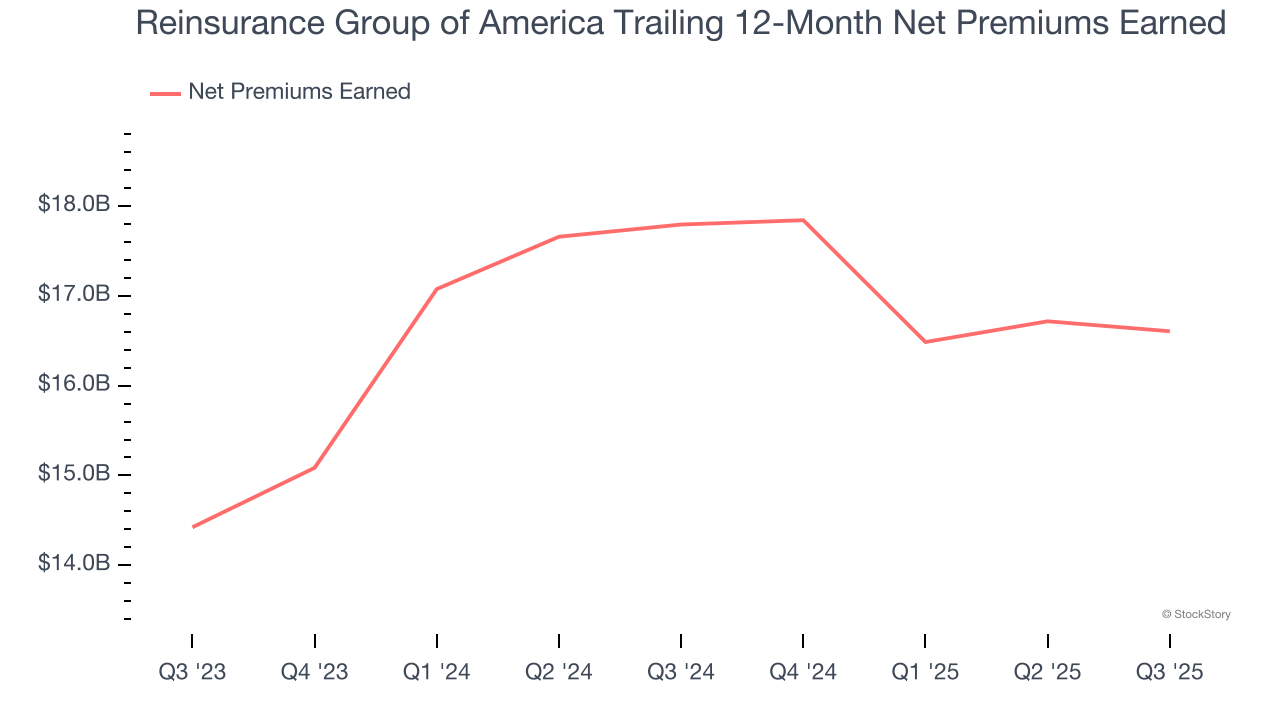

1. Net Premiums Earned Point to Soft Demand

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

Reinsurance Group of America’s net premiums earned has grown at a 7.3% annualized rate over the last two years, slightly worse than the broader insurance industry and slower than its total revenue.

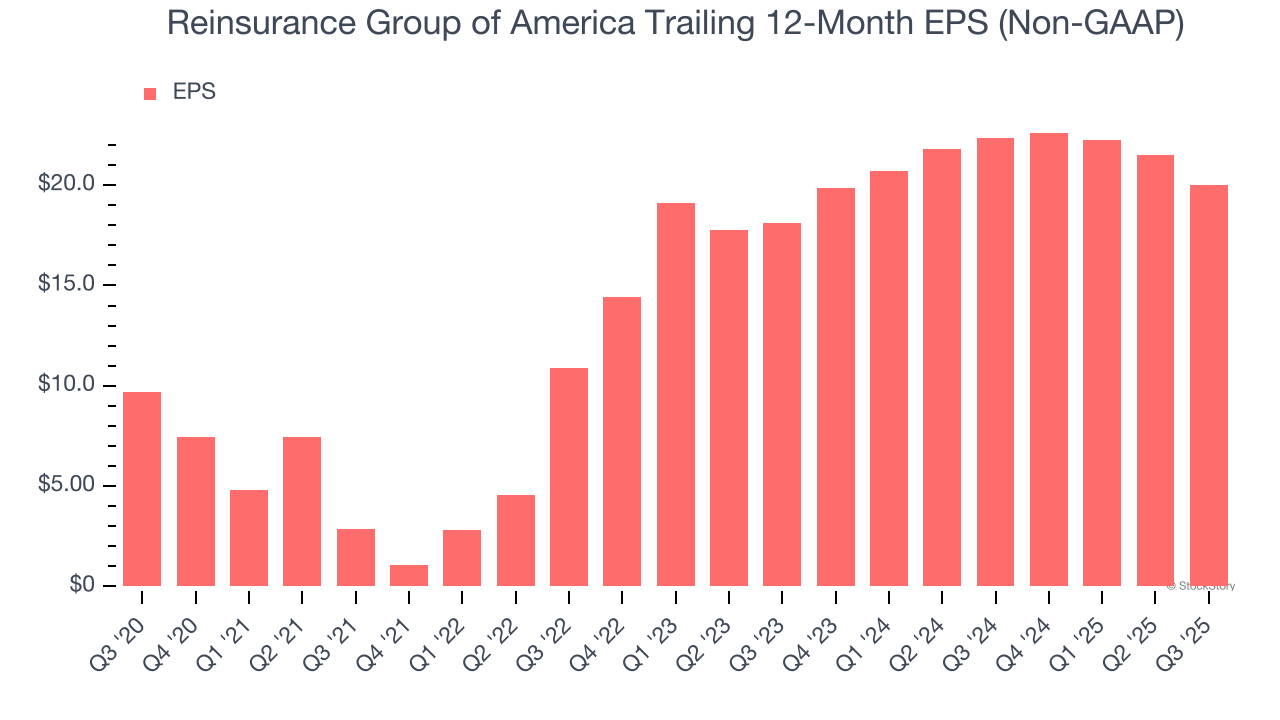

2. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Reinsurance Group of America’s EPS grew at a weak 5.1% compounded annual growth rate over the last two years, lower than its 11.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

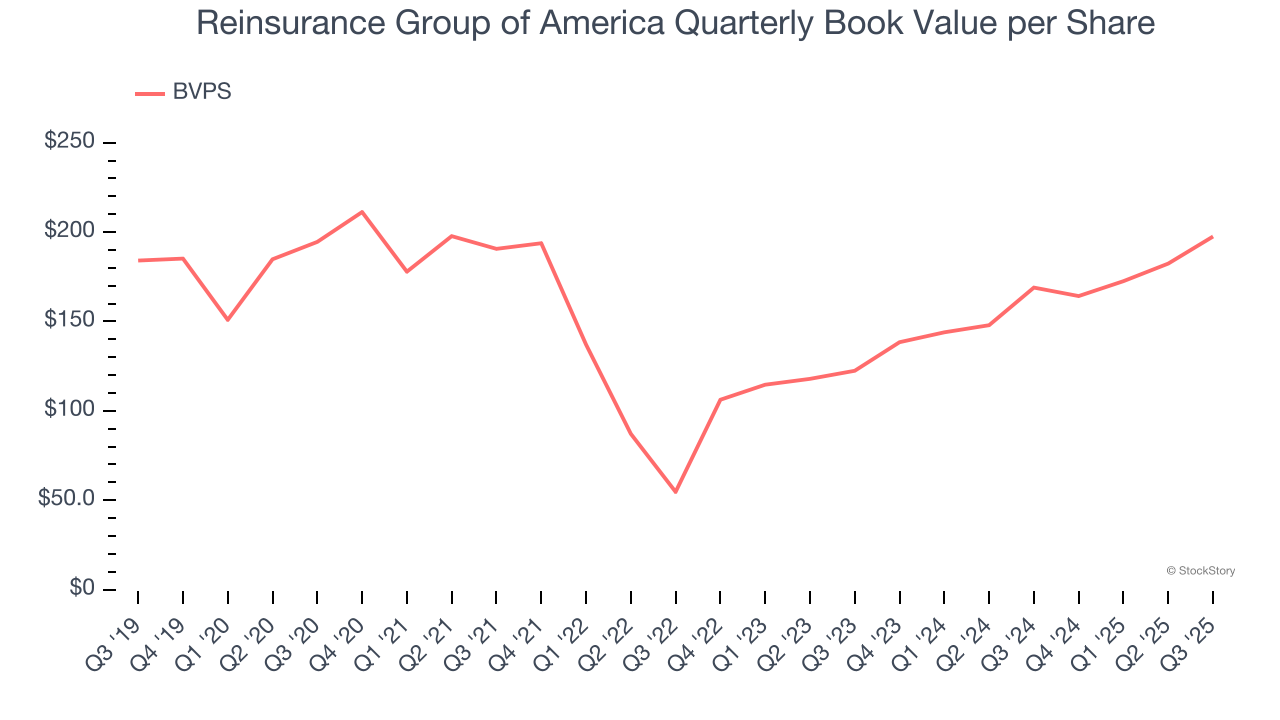

3. BVPS Projections Show Stormy Skies Ahead

Book value per share (BVPS) growth comes from an insurer’s ability to price risk appropriately and invest premiums profitably.

Over the next 12 months, Consensus estimates call for Reinsurance Group of America’s BVPS to shrink by 13.7% to $157.58, a sour projection.

Final Judgment

Reinsurance Group of America’s business quality ultimately falls short of our standards. With its shares lagging the market recently, the stock trades at 1× forward P/B (or $201.70 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Reinsurance Group of America

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.