Kirby currently trades at $109.77 per share and has shown little upside over the past six months, posting a small loss of 2.7%. The stock also fell short of the S&P 500’s 13.6% gain during that period.

Is now the time to buy Kirby, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Kirby Not Exciting?

We're sitting this one out for now. Here are three reasons why KEX doesn't excite us and a stock we'd rather own.

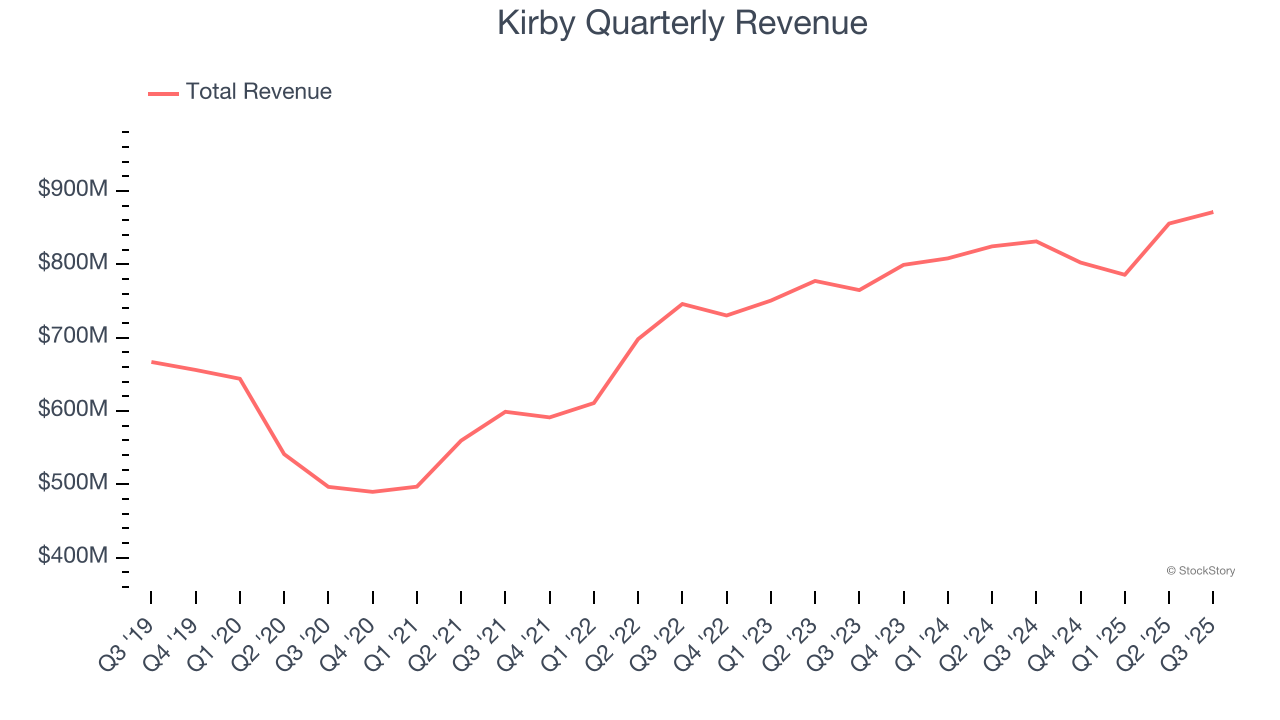

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Kirby’s sales grew at a mediocre 7.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

2. Free Cash Flow Margin Dropping

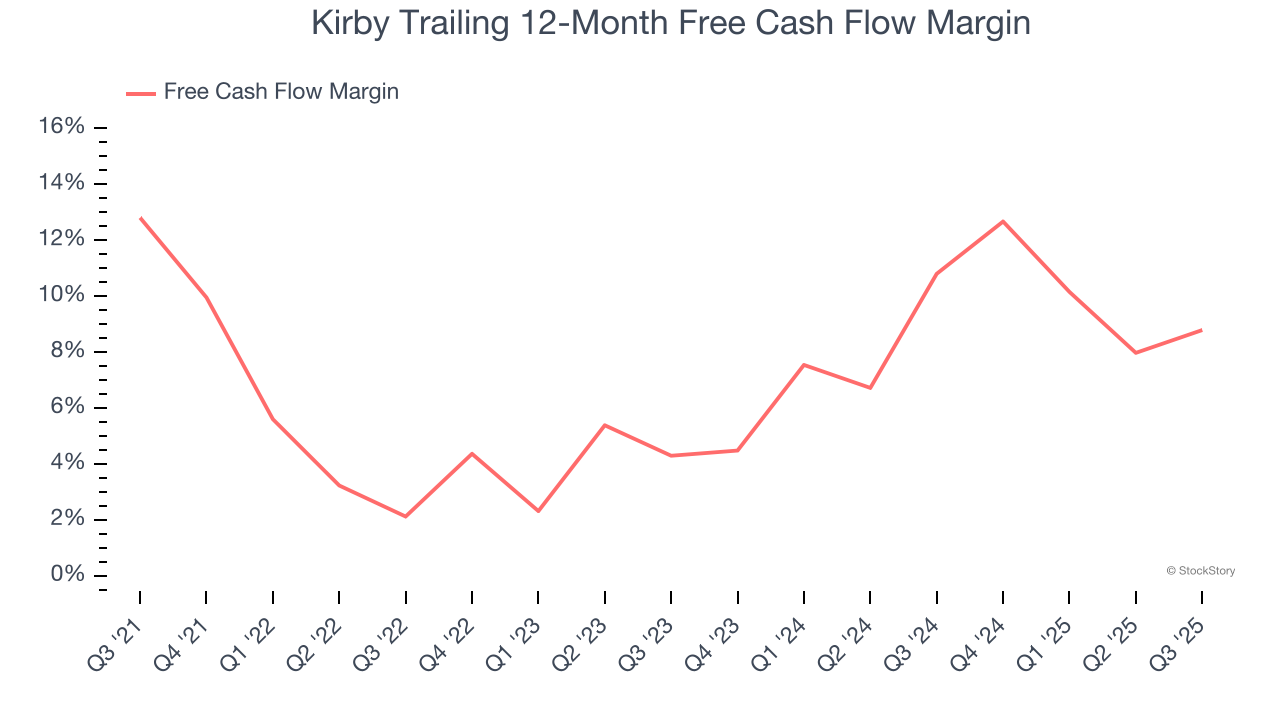

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Kirby’s margin dropped by 4 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Kirby’s free cash flow margin for the trailing 12 months was 8.8%.

3. Previous Growth Initiatives Haven’t Impressed

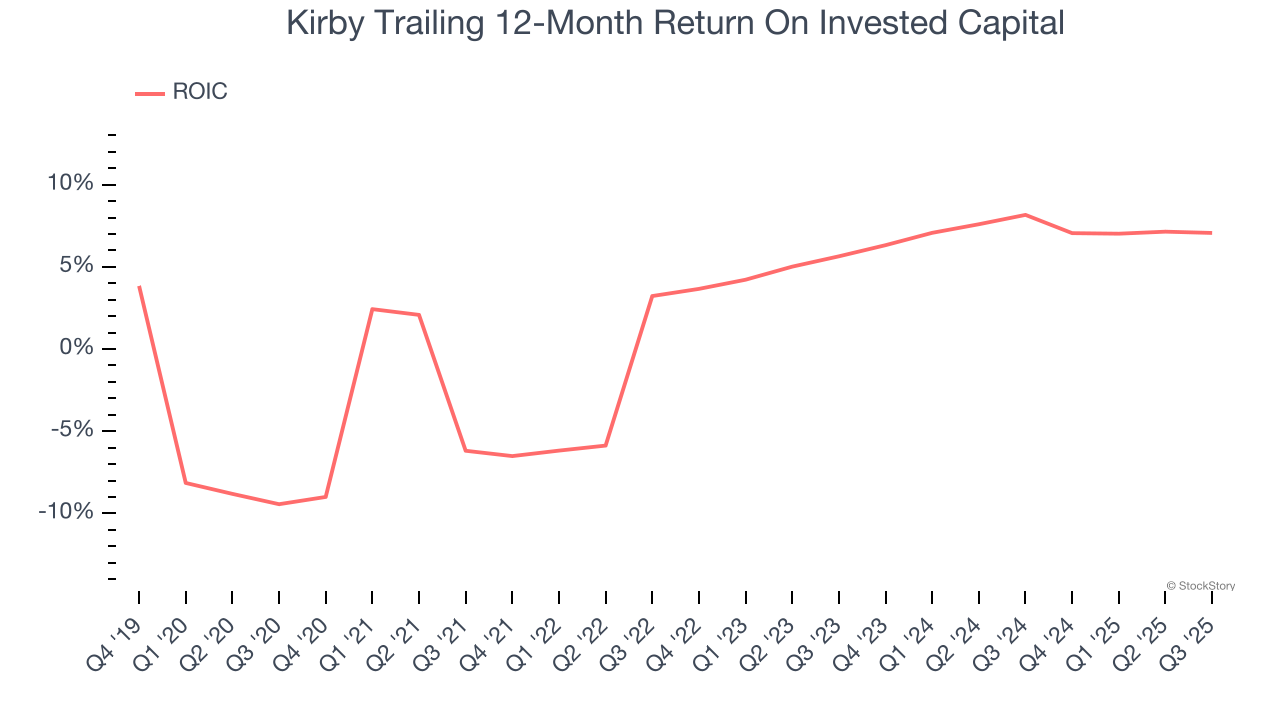

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Kirby historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.6%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

Kirby’s business quality ultimately falls short of our standards. With its shares lagging the market recently, the stock trades at 16.1× forward P/E (or $109.77 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Kirby

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.