Over the past six months, International Paper’s shares (currently trading at $38.39) have posted a disappointing 16.8% loss, well below the S&P 500’s 13.6% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in International Paper, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think International Paper Will Underperform?

Despite the more favorable entry price, we're cautious about International Paper. Here are three reasons there are better opportunities than IP and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, International Paper grew its sales at a sluggish 2.4% compounded annual growth rate. This was below our standards.

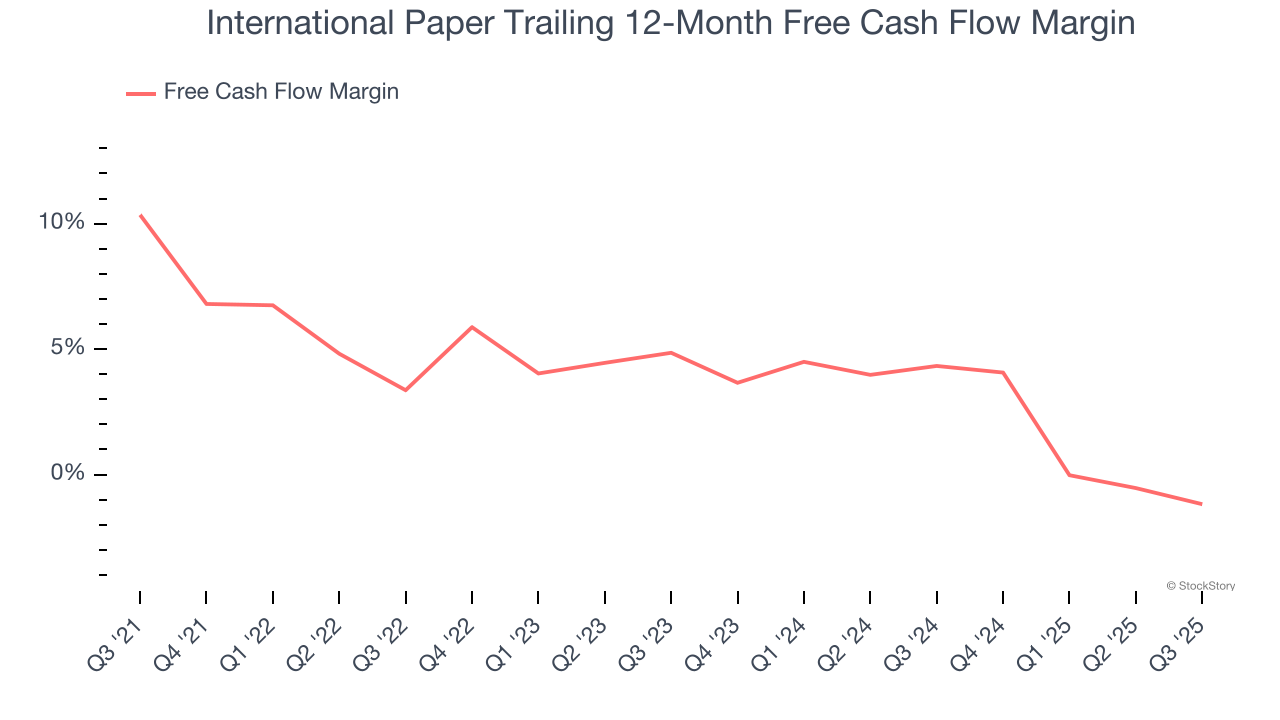

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, International Paper’s margin dropped by 11.5 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. International Paper’s free cash flow margin for the trailing 12 months was negative 1.2%.

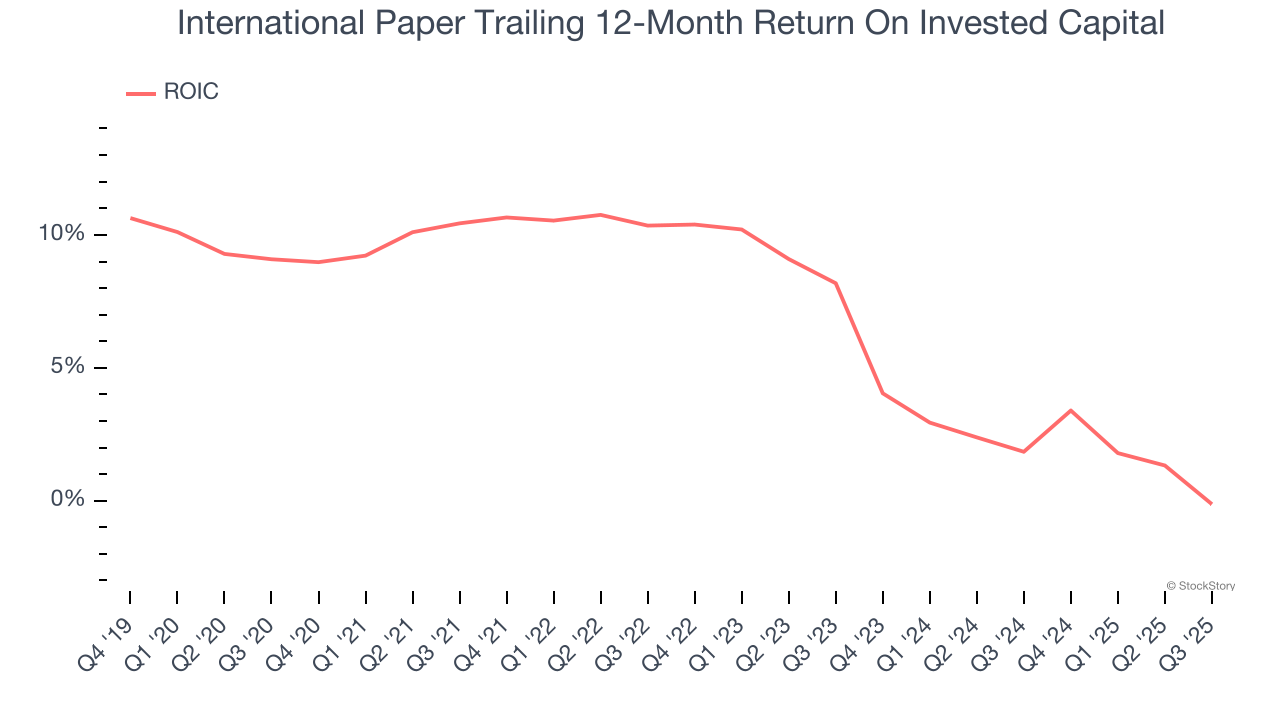

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, International Paper’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of International Paper, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 21.7× forward P/E (or $38.39 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of International Paper

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.