Pangaea Logistics (NASDAQ: PANL) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 10.2% year on year to $168.7 million. Its non-GAAP profit of $0.17 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Pangaea? Find out by accessing our full research report, it’s free for active Edge members.

Pangaea (PANL) Q3 CY2025 Highlights:

- Revenue: $168.7 million vs analyst estimates of $159.3 million (10.2% year-on-year growth, 5.9% beat)

- Adjusted EPS: $0.17 vs analyst estimates of $0.03 (significant beat)

- Adjusted EBITDA: $28.9 million vs analyst estimates of $21.57 million (17.1% margin, 33.9% beat)

- Operating Margin: 10%, in line with the same quarter last year

- Free Cash Flow was $24.4 million, up from -$20.1 million in the same quarter last year

- Market Capitalization: $324.9 million

"We delivered strong results in the third quarter of 2025, with Adjusted EBITDA up 20%, demonstrating the leverage in our model. This growth was supported by solid Arctic trade activity, robust utilization across our niche ice-class fleet, and the stability of our long-term COAs," stated Mark Filanowski, Chief Executive Officer of Pangaea Logistics Solutions.

Company Overview

Established in 1996, Pangaea Logistics (NASDAQ: PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

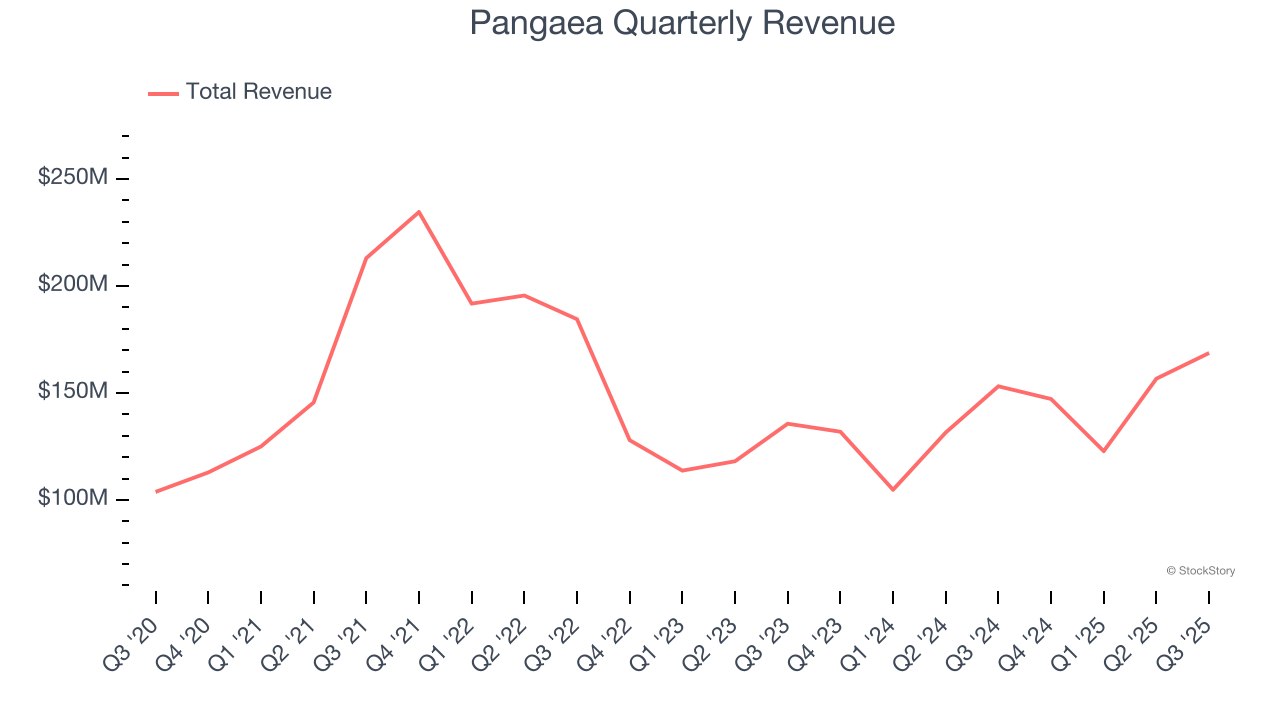

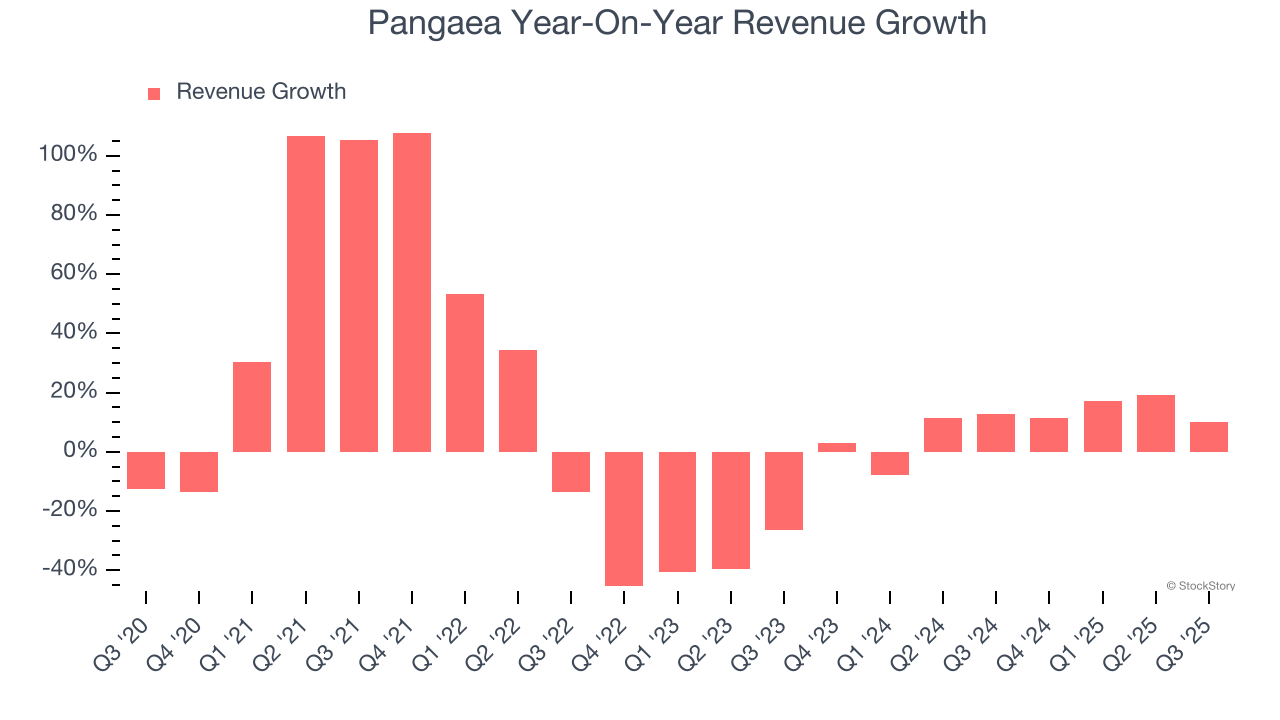

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Pangaea’s sales grew at a decent 8.2% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Pangaea’s annualized revenue growth of 9.6% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Pangaea recent performance stands out, especially when considering many similar Marine Transportation businesses faced declining sales because of cyclical headwinds.

This quarter, Pangaea reported year-on-year revenue growth of 10.2%, and its $168.7 million of revenue exceeded Wall Street’s estimates by 5.9%.

Looking ahead, sell-side analysts expect revenue to grow 14% over the next 12 months, an improvement versus the last two years. This projection is healthy and indicates its newer products and services will fuel better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

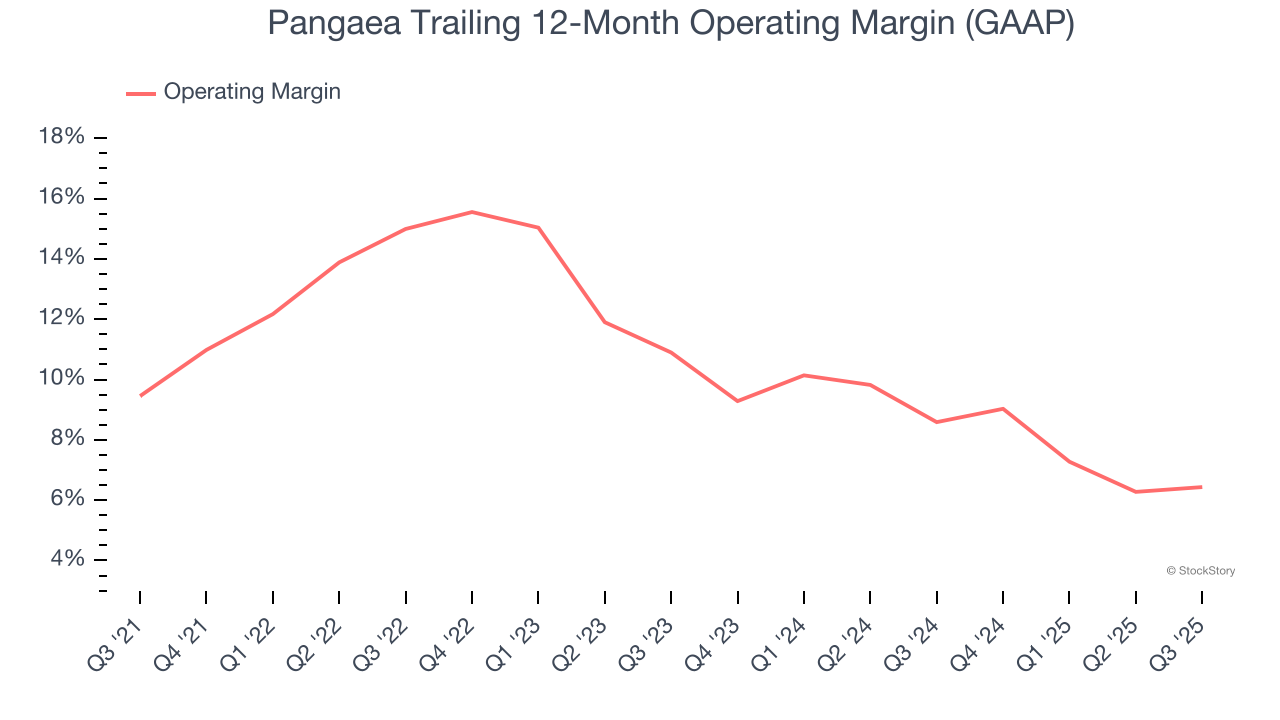

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Pangaea has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Pangaea’s operating margin decreased by 3 percentage points over the last five years. Many Marine Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope Pangaea can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

In Q3, Pangaea generated an operating margin profit margin of 10%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

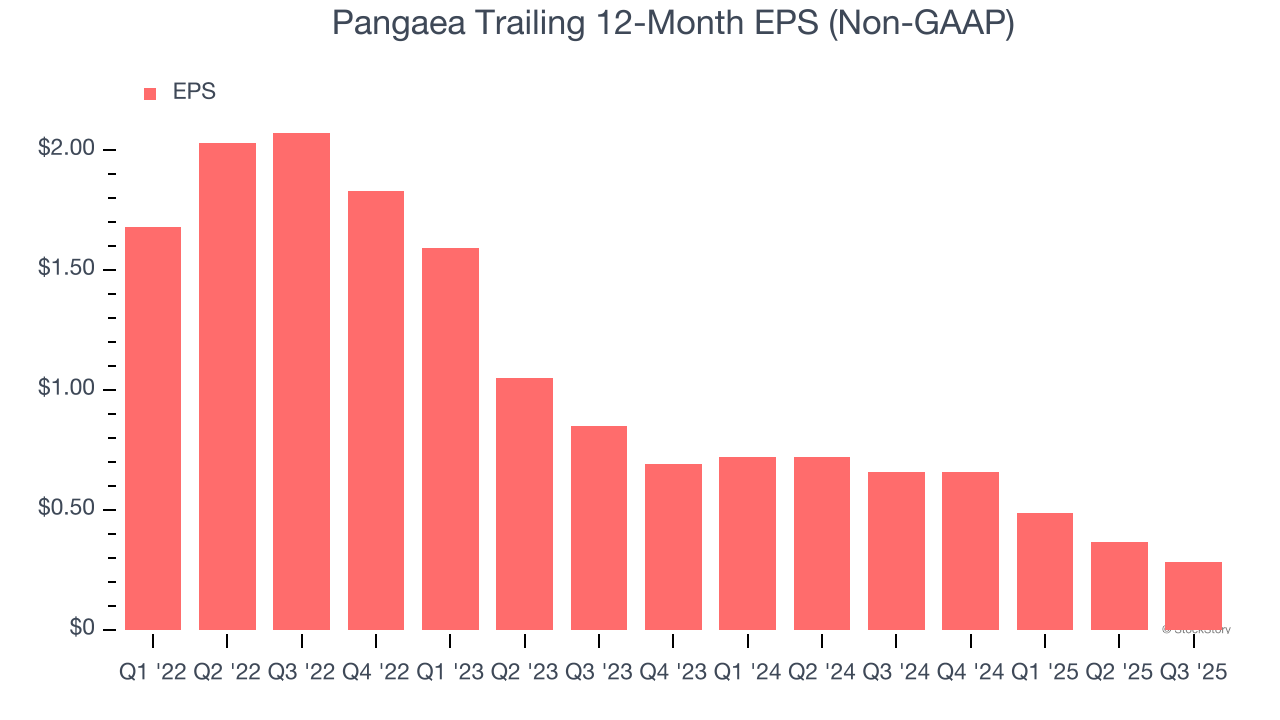

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Pangaea’s full-year EPS dropped 218%, or 33.6% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Pangaea’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Pangaea, its EPS declined by 42.6% annually over the last two years while its revenue grew by 9.6%. This tells us the company became less profitable on a per-share basis as it expanded.

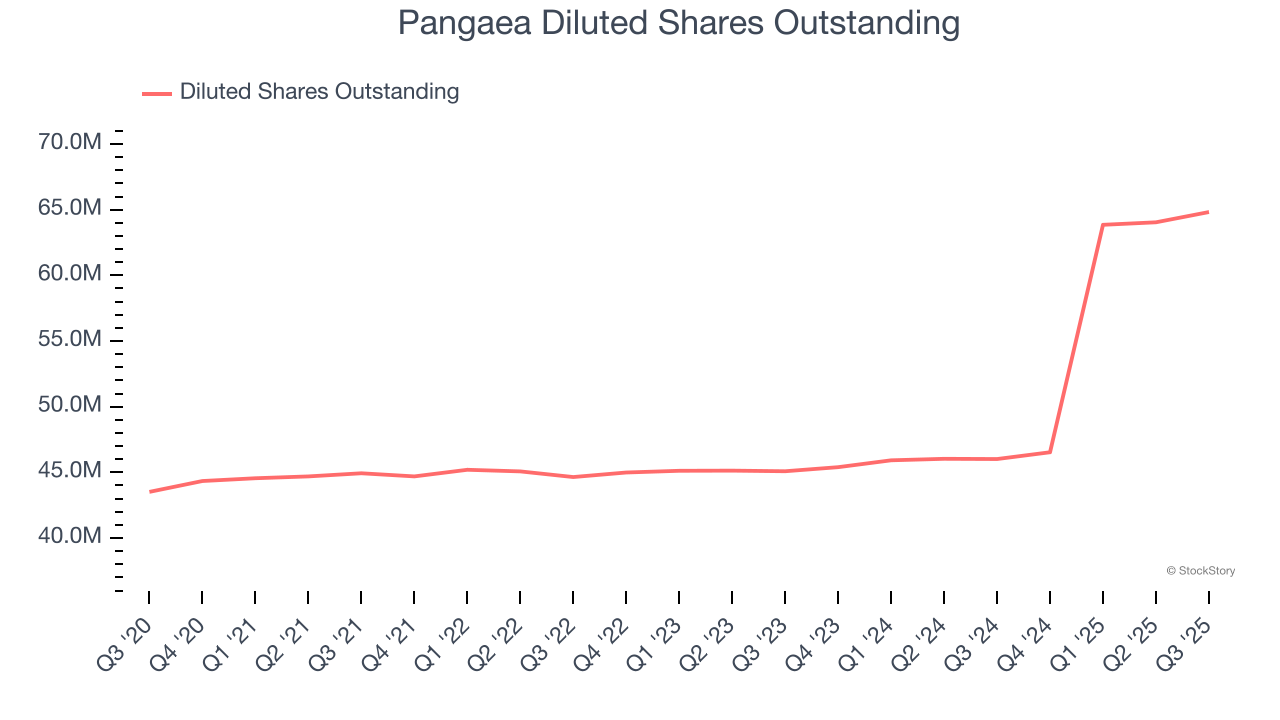

Diving into the nuances of Pangaea’s earnings can give us a better understanding of its performance. We mentioned earlier that Pangaea’s operating margin was flat this quarter, but a two-year view shows its margin has declinedwhile its share count has grown 43.8%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Pangaea reported adjusted EPS of $0.17, down from $0.25 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Pangaea’s Q3 Results

It was good to see Pangaea beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.9% to $5.16 immediately after reporting.

Sure, Pangaea had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.