Over the past six months, First Merchants’s stock price fell to $35.34. Shareholders have lost 9.8% of their capital, which is disappointing considering the S&P 500 has climbed by 11.3%. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in First Merchants, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is First Merchants Not Exciting?

Even with the cheaper entry price, we don't have much confidence in First Merchants. Here are three reasons you should be careful with FRME and a stock we'd rather own.

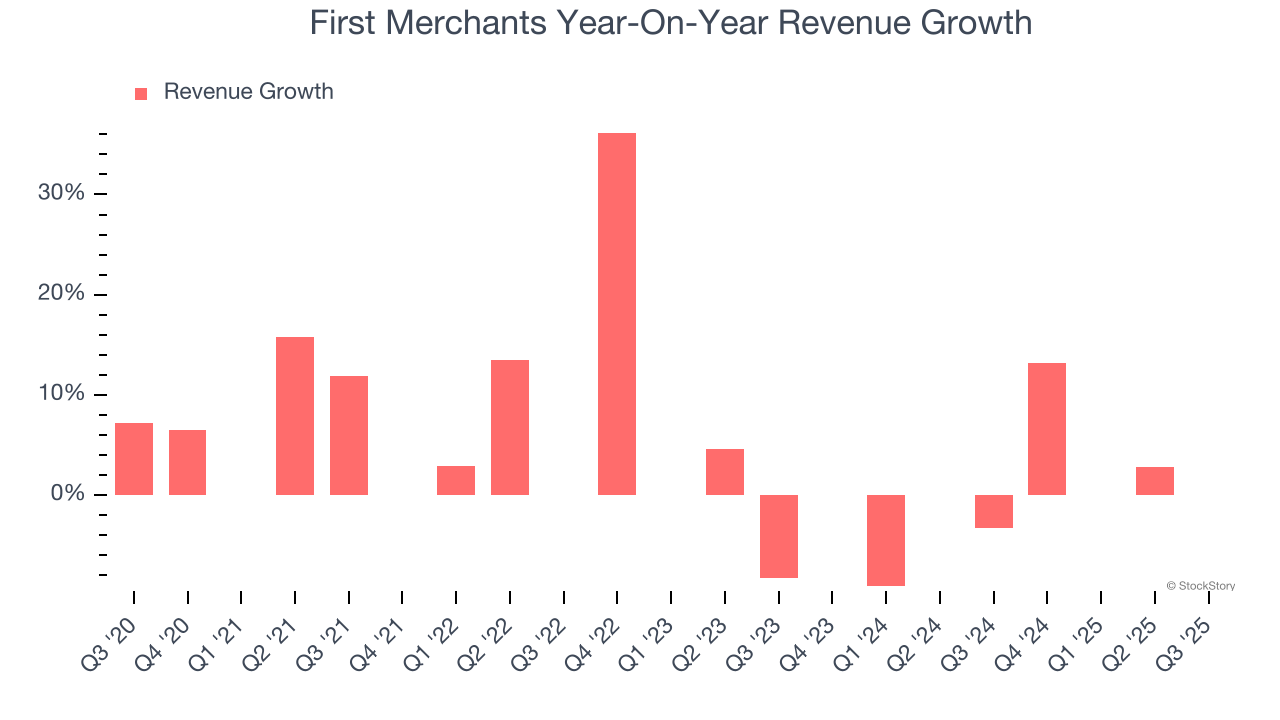

1. Revenue Growth Flatlining

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. First Merchants’s recent performance shows its demand has slowed as its revenue was flat over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

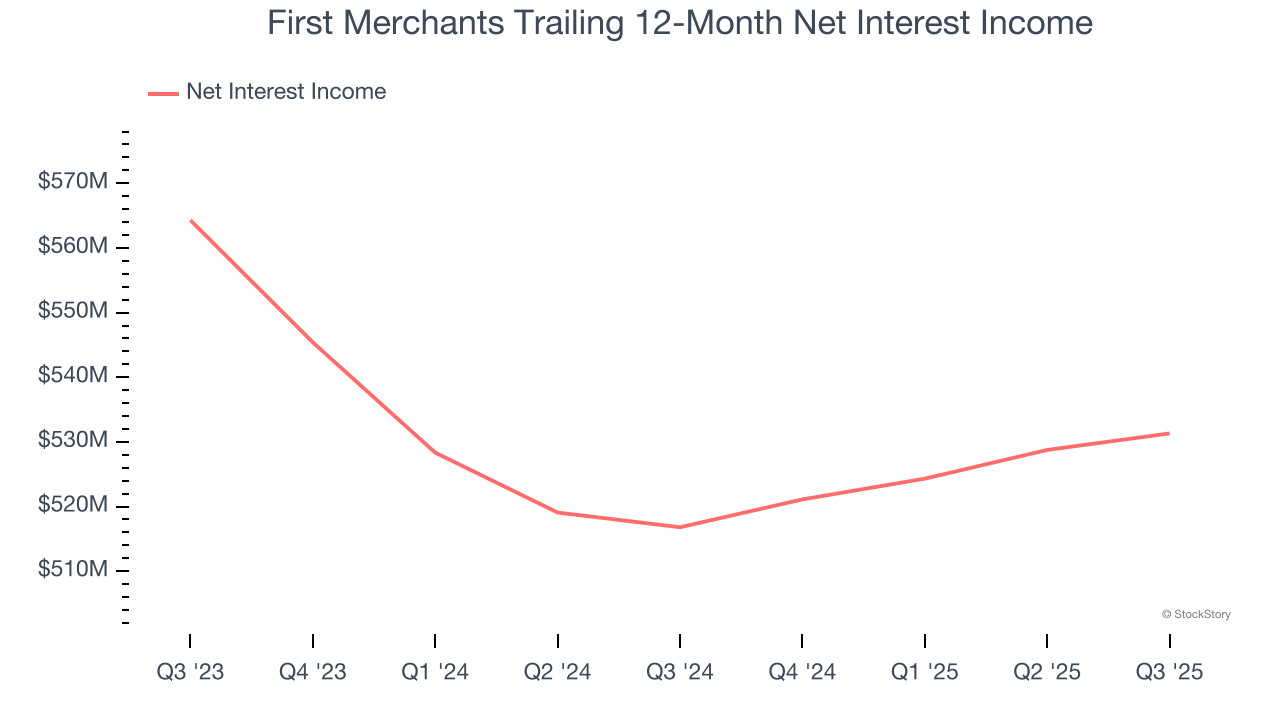

2. Net Interest Income Points to Soft Demand

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

First Merchants’s net interest income has grown at a 7.1% annualized rate over the last five years, slightly worse than the broader banking industry and in line with its total revenue. Its growth was driven by an increase in its outstanding loans as its net interest margin, which represents how much a bank earns in relation to its outstanding loan book, was flat throughout that period.

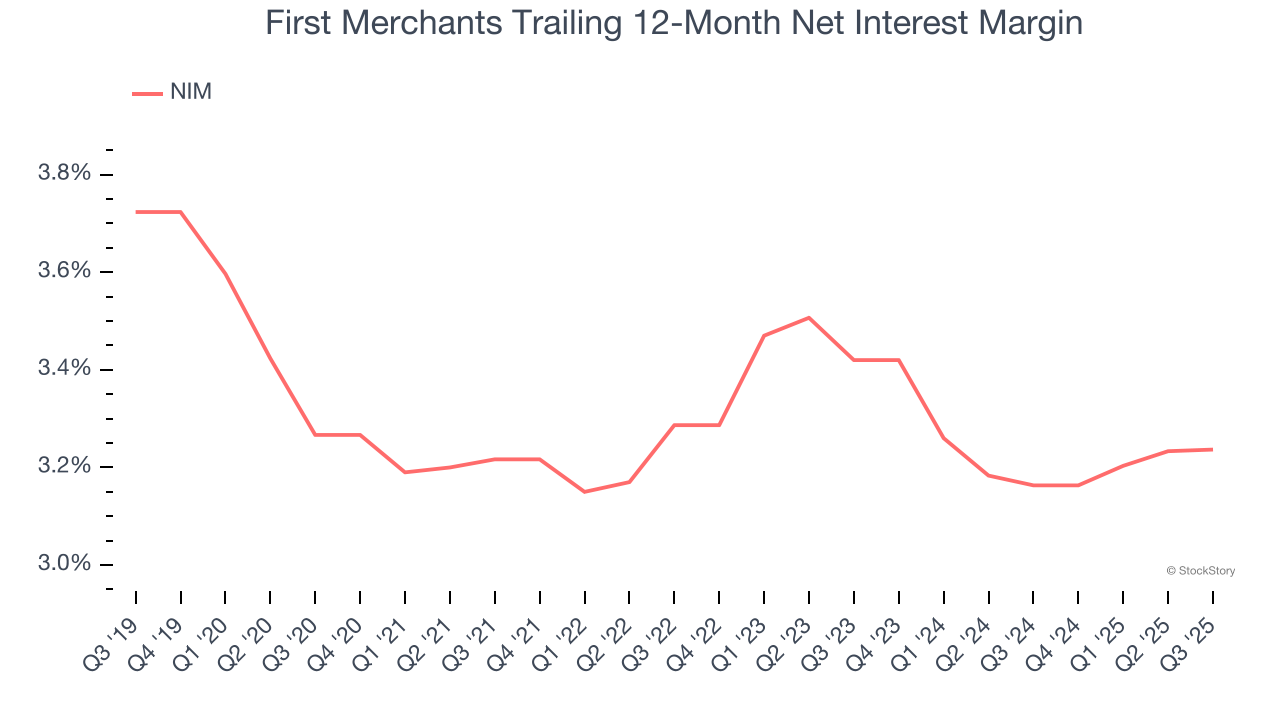

3. Net Interest Margin Dropping

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, First Merchants’s net interest margin averaged 3.2%. Its margin also contracted by 18.3 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean that First Merchants either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

Final Judgment

First Merchants’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 0.8× forward P/B (or $35.34 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than First Merchants

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.