Coca-Cola has been treading water for the past six months, recording a small return of 2.8% while holding steady at $71.48. The stock also fell short of the S&P 500’s 17.2% gain during that period.

Given the weaker price action, is now a good time to buy KO? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free for active Edge members.

Why Does KO Stock Spark Debate?

A pioneer and behemoth in carbonated soft drinks, Coca-Cola (NYSE: KO) is a storied beverage company best known for its flagship soda.

Two Positive Attributes:

1. Elite Gross Margin Powers Best-In-Class Business Model

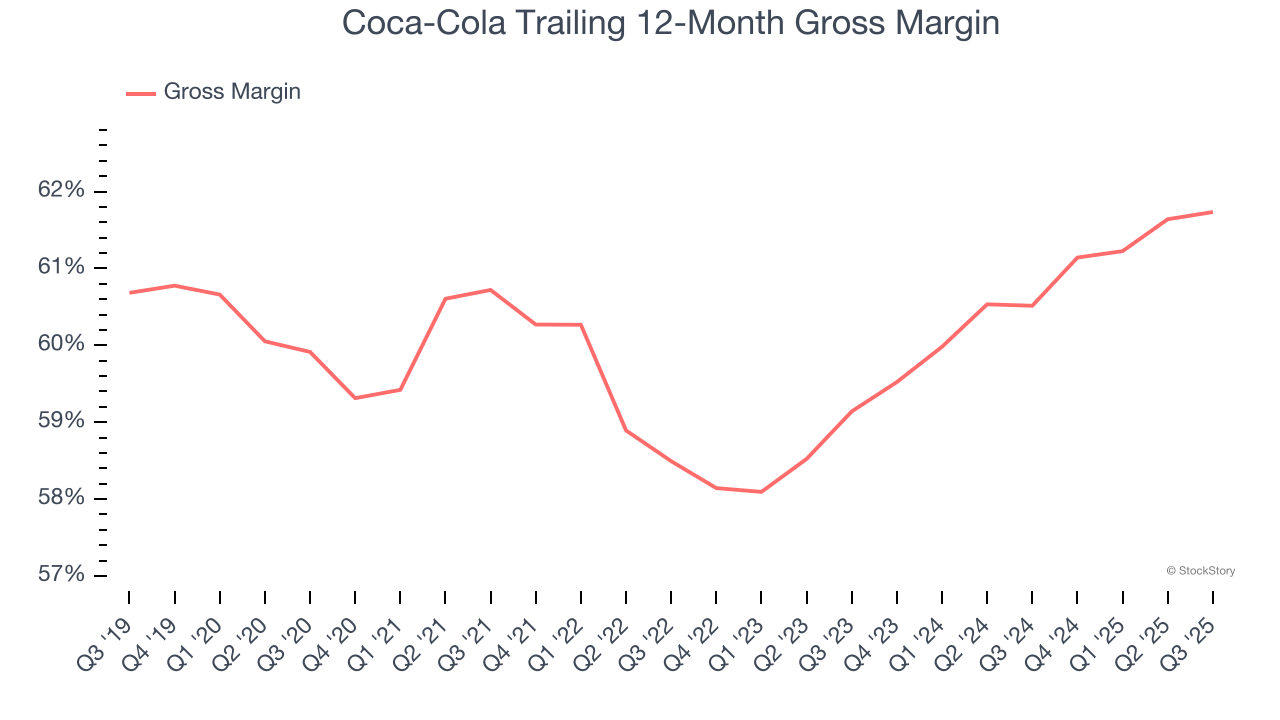

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Coca-Cola has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 61.1% gross margin over the last two years. That means for every $100 in revenue, only $38.87 went towards paying for raw materials, production of goods, transportation, and distribution.

2. Operating Margin Reveals a Well-Run Organization

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

Coca-Cola has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 25.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

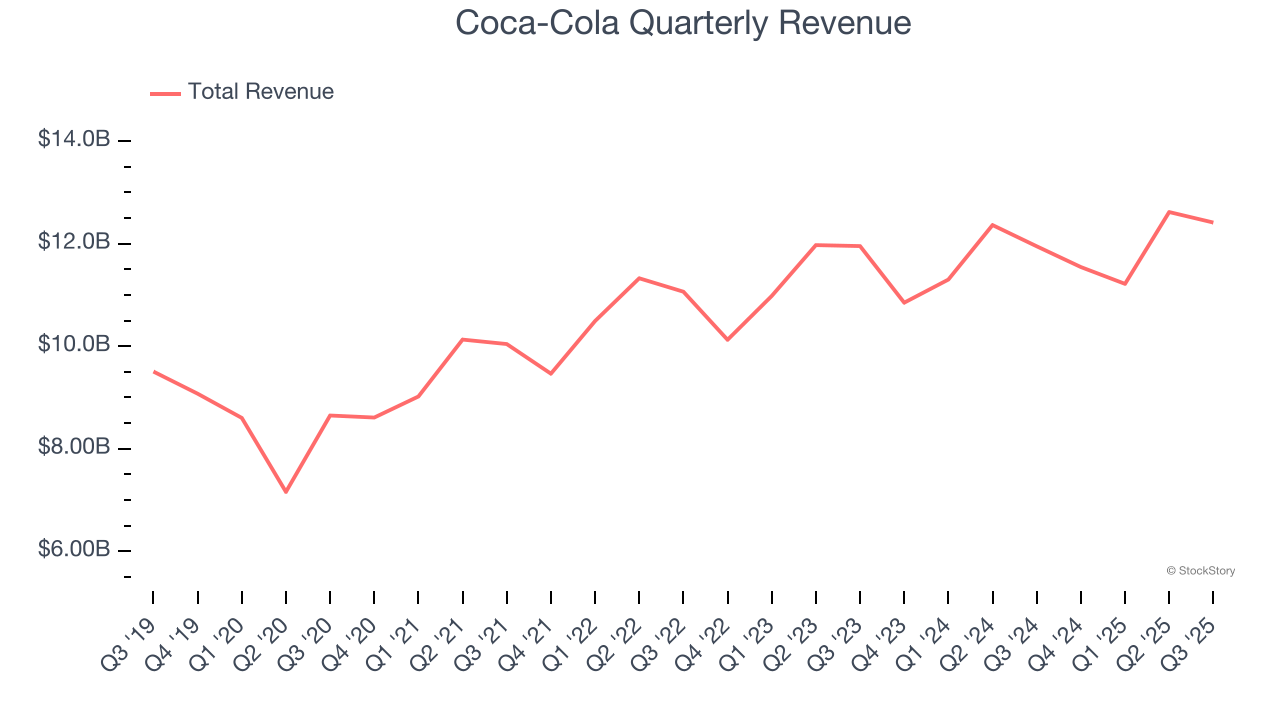

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Coca-Cola grew its sales at a sluggish 4.1% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer staples sector, but there are still things to like about Coca-Cola.

Final Judgment

Coca-Cola’s positive characteristics outweigh the negatives. With its shares lagging the market recently, the stock trades at 22.4× forward P/E (or $71.48 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.