Shareholders of Commvault would probably like to forget the past six months even happened. The stock dropped 25.9% and now trades at $130.37. This might have investors contemplating their next move.

Following the drawdown, is this a buying opportunity for CVLT? Find out in our full research report, it’s free for active Edge members.

Why Does Commvault Spark Debate?

Born from the need to create ironclad protection in an increasingly dangerous digital world, Commvault (NASDAQ: CVLT) provides data protection and cyber resilience software that helps organizations secure, back up, and recover their data across on-premises, hybrid, and multi-cloud environments.

Two Things to Like:

1. Billings Surge, Boosting Cash On Hand

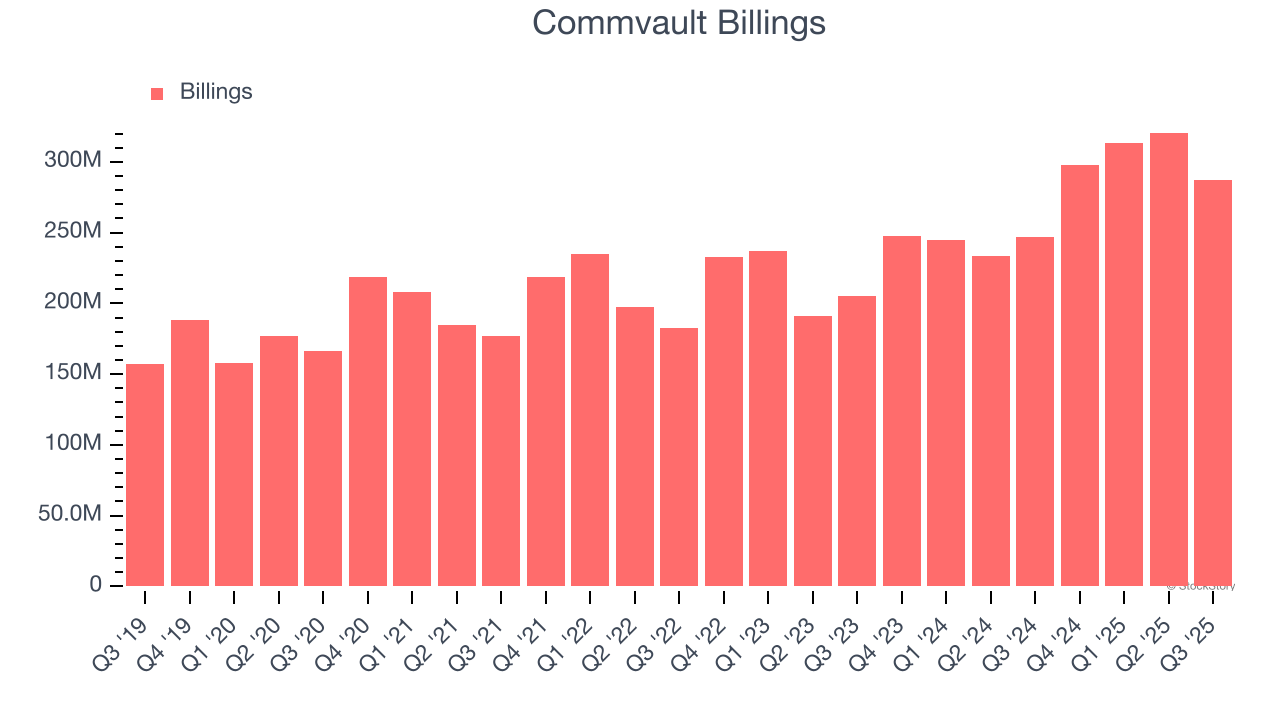

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Commvault’s billings punched in at $286.9 million in Q3, and over the last four quarters, its year-on-year growth averaged 25.4%. This performance was fantastic, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Commvault is extremely efficient at acquiring new customers, and its CAC payback period checked in at 7.7 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Commvault more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

One Reason to be Careful:

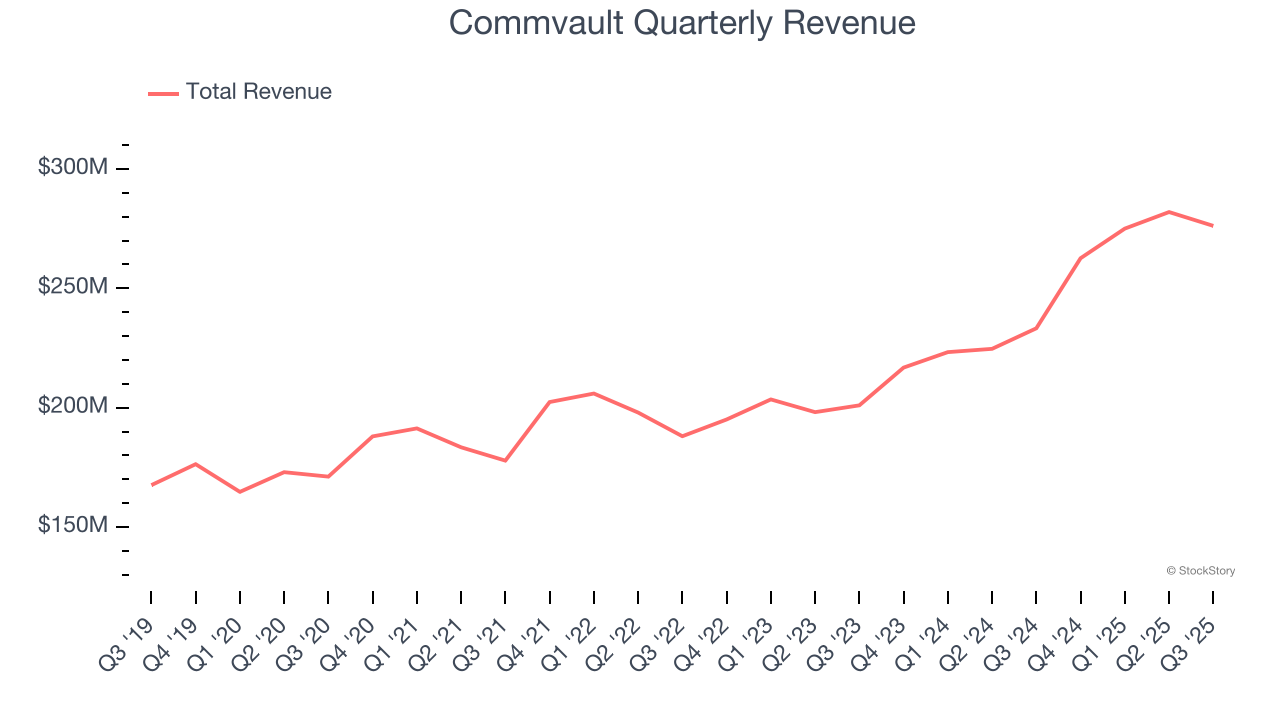

Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Commvault’s 9.8% annualized revenue growth over the last five years was sluggish. This wasn’t a great result compared to the rest of the software sector, but there are still things to like about Commvault.

Final Judgment

Commvault has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 4.8× forward price-to-sales (or $130.37 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Commvault

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.