The nuclear industry has surged back into prominence as a key growth sector, fueled by the escalating energy demands from artificial intelligence (AI) and data centers. AI's voracious appetite for reliable, baseload power has spotlighted nuclear energy as a cost-effective, abundant, and low-carbon solution that aligns with global sustainability goals.

In 2025, nuclear stocks delivered robust returns during this renaissance, with the sector benefiting from policy support, reactor extensions, and new builds worldwide. Cameco (CCJ), a leading uranium miner and fuel services provider, stands out as one of the premier names in the space. Even after its impressive run last year, compelling market dynamics—including tightening supply, soaring contract prices, and structural demand tailwinds—make CCJ a strong buy opportunity for investors seeking exposure to the nuclear boom.

About Cameco Stock

Cameco is a major player in the uranium industry, primarily engaged in mining, refining, and converting uranium for nuclear fuel. Headquartered in Saskatoon, Saskatchewan, Canada, the company operates world-class assets, including the McArthur River and Cigar Lake mines in Canada—among the highest-grade uranium deposits globally—and a joint venture in Kazakhstan's Inkai project. Cameco also provides nuclear fuel processing services and holds investments in uranium exploration and nuclear technology firms like Westinghouse Electric Company.

In 2025, CCJ stock surged approximately 78%, significantly outperforming the S&P 500's 16% gain, driven by rising uranium prices and renewed investor interest in clean energy. In just the first week of 2026, Cameco is already up 15%, with shares trading around $106, while sporting a market cap of about $45 billion. It trades at 109x earnings and has a forward price-to-sales ratio of roughly 12, calculated from projected 2026 revenues of around $3.7 billion.

This is elevated compared to Cameco's historical five-year median P/S of about 8.7 and the broader mining industry's average of 2.2, signaling a premium valuation. However, in the uranium subsector—where peers like Uranium Energy (UEC) boast P/S ratios of around 100—the metric reflects growth expectations rather than overvaluation.

Historically low ratios stemmed from depressed uranium markets after the Fukushima disaster; today's figure suggests CCJ is fairly valued, if not undervalued, given anticipated revenue expansion from demand surges, implying room for further appreciation without excessive risk.

Why Cameco Can Continue Running Higher

Cameco's momentum is poised to continue as a structurally tight uranium market should drive further growth. During a Goldman Sachs (GS) conference yesterday, Cameco's president and COO, Grant Isaac, revealed the company has been securing long-term contracts with utilities at unprecedented levels: price floors in the mid-$70s per pound and ceilings reaching $150 per pound, escalating over time. At their midpoints, these imply triple-digit pricing—well above the current spot price of around $82 per pound—underscoring the leverage producers hold in negotiations.

This pricing power stems from years of underinvestment in new mines, depleting secondary supplies, such as government inventories and the expired Megatons to Megawatts program, which once provided down-blended Russian uranium. Without these buffers, the market is highly vulnerable to disruptions, such as geopolitical tensions in key producing regions like Kazakhstan or mine delays. Isaac emphasized that any supply shock could trigger a rapid price spike, benefiting established low-cost operators like Cameco.

Demand-side tailwinds are equally robust. Utilities are extending reactor lifespans, pursuing new builds, and prioritizing energy security amid global decarbonization efforts. The AI-driven energy surge exacerbates this, as data centers require stable, carbon-free power that renewables alone can't reliably provide. Nuclear's role as a baseload complement positions uranium as essential, with contracting activity accelerating.

For Cameco, this translates to an exceptional outlook: control over high-grade, low-cost assets ensures margin expansion, while strategic positioning as a reliable supplier to global utilities shields against volatility. Analysts note the potential for utility panic buying, further elevating prices. Despite 2025's range-bound spot prices ($63 to $83 per pound), long-term indicators signal an upward trajectory. Investors should view CCJ's recent gains not as a peak but as the start of a multi-year upcycle in nuclear renaissance.

What Do Analysts Expect for CCJ Stock?

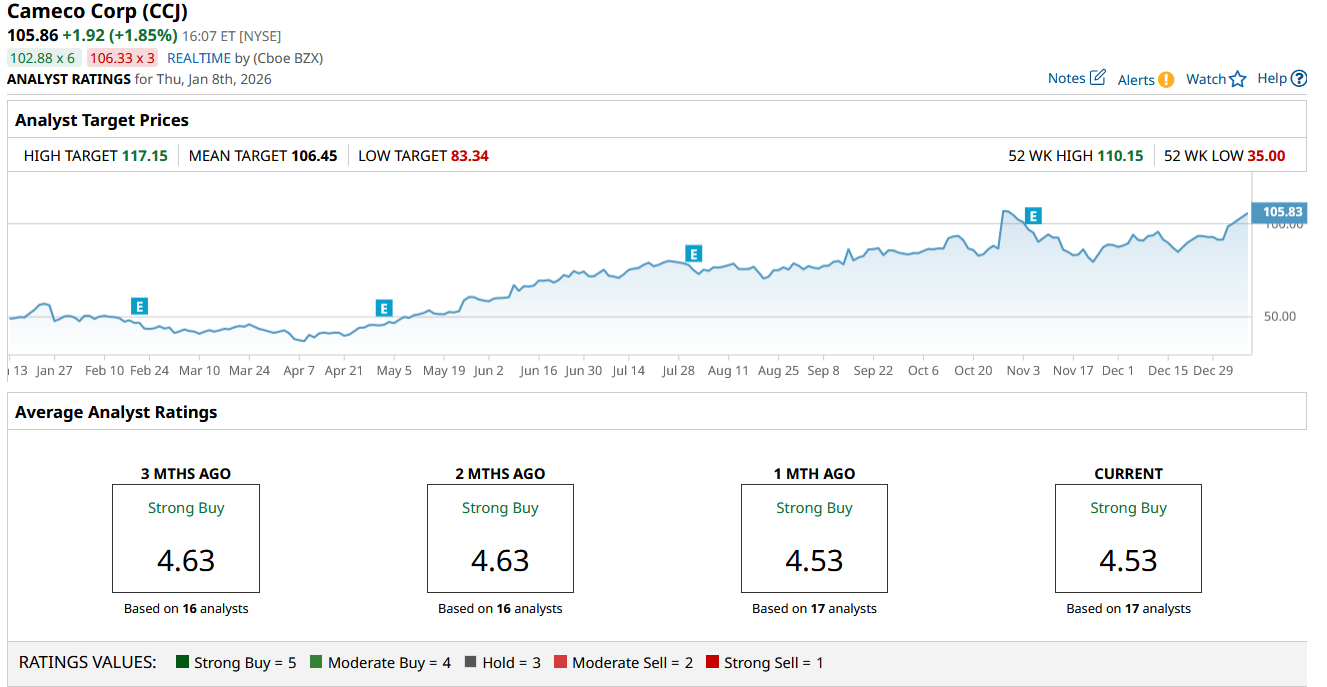

Wall Street remains bullish on Cameco, with a consensus rating of “Strong Buy” from 17 analysts covering CCJ stock. The ratings breakdown includes 11 “Strong Buy,” four “Moderate Buy,” and two “Hold,” with no Sell recommendations. This optimism has held steady, though slight adjustments occurred in recent months—Barchart's average score dipped marginally from 4.63 to 4.53 over the past quarter, reflecting one additional analyst but no major shifts in sentiment.

The mean price target of $106.45 represents a potential upside of just 0.5% from the current share price, suggesting Wall Street sees it as fairly valued. Yet despite Cameco's impressive rally last year reflecting uranium's tightening supply-demand dynamics, that could accelerate in 2026, making the stock a compelling investment despite elevated valuations.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart