Taiwan Semiconductor (TSM), widely known as TSMC, stands as one of the most valuable and influential technology companies in Asia by market capitalization. The chipmaking powerhouse has been a major winner from the artificial intelligence (AI) megatrend, as it manufactures some of the world’s most advanced AI processors for leading customers such as Nvidia (NVDA) and Advanced Micro Devices (AMD).

Following a strong set of third-quarter earnings released last October, which highlighted the company’s continued growth and resilience, TSMC is now preparing to report its fiscal 2025 fourth-quarter results on Jan. 15. With the AI boom still gaining momentum, TSM stock appears well-positioned and worth a closer look by investors.

About Taiwan Semiconductor Stock

Founded in 1987, TSMC revolutionized the semiconductor industry by pioneering the pure-play foundry model and has remained the world’s leading dedicated chip manufacturer ever since. The company sits at the center of a vast global ecosystem, partnering with the world’s top tech companies and providing industry-leading process technologies and design solutions that power innovation across the semiconductor landscape.

With operations spanning Asia, Europe, and North America, TSMC operates as a truly global corporate citizen. In 2024 alone, the company deployed 288 distinct process technologies and produced 11,878 products for 522 customers, offering one of the broadest portfolios of advanced, specialty, and advanced-packaging services in the industry. Headquartered in Hsinchu, Taiwan, TSMC continues to shape the future of global chipmaking.

Now boasting a market cap of roughly $1.65 trillion, this semiconductor heavyweight has delivered a solid performance for investors in 2025. Over the past year, TSM stock has climbed 53%, crushing the broader S&P 500 Index’s ($SPX) 17% return and highlighting just how powerfully the company is riding the global AI and chipmaking supercycle.

Taiwan Semiconductor’s Q3 Earnings Snapshot

Taiwan Semiconductor’s fiscal 2025 third-quarter earnings, released on Oct. 16, delivered a powerful show of growth on both the top and bottom lines. The chipmaking giant posted revenue of $33.1 billion, marking a 41% year-over-year (YOY) increase and a 10% sequential rise. The result also came in well ahead of Wall Street’s $31.5 billion estimate, reinforcing the strength of demand across its business.

Advanced chip technologies remained the clear growth engine. During the quarter, 3-nanometer chips accounted for 23% of total wafer revenue, 5-nanometer chips came in at 37%, and 7-nanometer chips came in at 14%. Taken together, advanced technologies — defined as 7-nanometer and smaller — represented a commanding 74% of total wafer revenue, highlighting how deeply TSMC is embedded in the cutting edge of semiconductor manufacturing.

That technology leadership translated into exceptional profitability. Gross margin reached 59.5%, operating margin stood at 50.6%, and net profit margin climbed to 45.7%, showcasing both pricing power and operational efficiency even as the company ramps up its most advanced nodes.

Profit growth was equally impressive. Third-quarter profit jumped 39.1% YOY, beating analyst expectations and hitting a fresh record, driven by relentless demand for AI chips. On a per-ADR basis, earnings came in at $2.92, comfortably above the consensus estimate of $2.59.

Management sounded confident about what lies ahead. “Our business in the third quarter was supported by strong demand for our leading-edge process technologies,” said Wendell Huang, Senior Vice President and CFO of Taiwan Semiconductor. “Moving into fourth quarter 2025, we expect our business to be supported by continued strong demand for our leading-edge process technologies," Huang added.

Based on its current outlook, TSMC expects Q4 2025 revenue to range between $32.2 billion and $33.4 billion, assuming an exchange rate of one U.S. dollar to 30.6 New Taiwan dollars. The company also projected a gross margin of 59% to 61% and an operating profit margin between 49% and 51%. Meanwhile, Wall Street expects Q4 profit to reach $2.71 per ADR, representing a 21% YOY increase.

What Do Analysts Expect for Taiwan Semiconductor Stock?

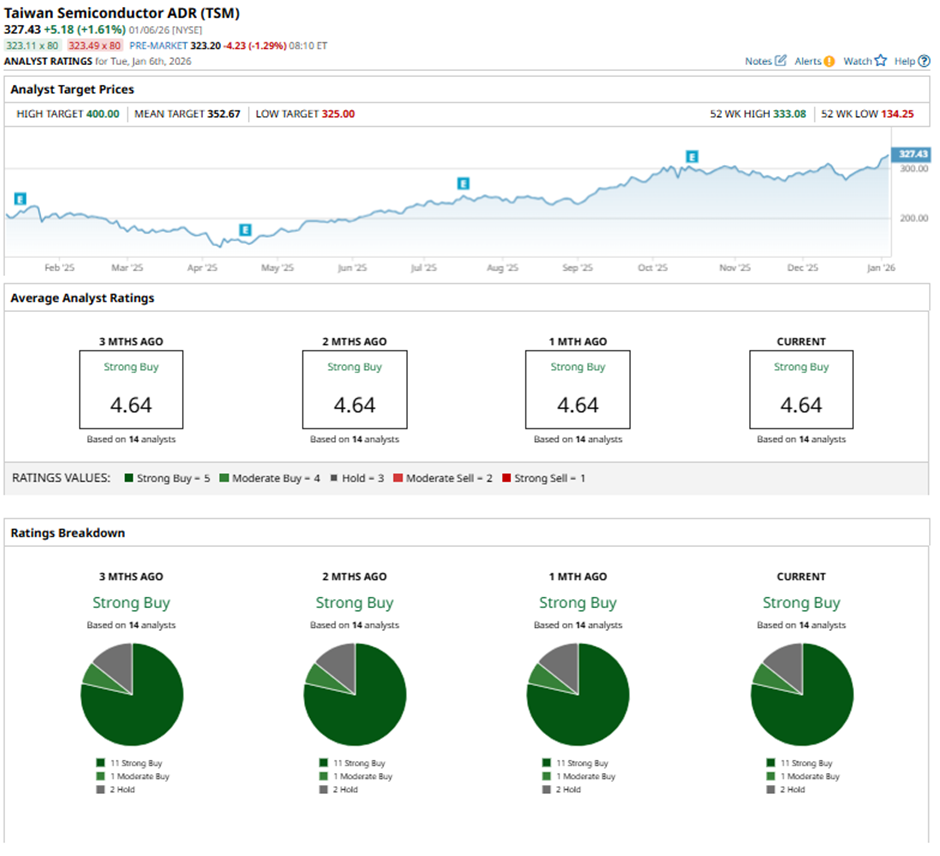

With Taiwan Semiconductor’s Q4 earnings just around the corner, Wall Street’s optimism toward TSM stock is hard to miss. TSM stock currently carries a consensus “Strong Buy” rating, reflecting broad confidence in its AI-driven growth story. Of the 14 analysts covering the stock, a commanding 11 rate it as a “Strong Buy,” one has a “Moderate Buy,” and only two remain on the sidelines with a “Hold" rating.

Price targets point to meaningful upside ahead. The average price target of $352.67 suggests the stock could climb 11% from current levels, while the Street-high target of $400 implies a far more bullish 26% potential upside. As the earnings release approaches, these projections highlight just how much faith analysts have in TSMC’s ability to keep delivering strong results in the heart of the global AI boom.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump Just Sent Blackstone Stock Plunging Below Key Support Levels. How Should You Play BX Here?

- Morgan Stanley Is Bullish on Nvidia After CES 2026. Should You Buy NVDA Stock Here?

- Evercore Analysts Love UnitedHealth Stock for 2026. Should You Buy UNH Here?

- Is Chevron Stock a Buy, Sell, or Hold for January 2026?