Silver (SIH26) just did what many thought was unlikely in the near term. The precious metal crossed $80 for the first time ever in late December, notching a more than 140% gain year‑to‑date (YTD) and delivering its strongest annual performance since 1979 before pulling back as profit‑taking set in. Even after the correction, silver was still singled out as one of December’s top‑performing commodities (alongside platinum), reinforcing its role as a go‑to safe haven.

Geopolitical tension has only strengthened the narrative. On Jan. 5, news that U.S. forces had captured Venezuelan President Nicolás Maduro helped send silver prices up 7.9%, as investors sought refuge in precious metals amid heightened uncertainty. Heading into 2026, silver’s long-term bullish trend remains intact, supported by concerns over dollar fiat debasement and resilient industrial demand.

Silver’s new price regime, combined with this uncertainty, puts high‑quality silver names firmly in focus, especially First Majestic Silver (AG), Pan American Silver (PAAS), and Wheaton Precious Metals (WPM). Can these three names turn silver's record‑setting move into sustained shareholder returns? Let’s dive in.

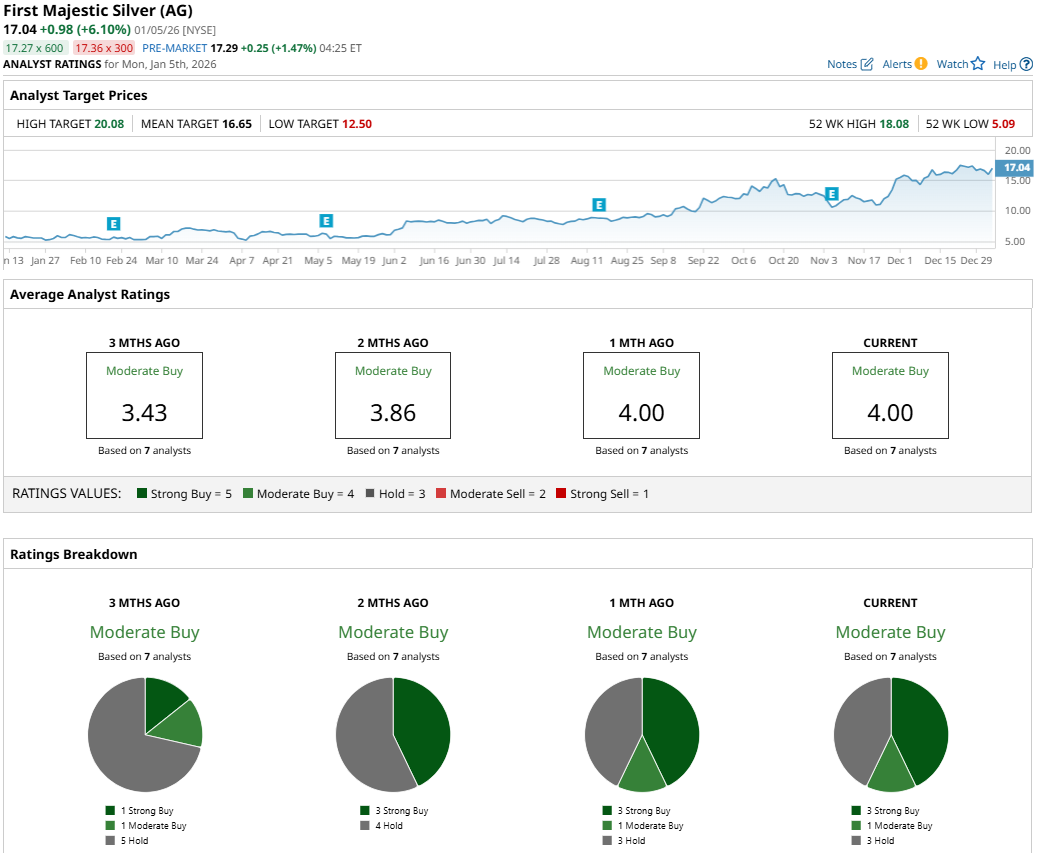

Silver Stock #1: First Majestic Silver (AG)

First Majestic Silver runs a portfolio of silver‑heavy mines across Mexico and the United States, backed by a market capitalization of roughly $7.9 billion. AG stock sits at $17.51 as of this writing, with a YTD gain of 5% so far and a 52‑week return of 195%.

AG stock trades on rich expectations, with a forward price-to-earnings ratio of 48.5 times and a price‑to‑sales multiple of 8.4 times. These multiples both rank well above the sector medians.

First Majestic Silver’s latest quarter came in at EPS of $0.07 versus a $0.11 consensus, a shortfall of $0.04 that produced a -36% earnings surprise. The results also showed sales of $285.1 million, up 8% year-over-year (YOY). Meanwhile, net income of $26.98 million marked a 49% YOY drop, highlighting how cost pressures and mix weighed on the company's bottom‑line growth.

The same period posted an operating cash flow of $258.12 million, up 77% YOY, and net cash flow of $233.18 million, a 28% YOY increase. These figures underline the cash‑generating power of the business.

That dynamic feeds directly into forward expectations, with the next earnings release scheduled for Feb. 19. Estimates call for EPS of $0.16 for the December quarter versus $0.03 a year earlier, and $0.25 for full‑year 2025 versus a $0.14 loss last year. These figures imply growth rates of 433% and 278%, respectively.

This optimism is captured in the consensus “Moderate Buy” rating for AG stock. The average price target of $16.65 points to 5% potential downside from current price levels, but the Street-high target of $20.08 suggest shares could rise 14% from here.

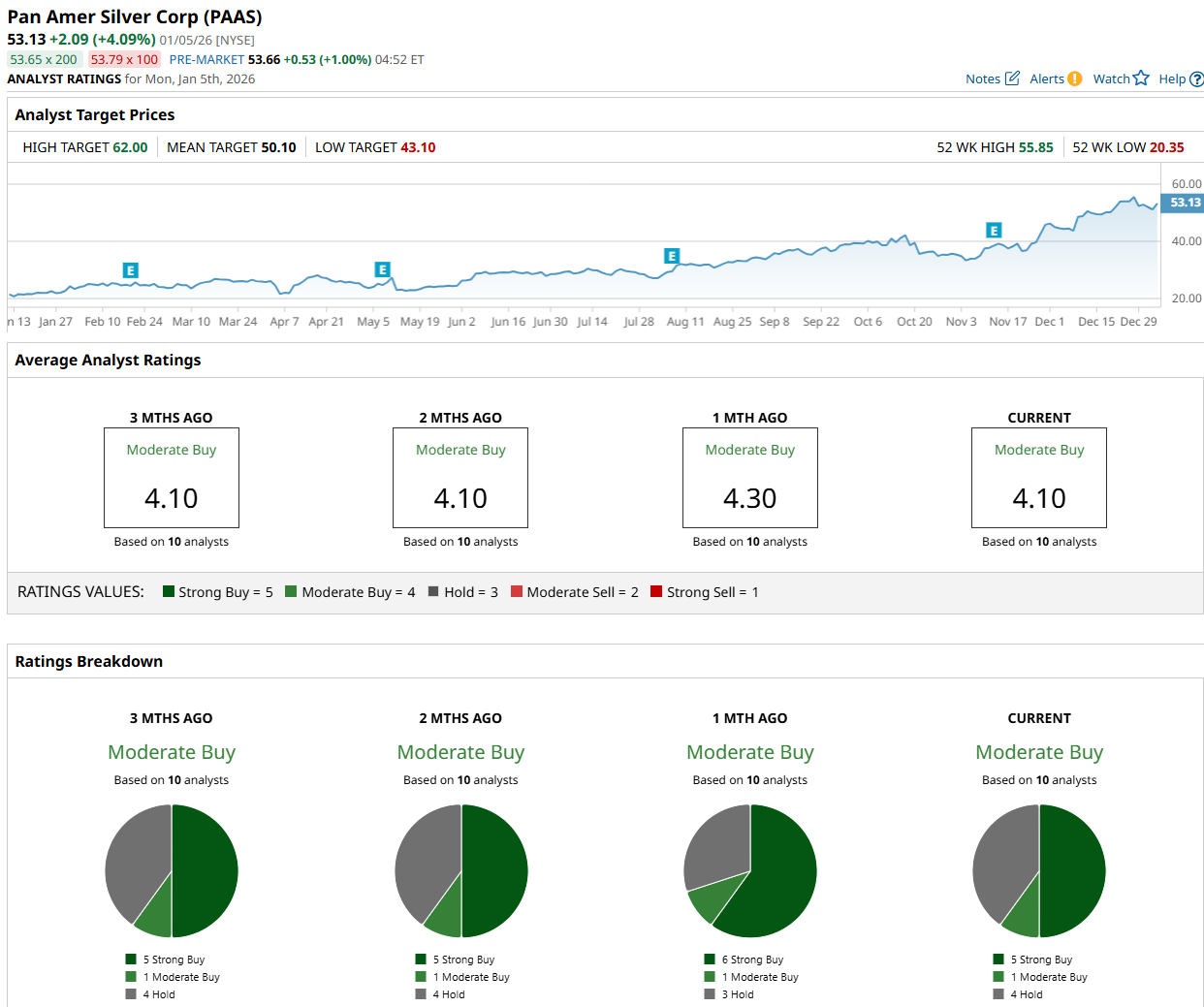

Silver Stock #2: Pan American Silver (PAAS)

Based in Canada, Pan American Silver (PAAS) primarily runs large-scale silver and gold mining operations across Latin America, with processing capacity and long-life reserves. PAAS stock trades at $53 as of this writing, with a YTD gain of 2% and a 52‑week return of 148%.

This company carries a market cap of $21.5 billion. PAAS stock also trades at 30.8 times trailing earnings versus a sector median of 18.6 times, which shows investors are willing to pay a clear premium.

The company's most recent earnings for the quarter ended Sept. 30 delivered EPS of $0.48 versus a $0.49 consensus, a modest $0.01 shortfall that translated into a -2% earnings surprise. Pan American Silver produced sales of $854.6 million, up 5% YOY, and net income of $168.6 million, down 11% YOY, showing how higher volumes and prices were partially offset by cost and mix headwinds. Pan American Silver also delivered operating cash flow of $776.9 million, climbing 66% YOY and signaling strong conversion at today’s metal prices.

PAAS has its next earnings date listed as Feb. 18, keeping the stock’s next catalyst close for 2026 positioning. Wall Street estimates call for $0.88 in EPS for the quarter against $0.35 in the prior year. Estimates also call for $2.22 in EPS for full‑year 2025 versus $0.79 for the prior year. These figures imply growth rates of 151% and 181%, respectively.

PAAS stock has a consensus “Moderate Buy” rating from 10 analysts and an average price target of $50.10, which sits almost 6% below its current price level. However, the Street-high target of $62 implies 17% potential upside from here.

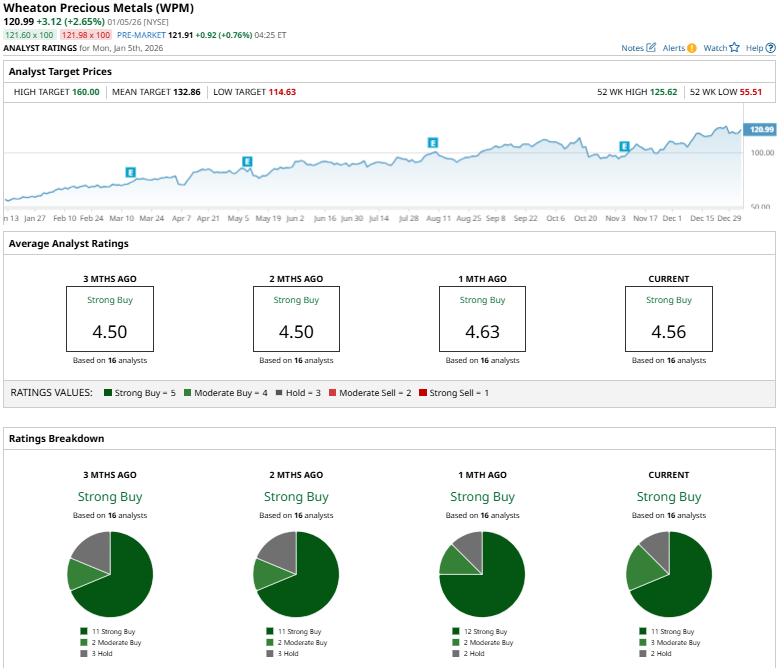

Silver Stock #3: Wheaton Precious Metals (WPM)

Wheaton Precious Metals (WPM) is a firm based in Vancouver, British Columbia, Canada. The $53.5 billion precious‑metals streaming giant specializes in long‑term silver and gold streaming contracts rather than directly operating mines.

WPM stock changes hands at the $123 level as of this writing. Currently, the stock has a YTD gain of 4% and a 52‑week return of 115%.

That valuation reflects its perceived quality, with a trailing earnings multiple of 52.4 times and a forward earnings multiple of 35.8 times. These multiples come in well above sector medians, which shows investors are willing to pay a substantial premium.

This most recent earnings snapshot for Wheaton Precious Metals underscores why the premium has held and even expanded. The quarter ended Sept. 30 delivered EPS of $0.62 versus a $0.59 estimate, a $0.03 beat that translated into a 5% surprise. The results also showed net income of $367.2 million, up 26% YOY as higher realized prices on its silver and gold streams dropped efficiently to the bottom line.

WPM’s forward profile keeps that narrative intact as markets move deeper into 2026. The next earnings release is scheduled for March 12, with an expected EPS of $0.84 for the December 2025 quarter versus $0.44 a year earlier, implying a growth rate of 91% YOY. Full‑year EPS is projected at $2.64 for fiscal 2025 versus $1.41 previously, equating to anticipated growth of 87% YOY.

WPM stock's analyst consensus sits at "Strong Buy" rating based on input from 16 analysts. The average price target of $132.86 implies roughly 8% potential upside from current levels, while the Street-high target of $160 implies 30% potential upside ahead.

Conclusion

Overall, silver still looks like it has the wind at its back heading into 2026, with safe‑haven flows, dollar weakness, and solid industrial use all pulling in the same direction. Unless there’s a sharp reversal in macro conditions or a surprise policy shock, the path of least resistance for silver prices (and related miners’ shares) is likely skewed to the upside.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.