With a market cap of $31.2 billion, Willis Towers Watson Public Limited Company (WTW) is a global advisory, broking and solutions firm. It helps organizations manage risk, design employee benefits, and improve retirement and investment outcomes. While the company is based in London, it operates in more than 140 countries and serves corporations, insurers and institutional clients.

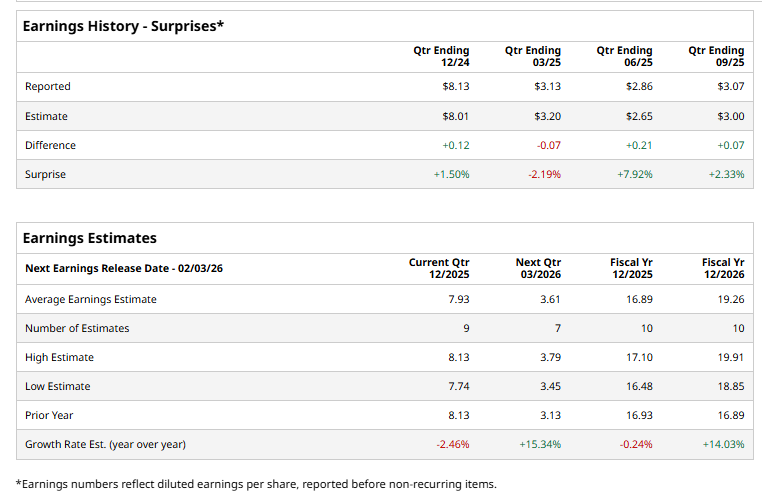

Willis Towers Watson is expected to release its fiscal Q4 2025 earnings results shortly. Ahead of this event, analysts expect WTW to report an adjusted EPS of $7.93, down 2.5% from $8.13 in the prior year's quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the insurance broker to post adjusted EPS of $16.89, a marginal decline from $16.93 in fiscal 2024. However, adjusted EPS is projected to grow 14% year over year to $19.26 in fiscal 2026.

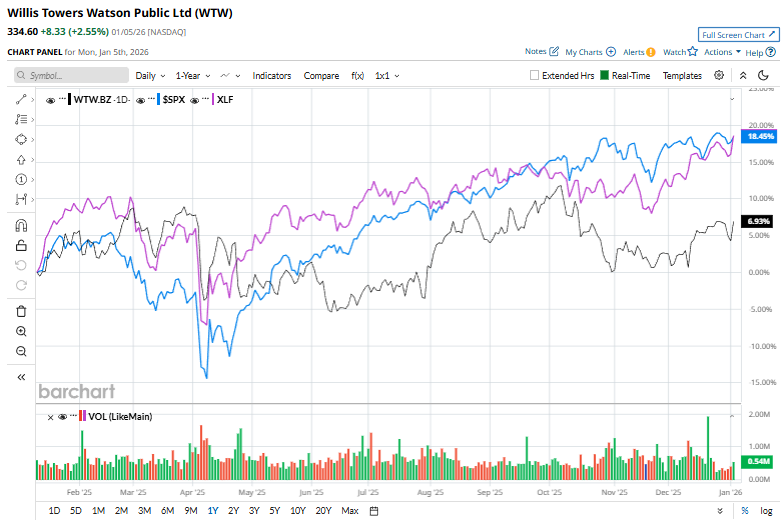

Shares of Willis Towers Watson have soared 8.3% over the past 52 weeks, trailing both the S&P 500 Index's ($SPX) 16.2% gain and the Financial Select Sector SPDR Fund's (XLF) 15.5% return over the period.

On Dec. 15, WTW shares rose 1.2% after the company announced the pricing of a $1 billion senior unsecured notes offering, comprising $700 million of 4.55% notes due 2031 and $300 million of 5.15% notes due 2036. Investors reacted positively to the funding plan, as the proceeds are expected to support the Newfront acquisition and refinance near-term debt, improving WTW’s maturity profile and financial flexibility.

Analysts' consensus view on WTW stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 24 analysts covering the stock, 13 recommend "Strong Buy," one suggests "Moderate Buy," nine indicate “Hold,” and one has a "Strong Sell." The average analyst price target for Willis Towers Watson is $367.30, indicating a potential upside of 9.8% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart