Pre-dawn Tuesday began with the news the US president is again wanting to take Greenland, a move that would bring and end to NATO.

Despite all continued geopolitical chaos, global stock markets continue to move higher.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.However, the uncertainty and fear of global investors is evident in the extended gains registered in the Metals sector.

Morning Summary: When the first piece of news one hears in the morning is the US president says he wants Greenland, it’s time to put away the coffee and go for something stronger. The reaction from Denmark, and other countries, is a military attack by the US on Greenland would end NATO, fitting with the plan drawn up by Russia’s Putin and China’s Xi nearly four years ago. So, well done Three Amigos. The second line of discussion had to do with how global markets generally shrugged off this past weekend’s events with the same US president saying he now runs Venezuela. I first heard this question early Monday in a message that read, “It seems like there’s not much of anything that can cause panic (in markets)”. That being said, gold’s Cash Index (GCY00) added as much as $26.39 (0.5%) overnight while silver’s Cash Index (SIY00) rallied as much as $2.73 (3.6%). What continues to drive silver higher? The increased threat of China treating Taiwan like the Russia treated Ukraine and the US treated Venezuela, disrupting the supply of high-tech electronics and semi-conductors. In other news, Asian stock markets closed higher Tuesday, European markets were mostly higher in early trade, and US stock index futures were quietly in the red across the board.

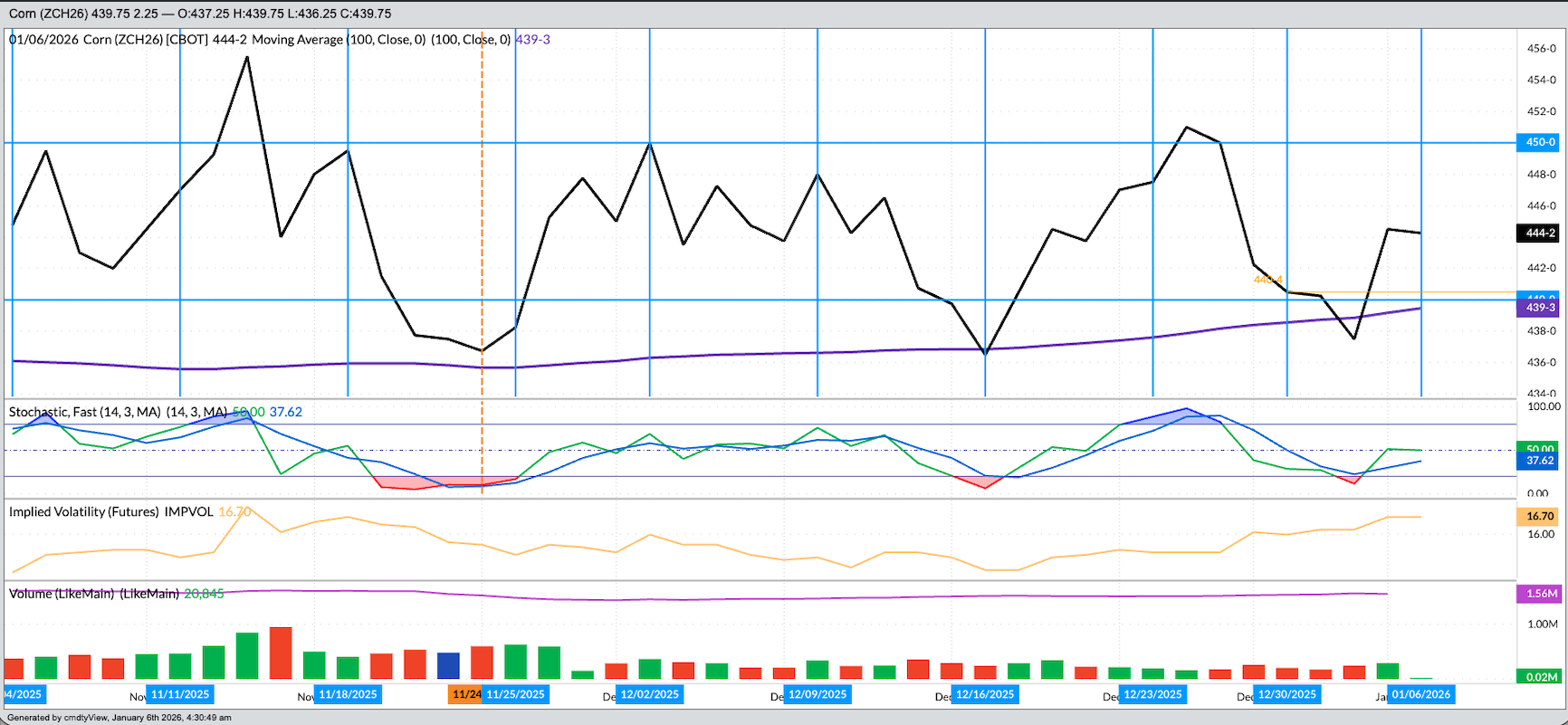

Corn: The corn market was quietly mixed pre-dawn as global trade focuses on the bigger issue of war mongering. As of this writing both the March and May issues were sitting unchanged on light trade volume while deferred issues were showing fractional losses. Fundamentally, the National Corn Index ($CNCI) was calculated near $4.0775 Monday night putting national average basis at 36.75 cents under March futures as compared to last Friday’s final figure of 37.25 cents under and the previous 5-year low weekly close for this week of 30.25 cents under March. The previous 10-year low weekly close is 35.0 cents under March. The bottom line is our reads on real supply and demand remain bearish while another round of imaginary fundamental numbers grows larger on the horizon. (In case you were wondering, I mean the January WASDE report set for release next Monday.) On the noncommercial side, Monday’s close saw the March issue up 4.0 cents from last Tuesday’s settlement indicating Watson has been adding to its net-long futures position. The latest Commitments of Traders update showed a noncommercial net-long futures position of 53,190 contracts, a decrease of 11,680 contracts as of Tuesday, December 30. Technically, there isn’t much going on with corn at this time.

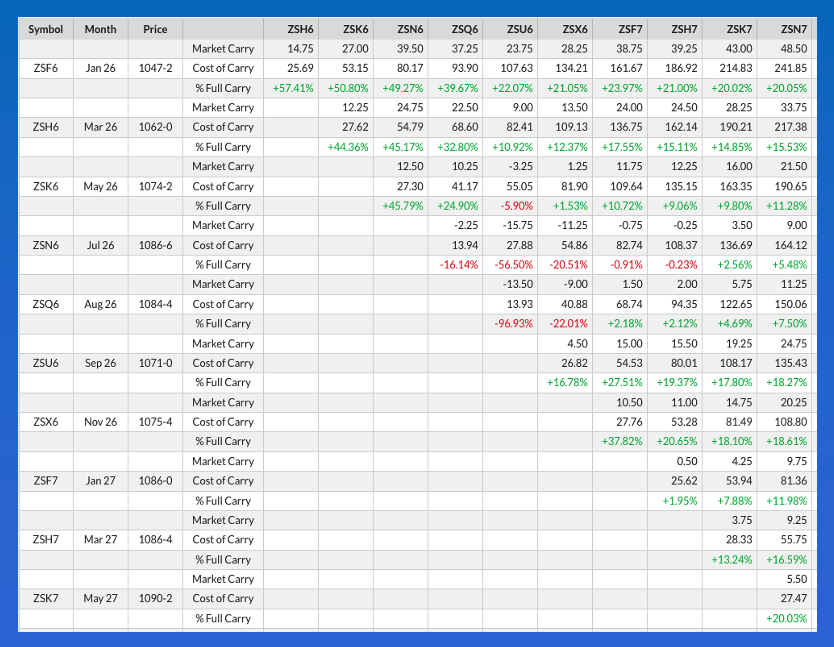

Soybeans: The soybean market was quietly in the green early Tuesday morning. As I talked about Monday, this week’s activity in soybeans has been interesting given geopolitical developments since last Friday’s close. One last look back at Friday’s session and we see the March issue rallied 7.75 cents off its session low on what turned out to be solid commercial buying interest. Monday saw more of the same as the March issue (ZSH26) finished 16.25 cents in the green while gaining 0.5 cent on May. For the sake of discussion, let’s assume[i] some of the commercial buying has come from China. Setting aside Market Rule #5 (It’s the what, not the why) for a moment, the question is why. Why would the world’s largest buyer be interested in US supplies as tensions between the two countries is being ratcheted up? As Michael Corleone said in the Godfather (1972 movie), “It’s not personal, it’s business”. China is likely covering some of its secondary soybean supply needs while waiting for its primary supplier – Brazil – to begin rebuilding stocks with the next harvest. As of Thursday, December 25, total sales of US soybeans to China were 6.624 mmt, down 60% from the same week the previous year.

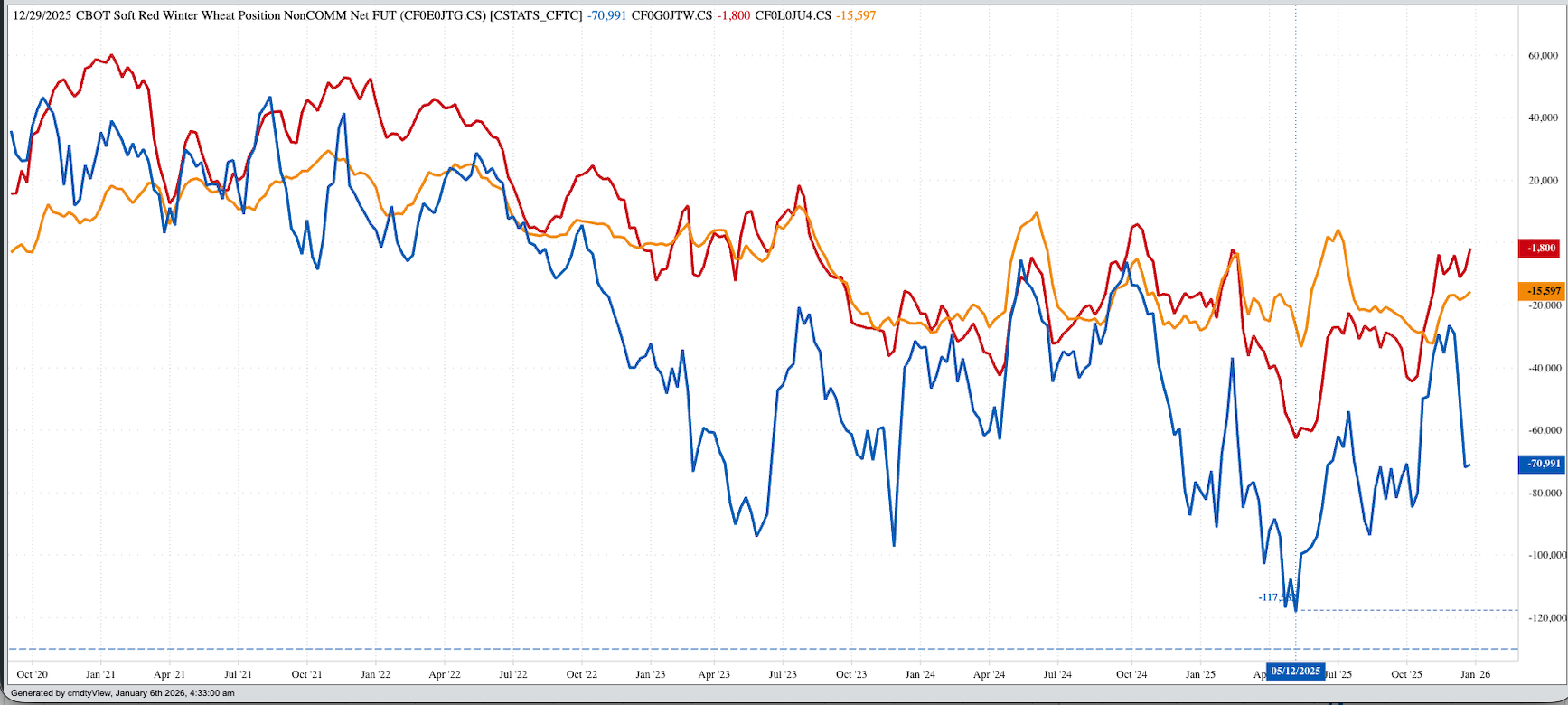

Wheat: The wheat sub-sector was quietly lower to start the day. This shouldn’t be much of a surprise to market watchers given the sub-sector closed higher Monday despite ongoing bearish fundamentals. Recall at the end of December all three National Cash Indexes ($CSWI) ($CRWI) ($CRSI) continued to run below previous 5-year end of December lows and well below previous 10-year end of December average prices. Based on the Law of Supply and Demand, this confirmed available US supplies continued to outweigh demand for those supplies. End of story. Still, the latest weekly export sales and shipments update, for the week ending Thursday, December 25, showed a pace projection for marketing year shipments of all US wheat of 979 mb, up 26% from reported export shipments of 776 mb for the 2024-25 marketing year. What does it tell us if US exports are running stronger, but the US cash markets are weaker? There are ample supplies to meet demand. On the noncommercial side, the latest Commitments of Traders report showed Watson decreased its net-short futures position in all three markets as of Tuesday, December 30, this despite all three March issues closing lower Tuesday-to-Tuesday. This tells us the commercial side continued to sell more than noncommercial interests were buying.

[i] Yes, I remember what “Assume” stands for when the word is broken into three smaller words.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart