Illinois-based Mondelez International, Inc. (MDLZ) is a leading global snack food company focused on biscuits, chocolate, confectionery and gum, with operations spanning more than 150 countries. Formed in 2012, the company owns a portfolio of iconic, billion-dollar brands such as Oreo, Cadbury, Milka, Ritz, Toblerone and Sour Patch Kids. It is currently valued at a market cap of $69.2 billion.

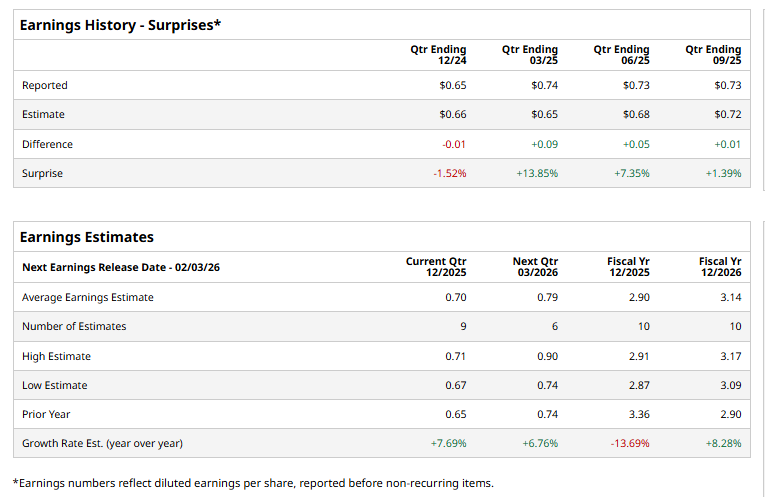

The company is set to announce its fourth-quarter results soon. Ahead of the event, analysts expect Mondelez to deliver an adjusted profit of $0.70 per share, up 7.7% year over year from $0.65 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates in three of the past four quarters, it missed the projections on another occasion.

For fiscal 2025, the company is expected to deliver an adjusted EPS of $2.90, down 13.7% from $3.36 reported in 2024. However, in fiscal 2026, its earnings are expected to rebound 8.3% year over year to $3.14 per share.

MDLZ stock prices have plunged 10.2% over the past 52 weeks, notably lagging behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 1.3% decline and the S&P 500 Index’s ($SPX) 16.2% gains during the same time frame.

Mondelez International’s stock has lagged the broader market over the past year primarily due to rising input costs, weakening consumer demand, and downward revisions to its earnings outlook. Key factors driving this underperformance also include unprecedented inflation in cocoa prices and other raw materials, which have significantly squeezed margins in its core chocolate and snack segments and forced aggressive price increases that have dampened volume growth and consumer demand. Additionally, softening demand in major markets such as Europe and North America, along with competitive pressures, have contributed to volume declines and investor concerns about growth sustainability.

Analysts maintain a cautiously optimistic outlook on Mondelez. The stock holds a consensus “Moderate Buy” rating overall. Of the 24 analysts covering the stock, opinions include 14 “Strong Buys,” three “Moderate Buys,” six “Holds,” and one “Strong Sell.” Its mean price target of $68.30 suggests a 27.1% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart