With a market cap of $16.5 billion, Essex Property Trust, Inc. (ESS) is a residential real estate investment trust (REIT) focused on acquiring, developing, redeveloping and managing multifamily apartment communities. The California-based company operates primarily in high-demand, supply-constrained West Coast markets, including Southern California, Northern California and the Seattle metropolitan area. The company operates a large portfolio of apartment homes, over 250 communities totaling more than 60,000 units, and is self-administered and self-managed, which supports operational alignment and cost control.

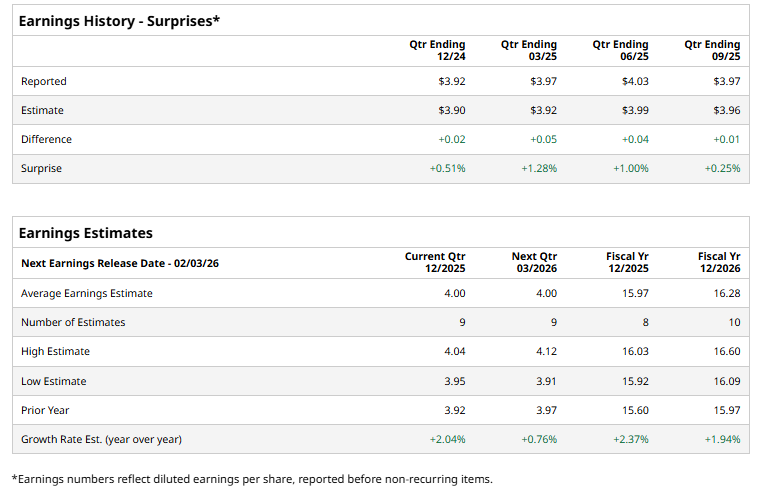

The REIT is expected to release its fiscal Q4 2025 results shortly. Ahead of this event, analysts project Essex Property to report core FFO of $4 per share, a 2% rise from $3.92 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts forecast the REIT to report core FFO of $15.97 per share, up 2.4% from $15.60 per share in fiscal 2024. In addition, core FFO is expected to grow 1.9% year over year to $16.28 per share in fiscal 2026.

Shares of Essex Property have decreased 11% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 13.5% gain and the Real Estate Select Sector SPDR Fund's (XLRE) 1% drop over the same time frame.

On Dec. 3, ESS’ operating partnership, Essex Portfolio, L.P., priced a $350 million offering of 4.875% senior unsecured notes due 2036, issued at a slight discount to par. The proceeds will primarily be used to refinance near-term debt maturities, including part of its $450 million notes due in April 2026, and for general corporate purposes, including working capital and potential acquisitions.

Analysts' consensus view on ESS stock is cautious, with an overall "Hold" rating. Among 27 analysts covering the stock, five suggest a "Strong Buy," two give a "Moderate Buy," 18 recommend a "Hold," and two have a "Strong Sell." The average analyst price target for Essex Property is $282.57, indicating a potential upside of 11.7% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart