U.S. markets closed 2025 on a strong note, with major indexes up double digits on the year. Given the strong year-end gains, income investors are scouting high-yield dividend plays for 2026.

Analysts note that a select group of defensive companies, especially those with robust payouts, could lead in the year ahead. One such name is Cal-Maine Foods (CALM), the nation’s largest egg producer. In late 2025, the company drew headlines when analysts highlighted its “record profits” and suggested CALM shares could rise roughly 20% in the coming year. With an 11% dividend yield and a history of strong free cash flow, CALM has become a talking point among top analysts as a potential top buy heading into 2026.

About CALM Stock

Cal-Maine Foods is unique in the U.S. food industry as the country’s largest fully integrated egg producer. The company’s product mix spans the full “egg value ladder,” including cage-free, organic, free-range, and other specialty eggs, and it operates strong brands like Eggland’s Best. In recent years, Cal-Maine has also expanded into prepared egg foods, such as patties, omelets, scrambled egg mixes, pancakes, etc., diversifying beyond raw shell eggs.

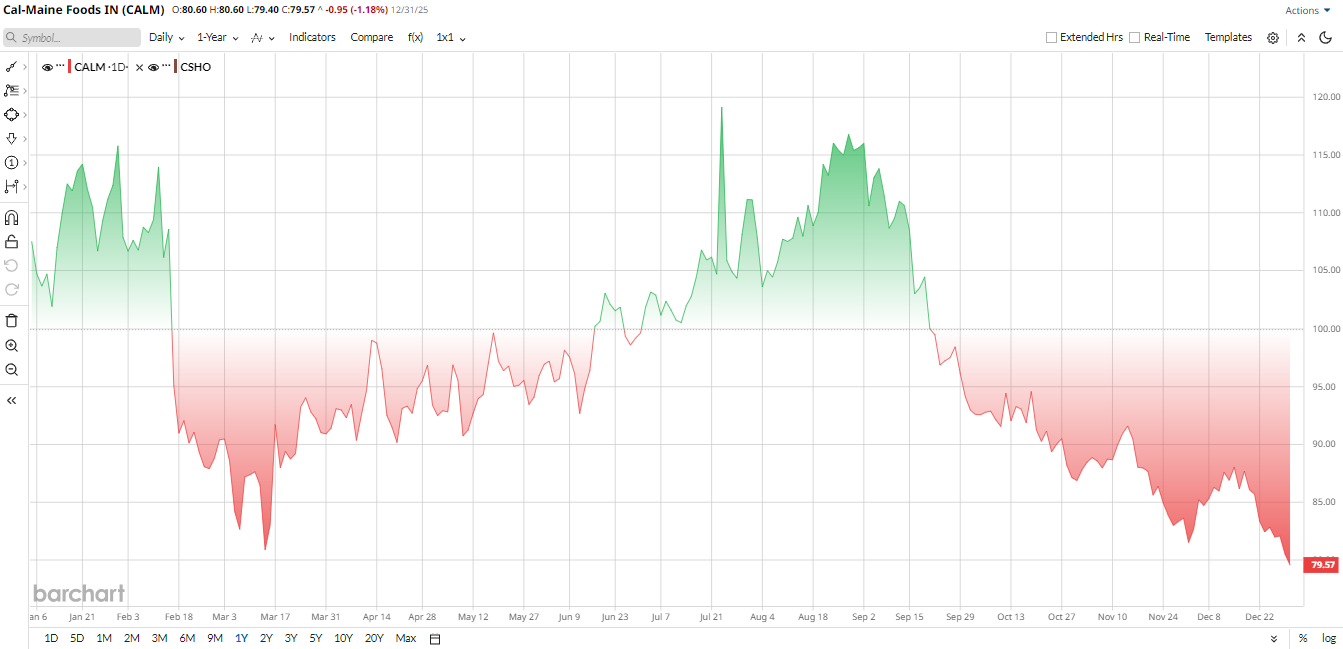

Cal-Maine’s stock was highly volatile in 2025. Early in the year, shares rallied sharply as avian flu outbreaks dramatically reduced egg supply and drove wholesale egg prices to record levels. In mid-2025, CALM briefly traded in the $120 to $130 range. Since then, the stock has pulled back, giving up early gains, and was down about 22% year-to-date (YTD) as the year closed. The pullback is partly due to oversupply in the egg market and weak consumer demand following the HPAI-driven price spike. Overall, the stock remains substantially lower than its mid-year peak, even as the company delivered solid fundamentals.

Following the pullback, thankfully, CALM is now trading at very cheap levels relative to its peers. Today, the stock trades around 3× forward earnings, far below the roughly 12× median P/E in the consumer defensive sector. Price-to-sales and price-to-cash flow ratios are also significantly lower than sector norms.

Meanwhile, Cal-Maine’s dividend yield is around 10.9%, dwarfing the 2.9% yield of an average consumer staples company. It funds this payout at a modest 33% of earnings versus 64% for the sector, so the dividend appears well-covered. In short, the stock combines an ultra-low multiple with a very high-income stream.

CALM Posts Blowout Q1 Quarter

Cal-Maine Foods posted its strongest first quarter in company history, reporting net sales of $922.6 million, up 17.4% from a year earlier, and net income of $199.3 million, or $4.12 a diluted share. The results were driven by higher shell-egg selling prices and expanding prepared-foods sales. Echo Lake Foods contributed about $70.5 million to net sales in the quarter.

Total dozens sold rose about 2.5% year-over-year (YoY) to roughly 317.6 million dozen, with specialty volumes growing faster and helping shift the mix toward higher-margin products. The company’s net average selling price per dozen was $2.486 in the quarter.

Margins also improved, with gross profit being $311.3 million with about a 33.7% margin and operating income being $249.2 million, aided in part by lower feed costs and contributions from Echo Lake. Operating cash flow surged to $278.6 million.

Cal-Maine declared a cash dividend of about $1.37 per share for the quarter and ended the period with roughly $1.25 billion in cash and short-term investments. The company repurchased no shares in Q1 and had roughly $450 million of remaining buyback authority.

Management said the quarter reflects progress on its strategy to expand specialty eggs and prepared foods while maintaining financial discipline but provided no formal forward revenue guidance tied to those initiatives.

Most analysts see the shares as undervalued. They note that fiscal 2025 earnings were extraordinary, with EPS over $24, and that the 2026 consensus EPS of $16 is far lower.

Recent Developments

Over the past two months, Cal-Maine has taken steps to strengthen its management and capacity in prepared egg products. In November 2025, the company announced it was appointing Keira Lombardo as its first-ever “Chief Strategy Officer” to guide long-term planning and innovation.

More significantly, in early December, it revealed a $15 million expansion at Echo Lake Foods (its acquired prepared-foods unit) to consolidate scrambled-egg production. The project will add about 17 million pounds of annual output by mid-2027. Cal-Maine is also installing a high-speed pancake line (previously announced) to boost breakfast-product volumes. These investments will ultimately expand Cal-Maine’s prepared-foods capacity by 30% over the next one to two years.

In the short term, management cautioned that Echo Lake operations would face some disruption, lower volumes, and higher costs through the rest of fiscal 2026 as construction and consolidation occur. Investors will watch these developments closely; while costly now, the initiatives should improve efficiency and “strengthen mid-cycle earnings” in the long run by diversifying beyond commodity eggs.

Analysts' Opinion on CALM Stock

Wall Street analysts have taken note of Cal-Maine’s turnaround. Benchmark Capital just initiated coverage on Dec. 1, with a “Buy” rating and $100 price target, arguing the market is “over-indexed to Cal-Maine’s legacy as a commodity producer” and noting the company’s shift into higher-value specialty and prepared foods.

On the other hand, Goldman Sachs recently kept a “Hold” rating but cut its target to $98 from $110, citing expected easing of egg price strength. Stephens Inc. maintains an “Equal-Weight” view with a $95 target after trimming estimates ahead of Q3 results. By comparison, the stock trades in the high-$70s, so the mean price target of $94 implies around 19% upside from today’s levels.

Final Words

Cal-Maine Foods enters 2026 with momentum and strong cash flows, but also with some risks. Its massive 2025 profits and newly announced expansion projects suggest a company intent on growth and diversification. The dividend yield of 11% is now one of the highest in the market, making the stock attractive to income investors. However, much depends on the egg market: if the flock recovers and egg prices fall faster than expected, the recent profits may reverse.

In that context, even modest normalization of earnings should keep CALM reasonably valued. For 2026, the consensus seems to be that Cal-Maine is cheap enough that the risks may be priced in. With analysts pointing to double-digit upside potential and management investing in future growth areas, Cal-Maine Foods stands out as a high-yield pick to watch in the year ahead.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart