With a market cap of $85.1 billion, Apollo Global Management, Inc. (APO) is a global alternative investment manager specializing in credit, private equity, infrastructure, real estate, and hedge fund strategies across both private and public markets. The firm serves institutional and individual investors worldwide, deploying contrarian, value, and distressed investment approaches across a broad range of industries and regions.

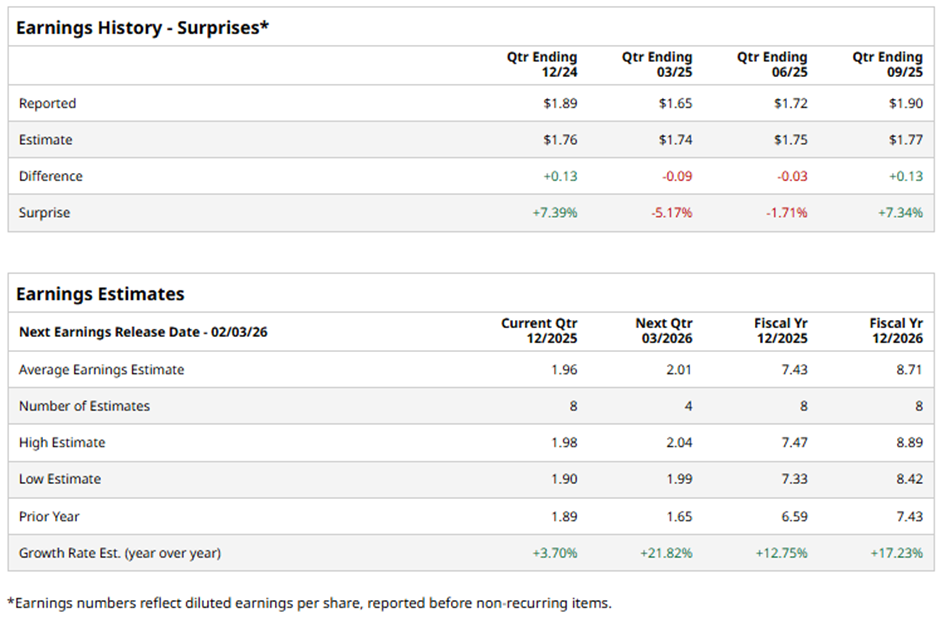

The New York-based company is expected to release its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast APO to report an adjusted EPS of $1.96, up 3.7% from $1.89 in the prior year's quarter. It has surpassed Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts anticipate Apollo Global to post an adjusted EPS of $7.43, a 12.8% increase from $6.59 in fiscal 2024. Looking ahead, adjusted EPS is projected to grow 17.2% year-over-year to $8.71 in fiscal 2026.

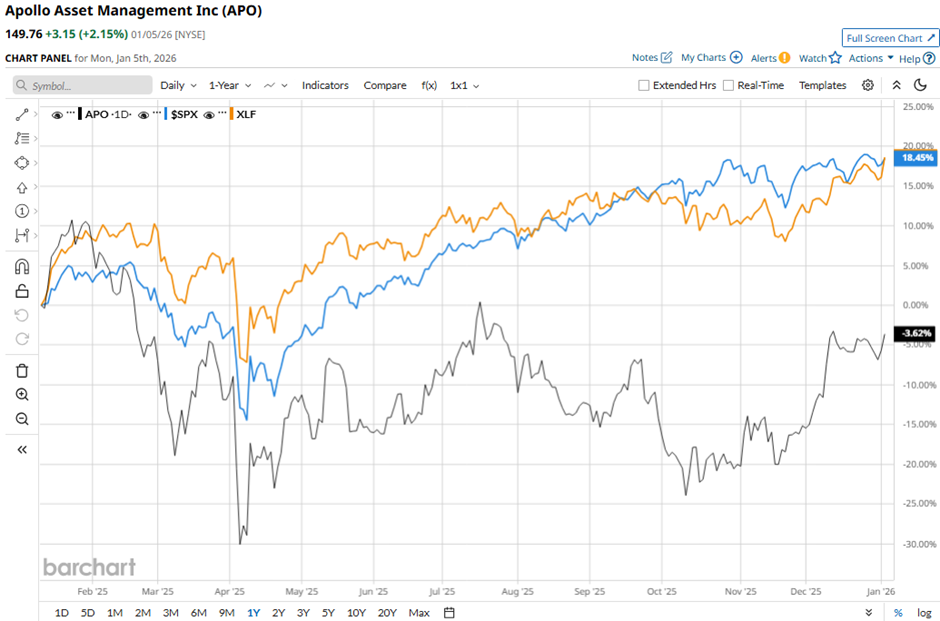

Shares of Apollo Global have decreased 11.4% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.2% gain and the State Street Financial Select Sector SPDR ETF's (XLF) 15.5% return over the period.

Shares of Apollo Global rose 5.3% on Nov. 4 after the firm reported strong Q3 2025 results, with adjusted EPS of $2.14 exceeding the consensus estimate and rising from $1.81 a year earlier. Investor sentiment was further boosted by record fee-related earnings of $652 million and management fees of $863 million, up 22% year-over-year, driven by higher third-party inflows, record capital deployment of $99B, and strong growth from Retirement Services clients.

Analysts' consensus view on APO stock is bullish, with a "Strong Buy" rating overall. Among 20 analysts covering the stock, 14 recommend "Strong Buy," one suggests "Moderate Buy," and five indicate “Hold.” The average analyst price target for Apollo Global is $164, indicating a potential upside of 9.5% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart