Commanding a market cap of about $17.9 billion, Bunge Global SA (BG) is a global agribusiness and food company that operates across the agricultural value chain, connecting farmers to consumer markets worldwide. Based in Missouri, it traces its origins to 1818, making it one of the oldest players in the sector.

Companies with a market cap of $10 billion or more are typically recognized as “large-cap stocks,” and BG fits the criterion. Bunge is a key intermediary in global agricultural supply chains, bridging farm production with food, feed, and industrial end markets. Its diverse operations and recent strategic expansion underscore a focus on scale, vertically integrated processing, and resilience amid commodity price volatility and evolving global demand.

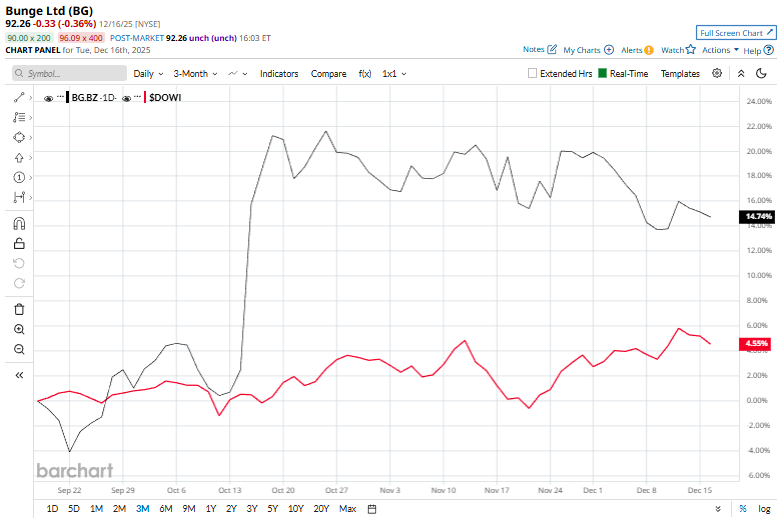

BG stock has tumbled 7.3% from its 52-week high of $99.55 recorded on Oct. 27. Over the last three months, shares have surged 10.2%, outpacing the Dow Jones Industrial Average’s ($DOWI) 5.2% rise over the same period.

BG surged 14.1% over the past 52 weeks, and 18.7% in 2025. In contrast, the DOWI has soared 10.1% over the past year and 13.1% in 2025.

BG has been trading above its 200-day moving average since early August and over its 50-day moving average since early October.

BG shares gained 1.8% on Nov. 5 after the company reported its Q3 2025 results. Its adjusted EPS of $2.27 surpassed expectations. Investor sentiment strengthened as the completed Viterra acquisition significantly lifted volumes, driving a 67% surge in soy processing and refining profit, more than doubling softseed processing profit, and delivering a 56% increase in grain merchandising and milling profit. Further supporting confidence, Bunge reaffirmed its full-year adjusted EPS guidance of $7.30–$7.60.

Top rival Tyson Foods, Inc. (TSN) has surged 1.3% in 2025 and dropped 2.6% over the past year, underperforming BG.

Among the ten analysts covering the BG stock, the consensus rating is a “Strong Buy.” Its mean price target of $106 suggests a 14.9% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Growth Stock With 137% Upside Faces New Challenge: Buy, Hold or Sell?

- How to Buy CSCO for a 2.5% Discount, or Achieve a 19% Annual Return

- S&P Futures Gain as Investors Weigh U.S. Jobs Data, Fed Speak and Micron Earnings in Focus

- This High-Yield Dividend Stock Trades at a Third of Its Record Highs: Is It a Buy for 2026?