With a market cap of $18.5 billion, Smurfit Westrock Plc (SW) is a global leader in fiber-based paper and packaging solutions. headquartered in Dublin, Ireland, it operates in 40 countries, producing containerboard, corrugated and consumer packaging, recycled paper products, and packaging machinery, with significant markets in food and beverage, e-commerce, retail, and industrial sectors.

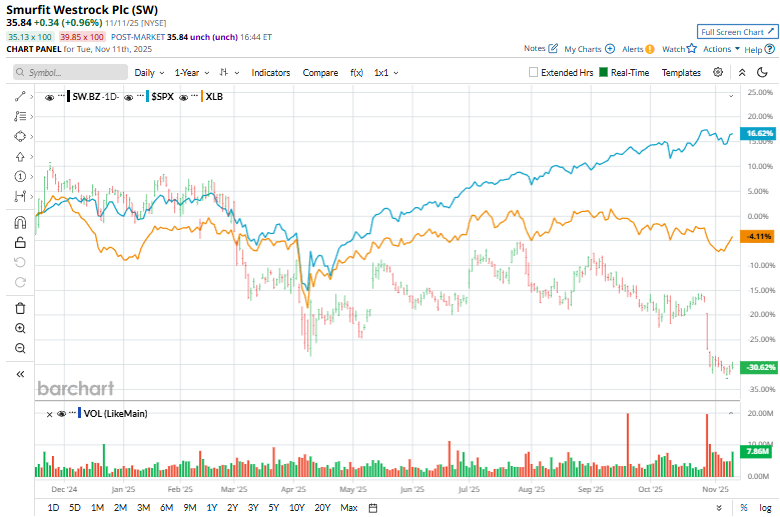

Shares of the packaging titan have underperformed the broader market. SW has declined 31.5% over the past year and 14.5% over the past six months. In contrast, the broader S&P 500 Index ($SPX) has gained 14.1% over the past 12 months and 21% in the past six months.

Looking closer, the company has also lagged behind the Materials Select Sector SPDR Fund's (XLB) 6.9% decline over the past year and 3.5% rise over the past six months.

On Oct. 29, Smurfit Westrock shares dipped 12.2% after releasing its third-quarter earnings. The packaging giant reported $8 billion in revenue, up from $7.7 billion a year earlier, and swung to a $245 million profit versus a prior-year loss, supported by strong operating cash flow of $1.1 billion and $579 million in adjusted free cash flow.

However, despite delivering $1.3 billion in adjusted EBITDA with a 16.3% margin, investors reacted to continued margin pressure, a challenging demand backdrop, and management’s plans for additional downtime in Q4 to optimize capacity, signaling near-term softness even as full-year guidance was maintained.

For the current fiscal year, ending in December 2025, analysts expect SW's EPS to fall marginally year-over-year to $2.06. The company's earnings surprise history is mixed. It beat the consensus estimates in one of the last four quarters while missing on three other occasions.

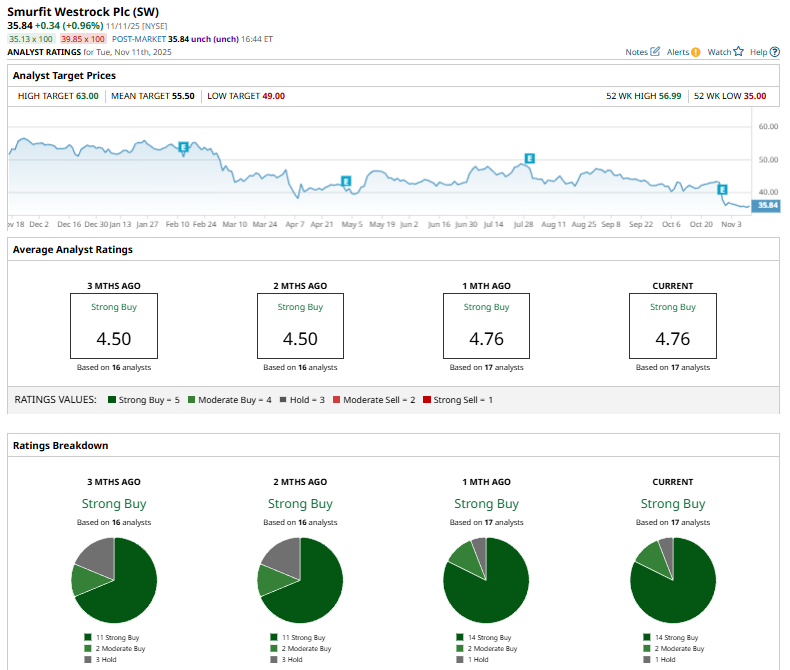

Among the 17 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 14 “Strong Buy” ratings, two “Moderate Buys,” and one “Hold.”

The current consensus is bullish than two months ago, when the stock had 11 “Strong Buy” suggestions.

On Nov. 10, Barclays analyst Gaurav Jain reiterated an “Overweight” rating on Smurfit WestRock but sharply cut the price target from $63 to $47, reflecting a 25% downward revision.

Its mean price target of $55.50 represents a premium of 58.9% from the current market prices. The Street-high price target of $63 implies a robust potential upside of 75.8% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart