Atlanta, Georgia-based Rollins, Inc. (ROL) is a global leader in pest-control services, operating in more than 70 countries through a portfolio of wholly-owned subsidiaries and franchises. Valued at $28.4 billion by market cap, the company serves both residential and commercial clients, offering protection against termites, insects, rodents and wildlife.

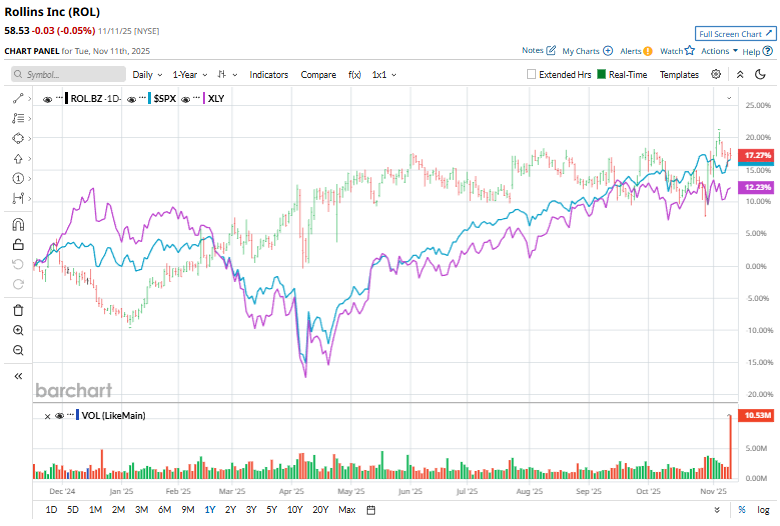

ROL has gained 15% over the past year, while the broader S&P 500 Index ($SPX) has rallied nearly 14.1%. In 2025, ROL stock is up 26.3%, surpassing the SPX’s 16.4% rise on a YTD basis.

Rollins has also exceeded returns from the Consumer Discretionary Select Sector SPDR Fund (XLY), which has gained 9.2% over the past year and 6.8% this year.

On Oct. 29, Rollins reported a strong third-quarter performance, posting 12% year-over-year revenue growth to $1.03 billion, including 7.2% organic growth. Continued demand strength and expansion across its pest-control operations helped drive profitability higher, with adjusted EPS climbing 21.4% to $0.35. Management highlighted disciplined execution, margin expansion, and a balanced mix of organic growth and acquisitions as key tailwinds for the period. The stock initially slipped 3.9% after the release but quickly reversed course, rallying 7.3% in the following session as investors digested the solid results.

For the current fiscal year, ending in December, analysts expect ROL’s EPS to grow 15.2% to $1.14 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in each of the last four quarters.

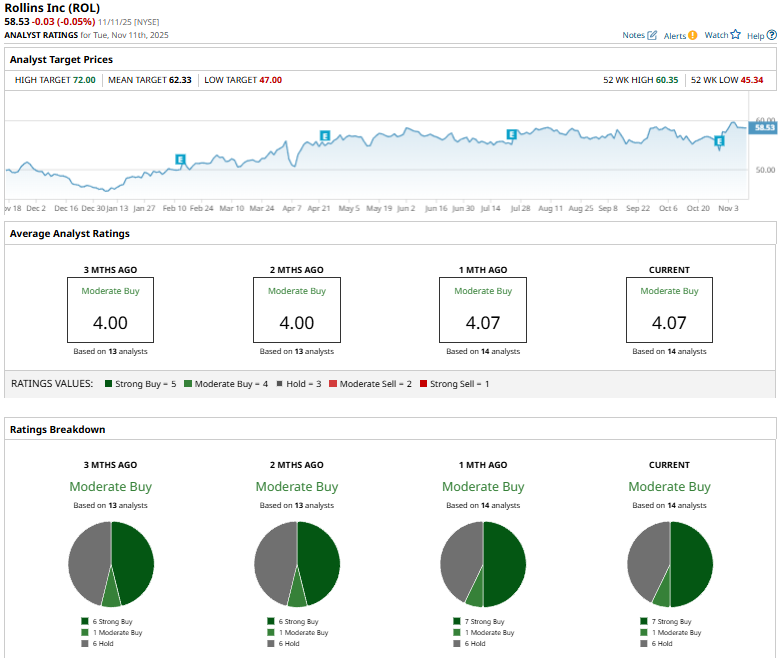

Among the 14 analysts covering ROL stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

This configuration is more bullish than two months ago, with six analysts suggesting a “Strong Buy.”

On Oct. 31, 2025, Canaccord Genuity’s Brian McNamara reiterated a “Hold” rating on Rollins while lifting the price target to $55 from $50, marking a 10% upward revision.

The mean price target of $62.33 represents a 6.5% premium to ROL’s current price levels. The Street-high price target of $72 suggests an upside potential of 23%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart